President of Student Council

What's your job?

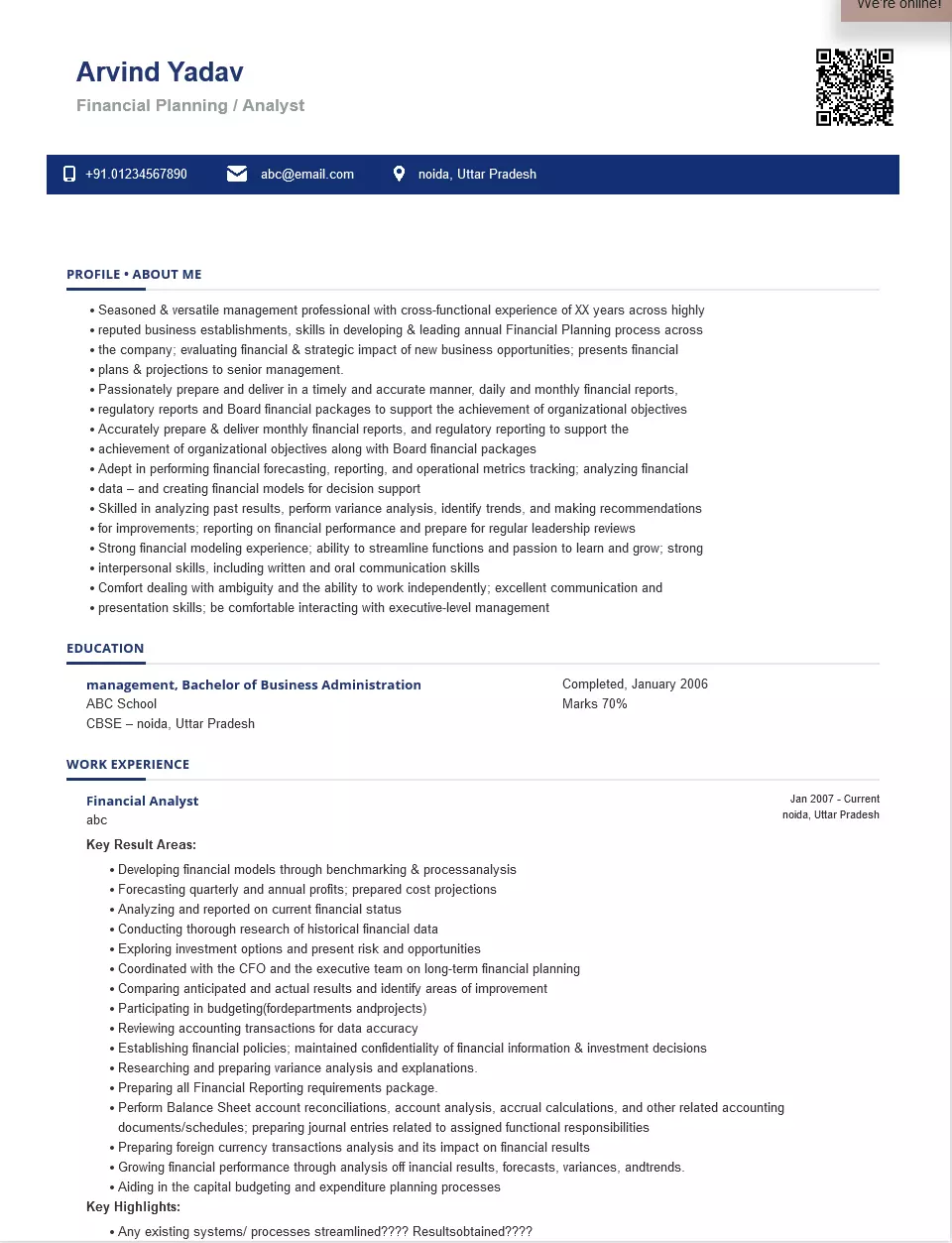

Financial Analyst Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Financial Analyst Resume Guide: Examples, Format & Tips for 2025

Master the Art of Creating an Impressive Financial Analyst Resume for India’s Finance Sector

A compelling financial analyst resume is your gateway to exciting opportunities in India’s dynamic finance industry. Whether you’re targeting roles at investment banks, asset management firms, corporate finance departments, or consulting firms, your resume must effectively showcase your analytical skills, financial modelling expertise, and ability to drive data-driven business decisions.

