- Arvind Yadav/Project Management Professional, Completed , January 2011

What's your job?

Tax Professional Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Tax Professional Resume Guide for India

A well-crafted tax professional resume is essential for success in India’s complex and dynamic tax landscape. Whether you’re a fresher starting your career in taxation or an experienced professional seeking positions at Big Four firms, large corporates, or specialized tax consultancies, this guide provides everything you need to create a standout resume that impresses Indian employers and passes ATS screening on portals like Naukri and LinkedIn.

This comprehensive guide includes:

- Resume format recommendations for Indian tax sector

- Key skills Indian employers look for

- Complete resume example with Indian context

- Top tax professional employers in India

- Salary insights in INR by experience level

- CA, GST Practitioner, and certification guidance

- ATS optimization tips for Indian job portals

Why Your Tax Professional Resume Matters in India

India’s tax landscape has transformed significantly with GST implementation and increasing compliance requirements. Companies like Deloitte, PwC, EY, KPMG, corporate tax teams, and specialized tax firms actively hire qualified tax professionals. A strong resume helps you:

- Stand out from thousands of CA and tax professionals on Naukri and LinkedIn

- Pass ATS screening used by Big Four firms and corporate tax departments

- Showcase skills that Indian employers value, including GST, income tax, and transfer pricing expertise

- Demonstrate your compliance track record and tax planning abilities

Indian hiring managers typically spend 6-10 seconds reviewing each resume initially. Your tax professional resume must immediately communicate your qualifications, domain expertise, and value. With India’s evolving tax regime and increasing scrutiny, tax professionals are in high demand—a well-optimized resume opens doors to excellent opportunities.

Tax Professional Resume Format for India

Indian employers prefer clean, professional resume formats. Here’s what works best for tax positions:

Recommended Format

- Length: 1-2 pages (freshers: 1 page, experienced: 2 pages max)

- Layout: Reverse chronological (most recent first)

- Font: Arial, Calibri, or Times New Roman (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Resume vs Biodata

In India, “biodata” is occasionally used for government tax positions. For Big Four, corporate, and private sector tax roles, use a professional resume format.

Personal Details for Indian Tax Resumes

Indian resumes typically include:

- Full name with CA designation (e.g., “Name, CA”)

- Phone number with country code (+91)

- Professional email address

- LinkedIn profile URL

- City, State (full address not required)

What to Avoid

- Decorative fonts or graphics (causes ATS issues)

- Personal information like religion, caste, or father’s name

- Salary expectations (discuss during interview)

- References (provide when requested)

Key Skills for Tax Professionals in India

Indian employers look for expertise across direct and indirect taxation with strong compliance focus.

Direct Tax Skills

- Income Tax Compliance: ITR filing, TDS/TCS compliance, advance tax

- Tax Audit: Section 44AB audits, tax audit reports

- Corporate Taxation: MAT, DDT, tax provisions under Companies Act

- International Tax: DTAA, POEM rules, CbCR, BEPS

- Transfer Pricing: TP documentation, benchmarking, APA/MAP

- Tax Litigation: Appeals, ITAT representation, assessments

- Tax Planning: Legitimate tax savings, structuring

Indirect Tax Skills (GST)

- GST Compliance: GSTR-1, GSTR-3B, GSTR-9, GSTR-9C

- GST Audit: Annual returns, reconciliation, compliance

- Input Tax Credit: ITC claims, reversals, GST reconciliation

- GST Advisory: Classification, rates, exemptions, anti-profiteering

- GST Litigation: Show cause notices, appeals, advance rulings

- E-invoicing & E-way Bills: Compliance and implementation

Software & Tools

- Tax Software: ClearTax, Taxmann, Saral TDS, Winman

- ERP Systems: SAP FICO, Oracle Tax modules

- Compliance Portals: Income Tax portal, GST portal, MCA

- Data Analytics: Excel (Advanced), SQL, Power BI

- Research Tools: Taxmann, SCC Online, Manupatra

Soft Skills for Tax Professionals

- Attention to Detail: Accuracy in tax calculations and filings

- Analytical Thinking: Interpreting tax laws and circulars

- Communication: Explaining tax positions to stakeholders

- Time Management: Meeting filing deadlines (quarterly, annual)

- Problem-Solving: Resolving tax disputes and queries

How to Present Skills

Create a dedicated skills section. List skills in order of relevance. Use exact keywords from job postings on Naukri or LinkedIn.

