- Arvind Yadav/Project Management Professional, Completed , January 2011

What's your job?

Credit and Collections Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Crafting the Perfect Credit and Collections Resume: A Comprehensive Guide for 2025

Introduction

Credit and Collections professionals are vital to the financial health of organisations across India, from banks and NBFCs to manufacturing companies and service providers. These professionals manage the critical function of assessing creditworthiness, extending credit facilities, and recovering outstanding payments. From HDFC Bank to Bajaj Finance, from Tata Steel to Reliance Industries, credit and collections specialists ensure businesses maintain healthy cash flow while managing risk effectively.

The role of credit and collections professionals has evolved significantly with the digitalisation of financial services, implementation of GST, and growth of lending platforms. Companies are seeking individuals who can combine traditional collection techniques with data analytics, digital tools, and customer-centric approaches. Whether you’re a fresher entering the finance field or an experienced professional seeking advancement to management roles, a well-crafted resume is essential for standing out in India’s competitive financial job market.

This comprehensive guide will help you create a credit and collections resume that effectively showcases your analytical skills, negotiation abilities, and track record in recovering outstanding dues. From highlighting your collection efficiency to demonstrating your success in reducing NPAs, we’ll cover everything you need to land your dream credit and collections role in 2025.

Section 1: Understanding Credit and Collections Roles in India

Overview of Duties and Responsibilities

Credit and Collections professionals in India handle crucial financial responsibilities that directly impact cash flow and risk management. Common duties include:

Credit Assessment: Evaluating loan applications, analysing financial statements, and assessing creditworthiness of individuals and businesses.

Credit Limit Management: Setting and monitoring credit limits based on customer financial health and payment history.

Collections Management: Following up on overdue accounts, negotiating payment plans, and ensuring timely recovery of dues.

Risk Analysis: Identifying potential default risks and implementing mitigation strategies to protect the organisation.

Documentation: Maintaining accurate records of credit decisions, collection efforts, and customer communications.

Legal Coordination: Working with legal teams for recovery through SARFAESI, DRT, or other legal channels when necessary.

Key Skills and Competencies Employers Look For

Employers in India’s credit and collections sector value a combination of analytical abilities and communication skills:

Financial Analysis: Ability to analyse balance sheets, income statements, and cash flow statements.

Credit Scoring Knowledge: Understanding of credit scoring models, CIBIL scores, and risk assessment methodologies.

Negotiation Skills: Ability to negotiate payment terms and settlements professionally.

Communication Skills: Professional communication for customer interactions and internal reporting.

Legal Knowledge: Understanding of RBI guidelines, SARFAESI Act, and debt recovery procedures.

Software Proficiency: Experience with collection software, CRM systems, and MS Excel for analysis.

Diversity of Roles Within Credit and Collections

The credit and collections field in India offers various specialisation paths:

Credit Analyst: Assesses loan applications and determines creditworthiness.

Collections Executive: Handles follow-ups on overdue accounts and negotiates payments.

Recovery Officer: Specialises in recovering NPAs and working with legal teams.

Credit Manager: Oversees credit policies, team management, and portfolio risk.

Collections Manager: Manages collection teams and strategies for large portfolios.

Risk Manager: Develops and implements credit risk frameworks and policies.

Section 2: Preparing Your Resume - Essential Components

Contact Information

Your contact section should be professional and easily accessible:

- Full Name: Clearly displayed at the top of your resume

- Phone Number: Include your mobile number with country code (+91)

- Email Address: Use a professional email (e.g., amit.verma@email.com)

- Location: City and state (e.g., Mumbai, Maharashtra)

- LinkedIn Profile: Include if it showcases relevant professional information

Professional Summary

Your summary should capture your experience, expertise, and career objectives:

Example for Experienced Professional: “Credit Manager with 10+ years of experience in banking and NBFC sectors. Managed credit portfolio of ₹500 crore at HDFC Bank reducing NPA from 3.5% to 1.8%. Expert in credit assessment, risk modelling, and collection strategies. Led team of 15 credit analysts achieving 95% collection efficiency. Seeking to drive credit excellence in a growth-oriented financial institution.”