India’s financial sector offers tremendous opportunities for skilled analysts across various domains—from equity research at firms like Motilal Oswal and ICICI Securities to corporate finance at Reliance Industries and Tata Group, and investment banking at Goldman Sachs, JP Morgan, and Kotak Investment Banking. Whether you’re aiming for positions in Mumbai’s Dalal Street financial hub or global capability centres in Bangalore and Gurgaon, your resume must demonstrate both technical prowess and business acumen.

This comprehensive guide will help you craft a resume that effectively showcases your analytical expertise and achievements, while tailoring it to the specific requirements of India’s top financial employers.

Section 1: Understanding the Financial Analyst Role in India

What Does a Financial Analyst Do?

Financial analysts evaluate financial data to help organisations make informed business decisions. They analyse market trends, assess company performance, build financial models, and provide recommendations on investments, budgets, and strategic initiatives.

Core Responsibilities:

- Financial Modelling: Building DCF, LBO, merger, and valuation models in Excel

- Financial Reporting: Preparing monthly, quarterly, and annual financial reports

- Variance Analysis: Comparing actual performance against budgets and forecasts

- Investment Analysis: Evaluating investment opportunities and risks

- Forecasting: Developing revenue, expense, and cash flow projections

- Industry Research: Analysing market trends, competitors, and sector dynamics

- Presentation: Creating investor presentations and management reports

- Budgeting: Assisting with annual budgeting and planning processes

Types of Financial Analyst Roles in India

- Corporate Financial Analyst: Working in FP&A departments of corporations

- Equity Research Analyst: Analysing stocks and providing investment recommendations

- Investment Banking Analyst: Supporting M&A, IPO, and capital raising transactions

- Credit Analyst: Assessing creditworthiness for lending decisions

- Risk Analyst: Evaluating and managing financial risks

- Portfolio Analyst: Supporting investment management decisions

- Budget Analyst: Managing organisational budgeting processes

- Treasury Analyst: Managing corporate cash and liquidity positions

Key Employers in India

- Investment Banks: Goldman Sachs, JP Morgan, Morgan Stanley, Kotak Investment Banking, ICICI Securities

- Asset Management: HDFC AMC, ICICI Prudential AMC, SBI MF, Nippon India, Aditya Birla AMC

- Consulting Firms: McKinsey, BCG, Bain, Deloitte, EY, KPMG, PwC

- Corporate FP&A: Reliance Industries, Tata Group, Infosys, Wipro, HUL, ITC

- Private Equity/VC: Warburg Pincus, KKR, Sequoia, Accel, Blackstone

- Rating Agencies: CRISIL, ICRA, CARE Ratings, India Ratings

- Banks: HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra, Yes Bank

- NBFCs: Bajaj Finance, HDFC Ltd, Shriram Group, Mahindra Finance

Section 2: Preparing to Write Your Financial Analyst Resume

Gathering Essential Information

Before writing your resume, compile:

- Work experience: Organisations, roles, types of analysis performed

- Technical skills: Financial modelling, valuation methods, software tools

- Quantified achievements: Revenue impact, cost savings, deals closed

- Education: Degrees, certifications (CA, CFA, MBA)

- Software proficiency: Excel (advanced), SQL, Python, Power BI, Bloomberg

- Industry exposure: Sectors analysed and transaction experience

- Publications/Research: Any published reports or research work

Understanding What Employers Seek

Indian finance employers look for:

- Strong financial modelling and valuation skills

- Advanced Excel proficiency (VBA, macros, pivot tables)

- Knowledge of accounting standards (Ind AS, IFRS, US GAAP)

- Understanding of Indian capital markets and regulations

- Clear analytical thinking and problem-solving ability

- Strong communication and presentation skills

- Attention to detail and accuracy under pressure

- Professional certifications (CA, CFA, MBA from tier-1 institutes)

Indian Finance Context

Highlight your understanding of:

- SEBI regulations and compliance requirements

- Indian accounting standards (Ind AS) and tax regulations

- RBI guidelines for banking and NBFC analysis

- BSE/NSE market dynamics and trading mechanisms

- Industry-specific regulations (pharma, telecom, power)

- GST implications and corporate tax structures

- Foreign exchange regulations (FEMA)

Section 3: Choosing the Right Resume Format

Chronological Format

Best for financial analysts with progressive experience in finance roles. Shows career growth and increasing responsibilities clearly.

