- Arvind Yadav/Project Management Professional, Completed , January 2006

What's your job?

Bookkeeper Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Creating a Professional Resume for Bookkeepers

Introduction

Bookkeeping forms the foundation of financial management for businesses across India, from small enterprises in tier-2 cities to large corporations in metropolitan areas. As companies increasingly recognise the importance of accurate financial record-keeping, the demand for skilled bookkeepers continues to grow. Whether you’re managing accounts for a retail business in Jaipur, a manufacturing unit in Coimbatore, or an IT firm in Bangalore, bookkeepers play a crucial role in maintaining financial health and compliance.

India’s evolving business landscape, with GST implementation and digital accounting adoption, has created new opportunities for bookkeeping professionals. Companies are seeking individuals who can handle traditional bookkeeping tasks while also navigating modern accounting software like Tally ERP 9, Zoho Books, and QuickBooks. Whether you’re a fresher with a commerce background or an experienced professional looking to advance your career, a well-crafted resume is essential for standing out in this competitive field.

This comprehensive guide will help you create a bookkeeper resume that effectively showcases your accounting skills, software proficiency, and attention to detail. From highlighting your Tally expertise to demonstrating your understanding of GST compliance, we’ll cover everything you need to land your dream bookkeeping role in 2025.

Section 1: Understanding the Bookkeeper Role in India

Overview of Duties and Responsibilities

Bookkeepers in India handle a wide range of financial record-keeping tasks that are essential for business operations. Common duties include:

Recording Daily Transactions: Maintaining accurate records of all financial transactions including sales, purchases, receipts, and payments in accounting software.

Bank Reconciliation: Matching company records with bank statements to identify and resolve discrepancies.

Accounts Payable Management: Processing vendor invoices, verifying accuracy, and ensuring timely payments while maintaining good vendor relationships.

Accounts Receivable Management: Tracking customer payments, following up on outstanding invoices, and maintaining accurate receivables records.

GST Compliance: Preparing and filing GST returns (GSTR-1, GSTR-3B), maintaining GST registers, and ensuring compliance with tax regulations.

Payroll Processing: Calculating salaries, deductions (PF, ESI, TDS), and ensuring timely disbursement of employee wages.

Key Skills and Competencies Employers Look For

Employers in India’s bookkeeping sector value a combination of technical proficiency and organisational skills:

Accounting Software Expertise: Proficiency in Tally ERP 9, Tally Prime, Zoho Books, QuickBooks, or other accounting software.

GST Knowledge: Understanding of GST rules, return filing, input tax credit, and compliance requirements.

Excel Proficiency: Advanced skills in Microsoft Excel including formulas, pivot tables, and data analysis.

Attention to Detail: Accuracy in recording transactions and identifying discrepancies in financial records.

Numerical Aptitude: Strong mathematical skills and ability to work with numbers efficiently.

Organisational Skills: Ability to manage multiple tasks, meet deadlines, and maintain systematic records.

Diversity of Roles Within Bookkeeping

The bookkeeping field in India offers various specialisation paths:

General Bookkeeper: Handles all aspects of day-to-day financial record-keeping for small to medium businesses.

Accounts Payable Specialist: Focuses on vendor payments, invoice processing, and payment scheduling.

Accounts Receivable Specialist: Manages customer invoices, collections, and credit control.

Payroll Bookkeeper: Specialises in salary processing, statutory deductions, and payroll compliance.

Tax Compliance Bookkeeper: Focuses on GST, TDS, and other tax-related record-keeping and filing.

Full-Charge Bookkeeper: Manages complete bookkeeping function including financial statements preparation.

