- Prepared asset, liability, and capital account entries by compiling and analyzing account information.

- Documented financial transactions by entering account information.

- Maintained accounting controls by preparing and recommending policies and procedures.

- Guided accounting clerical staff by coordinating activities and answering questions.

- Prepared payments by verifying documentation, and requesting disbursements.

- Recommended financial actions by analyzing accounting options.

What's your job?

Accountant Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

The Ultimate Guide to Crafting an Accountant Resume That Gets Hired

Introduction

The accounting profession forms the backbone of every successful organisation in India, from emerging startups to multinational corporations. With India’s economy growing rapidly and businesses expanding their operations, the demand for skilled accountants has never been higher. Whether you’re working with manufacturing firms in Pune, IT companies in Bangalore, or financial services in Mumbai, accountants play a crucial role in maintaining financial health and ensuring regulatory compliance.

In India’s competitive job market, having a well-crafted resume is essential for standing out among thousands of qualified candidates. The accounting sector in India encompasses diverse roles ranging from tax consultants and auditors to financial analysts and cost accountants. With the implementation of GST, increased regulatory requirements, and the push towards digital accounting, employers are seeking professionals who can demonstrate both technical expertise and adaptability.

This comprehensive guide will help you create an accountant resume that showcases your qualifications, highlights your achievements, and positions you as the ideal candidate for your target role. Whether you’re a fresher from a commerce background, a CA aspirant, or an experienced professional looking to advance your career, this guide provides the insights and examples you need to craft a compelling resume.

Section 1: Understanding the Accountant Role in India

Overview of Duties and Responsibilities

Accountants in India handle a wide range of financial responsibilities that vary based on the organisation’s size, industry, and specific requirements. Common duties include:

Financial Record Keeping: Maintaining accurate books of accounts, recording daily transactions, and ensuring proper documentation as per Indian accounting standards.

Tax Compliance: Preparing and filing GST returns, TDS returns, income tax returns, and ensuring compliance with the Income Tax Act and other applicable regulations.

Financial Reporting: Preparing balance sheets, profit and loss statements, cash flow statements, and other financial reports as per Indian GAAP or Ind AS.

Audit Support: Assisting with internal and statutory audits, preparing audit schedules, and liaising with external auditors.

Budgeting and Forecasting: Developing budgets, analysing variances, and providing financial projections to support business decisions.

Accounts Payable and Receivable: Managing vendor payments, customer collections, bank reconciliations, and cash flow management.

Key Skills and Competencies Employers Look For

Employers in India’s accounting sector value a combination of technical expertise and professional attributes:

Technical Accounting Knowledge: Proficiency in Indian accounting standards, taxation laws, and regulatory frameworks including GST, TDS, and Companies Act.

Software Proficiency: Hands-on experience with Tally ERP, SAP, Oracle Financials, QuickBooks, or other accounting software widely used in India.

Analytical Skills: Ability to analyse financial data, identify trends, and provide actionable insights for business improvement.

Attention to Detail: Precision in maintaining records, preparing reports, and ensuring accuracy in financial calculations.

Communication Skills: Clear communication with stakeholders, management, and regulatory authorities in both English and Hindi.

Integrity and Ethics: Strong ethical standards and commitment to maintaining confidentiality and compliance.

Diversity of Roles Within the Accounting Sector

The accounting profession in India offers numerous specialisation paths:

Tax Accountant: Specialises in tax planning, compliance, and filing for individuals and businesses.

Cost Accountant: Focuses on cost analysis, budgeting, and manufacturing cost management.

Audit Associate: Conducts internal or external audits to ensure financial accuracy and compliance.

Financial Analyst: Analyses financial data to support investment and business decisions.

Accounts Manager: Oversees accounting teams and manages overall financial operations.

Forensic Accountant: Investigates financial fraud and provides litigation support.