Functional Format

Suitable for career changers transitioning into finance from related fields like engineering or technology with relevant transferable skills.

Combination Format

Ideal for experienced analysts who want to highlight both technical skills and progressive experience. Works well for senior positions.

Recommended Format by Experience Level

| Experience Level | Recommended Format | Resume Length |

|---|---|---|

| Entry-Level (0-2 years) | Chronological | 1 page |

| Mid-Level (3-6 years) | Chronological | 1-2 pages |

| Senior (7+ years) | Combination | 2 pages |

Section 4: Writing a Compelling Professional Summary

Your summary should capture your experience, specialisation, and key achievements in 2-3 sentences.

Corporate Finance Analyst Summary

Results-driven financial analyst with 6 years of experience in FP&A at leading FMCG and manufacturing companies. Expert in financial modelling, budgeting, and variance analysis with a track record of identifying ₹50 crore+ in cost optimisation opportunities. CA, CFA Level 2 candidate with advanced Excel and SAP proficiency.

Equity Research Analyst Summary

Detail-oriented equity research analyst with 5 years of experience covering IT services and pharma sectors at top brokerage firms. Published 100+ research reports with 75% buy-rated stocks outperforming benchmarks. CFA charterholder with strong financial modelling skills and deep understanding of Indian capital markets.

Investment Banking Analyst Summary

High-performing investment banking analyst with 4 years of experience at bulge bracket and domestic banks. Executed 15+ transactions worth ₹5,000 crore across M&A, IPO, and debt capital markets. CA with CFA Level 3 cleared, proficient in DCF, LBO, and merger modelling.

Entry-Level Financial Analyst Summary

Motivated finance professional with CA qualification and internship experience in corporate finance. Strong foundation in financial analysis, valuation, and accounting with advanced Excel skills. Eager to apply analytical abilities to drive data-driven business decisions at a leading organisation.

Risk Analyst Summary

Analytical risk professional with 5 years of experience in credit risk and market risk management at leading private sector banks. Expert in risk modelling, stress testing, and regulatory reporting (Basel III, ICAAP). FRM certified with proficiency in Python, SQL, and risk management systems.

Section 5: Showcasing Your Financial Analyst Experience

Corporate Finance Analyst Example

Senior Financial Analyst Hindustan Unilever Limited, Mumbai | April 2020 – Present

- Lead FP&A activities for ₹8,000 crore beauty and personal care division, supporting strategic decision-making

- Build and maintain financial models for new product launches, evaluating IRR and payback periods

- Prepare monthly business reviews for senior management, highlighting variances and actionable insights

- Identified ₹75 crore in cost optimisation opportunities through detailed SKU-level profitability analysis

- Partner with brand teams on pricing analysis and promotional ROI assessment

- Coordinate annual budgeting process across 15 cost centres with ₹500 crore expense base

- Develop automated dashboards in Power BI reducing monthly reporting time by 40%

Financial Analyst Asian Paints Limited, Mumbai | June 2017 – March 2020

- Performed variance analysis comparing actual performance to budget and prior year

- Built financial models for capital expenditure projects totalling ₹200 crore annually

- Prepared quarterly investor presentations and analyst call materials

- Supported M&A due diligence for 2 strategic acquisitions worth ₹150 crore

- Automated monthly reporting processes using Excel VBA, saving 20 hours per month

- Analysed working capital trends and recommended improvements saving ₹30 crore annually

Equity Research Analyst Experience Example

Associate - Equity Research ICICI Securities, Mumbai | August 2019 – Present

- Cover 15 companies in IT services and technology sector with combined market cap of ₹8 lakh crore