Example for Mid-Level Professional: “Credit Analyst with 5 years of experience in corporate lending at ICICI Bank. Evaluated credit proposals worth ₹100 crore annually with 98% accuracy in risk assessment. Proficient in financial analysis, credit scoring, and RBI compliance. Certified Credit Professional from NIBM. Looking to advance into credit management role.”

Example for Fresher: “MBA Finance graduate from Symbiosis with specialisation in Banking. Completed internship at Bajaj Finance handling personal loan collections. Strong foundation in financial analysis, credit evaluation, and customer communication. Certified in Credit Risk Management from IIBF. Eager to start my career in credit and collections.”

Work Experience

Present your experience in reverse chronological order with quantified achievements:

Credit Manager | Bajaj Finserv | Pune | 2020-Present

- Manage credit operations for consumer lending portfolio of ₹300 crore

- Reduced NPA from 4.2% to 2.1% through improved collection strategies

- Lead team of 12 credit officers handling 10,000+ accounts monthly

- Implemented risk-based pricing model increasing profitability by 15%

Senior Credit Analyst | HDFC Bank | Mumbai | 2016-2020

- Evaluated corporate loan proposals ranging from ₹1 crore to ₹50 crore

- Maintained 99% accuracy in credit assessment with zero fraud cases

- Conducted financial analysis of 200+ companies annually

- Technologies: Finacle, CIBIL, MS Excel, financial modelling

Skills Section

Technical Skills:

- Credit Analysis: Financial statement analysis, ratio analysis, cash flow analysis

- Risk Assessment: Credit scoring, probability of default, loss given default

- Collection Tools: Collection CRM, dialer systems, skip tracing tools

- Banking Software: Finacle, Flexcube, TCS BaNCS

- MS Office: Advanced Excel (VLOOKUP, Pivot Tables), PowerPoint

- Compliance: RBI guidelines, SARFAESI Act, IBC, Fair Practices Code

Soft Skills:

- Negotiation

- Communication

- Problem Solving

- Analytical Thinking

- Decision Making

- Attention to Detail

Section 3: Resume Formats for Credit and Collections Professionals

Chronological Resume

Best suited for professionals with steady career progression in credit or finance. Lists work experience from most recent to oldest, highlighting career growth.

When to use: If you have 3+ years of continuous experience in credit or collections with clear progression.

Functional Resume

Focuses on skills and competencies rather than chronological work history. Useful for career changers or those with employment gaps.

When to use: If you’re transitioning from general banking to specialised credit roles.

Combination Resume

Blends the chronological and functional formats, highlighting both skills and work history. Ideal for experienced professionals seeking senior roles.

When to use: If you have diverse experience across credit, collections, and risk management.

Section 4: Professional Summary Examples

For Collection Manager: “Collection Manager with 8 years of experience in NBFC and banking sectors. Led collection operations for ₹200 crore portfolio at Muthoot Finance achieving 92% collection efficiency. Expert in bucket management, legal recovery, and team leadership. Reduced roll-forward rates by 35% through early intervention strategies. Strong track record in managing field collection teams.”

For Credit Risk Analyst: “Credit Risk Analyst with 6 years of experience in retail and corporate lending. Developed credit scorecards for Kotak Mahindra Bank improving default prediction by 25%. Expert in statistical modelling, data analysis, and risk quantification. Proficient in SAS, Python, and advanced Excel. Published research on credit risk in Indian banking sector.”

For Recovery Officer: “Recovery Officer with 5 years of experience in NPA recovery and legal collections. Recovered ₹25 crore in bad debts through SARFAESI and DRT proceedings at State Bank of India. Expert in negotiating OTS settlements and managing recovery agencies. Strong understanding of IBC and debt restructuring. Fluent in Hindi, English, and Marathi.”

For Fresher: “B.Com graduate from Mumbai University with JAIIB certification. Completed 6-month internship at NBFC handling telecalling collections. Strong foundation in credit basics, customer communication, and payment follow-up. Good knowledge of RBI guidelines and collection practices. Eager to build career in credit and collections.”