Section 2: Preparing Your Resume - Essential Components

Contact Information

Your contact section should be professional and easily accessible:

- Full Name: Clearly displayed at the top of your resume

- Phone Number: Include your mobile number with country code (+91)

- Email Address: Use a professional email (e.g., rahul.sharma@email.com)

- Location: City and state (e.g., Mumbai, Maharashtra)

- LinkedIn Profile: Include if it showcases relevant professional information

Professional Summary

Your summary should capture your experience, expertise, and career objectives:

Example for Experienced Professional: “Chartered Accountant with 8+ years of experience in financial reporting, taxation, and audit across manufacturing and IT sectors. Proven track record of implementing cost-saving measures resulting in ₹2.5 crore annual savings. Expertise in GST compliance, Ind AS implementation, and SAP FICO. Seeking a senior finance role to drive financial excellence and strategic growth.”

Example for Mid-Level Professional: “Commerce graduate with 4 years of experience in accounts payable, receivable, and tax compliance. Proficient in Tally ERP 9 and advanced Excel. Successfully managed GST filing for 15+ entities with 100% compliance record. Looking to leverage my expertise in a progressive organisation.”

Example for Fresher: “B.Com graduate from Mumbai University with CA Intermediate qualification. Strong foundation in accounting principles, taxation, and financial analysis. Completed articleship with a Big 4 firm handling audit and taxation projects. Eager to contribute to a dynamic finance team.”

Work Experience

Present your experience in reverse chronological order with quantified achievements:

Senior Accountant | Tata Consultancy Services | Mumbai | 2020-Present

- Managed month-end closing for 5 business units with combined revenue of ₹500 crore

- Implemented automated reconciliation process reducing closing time by 40%

- Led GST compliance for pan-India operations ensuring zero penalties

- Mentored team of 4 junior accountants improving team productivity by 25%

Accountant | Infosys BPO | Bangalore | 2017-2020

- Handled accounts payable processing for 200+ vendors with 99% accuracy

- Prepared quarterly financial reports for management review

- Assisted in statutory audit resulting in clean audit report for 3 consecutive years

- Reduced payment processing time by 30% through process improvements

Skills Section

Technical Skills:

- Accounting Software: Tally ERP 9, SAP FICO, Oracle Financials, QuickBooks

- Taxation: GST, TDS, Income Tax, Transfer Pricing

- Financial Reporting: Ind AS, Indian GAAP, IFRS

- MS Office: Advanced Excel (VLOOKUP, Pivot Tables, Macros), Word, PowerPoint

- ERP Systems: SAP, Oracle, Microsoft Dynamics

Soft Skills:

- Analytical Thinking

- Attention to Detail

- Time Management

- Team Collaboration

- Problem Solving

- Communication

Section 3: Resume Formats for Accountants

Chronological Resume

Best suited for professionals with steady career progression in accounting. Lists work experience from most recent to oldest, highlighting career growth and increasing responsibilities.

When to use: If you have 3+ years of continuous accounting experience with clear progression.

Functional Resume

Focuses on skills and competencies rather than chronological work history. Useful for career changers or those with employment gaps.

When to use: If you’re transitioning from a related field or have gaps in employment.

Combination Resume

Blends the chronological and functional formats, highlighting both skills and work history. Ideal for experienced professionals seeking senior roles.

When to use: If you have diverse experience and want to showcase both skills and career progression.

Section 4: Professional Summary Examples

For CA (Chartered Accountant): “Qualified Chartered Accountant with 6 years post-qualification experience in statutory audit, internal audit, and taxation. Completed articleship with Deloitte India. Expertise in conducting audits for listed companies under Companies Act 2013. Strong knowledge of Ind AS and ICAI standards.”

For Cost Accountant (CMA): “Cost and Management Accountant with 5 years of experience in manufacturing sector. Specialised in cost control, budgeting, and variance analysis. Reduced production costs by 15% through process optimisation at L&T. Proficient in SAP CO module and cost centre accounting.”

For Tax Specialist: “Tax professional with 7 years of experience in direct and indirect taxation. Managed tax compliance for Fortune 500 clients at KPMG India. Expertise in GST advisory, transfer pricing documentation, and tax litigation support. Handled tax audits worth ₹100+ crore.”

