- Arvind Yadav/Project Management Professional, Completed , January 2008

What's your job?

Treasurer Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Treasurer Resume Guide for India

A well-crafted Treasurer resume is essential for success in India’s corporate finance sector. Whether you’re a fresher starting your career in treasury or an experienced professional seeking positions at large corporates, banks, or multinational companies, this guide provides everything you need to create a standout resume that impresses Indian employers and passes ATS screening on portals like Naukri and LinkedIn.

This comprehensive guide includes:

- Resume format recommendations for Indian treasury sector

- Key skills Indian employers look for

- Complete resume example with Indian context

- Top treasurer employers in India

- Salary insights in INR by experience level

- CTP, CA, and certification guidance

- ATS optimization tips for Indian job portals

Why Your Treasurer Resume Matters in India

India’s corporate treasury function has grown in complexity with increasing foreign exchange management, regulatory requirements, and capital market activities. Organizations like Reliance Industries, Tata Group, Infosys, HDFC Bank, and numerous MNCs actively hire treasury professionals. A strong resume helps you:

- Stand out from thousands of finance professionals on Naukri and LinkedIn

- Pass ATS screening used by corporates and banks

- Showcase skills that Indian hiring managers value, including forex management, cash flow optimization, and fund raising

- Demonstrate your ability to manage corporate liquidity and financial risk

Indian corporate recruiters typically spend 6-10 seconds reviewing each resume initially. Your Treasurer resume must immediately communicate your treasury expertise, risk management abilities, and fund management experience. With India’s economy growing rapidly, treasury roles are in high demand—a well-optimized resume is essential.

Treasurer Resume Format for India

Indian employers prefer clean, professional resume formats. Here’s what works best:

Recommended Format

- Length: 1-2 pages (freshers: 1 page, experienced: 2 pages max)

- Layout: Reverse chronological (most recent first)

- Font: Arial, Calibri, or Times New Roman (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Resume vs Biodata

In India, use a professional resume format for corporate treasury positions. “Biodata” format is not suitable for treasury roles.

Personal Details for Indian Treasury Resumes

Indian resumes typically include:

- Full name with credentials (CA, CFA, CTP)

- Phone number with country code (+91)

- Professional email address

- LinkedIn profile URL

- City, State (full address not required)

What to Avoid

- Decorative fonts or graphics (causes ATS issues)

- Personal information like religion, caste, or father’s name

- Salary expectations (discuss during interview)

- References (provide when requested)

Key Skills for Treasurers in India

Indian employers look for comprehensive treasury expertise covering cash management, forex, and fund raising.

Cash & Liquidity Management

- Cash Flow Management: Cash forecasting, pooling, concentration

- Working Capital: Optimization, DSO/DPO management

- Bank Relationship: Multiple bank management, account structures

- Cash Pooling: Notional and physical pooling

- Liquidity Planning: Short-term and long-term liquidity

Foreign Exchange Management

- Forex Exposure: Identifying and measuring currency exposure

- Hedging: Forward contracts, options, swaps

- RBI Compliance: ECB regulations, FEMA compliance

- Transfer Pricing: Intercompany pricing, arm’s length documentation

- Repatriation: Dividend, royalty, and fee remittances

Fund Raising & Investments

- Debt Management: Bank loans, NCDs, commercial paper

- ECB (External Commercial Borrowings): RBI compliance, utilization

- Surplus Investment: Mutual funds, FDs, treasury bills

- Capital Structure: Debt-equity optimization

- Bond Issuances: Corporate bonds, masala bonds

Risk Management

- Interest Rate Risk: Hedging strategies, IRS

- Currency Risk: FX exposure management

- Counterparty Risk: Credit assessment, limits

- Commodity Risk: Hedging commodity exposures

Software & Systems

- Treasury Management Systems: SAP TRM, Kyriba, GTreasury

- ERP Systems: SAP, Oracle Financials

- Banking Platforms: Internet banking, SWIFT

- Excel: Advanced modeling, VBA

Soft Skills for Indian Treasury Roles

- Analytical Thinking: Complex financial analysis

- Decision Making: Quick responses to market changes

- Communication: Stakeholder management

- Compliance Focus: Regulatory adherence

How to Present Skills

Create a dedicated skills section. Group by category (Cash Management, Forex, Risk). Highlight treasury systems proficiency.