For Career Changer: “Sales professional transitioning to collections with 6 years of customer-facing experience. Expertise in customer negotiation, relationship management, and target achievement. Completed Credit Management certification from NIBM. Strong communication skills and result-oriented approach. Ready to apply sales experience to collections role.”

Section 5: Showcasing Credit and Collections Achievements

How to Present Achievements

Transform task descriptions into compelling achievements:

Instead of: “Managed collections” Write: “Managed collection operations for ₹150 crore portfolio achieving 94% collection efficiency, reducing NPA from 5% to 2.5% and recovering ₹8 crore in bad debts through strategic bucket management”

Instead of: “Did credit analysis” Write: “Evaluated 500+ credit proposals annually worth ₹200 crore with 98% accuracy in risk assessment, resulting in zero default cases in sanctioned portfolio”

Sample Work Experience Entries

Head - Collections | Tata Capital | Mumbai

- Oversee collection operations for consumer and commercial lending portfolio of ₹1000 crore

- Lead team of 50+ collection executives across 10 branches in Western India

- Implemented AI-based collection prioritisation reducing delinquency by 30%

- Achieved 96% collection efficiency with 15% reduction in operational costs

- Technologies: Collection CRM, predictive analytics, power dialer

Credit Manager | L&T Finance | Bangalore

- Manage credit underwriting for SME and mid-corporate lending

- Evaluated proposals worth ₹500 crore annually maintaining 2% portfolio NPA

- Developed sector-specific credit policies for manufacturing and services

- Trained 20 credit officers on credit assessment and risk evaluation

- Technologies: Finacle, CIBIL, Excel modelling, internal rating system

Senior Collections Executive | Mahindra Finance | Chennai

- Handled collection for 2000+ accounts with outstanding of ₹50 crore

- Achieved 95% collection efficiency for 0-30 DPD bucket

- Negotiated 100+ OTS settlements recovering ₹5 crore annually

- Coordinated with legal team for 50+ SARFAESI cases

- Technologies: Collection software, mobile apps, skip tracing tools

Entry-Level Project Ideas

For freshers, showcase relevant experience:

- Internship Work - Telecalling collections, documentation, customer follow-ups

- Academic Projects - Credit risk analysis case studies, NPA management research

- Certifications - JAIIB, CAIIB, Credit Management certifications from NIBM

- Volunteer Work - Helping SHGs or microfinance organisations with collections

Section 6: Skills to Include in Your Credit and Collections Resume

Technical Skills

- Credit Analysis: Financial statement analysis, ratio analysis, cash flow projections

- Risk Assessment: Credit scoring models, rating systems, probability of default

- Collection Management: Bucket strategy, skip tracing, legal recovery

- Banking Software: Finacle, Flexcube, TCS BaNCS, loan management systems

- CRM Systems: Salesforce, collection-specific CRMs, dialer systems

- Microsoft Excel: Advanced formulas, Pivot Tables, financial modelling

- Data Analysis: SQL basics, data extraction, MIS reporting

- Compliance: RBI guidelines, SARFAESI Act, IBC, Fair Practices Code

- Documentation: Credit proposals, sanction notes, legal notices

- Reporting: Portfolio analysis, collection dashboards, NPA reporting

Soft Skills

- Negotiation: Professional discussions with defaulting customers

- Communication: Clear verbal and written communication with stakeholders

- Analytical Thinking: Evaluating complex financial situations

- Decision Making: Quick and accurate credit decisions under pressure

- Problem Solving: Finding solutions for difficult collection cases

- Persistence: Following up consistently on overdue accounts

- Empathy: Understanding customer situations while maintaining professionalism

- Teamwork: Collaborating with sales, legal, and operations teams

Section 7: Certifications and Professional Development

Essential Certifications for Credit and Collections Professionals

JAIIB (Junior Associate of Indian Institute of Bankers)

- Issued by: Indian Institute of Banking and Finance (IIBF)

- Value: Foundation certification for banking professionals

CAIIB (Certified Associate of Indian Institute of Bankers)

- Issued by: IIBF

- Value: Advanced certification demonstrating expertise

Certified Credit Professional

- Issued by: NIBM (National Institute of Bank Management)