Tax Professional Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Deepika Joshi, CA

Bangalore, Karnataka | +91-98XXX-XXXXX | deepika.joshi@email.com | linkedin.com/in/deepikajoshi-tax

Professional Summary

Detail-oriented Chartered Accountant with 7+ years of experience in corporate taxation, GST compliance, and transfer pricing for manufacturing and IT sectors. Expertise in income tax provisions, GST annual returns (GSTR-9C), and TP documentation with proven track record of zero penalty on tax filings. Experienced in tax litigation, assessments, and advisory for companies with turnover up to ₹5,000 Cr. Proficient in SAP FICO, Taxmann, and compliance portals. Seeking senior tax role at a leading organization.

Key Skills

Corporate Income Tax | GST Compliance (GSTR-1, 3B, 9, 9C) | TDS/TCS Compliance | Transfer Pricing | Tax Audit (44AB) | Tax Provisions (Ind AS) | Tax Litigation | International Tax (DTAA) | SAP FICO | ClearTax | Taxmann | Income Tax Portal | GST Portal | Tax Planning | Advance Rulings | MIS Reporting

Professional Experience

Senior Tax Manager | Bosch India Ltd | Bangalore | April 2021 – Present

- Lead direct and indirect tax compliance for 4 Bosch entities with combined revenue of ₹8,000 Cr

- Manage team of 6 tax professionals handling income tax, GST, TDS, and transfer pricing

- Ensure timely filing of corporate ITRs, GST returns, TDS returns with zero-penalty track record

- Prepare and review GSTR-9 and GSTR-9C annual returns, managing ITC reconciliation for ₹200 Cr+

- Handle transfer pricing documentation for 15+ international transactions with AEs

- Coordinate tax assessments and respond to notices from Income Tax and GST authorities

- Implemented SAP tax module upgrades for e-invoicing and new GST compliance requirements

- Reduced withholding tax leakage by 25% through improved TDS monitoring and vendor management

- Present tax updates and risk assessment to CFO and audit committee quarterly

Tax Manager | Deloitte Haskins & Sells LLP | Bangalore | June 2018 – March 2021

- Provided tax advisory and compliance services to 20+ clients across manufacturing, IT, and pharma

- Prepared and reviewed corporate tax returns, tax audit reports, and tax provisions

- Handled GST implementation and ongoing compliance for multiple clients

- Conducted transfer pricing studies and prepared TP documentation for clients

- Represented clients in income tax assessments and drafted submissions

- Advised on tax implications of M&A transactions and corporate restructuring

- Trained junior staff on income tax and GST provisions

- Received “Star Performer” recognition for FY2020

Senior Tax Associate | PwC India | Mumbai | July 2016 – May 2018

- Assisted in tax compliance and advisory for large corporate clients

- Prepared tax returns, tax audit reports, and quarterly tax provisions

- Handled TDS compliance, return filing, and TDS assessments

- Participated in GST transition and advised clients on GST implementation

- Conducted research on tax issues and prepared technical memos

Articleship | M/s Kumar & Associates | Delhi | August 2013 – June 2016

- Completed 3-year CA articleship with focus on direct and indirect taxation

- Assisted in tax audits, income tax return preparation, and VAT/CST compliance

- Gained exposure to assessments, appellate proceedings, and tax litigation

Education

Chartered Accountant (CA) | Institute of Chartered Accountants of India (ICAI) | 2016

- Cleared Final exam in first attempt

Bachelor of Commerce (B.Com Hons) | Delhi University | 2013

- First Class with Distinction (78%)

- Specialization: Taxation

Higher Secondary Certificate | CBSE Board | 2010

- 88% in Commerce stream

Certifications

- Chartered Accountant (CA) | ICAI | 2016

- GST Practitioner Certificate | ICAI | 2019

- Certificate Course on International Taxation | ICAI | 2020

- Transfer Pricing Certification | ICAI | 2021

- Diploma in Information Systems Audit (DISA) | ICAI | 2018

Professional Memberships

- Fellow Member, ICAI (FCA)

- Member, Bangalore Branch of SIRC of ICAI

- Member, Direct Tax Committee, ICAI

Languages

English (Fluent) | Hindi (Native) | Kannada (Conversational)

Declaration

I hereby declare that the information provided above is true to the best of my knowledge.