Treasurer Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Vikram Sharma, CA, CTP

Mumbai, Maharashtra | +91-98XXX-XXXXX | vikram.sharma.treasury@email.com | linkedin.com/in/vikramsharma-treasury

Corporate Treasurer | 12+ Years Treasury Experience | CA, CTP Certified

Professional Summary

Results-driven Corporate Treasurer with 12+ years of experience in cash management, forex hedging, and corporate fund raising for large Indian corporates. Expertise in managing treasury operations for companies with turnover of ₹20,000 Cr+, handling forex exposure of $500M+, and raising debt of ₹3,000 Cr through NCDs and bank facilities. Strong background in RBI compliance, ECB management, and working capital optimization. CA with Certified Treasury Professional (CTP) certification. Seeking senior treasury leadership role.

Skills

Cash Management: Cash Flow Forecasting, Liquidity Planning, Cash Pooling, Working Capital Optimization, Bank Relationship Forex Management: FX Hedging (Forwards, Options), FEMA Compliance, ECB Management, Transfer Pricing, Repatriation Fund Raising: Bank Loans, NCDs, Commercial Paper, ECB, Capital Structure Optimization Risk Management: Interest Rate Risk, Currency Risk, Counterparty Risk, Commodity Hedging Systems: SAP TRM, Oracle Treasury, Bloomberg, Reuters, SWIFT, Advanced Excel

Professional Experience

Head of Treasury | Mahindra & Mahindra Ltd | Mumbai | April 2019 – Present

- Lead treasury operations for automotive and farm equipment business with revenue of ₹90,000 Cr

- Manage forex exposure of $800M+ through systematic hedging program achieving hedge effectiveness of 95%+

- Optimize cash management across 50+ bank accounts ensuring zero idle cash

- Raised ₹2,500 Cr through NCDs at competitive rates (AAA rated)

- Negotiate and manage $500M ECB facilities with international banks

- Reduced borrowing cost by 50 bps through optimal debt mix and timing

- Implement SAP TRM treasury management system across group companies

- Lead team of 8 treasury professionals handling daily operations

- Present treasury strategy and risk updates to CFO and board quarterly

Deputy General Manager - Treasury | Godrej Industries Ltd | Mumbai | June 2015 – March 2019

- Managed treasury operations for diversified conglomerate with ₹12,000 Cr turnover

- Executed forex hedging for $200M+ annual exposure across multiple currencies

- Raised ₹800 Cr working capital facilities and ₹500 Cr term loans

- Managed investment portfolio of ₹500 Cr in liquid funds and FDs

- Implemented cash pooling structure reducing interest cost by ₹3 Cr annually

- Ensured 100% FEMA and RBI compliance for all treasury transactions

Manager - Treasury | Tata Motors Ltd | Mumbai | July 2012 – May 2015

- Handled day-to-day treasury operations including cash management and forex

- Executed forex transactions (spot, forwards, options) for trade-related exposures

- Prepared daily cash position and weekly/monthly forecasts

- Managed bank relationships and negotiated facility terms

- Supported ECB drawdowns and compliance reporting

Senior Executive - Finance | Larsen & Toubro Ltd | Mumbai | August 2009 – June 2012

- Started career in corporate finance and treasury

- Assisted in cash flow forecasting and bank reconciliation

- Supported senior treasury team in forex operations

- Gained exposure to fund raising and compliance

Key Achievements

Treasury Transformation | Mahindra & Mahindra | 2021

- Implemented SAP TRM system for end-to-end treasury automation

- Integrated 50+ bank accounts for real-time visibility

- Result: 40% reduction in manual effort, improved cash forecasting accuracy

Cost Optimization | Mahindra & Mahindra | 2020

- Restructured debt portfolio with optimal mix of NCDs, bank loans, and CP

- Negotiated improved pricing with relationship banks

- Result: ₹25 Cr annual interest savings, improved credit rating

Forex Hedging Excellence | Godrej Industries | 2018

- Developed systematic hedging policy for multi-currency exposures

- Implemented options strategies for volatile currency pairs

- Result: 95% hedge effectiveness, protected margins during currency volatility

Education

Chartered Accountant (CA) | Institute of Chartered Accountants of India (ICAI) | 2009