Section 2: Preparing Your Resume - Essential Components

Contact Information

Your contact section should be professional and easily accessible:

- Full Name: Clearly displayed at the top of your resume

- Phone Number: Include your mobile number with country code (+91)

- Email Address: Use a professional email (e.g., neha.gupta@email.com)

- Location: City and state (e.g., Ahmedabad, Gujarat)

- LinkedIn Profile: Include if it showcases relevant professional information

Professional Summary

Your summary should capture your experience, expertise, and career objectives:

Example for Experienced Professional: “Senior Bookkeeper with 8+ years of experience in financial record-keeping and GST compliance. Managed complete books of accounts for manufacturing firms with annual turnover of ₹50 crore. Expert in Tally ERP 9, bank reconciliation, and payroll processing. Reduced accounts receivable aging by 40% through improved collection processes. Seeking to contribute bookkeeping expertise to a growing organisation.”

Example for Mid-Level Professional: “Bookkeeper with 4 years of experience in accounts payable, receivable, and GST compliance. Proficient in Tally Prime and advanced Excel. Successfully managed vendor payments for 200+ suppliers at a retail chain. Strong track record of maintaining 99% accuracy in transaction recording. Looking to grow in a challenging accounts role.”

Example for Fresher: “B.Com graduate from Gujarat University with Tally certification. Completed 6-month internship handling day-book entries and bank reconciliation. Strong foundation in accounting principles, GST basics, and Microsoft Excel. Eager to apply my skills in a professional bookkeeping environment.”

Work Experience

Present your experience in reverse chronological order with quantified achievements:

Senior Bookkeeper | Reliance Retail | Ahmedabad | 2020-Present

- Managed complete books of accounts for 15 retail outlets with combined revenue of ₹30 crore

- Processed 500+ vendor invoices monthly ensuring 100% accuracy and timely payments

- Reduced payment processing time by 35% through implementation of automated workflows

- Prepared monthly GST returns ensuring zero penalties for 4 consecutive years

Bookkeeper | Arvind Mills | Ahmedabad | 2017-2020

- Maintained day-to-day financial records for textile manufacturing unit

- Reconciled 8 bank accounts monthly identifying and resolving discrepancies within 48 hours

- Processed payroll for 150+ employees including PF, ESI, and TDS calculations

- Assisted in year-end closing and statutory audit preparation

Skills Section

Technical Skills:

- Accounting Software: Tally ERP 9, Tally Prime, Zoho Books, QuickBooks

- Taxation: GST (GSTR-1, GSTR-3B, GSTR-9), TDS, Professional Tax

- MS Office: Advanced Excel, Word, Outlook

- Payroll: PF, ESI, Gratuity calculations

- Financial Reporting: Trial Balance, P&L, Balance Sheet

- Banking: Reconciliation, Online banking, Payment processing

Soft Skills:

- Attention to Detail

- Time Management

- Numerical Accuracy

- Organisational Skills

- Communication

- Problem Solving

Section 3: Resume Formats for Bookkeepers

Chronological Resume

Best suited for professionals with steady career progression in bookkeeping or accounting. Lists work experience from most recent to oldest, highlighting career growth.

When to use: If you have 3+ years of continuous bookkeeping experience with clear progression.

Functional Resume

Focuses on skills and competencies rather than chronological work history. Useful for career changers or those with employment gaps.

When to use: If you’re transitioning from a related field or have gaps in employment.

Combination Resume

Blends the chronological and functional formats, highlighting both skills and work history. Ideal for experienced professionals seeking senior roles.

When to use: If you have diverse experience and want to showcase both skills and career progression.

Section 4: Professional Summary Examples

For Full-Charge Bookkeeper: “Full-Charge Bookkeeper with 6 years of experience managing complete accounting cycle for SMEs. Prepared monthly financial statements for management review. Expert in Tally ERP 9, GST compliance, and bank reconciliation. Managed accounts for businesses with turnover up to ₹25 crore. Reduced month-end closing time from 10 days to 5 days.”

For Accounts Payable Specialist: “Accounts Payable specialist with 5 years of experience processing high-volume vendor invoices. Managed payments for 300+ vendors at an FMCG company. Achieved 99.5% accuracy in invoice processing and payment scheduling. Proficient in Tally and SAP. Negotiated early payment discounts saving ₹15 lakhs annually.”