Deepika Joshi Bangalore, December 2024

Top Tax Professional Employers in India

India’s tax sector offers excellent opportunities. Here are the top employers:

Big Four Accounting Firms

- Deloitte Haskins & Sells LLP: Large tax practice, direct and indirect tax

- PwC India: Strong tax advisory and compliance services

- EY India (Ernst & Young): Tax and transaction advisory

- KPMG India: Tax and regulatory services

Mid-Size Tax Firms

- Grant Thornton Bharat LLP: Growing tax practice

- BDO India: Tax advisory and compliance

- RSM India: International tax network

- Dhruva Advisors: Specialized tax advisory

- SKP Group: Direct and indirect tax

- Nangia Andersen: International tax focus

Corporate Tax Departments

- Reliance Industries: Large in-house tax team

- Tata Group Companies: TCS, Tata Steel, Tata Motors

- HDFC Bank / ICICI Bank: Banking tax teams

- Infosys / Wipro / TCS: IT sector tax

- Mahindra Group: Diversified businesses

- Hindustan Unilever: FMCG tax operations

- Bosch India: Manufacturing tax

Government & Regulatory

- Income Tax Department: IRS officers

- GST Department: State and Central GST

- CBIC: Central Board of Indirect Taxes

- Advance Ruling Authority: Tax tribunals

Tax Technology Companies

- ClearTax: GST and ITR software

- Zoho: Compliance software

- Taxmann: Tax research and compliance

- Saral: TDS and GST solutions

How to Apply

- Apply through Naukri.com and LinkedIn

- Visit Big Four career portals directly

- Apply through ICAI placement portal for freshers

- Network through CA study groups and professional events

- Tax specialized recruitment agencies

Tax Professional Salary in India

Salaries vary based on experience, firm type, specialization, and location. Big Four and specialized firms pay competitive salaries.

Salary by Experience Level

| Experience | Big Four (INR) | Mid-Size Firms (INR) | Corporate (INR) |

|---|---|---|---|

| Fresher CA (0-2 years) | ₹7 - ₹12 LPA | ₹5 - ₹9 LPA | ₹6 - ₹10 LPA |

| Associate (3-5 years) | ₹12 - ₹20 LPA | ₹9 - ₹15 LPA | ₹10 - ₹16 LPA |

| Manager (5-8 years) | ₹20 - ₹35 LPA | ₹15 - ₹25 LPA | ₹16 - ₹28 LPA |

| Senior Manager (8-12 years) | ₹35 - ₹55 LPA | ₹25 - ₹40 LPA | ₹28 - ₹45 LPA |

| Director/Partner (12+ years) | ₹55 LPA - ₹2 Cr+ | ₹40 - ₹80 LPA | ₹45 - ₹1 Cr |

Note: Partners at Big Four earn significantly through profit-sharing.

Salary by City

| City | Salary Range (Manager Level) |

|---|---|

| Mumbai | ₹20 - ₹38 LPA |

| Delhi NCR | ₹18 - ₹35 LPA |

| Bangalore | ₹18 - ₹32 LPA |

| Pune | ₹16 - ₹28 LPA |

| Hyderabad | ₹15 - ₹26 LPA |

| Chennai | ₹14 - ₹25 LPA |

Factors Affecting Salary

- Qualifications: CA essential; LL.B adds premium for litigation

- Specialization: Transfer pricing, international tax pay higher

- Firm Type: Big Four typically 20-40% higher than mid-size

- Industry Expertise: Banking, pharma, IT specialization valued

- Compliance Track Record: Zero-penalty history valued

- Litigation Experience: ITAT representation adds value

Salary data based on Glassdoor India, AmbitionBox, and industry surveys.

Certifications for Tax Professionals in India

Professional certifications demonstrate expertise and enhance career prospects.

Essential Certifications

Chartered Accountant (CA) - ICAI The gold standard for tax professionals in India. Required for signing tax audit reports. Comprehensive coverage of direct and indirect taxation.

GST Practitioner Certificate - ICAI/NACIN Demonstrates GST expertise. Valuable for compliance and advisory roles post-GST implementation.

LL.B (Bachelor of Laws) Valuable addition for tax litigation and advisory roles. Many senior tax professionals combine CA with LL.B.