- Cleared Final in first attempt

Bachelor of Commerce (B.Com) | Mumbai University | 2006

- First Class (72%)

- Specialization: Accounting and Finance

Certifications

- Certified Treasury Professional (CTP) | Association for Financial Professionals | 2016

- Certificate in Treasury and Forex Management | ICAI | 2014

- FEMA and ECB Regulations | ICAI | 2015

- SAP Treasury (TRM) Certification | SAP | 2020

- Advanced Excel and Financial Modeling | 2012

Professional Memberships

- Member, Institute of Chartered Accountants of India (ICAI)

- Member, Association for Financial Professionals (AFP)

- Member, Treasury Management Association of India

Languages

English (Fluent) | Hindi (Native) | Marathi (Native)

Declaration

I hereby declare that the information provided above is true to the best of my knowledge.

Vikram Sharma Mumbai, December 2024

Top Treasurer Employers in India

India’s corporate sector offers excellent treasury opportunities. Here are the top employers:

Large Indian Corporates

- Reliance Industries: Large treasury operations

- Tata Group: TCS, Tata Motors, Tata Steel

- Mahindra Group: Automotive and diversified

- Godrej Group: Consumer and industrial

- Larsen & Toubro: Engineering and construction

- Adani Group: Ports, power, infrastructure

- Aditya Birla Group: Metals, telecom, financial services

Banking & Financial Services

- HDFC Bank: Treasury and capital markets

- ICICI Bank: Treasury operations

- Axis Bank: Corporate treasury

- Kotak Mahindra Bank: Treasury and markets

- SBI: Treasury division

MNC Treasury Centers

- Accenture: Shared services treasury

- IBM India: Treasury operations

- Microsoft India: Corporate treasury

- Google India: Finance and treasury

- Amazon India: Treasury shared services

NBFCs & Financial Institutions

- Bajaj Finance: Treasury and ALM

- HDFC Ltd: Treasury operations

- LIC Housing Finance: Fund management

- Shriram Group: Treasury operations

IT & Services Companies

- TCS: Large treasury team

- Infosys: Corporate treasury

- Wipro: Treasury operations

- HCL Technologies: Treasury function

How to Apply

- Apply through Naukri.com and LinkedIn

- Company career pages directly

- Treasury recruitment agencies

- AFP and ICAI job boards

- Professional network referrals

Treasurer Salary in India

Treasury careers offer competitive salaries with good growth. Salaries vary based on experience, company size, and complexity.

Salary by Experience Level

| Experience | Large Corporates (INR) | Mid-Size Companies (INR) |

|---|---|---|

| Fresher (0-3 years) | ₹6 - ₹12 LPA | ₹4 - ₹8 LPA |

| Manager (4-8 years) | ₹12 - ₹25 LPA | ₹8 - ₹18 LPA |

| Senior Manager (8-12 years) | ₹25 - ₹45 LPA | ₹18 - ₹32 LPA |

| Head/VP (12-18 years) | ₹45 - ₹80 LPA | ₹32 - ₹55 LPA |

| CFO/Group Treasurer (18+ years) | ₹80 LPA - ₹2 Cr+ | ₹55 - ₹1 Cr |

Note: MNCs and large conglomerates pay premium for treasury roles.

Salary by City

| City | Salary Range (Senior Manager) |

|---|---|

| Mumbai | ₹30 - ₹50 LPA |

| Delhi NCR | ₹25 - ₹45 LPA |

| Bangalore | ₹25 - ₹42 LPA |

| Pune | ₹22 - ₹38 LPA |

| Chennai | ₹20 - ₹35 LPA |

Factors Affecting Salary

- Company Size: Large corporates pay significantly higher

- Complexity: Multi-currency, ECB exposure adds value

- Qualifications: CA, CTP, CFA command premium

- Industry: BFSI, manufacturing treasury pay well

- Transaction Volume: Large forex, fund raising experience valued

Salary data based on Glassdoor India, AmbitionBox, and industry surveys.

