- Participated in risk management workshops and seminars

- Collaborated with other members on risk assessment projects and case studies

What's your job?

Risk Management Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Risk Management Resume Guide for India

A well-crafted risk management resume is essential for success in India’s growing risk and compliance sector. Whether you’re a fresher starting your career after completing an MBA or a professional certification, or an experienced professional seeking growth at leading banks like HDFC, ICICI, SBI, or corporate risk departments, this guide provides everything you need to create a standout resume.

This comprehensive guide includes:

- Resume format recommendations for India

- Key skills Indian risk employers look for

- Complete resume example with Indian context

- Top risk management employers in India

- Salary insights in INR by experience level

- Certification guidance

- ATS optimization tips for Indian job portals

Why Your Risk Management Resume Matters in India

India’s risk management sector is expanding rapidly, with banks, NBFCs, insurance companies, Big 4 firms, and large corporates actively hiring skilled risk professionals. A strong resume helps you:

- Stand out from thousands of applicants on Naukri and LinkedIn

- Pass ATS screening used by large financial institutions

- Showcase skills that Indian employers value, including regulatory compliance and risk modeling

- Demonstrate your expertise in Indian regulatory frameworks (RBI, SEBI, IRDAI)

Indian risk management recruiters value technical skills, regulatory knowledge, and analytical abilities. Your resume must immediately communicate your risk expertise, certifications, and understanding of the Indian regulatory environment. With India’s focus on risk governance, a well-optimized resume is your ticket to landing interviews at top institutions.

Risk Management Resume Format for India

Indian employers prefer clean, professional resume formats. Here’s what works best:

Recommended Format

- Length: 1-2 pages (freshers: 1 page, experienced: 2 pages max)

- Layout: Reverse chronological (most recent first)

- Font: Clean fonts like Calibri or Arial (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Professional Presentation

Your resume should reflect the precision expected in risk management. Keep it data-driven and results-focused.

Personal Details for Indian Risk Management Resumes

Include:

- Full name

- Phone number with country code (+91)

- Professional email address

- LinkedIn profile URL

- City, State (full address not required)

What to Avoid

- Complex formatting or graphics

- Personal information like religion or caste

- Salary expectations

- References (provide when requested)

Key Skills for Risk Managers in India

Indian financial employers look for specific risk management capabilities.

Core Risk Skills

- Credit Risk: Loan assessment, portfolio risk, NPAs

- Market Risk: VaR, stress testing, scenario analysis

- Operational Risk: Process risk, control assessment

- Regulatory Compliance: RBI, SEBI, IRDAI guidelines

- Enterprise Risk: ERM frameworks, risk appetite

- Liquidity Risk: ALM, funding risk

- Fraud Risk: Detection, prevention, investigation

Technical Skills

- Risk modeling and analytics

- Statistical software (R, Python, SAS)

- Excel (advanced modeling)

- SQL and database management

- Risk management systems (SAS Risk, Moody’s)

- Business intelligence tools

- Basel III/IV frameworks

Regulatory Knowledge for India

- RBI guidelines and circulars

- Basel norms implementation

- SEBI regulations

- IRDAI guidelines

- ICAAP and SREP requirements

- Ind-AS and accounting standards

- PMLA and KYC requirements

Soft Skills Valued

- Analytical Thinking: Data analysis and interpretation

- Communication: Reporting to board and regulators

- Attention to Detail: Precision in risk calculations

- Problem-Solving: Risk mitigation strategies

- Stakeholder Management: Cross-functional coordination

How to Present Skills

List technical and regulatory skills prominently. Mention specific risk tools and frameworks. Include certifications with issuing bodies.