ICAI Certificate Courses

- International Taxation: DTAA, BEPS, cross-border transactions

- Transfer Pricing: TP documentation, benchmarking, compliance

- Indirect Taxes: Comprehensive GST coverage

- Valuation: Business and securities valuation

- Forensic Accounting: Fraud investigation

Other Valuable Certifications

- CMA (ICMAI): Cost and management accounting

- CS (ICSI): Company law expertise

- ACCA (UK): International recognition

- Diploma in Taxation Law: Various law universities

How to List Certifications

Display CA prominently after your name. Include ICAI certificate courses with year obtained. Professional course completions add credibility.

ATS Tips for Your Tax Professional Resume

Most firms and corporates use Applicant Tracking Systems (ATS) for screening. Optimize your resume:

For Naukri.com

- Use keywords from job descriptions (GST, transfer pricing, tax audit, CA)

- Keep formatting simple (no tables, columns, or graphics)

- Use standard section headings (Experience, Education, Skills)

- Upload in .docx or .pdf format

- Update your Naukri profile regularly

For LinkedIn Applications

- Match your resume to your LinkedIn profile

- Use industry-standard job titles (Tax Manager, Senior Tax Associate)

- Include relevant keywords in your LinkedIn skills section

- Get endorsements from partners and colleagues

General ATS Tips

- DO: Use standard fonts, clear headings, bullet points

- DO: Include metrics (managed ₹200 Cr ITC, zero-penalty record)

- DO: Mention ICAI membership details

- DON’T: Use headers/footers, text boxes, or images

- DON’T: Use creative section titles

Keyword Strategy for Indian Tax Roles

Common keywords from job postings:

- Tax Professional, Tax Manager, Senior Tax Associate, Tax Consultant

- CA, GST, Income Tax, TDS, TCS, Transfer Pricing

- Tax Audit (44AB), GSTR-1, GSTR-3B, GSTR-9, GSTR-9C

- International Tax, DTAA, BEPS, TP Documentation

- SAP FICO, ClearTax, Taxmann, Compliance Portal

- Tax Litigation, Assessment, Appeals, ITAT

Final Tips for Your Tax Professional Resume

✅ Display CA qualification prominently—essential for tax roles

✅ Highlight compliance track record—zero-penalty filings impress employers

✅ Show specialization—GST, transfer pricing, international tax expertise

✅ Quantify scope (managed ₹5,000 Cr turnover clients, ₹200 Cr ITC)

✅ Include Big Four or reputed firm experience—carries significant weight

✅ Mention litigation experience—assessments, appeals, ITAT representation

✅ Proofread meticulously—accuracy is paramount in tax profession

Quick Checklist

- Contact information with +91 phone number and LinkedIn

- CA designation after name (e.g., “Name, CA”)

- Professional summary with specialization and achievements

- Skills section with GST, income tax, transfer pricing keywords

- Experience showing client turnover, compliance scope, and outcomes

- Education with CA and degree details

- Certifications (CA, GST Practitioner, ICAI courses)

- Professional memberships (ICAI)

- ATS-friendly formatting

- Declaration statement

Ready to create your professional tax resume? Use our resume builder to get started with expert-designed templates optimized for Indian job portals.

For more guidance on resume structure, check out our resume format guide with tips specifically for the Indian tax and finance job market.

Frequently Asked Questions

What should a tax professional resume include?

A strong tax professional resume should include a clear summary, key tax skills, work experience, certifications, and education. Highlight areas like income tax filing, GST compliance, tax audits, TDS, and regulatory knowledge. Employers want to quickly see your expertise and compliance accuracy.

How do I write a professional summary for a tax professional resume?

Your summary should briefly explain your experience, specialization, and value. For example: years of experience, types of taxes handled (direct/indirect), industries served, and your ability to ensure compliance and minimize tax risk.

Which skills are most important for a tax professional resume?

Important skills include tax planning, GST returns, income tax filing, TDS, tax audits, compliance management, financial analysis, Excel, and tax software. Soft skills like attention to detail and analytical thinking also matter.

How can a fresher write an effective tax professional resume?

Freshers should focus on education, internships, articleship experience, certifications, and practical exposure to tax filings or compliance work. Mention tools, coursework, and any hands-on training related to taxation.