Certifications for Treasurers in India

Professional certifications enhance your credibility in treasury.

Essential Certifications

- CA (Chartered Accountant): Strong foundation for treasury

- CTP (Certified Treasury Professional): Global treasury certification

- CFA (Chartered Financial Analyst): Investment and risk focus

ICAI Certificates

- Certificate in Treasury and Forex Management: ICAI course

- FEMA and ECB Regulations: Compliance focus

- Certificate in International Trade and Finance: Trade finance

Technical Certifications

- SAP TRM Certification: Treasury management system

- Oracle Treasury Cloud: ERP treasury module

- Advanced Excel/VBA: Modeling skills

Professional Development

- MBA Finance: Career advancement

- Risk Management Certifications: FRM, PRM

- Banking Certifications: CAIIB for banking treasury

How to List Certifications

Include CA after name. CTP is highly valued for treasury roles. List relevant certifications prominently.

ATS Tips for Your Treasurer Resume

Most companies use Applicant Tracking Systems (ATS) to screen resumes. Optimize yours:

For Naukri.com

- Use keywords from job descriptions (treasury, forex, cash management)

- Keep formatting simple (no tables, columns, or graphics)

- Use standard section headings (Experience, Education, Skills)

- Upload in .docx or .pdf format

- Update profile regularly

For LinkedIn Applications

- Match your resume to your LinkedIn profile

- Use standard job titles (Treasurer, Treasury Manager, Head of Treasury)

- Include certifications (CTP, CA)

- Get endorsements from finance professionals

General ATS Tips

- DO: Standard fonts, clear headings, bullet points

- DO: Include metrics (₹20,000 Cr turnover, $500M forex exposure)

- DO: Mention treasury systems and compliance

- DON’T: Use headers/footers, text boxes, images

- DON’T: Use creative section titles

Keyword Strategy for Treasury Roles

Common keywords from job postings:

- Treasurer, Treasury Manager, Head of Treasury

- Cash Management, Liquidity, Working Capital

- Forex, FX Hedging, Forward Contracts, Options

- ECB, FEMA, RBI Compliance

- Fund Raising, NCDs, Bank Loans

- SAP TRM, Treasury Management System

Final Tips for Your Treasurer Resume

✅ Highlight treasury scope—turnover, forex exposure, debt raised

✅ Quantify achievements (₹20,000 Cr turnover, $500M exposure, ₹25 Cr savings)

✅ Show forex expertise—hedging strategies, compliance

✅ Include fund raising—NCDs, ECB, bank facilities

✅ Demonstrate risk management—currency, interest rate, counterparty

✅ Mention treasury systems—SAP TRM, banking platforms

✅ Proofread carefully—accuracy essential in treasury

Quick Checklist

- Contact with +91 phone and LinkedIn

- CA/CTP credentials displayed

- Professional summary with treasury scope

- Skills organized by category (Cash, Forex, Risk)

- Experience showing turnover and exposure managed

- Key achievements with measurable results

- Education with CA and relevant certifications

- Professional memberships (ICAI, AFP)

- ATS-friendly formatting

- Declaration statement

Ready to create your professional Treasurer resume? Use our resume builder to get started with expert-designed templates optimized for Indian job portals.

For more guidance on resume structure, check out our resume format guide with tips specifically for the Indian corporate finance job market.

Frequently Asked Questions

What does a treasurer do in an organization?

A treasurer manages the organization's finances—cash flow, budgets, investments, banking, and financial risk. They make sure money is available when needed and used responsibly.

What skills are most important for a treasurer?

Strong financial planning, cash management, budgeting, risk assessment, and compliance skills are key. Clear reporting, attention to detail, and decision-making also matter a lot.

What should a treasurer include in their resume?

A treasurer resume should highlight cash flow management, budgeting, financial reporting, investment handling, audit coordination, and compliance experience. Numbers and results make a big difference.

How is a treasurer different from an accountant?

An accountant focuses on recording and reporting past financial transactions, while a treasurer looks ahead—managing funds, liquidity, investments, and financial strategy.