For Fresher: “B.Com (Hons) graduate from Delhi University with distinction. Completed CA Intermediate and currently pursuing CA Final. Six-month internship experience with PwC in audit and assurance. Strong foundation in accounting principles and eager to learn.”

For Accounts Manager: “Finance professional with 10+ years of experience managing accounting operations for mid-sized enterprises. Led team of 12 accountants at Mahindra & Mahindra. Implemented Tally ERP across 8 branches reducing manual errors by 60%. Expertise in MIS reporting and financial planning.”

Section 5: Work Experience Examples with Metrics

How to Describe Achievements

Transform duties into achievements using the CAR method (Challenge, Action, Result):

Instead of: “Responsible for GST filing” Write: “Managed GST compliance for 25 entities across 12 states, ensuring 100% on-time filing and zero penalties, saving ₹15 lakhs in potential fines”

Instead of: “Handled accounts payable” Write: “Processed 500+ vendor invoices monthly with 99.5% accuracy, negotiating early payment discounts worth ₹8 lakhs annually”

Sample Work Experience Entries

Financial Controller | Reliance Industries | Mumbai

- Oversaw financial operations for petrochemicals division with ₹5,000 crore annual turnover

- Led implementation of SAP S/4HANA reducing month-end closing from 15 to 7 days

- Developed cash flow forecasting model improving working capital efficiency by 20%

- Coordinated with Big 4 auditors ensuring clean statutory audit reports

Senior Tax Consultant | Ernst & Young | Gurgaon

- Advised 30+ clients on GST transition and compliance strategies

- Prepared transfer pricing documentation for multinational corporations

- Represented clients before tax authorities in assessment proceedings

- Generated ₹2 crore in new business through client referrals

Accounts Executive | HDFC Bank | Chennai

- Reconciled daily transactions worth ₹50 crore across 15 branch accounts

- Prepared RBI regulatory reports with 100% accuracy and timeliness

- Identified and recovered ₹25 lakhs in outstanding receivables

- Trained 10 new joiners on banking operations and compliance

Section 6: Skills to Include in Your Accountant Resume

Technical Skills

- Accounting Software: Tally ERP 9, Tally Prime, SAP FICO, Oracle Financials, QuickBooks, Zoho Books

- Taxation: GST (GSTR-1, GSTR-3B, GSTR-9), TDS, Income Tax, Advance Tax, Transfer Pricing

- Financial Reporting: Indian GAAP, Ind AS, IFRS, Schedule III reporting

- Audit: Internal Audit, Statutory Audit, Tax Audit, Stock Audit

- MS Excel: VLOOKUP, HLOOKUP, Pivot Tables, Macros, Power Query, Data Analysis

- ERP Systems: SAP, Oracle, Microsoft Dynamics 365, NetSuite

- Regulatory Compliance: Companies Act 2013, SEBI regulations, RBI guidelines, FEMA

- Banking Operations: Reconciliation, LC/BG processing, Treasury management

- Payroll Management: EPF, ESI, Professional Tax, Gratuity calculations

- Data Analytics: Power BI, Tableau, SQL for financial analysis

Soft Skills

- Analytical Thinking: Ability to interpret financial data and identify trends

- Attention to Detail: Ensuring accuracy in financial records and reports

- Time Management: Meeting multiple deadlines during month-end and year-end closing

- Communication: Presenting financial information to non-finance stakeholders

- Problem Solving: Resolving discrepancies and process bottlenecks

- Integrity: Maintaining ethical standards and confidentiality

- Team Collaboration: Working effectively with cross-functional teams

- Adaptability: Keeping pace with regulatory changes and new technologies

Section 7: Certifications and Professional Development

Essential Certifications for Indian Accountants

Chartered Accountant (CA)

- Issued by: Institute of Chartered Accountants of India (ICAI)