- Publish quarterly result updates, sector reports, and thematic pieces for institutional clients

- Build detailed DCF and relative valuation models for coverage universe

- Conduct management meetings, site visits, and channel checks to gather primary insights

- Achieved 72% accuracy on stock recommendations with average alpha of 8% over Nifty IT

- Present investment ideas to fund managers managing ₹50,000 crore+ in assets

- Train and mentor 2 junior analysts on modelling and research methodology

Investment Banking Analyst Experience Example

Analyst - Investment Banking Kotak Investment Banking, Mumbai | July 2018 – Present

- Execute M&A and capital markets transactions across technology, consumer, and healthcare sectors

- Completed 10+ transactions with aggregate value exceeding ₹3,500 crore

- Played key role in ₹500 crore IPO for consumer durables company (book building and pricing)

- Built detailed financial models (DCF, trading comps, transaction comps, LBO) for client pitches

- Prepared confidential information memoranda, management presentations, and deal marketing materials

- Coordinated due diligence workstreams with legal, accounting, and technical advisors

- Developed sector expertise in consumer and retail with 20+ pitch decks delivered

Credit Analyst Experience Example

Credit Analyst HDFC Bank, Mumbai | September 2017 – Present

- Analyse credit proposals for mid-corporate segment with exposure limits up to ₹200 crore

- Evaluate financial statements, cash flows, and business models to assess repayment capacity

- Prepare credit appraisal notes and present recommendations to sanctioning authorities

- Monitor portfolio of 50+ accounts with combined exposure of ₹2,500 crore

- Conduct industry research and maintain sector risk assessments for manufacturing and services

- Achieved zero NPAs in portfolio over 5-year period through rigorous credit selection

- Reduced credit appraisal turnaround time by 30% through process improvements

Section 6: Essential Skills for Financial Analyst Resumes

Technical/Hard Skills

- Financial Modelling: DCF, LBO, merger models, three-statement models

- Valuation Methods: Comparable company analysis, precedent transactions, DCF

- Advanced Excel: VBA macros, pivot tables, VLOOKUP, INDEX-MATCH, financial functions

- Data Analysis: SQL, Python (pandas, numpy), R for statistical analysis

- BI Tools: Power BI, Tableau, SAP Analytics Cloud

- ERP Systems: SAP FICO, Oracle Financials, Tally

- Bloomberg/Reuters: Terminal operations, data extraction, screening

- Accounting Standards: Ind AS, IFRS, US GAAP principles

Soft Skills

- Analytical Thinking: Breaking down complex problems systematically

- Attention to Detail: Ensuring accuracy in models and reports

- Communication: Presenting findings to non-financial stakeholders

- Time Management: Meeting tight deadlines under pressure

- Teamwork: Collaborating across functions (sales, operations, strategy)

- Business Acumen: Understanding commercial implications of analysis

- Adaptability: Working with changing priorities and ambiguity

- Problem-Solving: Developing creative solutions to business challenges

Domain Knowledge

- Indian capital markets (equity, debt, derivatives)

- SEBI regulations and compliance requirements

- Indian accounting and tax regulations

- Industry-specific analysis frameworks

- M&A process and deal execution

- Risk management frameworks (Basel, ICAAP)

- Corporate governance standards

Section 7: Education and Certifications

Educational Qualifications

Preferred Qualifications:

- Chartered Accountant (CA) from ICAI

- MBA Finance from IIMs, ISB, XLRI, FMS, SP Jain, MDI

- B.Tech/BE + MBA combination

- BCom/BBA from leading universities (SRCC, St. Xavier’s, Christ)

- M.Com/MFM from premier institutes

Advanced Qualifications:

- CFA (Chartered Financial Analyst)

- FRM (Financial Risk Manager)

- CPA (Certified Public Accountant)