- Value: Specialised certification in credit management

Credit Risk Management Certification

- Issued by: IIBF, NIBM, various institutes

- Value: Demonstrates expertise in risk assessment

Professional Qualifications

- B.Com/M.Com (Bachelor/Master of Commerce)

- MBA Finance (Master of Business Administration)

- CA (Chartered Accountant) - pursuing or qualified

- CFA (Chartered Financial Analyst) - pursuing or qualified

- FRM (Financial Risk Manager) - for risk roles

Training Programmes

- Credit Appraisal and Monitoring - NIBM, banks’ training centres

- SARFAESI and DRT Procedures - Legal training institutes

- Advanced Excel for Finance - Various training providers

- Collection Management - Banking training institutes

Section 8: Tips by Experience Level

Entry-Level (0-2 Years)

- Highlight Education: Emphasise your commerce/finance degree and relevant coursework

- Include Certifications: JAIIB, credit management courses add significant value

- Showcase Internships: Detail your internship experiences with specific learnings

- Mention Language Skills: Regional languages are valuable for collections

- Emphasise Soft Skills: Communication, persistence, and analytical abilities

- Add Academic Projects: Credit-related case studies and research work

Mid-Level (3-7 Years)

- Focus on Metrics: Collection efficiency, NPA reduction, recovery amounts

- Show Portfolio Management: Size of portfolio managed, number of accounts

- Highlight Improvements: Process improvements, efficiency gains, cost reduction

- Demonstrate Team Contribution: Training juniors, team achievements

- Include Specialisation: Retail, corporate, SME, or specific industry expertise

- Show Software Expertise: Advanced features of banking and collection systems

Senior-Level (8+ Years)

- Strategic Contributions: Policy development, portfolio strategy, risk framework

- Leadership Experience: Team size managed, hiring, training, performance management

- Cross-Functional Coordination: Working with sales, legal, and risk teams

- Regulatory Expertise: RBI audits, compliance management, regulatory changes

- Business Impact: Revenue contribution, cost savings, profitability improvement

- Industry Recognition: Awards, publications, conference presentations

Section 9: ATS Optimisation Tips

Understanding ATS in Indian Financial Sector

Many Indian banks and NBFCs use Applicant Tracking Systems to screen resumes. Common systems include Naukri RMS, Taleo, and various HRMS solutions.

Keyword Optimisation

Include relevant keywords from the job description:

- Job titles: Credit Analyst, Collections Officer, Credit Manager

- Skills: Credit analysis, collections, NPA recovery, risk assessment

- Metrics: Collection efficiency, DPD, NPA, recovery rate

- Software: Finacle, CIBIL, collection CRM, Excel

Formatting Best Practices

- Use standard fonts (Arial, Calibri, Times New Roman)

- Avoid tables, graphics, and complex formatting

- Use standard section headings (Experience, Education, Skills)

- Save as PDF or .docx as specified

- Keep file size under 2MB

Common Mistakes to Avoid

- Using headers and footers (ATS may not read them)

- Including photos or graphics

- Using abbreviations without full forms

- Inconsistent date formats

- Missing contact information

Conclusion

Creating a compelling credit and collections resume requires showcasing your analytical skills, negotiation abilities, and track record in managing credit risk and recovering dues. By following this guide, you can craft a resume that effectively communicates your expertise to employers across India’s banking and financial services sector.

The credit and collections profession in India offers excellent opportunities for growth, from entry-level analyst roles to senior management positions in leading banks like HDFC, ICICI, SBI, and NBFCs like Bajaj Finance, L&T Finance, and Mahindra Finance. Whether you’re a fresher entering the field, a mid-level professional seeking advancement, or a senior professional targeting leadership roles, a well-crafted resume is your key to career success.

Remember to tailor your resume for each application, quantify your achievements with specific metrics (NPA reduction, collection efficiency, recovery amounts), and keep your certifications section updated. Highlight your understanding of RBI guidelines and compliance requirements as these are critical in the regulated financial sector.