- Duration: 3-5 years including articleship

- Value: Most respected accounting qualification in India, mandatory for statutory audit

Cost and Management Accountant (CMA)

- Issued by: Institute of Cost Accountants of India (ICMAI)

- Duration: 2-3 years

- Value: Specialisation in cost accounting, essential for manufacturing sector

Company Secretary (CS)

- Issued by: Institute of Company Secretaries of India (ICSI)

- Duration: 2-3 years

- Value: Expertise in corporate law and compliance

Certified Information Systems Auditor (CISA)

- Issued by: ISACA

- Value: IT audit and information systems expertise

ACCA (Association of Chartered Certified Accountants)

- Issued by: ACCA Global

- Value: International accounting qualification recognised globally

CFA (Chartered Financial Analyst)

- Issued by: CFA Institute

- Value: Investment analysis and portfolio management expertise

Additional Certifications

- GST Certification from ICAI

- SAP FICO Certification

- Oracle Financial Cloud Certification

- Tally Certified Professional

- Advanced Excel Certification

Section 8: Tips by Experience Level

Entry-Level (0-2 Years)

- Highlight Education: Emphasise your B.Com, M.Com, or CA/CMA pursuit with grades

- Include Internships: Detail articleship or internship experiences with specific projects

- Showcase Academic Projects: Financial analysis projects, case studies, or research work

- Mention Relevant Coursework: Taxation, financial accounting, cost accounting, auditing

- Emphasise Software Skills: Tally, Excel, and any ERP exposure during training

- Add Extracurriculars: Commerce society memberships, CA study groups, seminars attended

Mid-Level (3-7 Years)

- Focus on Achievements: Quantify your contributions with metrics and outcomes

- Highlight Specialisation: Tax, audit, financial reporting, or industry expertise

- Show Career Progression: Demonstrate growth from junior to senior roles

- Include Team Leadership: Any experience mentoring juniors or leading small teams

- Mention Process Improvements: Efficiency gains, cost savings, or automation initiatives

- Professional Development: Certifications obtained, training programmes completed

Senior-Level (8+ Years)

- Strategic Contributions: Impact on business decisions and organisational growth

- Leadership Experience: Team sizes managed, departments led, or functions headed

- Cross-Functional Expertise: Finance transformation, ERP implementations, M&A due diligence

- Stakeholder Management: Board presentations, investor relations, audit committee interactions

- Industry Recognition: Awards, speaking engagements, professional body memberships

- Business Acumen: Understanding of business operations beyond just accounting

Section 9: ATS Optimisation Tips

Understanding ATS in Indian Context

Many large Indian companies and MNCs use Applicant Tracking Systems to screen resumes. Common systems include Taleo, Workday, SuccessFactors, and Naukri RMS.

Keyword Optimisation

Include relevant keywords from the job description:

- Technical terms: GST, TDS, Ind AS, IFRS, SAP FICO, Tally

- Job titles: Accountant, Finance Executive, Tax Consultant, Audit Associate

- Skills: Financial analysis, budgeting, reconciliation, compliance

- Certifications: CA, CMA, CS, ACCA, CFA

Formatting Best Practices

- Use standard fonts (Arial, Calibri, Times New Roman)

- Avoid tables, graphics, and complex formatting

- Use standard section headings (Experience, Education, Skills)

- Save as PDF or .docx as specified

- Keep file size under 2MB

- Use standard date formats (Month Year or MM/YYYY)

Common Mistakes to Avoid

- Using headers and footers (ATS may not read them)

- Submitting image-based resumes

- Using abbreviations without full forms

- Inconsistent formatting throughout the document

Conclusion

Creating a compelling accountant resume requires careful attention to both content and presentation. By following this guide, you can craft a resume that effectively showcases your qualifications, achievements, and potential value to prospective employers. Remember to tailor your resume for each application, quantify your achievements wherever possible, and ensure your document is ATS-friendly.

The accounting profession in India offers tremendous opportunities for growth and specialisation. Whether you’re pursuing CA, CMA, or building expertise in taxation, audit, or financial analysis, a well-crafted resume is your first step towards career advancement.