What qualifications are useful for a treasurer role?

Degrees in finance, accounting, or commerce are common. Certifications like CA, CMA, CPA, or CFA add strong credibility, especially for senior treasurer roles.

How much experience is needed to become a treasurer?

Most treasurer roles require several years of experience in finance, accounting, or financial management. Senior positions usually expect leadership and strategic planning experience.

What achievements should a treasurer highlight on a resume?

Examples include improving cash flow, reducing financial risk, optimizing investments, managing large budgets, or ensuring zero audit issues. Results matter more than responsibilities.

Is a treasurer role only for large companies?

No. Treasurers are needed in corporations, nonprofits, trusts, societies, schools, and startups—anywhere financial oversight and fund management are important.

How can a fresher prepare for a treasurer-related role?

Freshers can start in finance, accounts, or audit roles, build strong fundamentals, learn financial tools, and gradually move into treasury responsibilities.

Can I create a professional treasurer resume online?

Yes. Using an online resume builder helps structure your experience clearly, highlight key skills, and tailor your resume to treasurer-specific job requirements.

What should an Indian treasurer include in their resume?

An Indian treasurer resume should highlight experience with Indian banks, statutory payments, audits, budget control, fund tracking, and reporting to committees or management boards.

Which qualifications are preferred for treasurers in India?

Degrees in Commerce, Finance, or Accounting are common. Professional qualifications such as CA, CMA, CPA, or MBA (Finance) are highly valued, especially for corporate treasurer roles.

Is the treasurer role in India only a senior position?

Not always. Junior treasury or finance roles often handle cash management and banking tasks, which can grow into a full treasurer role with experience.

How is a treasurer different from an accountant in India?

An accountant focuses on bookkeeping, GST returns, and financial records, while a treasurer focuses on fund availability, cash planning, banking relationships, and financial risk management.

What achievements stand out for treasurers in Indian resumes?

Examples include improving cash flow, reducing banking charges, ensuring timely statutory payments, handling large society or trust funds, and supporting clean audits.

Can treasurer experience in societies or trusts be valuable in India?

Yes. Experience as a treasurer in housing societies, trusts, or NGOs is highly relevant and shows financial responsibility, compliance knowledge, and stakeholder coordination.