For Payroll Bookkeeper: “Payroll specialist with 4 years of experience processing salaries for 500+ employees. Expert in PF, ESI, TDS, and Professional Tax calculations. Ensured 100% compliance with statutory requirements. Implemented automated payroll system reducing processing time by 50%. Proficient in Tally Payroll and Excel.”

For Fresher: “B.Com graduate from Pune University with distinction. Completed Tally ERP 9 certification and GST practitioner course. Interned at a CA firm handling voucher entries, bank reconciliation, and GST data preparation. Strong foundation in accounting principles and eager to start my bookkeeping career.”

For Career Changer: “Administrative professional transitioning to bookkeeping with 5 years of office management experience. Completed B.Com through correspondence and Tally certification. Experience handling petty cash, expense reports, and basic accounting entries. Strong organisational skills and attention to detail. Ready to apply administrative expertise to bookkeeping role.”

Section 5: Showcasing Bookkeeping Skills

How to Present Achievements

Transform task descriptions into compelling achievements:

Instead of: “Responsible for accounts payable” Write: “Processed 400+ vendor invoices monthly with 99.8% accuracy, ensuring timely payments and maintaining strong vendor relationships”

Instead of: “Did bank reconciliation” Write: “Reconciled 10 bank accounts monthly identifying discrepancies worth ₹5 lakhs and resolving within 24 hours”

Sample Work Experience Entries

Bookkeeper | Godrej Industries | Mumbai

- Maintained complete books of accounts for consumer products division with ₹100 crore turnover

- Processed 600+ transactions daily including sales, purchases, and expenses

- Prepared monthly GST returns and ensured 100% compliance with filing deadlines

- Managed petty cash of ₹50,000 with zero discrepancies over 3 years

- Technologies: Tally ERP 9, SAP, Microsoft Excel

Accounts Assistant | Bajaj Electricals | Pune

- Entered daily transactions in Tally including sales invoices and purchase vouchers

- Assisted in monthly bank reconciliation for 5 accounts

- Prepared vendor payment schedules and followed up on outstanding receivables

- Supported audit process by preparing schedules and documentation

- Technologies: Tally Prime, MS Excel, Email management

Junior Bookkeeper | Local Retail Chain | Nagpur

- Recorded daily sales and purchases in accounting software

- Maintained inventory records and reconciled with physical stock

- Prepared daily cash reports and deposited collections in bank

- Assisted senior accountant with GST return preparation

- Technologies: Tally ERP 9, MS Excel

Entry-Level Project Ideas

For freshers, showcase relevant experience:

- Internship Work - Day-book entries, bank reconciliation, GST data preparation

- Academic Projects - Financial analysis, accounting case studies

- Tally Certification - Practical exercises completed during training

- Volunteer Work - Managing accounts for NGOs or community organisations

- Family Business - Helped maintain books for family shop or business

Section 6: Skills to Include in Your Bookkeeper Resume

Technical Skills

- Accounting Software: Tally ERP 9, Tally Prime, Zoho Books, QuickBooks, Busy Accounting

- GST Compliance: GSTR-1, GSTR-3B, GSTR-9, Input Tax Credit, E-way bills

- Payroll Management: PF, ESI, Professional Tax, TDS on salary, Gratuity

- Microsoft Excel: VLOOKUP, HLOOKUP, Pivot Tables, Formulas, Data validation

- Bank Reconciliation: Statement matching, Discrepancy resolution, BRS preparation

- Financial Reporting: Trial Balance, Profit and Loss, Balance Sheet

- Accounts Payable: Invoice processing, Vendor management, Payment scheduling

- Accounts Receivable: Customer invoicing, Collection follow-up, Aging analysis

- TDS Compliance: TDS deduction, Return filing, Certificate issuance

- Documentation: Voucher preparation, Ledger maintenance, Filing systems

Soft Skills

- Attention to Detail: Ensuring accuracy in every transaction entry

- Numerical Aptitude: Comfort working with numbers and calculations

- Time Management: Meeting deadlines for returns and reports

- Organisational Skills: Maintaining systematic records and files

- Communication: Coordinating with vendors, customers, and team members

- Integrity: Handling confidential financial information responsibly

- Problem Solving: Identifying and resolving discrepancies

- Adaptability: Learning new software and adapting to process changes

Section 7: Certifications and Professional Development

Essential Certifications for Indian Bookkeepers

Tally Certification

- Issued by: Tally Education

- Value: Demonstrates proficiency in India’s most widely used accounting software