Ready to create your professional accountant resume? Use our resume builder to get started with professionally designed templates, or explore more resume samples for inspiration. For personalised guidance, our expert resume writers are here to help you craft a document that opens doors to your dream accounting role.

Frequently Asked Questions

What should an accountant resume include?

An accountant's resume should list your contact information, a strong professional summary, key accounting skills, work experience, education, and relevant certifications — all tailored to the job you're applying for.

How do I write a professional summary for an accountant's resume?

Your summary should briefly highlight your experience level, key accounting strengths (like GST, TDS, financial reporting), and what value you bring — such as accuracy or compliance expertise.

Which skills should I add to my accountant resume?

Include both technical skills (like GST compliance, Ind AS, Tally, SAP FICO, financial reporting) and soft skills (such as attention to detail, communication, and time management).

What resume format works best for accountants?

The reverse-chronological format is preferred — most recent experience first. Keep it clean and professional so hiring managers and ATS systems can easily read it.

How long should my accountant resume be?

For freshers, one page is usually enough. Experienced accountants can use up to two pages if the content is relevant and well-structured.

Do I need accounting certifications on my resume?

Yes — certifications like CA, CMA, ACCA, or SAP FICO show expertise and boost credibility, especially for specialized roles.

How do I tailor my resume to a job posting?

Match your resume to the job description by including keywords and skills mentioned in the posting — this helps with both ATS and recruiter relevance.

Should I include software and tools on my resume?

Definitely — list accounting and finance tools you know well, such as Tally ERP 9, SAP FICO, QuickBooks, Oracle Financials, Excel (advanced).

How can I make my resume ATS-friendly?

Use standard headings (like Experience, Skills, Education), avoid graphics or text boxes, and include relevant keywords so ATS software can scan your resume correctly.

What mistakes should I avoid on an accountant's resume?

Avoid long paragraphs, outdated details, spelling mistakes, and irrelevant personal info. Stay focused on achievements and measurable contributions instead of vague duties.

Can freshers use these accountant resume samples?

Yes — freshers can use the samples as a template, highlight education, internships, software knowledge, and accounting coursework to make a strong first resume.

Do I need a cover letter with my accountant resume?

A cover letter isn't always required, but it's a great place to explain your career goals, highlight your best achievements, and connect your experience directly to the job you're applying for.