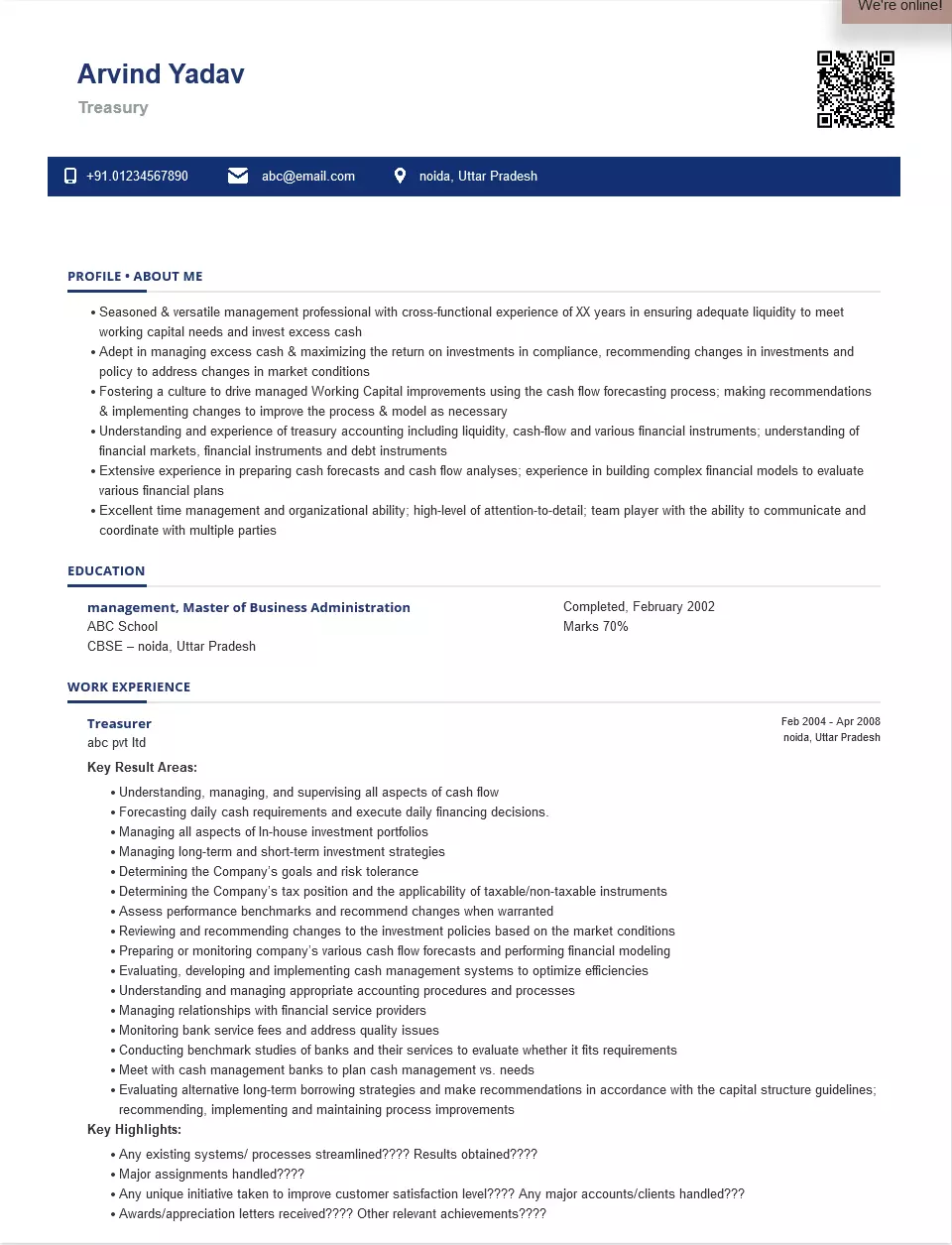

Treasurer Text-Only Resume Templates and Samples

Arvind Yadav

Phone: 01234567890

Email: abc@email.com

Address: sec-44, Noida, Noida

About Me

Treasury

Meticulous Treasurer with extensive non-profit industry background. Very skilled at collaborating with executives to develop successful financial plans aimed at realizing the business objective. Excited to provide leadership and talent to the company that has possibilities for expansion.

Education

Management, Master of Business Administration, Completed, February 2002

ABC School

CBSE

Noida, UP

Certifications

Work Experience

Period: February 2004 - April 2008

Treasurer

Abc Pvt Ltd

- Forecasting daily cash requirements and executing daily financing decisions.

- Managing all aspects of In-house investment portfolios and long-term and short-term investment strategies

- Determining the Company’s goals, risk tolerance, tax position, and the applicability of taxable/non-taxable instruments.

- Preparing or monitoring the company’s various cash flow forecasts and performing financial modeling.

- Evaluating, developing, and implementing cash management systems to optimize efficiencies

- Conducting benchmark studies of banks and their services to evaluate whether it fits the requirements

Period: August 2017 - October 2018

Treasurer

Terma Pvt Ltd.

- Managed treasury function, including meeting short and long-term funding needs

- Determined appropriate capital structure

- Initiated and oversaw the execution of all capital market transactions; managed tax function

- Ensured the maintenance of corporate liquidity and financial stability

- Developed & managed strategies, operations, policies & budgets relating to treasury activities

- Directed development & revision of financial policies for capital structure, working capital, treasury operations, foreign exchange interest rate risk management, and insurance risk management

- Directed capital markets, borrowing, investing, foreign exchange, treasury operations, financial risk management, and corporate finance initiatives

- Supervised the maintenance of internal controls designed to safeguard corporate assets and the integrity of its fiscal systems

Skills

- Accuracy

- Analytical Skills

- Good Team Player

- Mathematics

- Problem-solving

Languages

Softwares

Operating System

Personal Interests

Exhibiting a desire to experience new cultures and environments—especially if your role would involve working with foreign colleagues, partners or clients—can really help your resume shine.

India's

premier resume service

India's

premier resume service