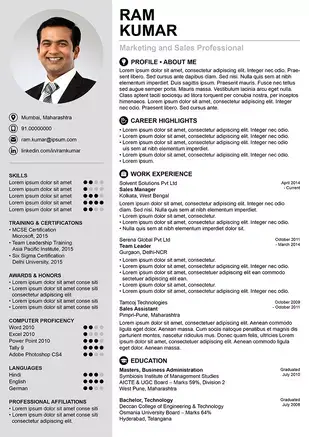

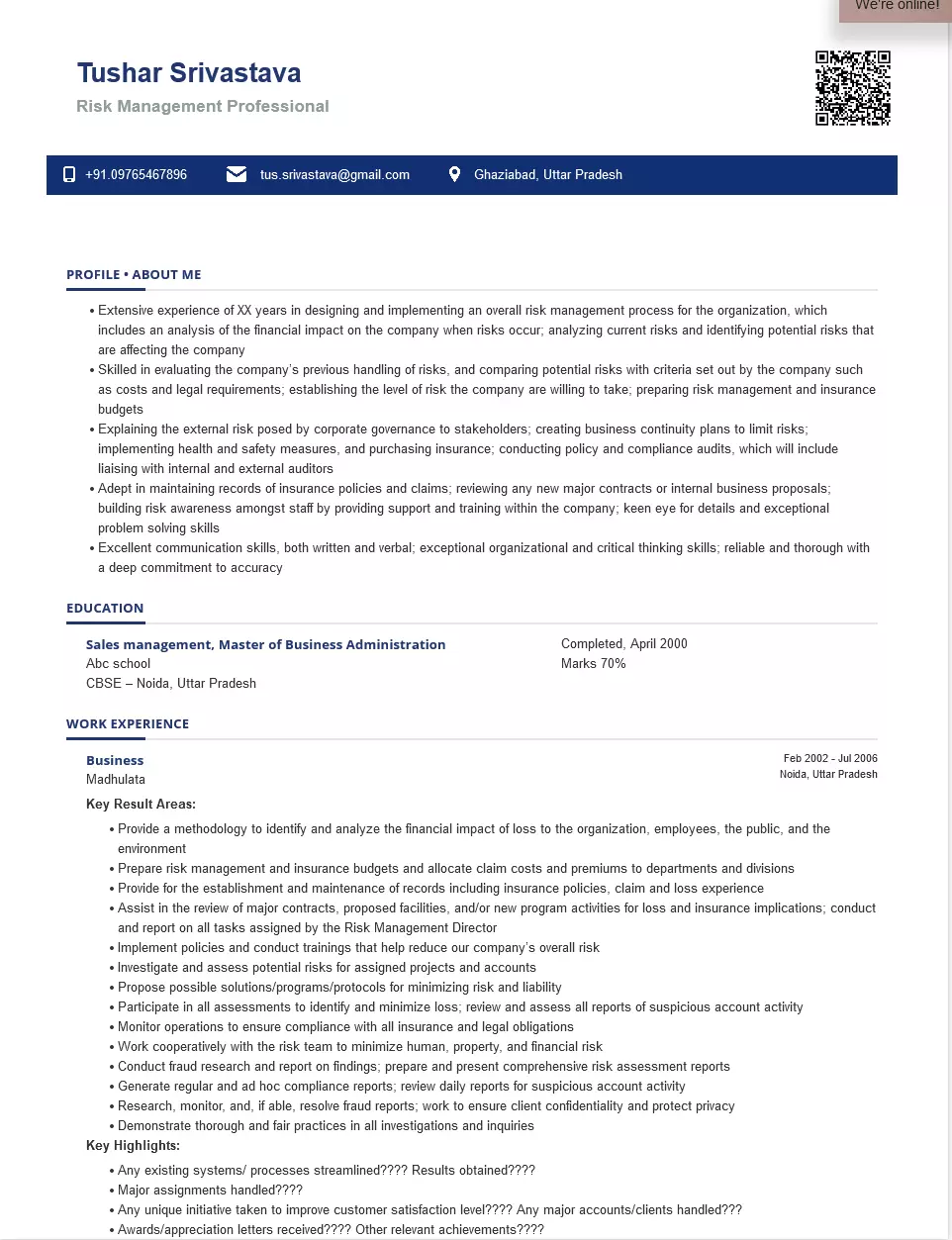

Risk Management Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Priya Mehta

Mumbai, Maharashtra | +91-98XXX-XXXXX | priya.mehta@email.com | linkedin.com/in/priyamehta

Professional Summary

Senior Risk Manager with 10+ years of experience in credit risk, market risk, and regulatory compliance at leading Indian banks. FRM certified with expertise in Basel III implementation, stress testing, and ICAAP documentation. Successfully led RBI inspection preparations with zero major observations. Proven track record of building risk frameworks reducing credit losses by 25% and ensuring regulatory compliance across all risk dimensions.

Key Skills

Credit Risk | Market Risk | Basel III | RBI Compliance | Risk Modeling | Stress Testing | ICAAP | Portfolio Analytics | VaR | Python/R | SAS | ERM Framework