Accountant Text-Only Resume Templates and Samples

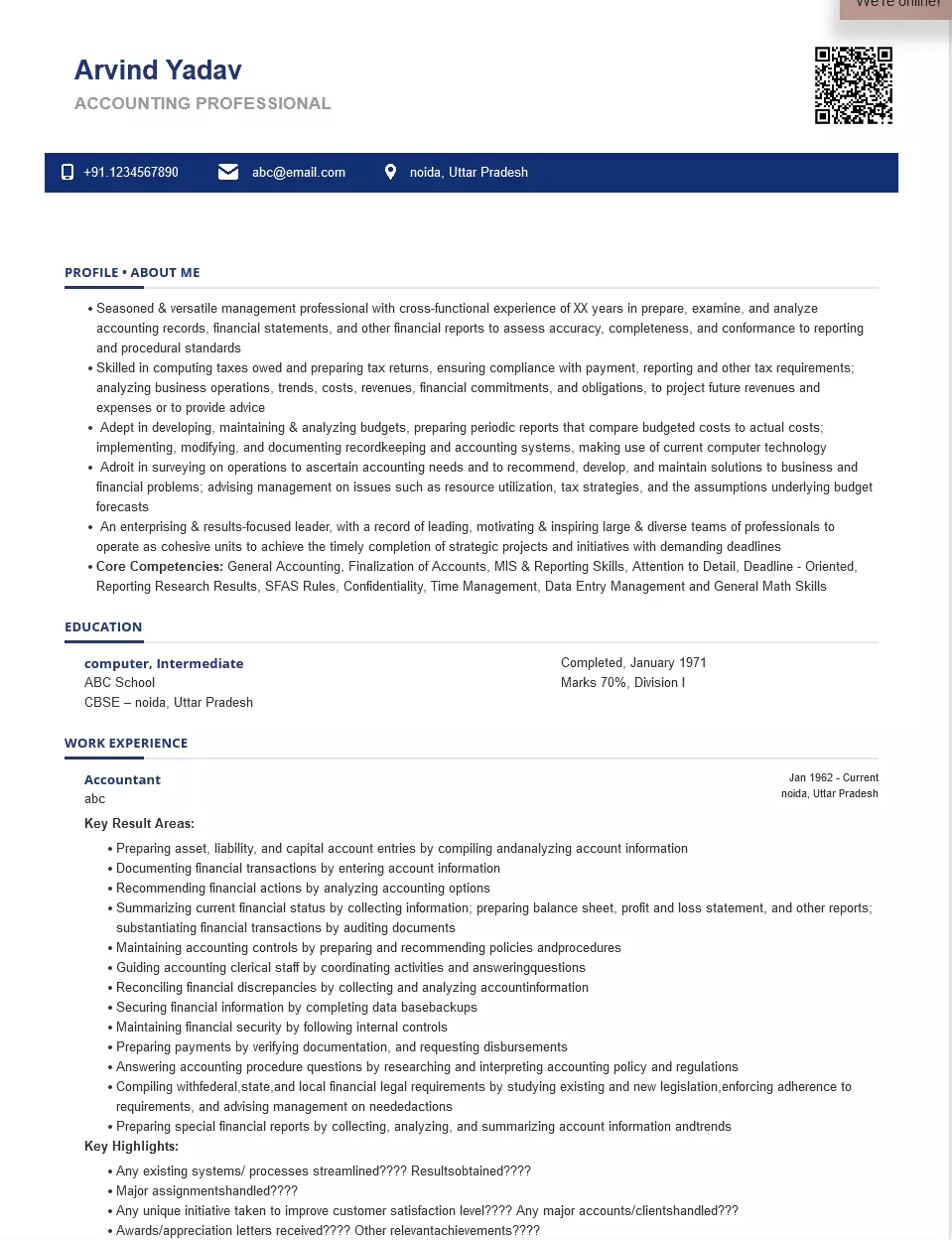

Arvind Yadav

Phone: 1234567890

Email: abc@email.com

Address: sec-44, Noida, noida

About Me

ACCOUNTING PROFESSIONAL

Versatile accounting management professional with experience XX years in preparing, examining, and analyzing accounting records, financial statements, and other financial reports. Assess accuracy, completeness, and conformance to reporting and procedural standards. Adroit in surveying operations to ascertain accounting needs and to recommend, develop, and maintain solutions to business and financial problems. Looking for an opportunity in a fast-growing company to build out the best accounting practices and make accounting a competitive advantage within your organization.

Education

Computer, Intermediate, Completed, January 1971

ABC School

CBSE

Noida, UP

Work Experience

Period: September 2017 - Current

Accountant

Abc Pvt Ltd

Period: June 2016 - August 2017

Accountant

AYC Ltd.

- Posted & processed journal entries to ensure all business transactions are recorded

- Updated accounts receivable and issue invoices; updated accounts payable & performed reconciliations

- Assisted in the processing of balance sheets, income statements & other financial statements according to legal & company accounting & financial guidelines; assisted with reviewing expenses, payroll records, etc. as assigned

- Updated financial data in databases to ensure that information will be accurate and immediately available when needed

- Prepared & submitted weekly/monthly reports; assisted senior accountants in the preparation of monthly/yearly closings

Skills

- General Accounting

- Finalization of Accounts

- MIS & Reporting Skills

- Attention to Detail

- Deadline – Oriented

- Reporting Research Results

- SFAS Rules

- Confidentiality

- Time Management

- Data Entry Management

- General Math Skills

India's

premier resume service

India's

premier resume service