- PhD in Finance or Economics

Valuable Certifications

| Certification | Issuing Body | Benefit |

|---|---|---|

| CFA (Chartered Financial Analyst) | CFA Institute | Global gold standard for investment analysis |

| CA (Chartered Accountant) | ICAI | Most valued qualification in India |

| FRM (Financial Risk Manager) | GARP | Essential for risk management roles |

| CPA | AICPA | US-focused, valuable for MNC roles |

| CMA (Cost Management Accountant) | ICAI/IMA | Management accounting expertise |

| CFP (Certified Financial Planner) | FPSB | Wealth management roles |

| NISM Series | NISM | Mandatory for capital market roles |

| Bloomberg Market Concepts | Bloomberg | Terminal proficiency certification |

Technical Certifications

- Microsoft Excel Expert - Advanced spreadsheet certification

- Python for Finance - Coursera/Udemy certifications

- SQL Certification - Oracle/Microsoft data analysis

- Tableau/Power BI - Data visualisation certifications

- Financial Modelling Certificate - CFI or Wall Street Prep

Section 8: Tips for Different Experience Levels

Entry-Level Financial Analysts (0-2 years)

- Lead with education credentials (CA, MBA, CFA progress)

- Include internship experiences with quantified achievements

- Highlight technical skills prominently (Excel, SQL, Python)

- Mention relevant coursework and academic projects

- Include case competition wins or finance club leadership

- Show progression through CFA levels or CA articleship

- Keep resume to one page with clean formatting

- Emphasise eagerness to learn and grow

Mid-Level Financial Analysts (3-6 years)

- Lead with professional achievements and impact metrics

- Highlight transaction or project experience with values

- Showcase progression in responsibility and scope

- Include cross-functional experience and stakeholder management

- Mention team leadership or mentoring experience

- List completed certifications (CFA charter, CA)

- Include industry specialisation if applicable

- Demonstrate breadth across financial disciplines

Senior Financial Analysts (7+ years)

- Emphasise strategic impact and business outcomes

- Highlight leadership experience and team management

- Include high-value transactions or decisions influenced

- Showcase expertise across multiple industries or functions

- Mention board presentations or C-suite interactions

- Include external recognition (awards, publications, speaking)

- Demonstrate thought leadership and innovation

- Show progression to strategic advisory roles

Section 9: ATS Optimisation for Financial Analyst Resumes

Keywords to Include

Job Title Keywords:

- Financial Analyst, Senior Financial Analyst

- FP&A Analyst, Corporate Finance Analyst

- Equity Research Analyst, Investment Banking Analyst

- Credit Analyst, Risk Analyst

Technical Keywords:

- Financial modelling, DCF valuation

- Variance analysis, budgeting, forecasting

- Excel, VBA, Power BI, SQL, Python

- Ind AS, IFRS, GAAP

- Bloomberg, Reuters

Skill Keywords:

- Analytical skills, attention to detail

- Financial reporting, management reporting

- M&A analysis, due diligence

- Investor relations, board reporting

Certification Keywords:

- CFA, CA, FRM, CPA, CMA

- MBA Finance, BCom, MFM

- NISM certified

ATS Best Practices

- Use simple formatting without graphics or complex tables

- Include exact job title keywords from the posting

- List technical skills and certifications clearly

- Use standard section headings (Experience, Education, Skills)

- Quantify achievements with ₹ values and percentages

- Include both full terms and abbreviations (Chartered Accountant/CA)

- Save resume in .docx or .pdf format as requested

- Avoid headers, footers, and text boxes

Frequently Asked Questions

What should I include in a financial analyst resume?

Focus on your financial modelling expertise (DCF, LBO, merger models), quantified achievements (deals executed, cost savings identified, revenue impact), technical skills (Excel, SQL, Python, Power BI), and professional certifications (CA, CFA, MBA). Include specific transaction values and portfolio sizes to demonstrate the scale of your experience.

Which certifications are most valuable for a financial analyst resume in India?

Chartered Accountant (CA) from ICAI is the most valued qualification in India. CFA (Chartered Financial Analyst) is the global gold standard for investment analysis roles. For risk management positions, FRM (Financial Risk Manager) is essential. An MBA from premier institutes (IIMs, ISB, XLRI) adds significant value, especially for senior positions.

How do I write a financial analyst resume with no experience?

Lead with your education credentials (CA, MBA, CFA progress) and include internship experiences with quantified achievements. Highlight technical skills prominently (Excel, SQL, Python), mention relevant coursework and academic projects, and include case competition wins or finance club leadership. Emphasise your articleship experience if you're a CA.