GST Practitioner Certification

- Issued by: GSTN or various institutions

- Value: Shows expertise in GST compliance and filing

Certified Bookkeeper

- Issued by: Various professional bodies

- Value: Validates bookkeeping knowledge and skills

Microsoft Office Specialist (Excel)

- Issued by: Microsoft

- Value: Proves advanced Excel proficiency

Professional Qualifications

- B.Com (Bachelor of Commerce)

- M.Com (Master of Commerce)

- CA Foundation/Intermediate (pursuing)

- CMA Foundation/Intermediate (pursuing)

- Diploma in Accounting and Taxation

Training Programmes

- Advanced Excel for Accounting - Various institutes

- GST Certification Course - ICAI/ICSI/private institutes

- Tally ERP 9/Prime Certification - Tally Education

- QuickBooks Certification - Intuit

- Payroll Management Course - Various institutes

Section 8: Tips by Experience Level

Entry-Level (0-2 Years)

- Highlight Education: Emphasise your B.Com/M.Com with relevant coursework and grades

- Include Certifications: Tally, GST, Excel certifications add credibility

- Showcase Internships: Detail your internship experiences with specific tasks handled

- Mention Academic Projects: Accounting projects, case studies, or practical work

- Emphasise Software Skills: Tally, Excel, and other relevant software

- Add Volunteer Work: Any experience managing accounts for organisations

Mid-Level (3-7 Years)

- Focus on Achievements: Quantify your contributions (accuracy rates, cost savings)

- Show Process Improvements: Efficiency gains, automation initiatives

- Highlight Volume Handled: Number of transactions, invoices, or accounts managed

- Demonstrate Compliance: GST filing record, audit clearances

- Include Team Contribution: Training juniors, process documentation

- Show Software Expertise: Advanced features of accounting software

Senior-Level (8+ Years)

- Strategic Contributions: Process improvements, system implementations

- Leadership Experience: Team supervision, training, and development

- Audit Coordination: Working with internal and external auditors

- Multi-Entity Experience: Managing accounts for multiple companies or branches

- System Implementations: ERP implementations, software migrations

- Compliance Excellence: Track record of clean audits and zero penalties

Section 9: ATS Optimisation Tips

Understanding ATS in Indian Context

Many Indian companies use Applicant Tracking Systems to screen resumes. Common systems include Naukri RMS, Taleo, and various HR software solutions.

Keyword Optimisation

Include relevant keywords from the job description:

- Technical terms: Tally, GST, Bank Reconciliation, Accounts Payable

- Job titles: Bookkeeper, Accounts Assistant, Accounts Executive

- Skills: Ledger maintenance, Invoice processing, Payroll

- Certifications: Tally certified, B.Com, GST practitioner

Formatting Best Practices

- Use standard fonts (Arial, Calibri, Times New Roman)

- Avoid tables, graphics, and complex formatting

- Use standard section headings (Experience, Education, Skills)

- Save as PDF or .docx as specified

- Keep file size under 2MB

- Use simple bullet points for lists

Common Mistakes to Avoid

- Using headers and footers (ATS may not read them)

- Including photos or graphics

- Using abbreviations without full forms

- Inconsistent date formats

- Missing contact information

Conclusion

Creating a compelling bookkeeper resume requires showcasing your technical expertise in accounting software, attention to detail, and track record of accuracy. By following this guide, you can craft a resume that effectively communicates your bookkeeping skills and experience to employers in India’s growing business landscape.