How do I tailor my tax professional resume for Indian tax roles?

Mention experience with Indian tax laws such as GST, Income Tax Act, ROC filings, TDS/TCS, and statutory compliance. Using India-specific keywords improves relevance for recruiters and ATS systems.

What certifications should I add to a tax professional resume?

Include certifications like CA, CMA, CS, CPA, or tax-related diplomas. Short-term certifications in GST, income tax, or compliance tools can also strengthen your resume.

How do I show achievements on a tax professional resume?

Use numbers where possible. For example, "Filed 500+ GST returns with 100% compliance" or "Reduced tax liability by 15% through effective tax planning." This makes your experience more credible and impactful.

Should a tax professional resume be one or two pages?

For freshers and early professionals, one page is ideal. Experienced tax professionals with extensive compliance or advisory experience can use two pages, but keep it concise and relevant.

What keywords should I use in a tax professional resume?

Use keywords like tax professional resume, tax consultant, GST compliance, income tax returns, tax audit, TDS, tax planning, and statutory compliance. These help your resume rank better in ATS and search results.

How often should I update my tax professional resume?

Update your resume whenever you gain new experience, certifications, or handle major tax projects. Keeping it updated ensures you're ready for new opportunities at any time.

Can I use a resume builder for a tax professional resume?

Yes. A resume builder helps structure your resume professionally, ensures ATS compatibility, and saves time. Choose templates designed for finance or taxation roles.

What mistakes should I avoid in a tax professional resume?

Avoid vague descriptions, outdated tax laws, spelling errors, and irrelevant information. Accuracy and clarity are critical for tax-related roles.