How should I quantify achievements on my financial analyst resume?

Use specific metrics with ₹ values and percentages: deals executed (₹500 crore IPO), cost savings identified (₹75 crore optimisation), portfolio sizes managed (₹2,500 crore exposure), revenue impact delivered, and efficiency improvements (reduced reporting time by 40%). For example, "Identified ₹150 crore in EBITDA improvement through store-level P&L analysis" is more impactful than "Performed financial analysis."

What technical skills should I highlight for financial analyst roles in India?

Prioritise advanced Excel (VBA, macros, pivot tables), financial modelling (DCF, three-statement models), data analysis (SQL, Python with pandas), BI tools (Power BI, Tableau), and ERP systems (SAP FICO). Knowledge of Indian accounting standards (Ind AS), Bloomberg/Reuters terminal operations, and SEBI regulations is highly valued by Indian employers.

How long should a financial analyst resume be?

Keep it to one page for entry-level (0-2 years) and mid-level (3-6 years) positions. Senior professionals (7+ years) can extend to two pages. Focus on relevant finance experience with quantified achievements rather than lengthy job descriptions. Use a combination format for senior roles to highlight both technical skills and progressive experience.

Conclusion

Financial analysts play a critical role in driving data-informed decisions across India’s corporate and financial sectors. Whether you’re building models at an investment bank, analysing equities at a brokerage, or supporting FP&A at a leading corporation, your resume must demonstrate both technical expertise and business impact.

Your financial analyst resume should showcase quantified achievements—deals executed, cost savings identified, revenue impact delivered—alongside technical proficiencies in modelling, analysis, and reporting. In India’s competitive finance job market, credentials like CA, CFA, and MBA from premier institutes significantly strengthen your candidacy.

Focus on demonstrating progression in responsibility, scope, and impact. Include specific transaction values, portfolio sizes, and business outcomes to make your contributions tangible. Technical skills in Excel, Python, and business intelligence tools are increasingly essential alongside traditional finance expertise.

Use this guide to create a resume that positions you for opportunities at India’s leading financial institutions—from investment banks on Dalal Street to multinational consulting firms and blue-chip corporate finance departments. A well-crafted financial analyst resume opens doors to a rewarding career in India’s growing finance sector.

Pro Tip: Leverage ShriResume’s AI Resume Builder to create a professional financial analyst resume that highlights your analytical skills, certifications, and quantified achievements to impress top finance employers.

Financial Analyst Text-Only Resume Templates and Samples

Abhijeet Saha

Phone: 987127588

Email: writer@shriresume.com

Address: Arrah

About Me

Financial Analyst

Dedicated and analytical individual with a Bachelor's degree in Commerce and a passion for financial analysis, seeking an entry-level position as a Financial Analyst. Eager to leverage theoretical knowledge and certifications to analyze financial data, generate insights, and support decision-making processes in an organization in India.

Extra Curricular Activities

Education

Accounts, Bachelor of Education, Completed, April 2024

ARES Schools

Mumbai University

Akot, MH

Certifications

- Chartered Financial Analyst (CFA) Level I, Completed , November 2023

- Financial Modeling and Valuation Analyst (FMVA), Completed , October 2023

Internships

Period: January 2024

Financial Intern

NMT Delhi

- Assisted in financial analysis and reporting activities

- Conducted research on industry trends and competitive analysis

- Supported in the preparation of financial models and forecasts

- Collaborated with team members on ad-hoc projects and presentations

Skills

- Strong ability to analyze financial data, develop financial models, and perform forecasting to support business decision-making.

- Proficient in financial modeling, forecasting, and valuation techniques

- Strong analytical skills and ability to interpret financial data

- Familiarity with financial software such as Microsoft Excel, Bloomberg, and SAP

- Knowledgeable in financial statement analysis and ratio analysis

- Effective communication and presentation skills for reporting findings to stakeholders

- Detail-oriented with a focus on accuracy and precision in analysis

Languages

Softwares

Operating System

Personal Interests

Badminton

Reading History

India's

premier resume service

India's

premier resume service