Ready to create your professional credit and collections resume? Use our resume builder to get started with professionally designed templates, or explore more resume samples for inspiration. For personalised guidance, our expert resume writers are here to help you craft a document that opens doors to your dream finance role.

Frequently Asked Questions

What sections should a strong credit and collections resume include?

At minimum, include contact information, a professional summary, work experience, key skills, and education. Depending on your experience level, you may also add certifications, achievements, projects, or industry-specific sections that highlight your expertise.

How do I write a professional summary for a credit and collections role?

Keep it concise — two to three sentences highlighting your experience level, core competencies, and a key achievement or strength that shows why you're right for the job. Tailor it to match the specific role you're applying for.

What skills are most important to list on a credit and collections resume?

Include a mix of technical skills specific to credit and collections roles and soft skills like communication, problem-solving, and teamwork. Research job postings in your target companies to identify the most commonly requested skills.

How detailed should my work experience be?

Use bullet points to describe your roles, focusing on specific results, tools used, and the impact you made. Quantify achievements where possible — numbers and percentages help recruiters quickly understand your contributions.

Do I need certifications on my credit and collections resume?

Certifications aren't always required, but they can strengthen your application — especially if they demonstrate advanced training or specialised expertise. List the certification name, issuing organisation, and year obtained.

What's the best resume format for a credit and collections?

Most credit and collections professionals benefit from a reverse-chronological format that lists your most recent experience first. If you're changing careers or have gaps, a functional or combination format might work better.

How long should my credit and collections resume be?

Aim for one page if you're early in your career. Experienced professionals with extensive achievements can use two pages — just ensure every section adds value and remains relevant to the role.

Should I tailor my resume for each job application?

Yes. Customising your resume with keywords and responsibilities from the job posting improves your chances of passing Applicant Tracking Systems (ATS) and resonating with recruiters. Focus on relevant experience and skills for each role.