The bookkeeping profession in India offers excellent opportunities for growth, especially with the increasing emphasis on digital accounting and GST compliance. Whether you’re a fresher with Tally certification, a mid-level professional seeking advancement, or a senior bookkeeper targeting supervisory roles, a well-crafted resume is your key to career success.

Remember to tailor your resume for each application, quantify your achievements wherever possible, and keep your software skills section updated with the latest tools. Highlight your accuracy rates and compliance track record to demonstrate your reliability.

Ready to create your professional bookkeeper resume? Use our resume builder to get started with professionally designed templates, or explore more resume samples for inspiration. For personalised guidance, our expert resume writers are here to help you craft a document that opens doors to your dream bookkeeping role.

Frequently Asked Questions

What sections should a strong bookkeeper resume include?

At minimum, include contact information, a professional summary, work experience, key skills, and education. Depending on your experience level, you may also add certifications, achievements, projects, or industry-specific sections that highlight your expertise.

How do I write a professional summary for a bookkeeper role?

Keep it concise — two to three sentences highlighting your experience level, core competencies, and a key achievement or strength that shows why you're right for the job. Tailor it to match the specific role you're applying for.

What skills are most important to list on a bookkeeper resume?

Include a mix of technical skills specific to bookkeeper roles and soft skills like communication, problem-solving, and teamwork. Research job postings in your target companies to identify the most commonly requested skills.

How detailed should my work experience be?

Use bullet points to describe your roles, focusing on specific results, tools used, and the impact you made. Quantify achievements where possible — numbers and percentages help recruiters quickly understand your contributions.

Do I need certifications on my bookkeeper resume?

Certifications aren't always required, but they can strengthen your application — especially if they demonstrate advanced training or specialised expertise. List the certification name, issuing organisation, and year obtained.

What's the best resume format for a bookkeeper?

Most bookkeeper professionals benefit from a reverse-chronological format that lists your most recent experience first. If you're changing careers or have gaps, a functional or combination format might work better.

How long should my bookkeeper resume be?

Aim for one page if you're early in your career. Experienced professionals with extensive achievements can use two pages — just ensure every section adds value and remains relevant to the role.

Should I tailor my resume for each job application?

Yes. Customising your resume with keywords and responsibilities from the job posting improves your chances of passing Applicant Tracking Systems (ATS) and resonating with recruiters. Focus on relevant experience and skills for each role.