Tax Professional Text-Only Resume Templates and Samples

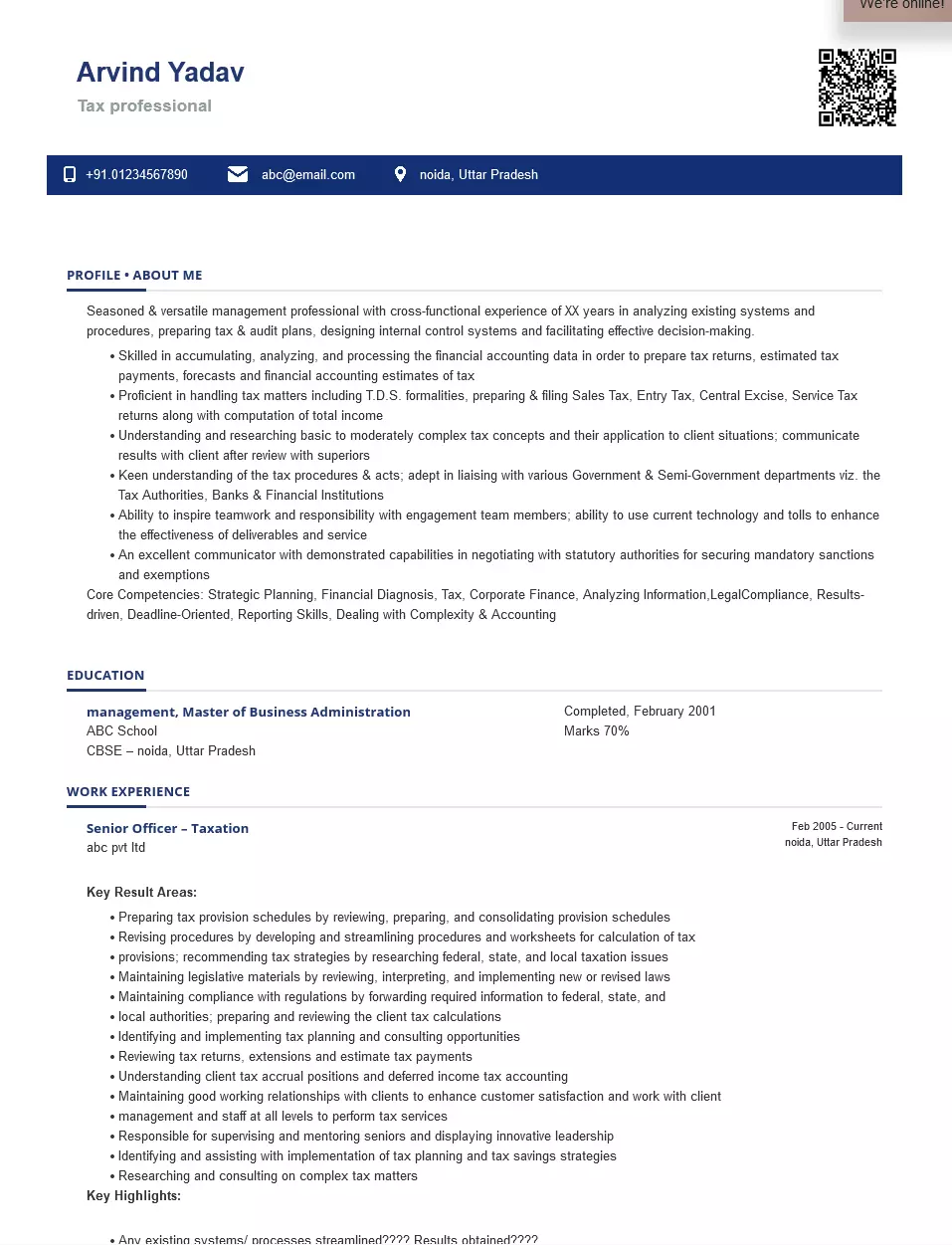

Arvind Yadav

Phone: 01234567890

Email: abc@email.com

Address: sec-44, Noida, Noida

About Me

Tax professional

A highly motivated and energetic tax professional with cross-functional experience of XX years in analyzing existing systems and procedures, preparing tax & audit plans, designing internal control systems, and facilitating effective decision-making. Proficient in handling tax matters including T.D.S. formalities, preparing & filing Sales Tax, Entry Tax, Central Excise, and Service Tax returns along with computation of total income. Ability to inspire teamwork and responsibility by engaging team members

Core Competencies: Strategic Planning, Financial Diagnosis, Tax, Corporate Finance, Analyzing Information, LegalCompliance, Results-driven, Deadline-Oriented, Reporting Skills, Dealing with Complexity & Accounting

Education

Management, Master of Business Administration, Completed, February 2001

ABC School

CBSE

Noida, UP

Certifications

Work Experience

Period: June 2009 - Current

Officer – Taxation

ABCD Ltd

- Calculated taxes on a monthly and quarterly basis; collected various Tax Form Books from the concerned departments and fulfilled all necessary formalities.

- Performed Tax Planning and undertook a cost-benefit analysis for supporting critical business decisions.

- Streamlined effective & tax-efficient strategies for inbound & outbound investments including analysis of proposed GAAP provisions.

- Ensured timely completion of audit assignments and assisted statutory auditors with the completion of Tax & Statutory Audits.

- Handled matters related to Direct Tax; preparing tax plans, filing tax returns, and ensuring timely assessment & filing of returns as per the provisions of respective Tax Acts.

Period: February 2005 - January 2009

Senior Officer – Taxation

ABCD Pvt Ltd

- Preparing tax provision schedules by reviewing, preparing, and consolidating provision schedules

- Revising procedures by developing and streamlining procedures and worksheets for the calculation of tax

- provisions; recommending tax strategies by researching federal, state, and local taxation issues

- Maintaining legislative materials by reviewing, interpreting, and implementing new or revised laws

- Maintaining compliance with regulations by forwarding required information to federal, state, and

- local authorities; preparing and reviewing the client tax calculations

- Identifying and implementing tax planning and consulting opportunities

- Reviewing tax returns, extensions and estimate tax payments

- Understanding client tax accrual positions and deferred income tax accounting

- Maintaining good working relationships with clients to enhance customer satisfaction and work with the client

- management and staff at all levels to perform tax services

- Responsible for supervising and mentoring seniors and displaying innovative leadership

- Identifying and assisting with the implementation of tax planning and tax savings strategies

- Researching and consulting on complex tax matters

Skills

- Strategic Planning

- Financial Diagnosis

- Tax

- Corporate Finance

- Analyzing Information

- Legal Compliance

- Results-driven

- Deadline-Oriented

- Reporting Skills

- Dealing with Complexity & Accounting

Languages

Softwares

Operating System

Personal Interests

Exhibiting a desire to experience new cultures and environments—especially if your role would involve working with foreign colleagues, partners or clients—can really help your resume shine.

India's

premier resume service

India's

premier resume service