Credit and Collections Text-Only Resume Templates and Samples

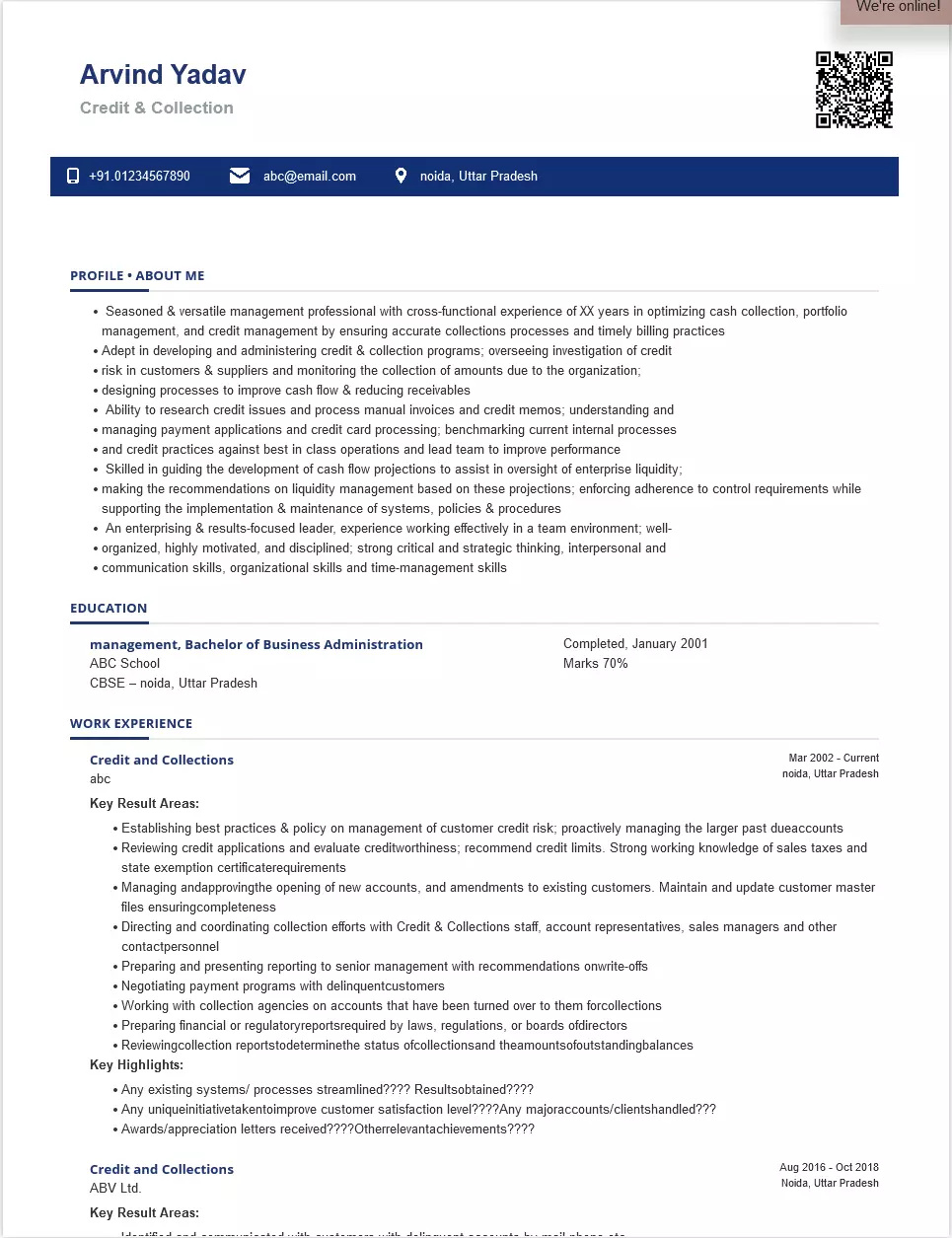

Arvind Yadav

Phone: 01234567890

Email: abc@email.com

Address: sec-44, Noida, noida

About Me

Credit & Collection

Highly motivated and energetic with XX years of experience in optimizing cash collection, portfolio management, and credit management by ensuring accurate collections processes and timely billing practices. An enterprising & results-focused leader, with experience working effectively in a team environment; well-organized, highly motivated, and disciplined. Strong critical and strategic thinking, interpersonal and communication skills, organizational skills, and time-management skills

Education

Management, Bachelor of Business Administration, Completed, January 2001

ABC School

CBSE

Noida, UP

Certifications

Work Experience

Period: March 2002 - Current

Credit and Collections

Abc Pvt Ltd

- Establishing best practices & policies on the management of customer credit risk; proactively managing the larger past due accounts

- Reviewing credit applications and evaluating creditworthiness; recommend credit limits. Strong working knowledge of sales taxes and state exemption certificate requirements

- Managing and approving the opening of new accounts, and amendments to existing customers. Maintain and update customer master files ensuring completeness

- Directing and coordinating collection efforts with Credit & Collections staff, account representatives, sales, managers, and other contact personnel

- Preparing and presenting reports to senior management with recommendations on write-offs

- Negotiating payment programs with delinquent customers

- Working with collection agencies on accounts that have been turned over to them for collections

- Preparing financial or regulatory reports required by laws, regulations, or boards of directors

- Reviewing collection reports to determine the status of collections and the amounts of outstanding balances

Period: August 2016 - October 2018

Credit and Collections

ABV Ltd.

- Identified and communicated with customers with delinquent accounts by mail, phone, etc.

- Worked out terms for payment or initiates other actions as necessary

- Ensured collections operations functioned smoothly and effectively

- Created and maintained credit history files

- Analyzed and assessed the creditworthiness of account/client using external credit risk management tools/reports; supported the collection efforts/calls for accounts receivable portfolio

- Performed account/payment reconciliations; responded to credit inquiries from external & internal clients

- Identified delinquent accounts requiring external collection efforts; identified lousy debt or financial exposure

Skills

- Good Communication and Customer Service

- Flexible Work Schedule

- Extremely Motivated and Flexible Team Contributor

- Oracle 11i

- Advanced Collections and Credit Management Modules

- Siebel On Demand

- Knowledge Of SAP

- Oracle

- Microsoft Dynamics/Great Plains

- Northridge

- Loanledger

- Microsoft Office

India's

premier resume service

India's

premier resume service