Bookkeeper Text-Only Resume Templates and Samples

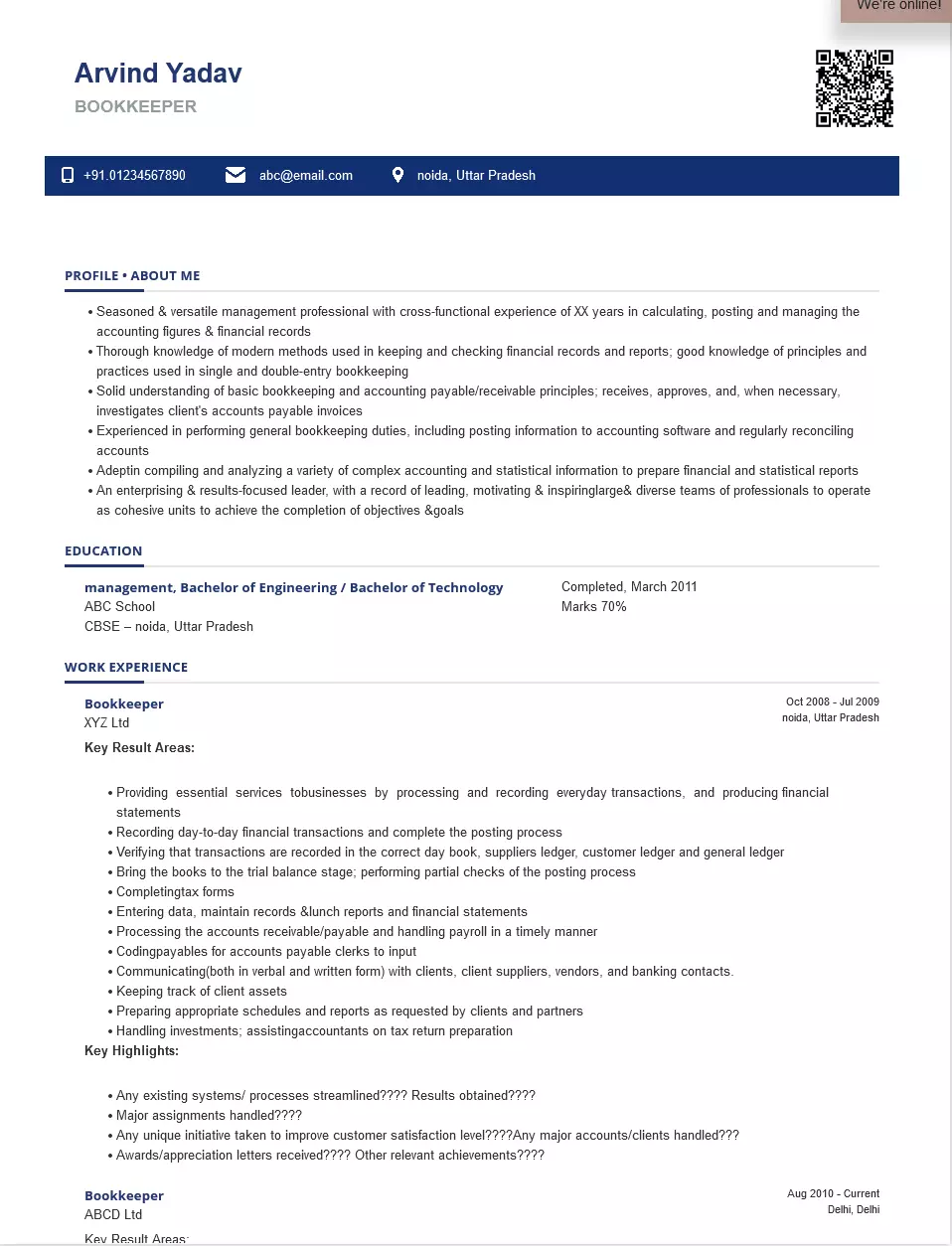

Arvind Yadav

Phone: 01234567890

Email: abc@email.com

Address: sec-44, Noida, Noida

About Me

BOOKKEEPER

Extensive XX years of experience in performing general bookkeeping duties, including posting information to accounting software and regularly reconciling accounts. Solid understanding of basic bookkeeping and accounting payable/receivable principles; receives, approves, and, when necessary, investigates client's accounts payable invoices. Looking for an opportunity as a full-time bookkeeper at your quickly growing company.

Education

Management, Bachelor of Engineering / Bachelor of Technology, Completed, March 2011

ABC School

CBSE

Noida, UP

Certifications

Work Experience

Period: October 2008 - Current

Bookkeeper

XYZ Ltd

- Developed a system to account for financial transactions by establishing a chart of accounts.

- Defined bookkeeping policies and procedures for new employees.

- Stayed up to date to ensure that the business gets the most money out of the Payment Protection Program (PPP).

- Performed each and every bank statement and credit card statement reconciliation for 8 company units.

- Processed payments and documented account changes for accuracy and transparency.

- Handled daily bank deposits and managed statements.

Period: August 2001 - August 2008

Bookkeeper

ABCD Ltd

- Maintained subsidiary accounts by verifying, allocating, and posting transactions

- Balanced subsidiary accounts by reconciling entries

- Maintained general ledger by transferring subsidiary account summaries

- Balanced general ledger by preparing a trial balance; reconciling entries

Skills

- QuickBooks

- Microsoft Excel/Word

- Accounts Payable

- Accounts Receivable

- GAAP

- Multi-tasking

- Detail-Oriented

India's

premier resume service

India's

premier resume service