Professional Experience

Senior Manager – Credit Risk | HDFC Bank | Mumbai | April 2019 – Present

- Lead credit risk management for retail portfolio worth ₹50,000 crore

- Develop and validate credit scoring models improving approval accuracy by 20%

- Manage ICAAP documentation and capital adequacy reporting

- Prepare board-level risk reports and MIS dashboards

- Coordinate RBI inspections with zero major observations in 3 years

- Implement Basel III advanced approaches for credit risk

- Lead team of 8 risk analysts

- Reduced NPA ratio from 3.2% to 2.4% through enhanced early warning systems

Manager – Risk Analytics | ICICI Bank | Mumbai | June 2015 – March 2019

- Developed market risk VaR models for trading book

- Implemented stress testing framework for liquidity risk

- Prepared regulatory submissions to RBI

- Built credit risk scorecards using logistic regression

- Automated risk reporting reducing TAT by 50%

- Received “Excellence Award” for Basel III project

Risk Analyst | Axis Bank | Mumbai | July 2012 – May 2015

- Analyzed credit portfolio for early warning signals

- Prepared risk reports for management and board

- Supported regulatory compliance activities

- Developed Excel-based risk tools

- Assisted in internal audit responses

Education

MBA (Finance) | IIM Calcutta | 2012

- 2-year full-time program

- Specialization: Risk Management and Finance

- Dean’s Merit List

B.Com (Honours) | Shri Ram College of Commerce, Delhi | 2010

- First Class with Distinction

- Specialization: Accountancy

Certifications

- Financial Risk Manager (FRM) | GARP | 2015

- Certified Enterprise Risk Professional (CERP) | IRM | 2018

- Certificate in Quantitative Finance (CQF) | Fitch Learning | 2020

- Advanced Excel and VBA | 2014

- Python for Finance | Coursera | 2019

Risk Frameworks & Tools

- Regulatory: Basel III, RBI guidelines, ICAAP, SREP

- Credit Risk: PD/LGD/EAD models, scorecards, rating systems

- Market Risk: VaR (Historical, Parametric, Monte Carlo), Greeks

- Operational Risk: RCSA, KRI, loss database

- Tools: SAS Enterprise Risk, Moody’s RiskCalc, Python, R, SQL

Key Achievements

- Led Basel III advanced approach implementation for credit risk

- Zero major RBI observations across 3 inspection cycles

- Reduced credit losses by ₹200 crore through enhanced EWS

- Built risk analytics team from scratch (hired and trained 8 analysts)

- Presented at Indian Banks’ Association risk conference 2023

Publications & Speaking

- “Credit Risk Modeling in Indian Context” – NIBM Journal, 2022

- Speaker at ASSOCHAM Risk Management Summit 2023

- Internal training on Basel III for 200+ employees

Languages

Hindi (Native) | English (Fluent) | Gujarati (Native) | Marathi (Conversational)

Declaration

I hereby declare that the information provided above is true to the best of my knowledge.

Priya Mehta Mumbai, December 2024

Top Risk Management Employers in India

India’s risk management sector offers excellent opportunities:

Banks

- SBI: India’s largest bank

- HDFC Bank: Private sector leader

- ICICI Bank: Major private bank

- Axis Bank: Large private bank

- Kotak Mahindra Bank: Growing private bank

- Bank of Baroda, PNB: Large PSU banks

NBFCs

- Bajaj Finance: Leading NBFC

- HDFC Ltd: Housing finance

- L&T Finance: Diversified NBFC

- Mahindra Finance: Vehicle finance

- Muthoot Finance: Gold loans

Insurance Companies

- LIC: Public sector insurance

- ICICI Prudential: Private life insurance

- HDFC Life: Leading insurer

- SBI Life: Bank-backed insurer

- General Insurance: New India, ICICI Lombard

Big 4 and Consulting

- Deloitte Risk Advisory: Risk consulting

- PwC Risk Assurance: Financial services risk

- KPMG Risk Consulting: Enterprise risk

- EY Financial Services Risk: Banking risk

- McKinsey, BCG: Strategy and risk

Corporates

- Reliance Industries: Corporate risk

- Tata Group companies: Multiple entities

- Infosys/TCS: IT sector risk

- Large manufacturing: Operational risk

How to Apply

- Apply through company career pages

- Use Naukri and LinkedIn

- Network at risk conferences (PRMIA, GARP events)

- Campus placements for freshers

- Recruitment consultants (Hays, Michael Page)

Risk Management Salary in India

Salaries vary based on experience, employer type, and certifications.

Salary by Experience Level

| Experience | Annual Salary (INR) |

|---|---|

| Fresher/Analyst (0-3 years) | ₹6 - ₹15 LPA |

| Manager (4-7 years) | ₹15 - ₹35 LPA |

| Senior Manager (8-12 years) | ₹35 - ₹60 LPA |

| VP/Director (12+ years) | ₹60 - ₹1.5 Cr |

| CRO/Head of Risk | ₹1 Cr - ₹5 Cr+ |

Note: Big 4 and private banks pay higher; FRM certification adds 20-30% premium.

Salary by City

| City | Salary Range (Manager Level) |

|---|---|

| Mumbai | ₹25 - ₹45 LPA |

| Delhi NCR | ₹22 - ₹40 LPA |

| Bangalore | ₹20 - ₹38 LPA |

| Chennai | ₹18 - ₹32 LPA |

| Hyderabad | ₹18 - ₹32 LPA |

| Kolkata | ₹15 - ₹28 LPA |

Certification Premium

- FRM: 20-30% salary increase

- CFA: Additional premium in market risk

- MBA from IIM: Significant premium

- CA/CPA: Valued in credit risk

Factors Affecting Salary

- Employer Type: Banks pay more than NBFCs

- Certifications: FRM is highly valued

- Technical Skills: Python/R adds premium

- Experience: Regulatory experience valued

Salary data based on Glassdoor India, AmbitionBox, and industry surveys.

Certifications for Risk Professionals in India

Professional certifications significantly boost career prospects.

Essential Certifications

- FRM (Financial Risk Manager): GARP certification, globally recognized

- PRM (Professional Risk Manager): PRMIA certification

- CFA (Chartered Financial Analyst): CFA Institute

- CERP (Certified Enterprise Risk Professional): IRM certification

Recommended Certifications

- CA (Chartered Accountant): ICAI certification

- CAIIB: Banking certification from IIBF

- CQF: Certificate in Quantitative Finance

- Basel III Certification: Various providers

Educational Background

- MBA Finance: IIMs, ISB, top B-schools

- M.Com/Economics: Quantitative background

- Engineering + MBA: Valued for analytics

- CA/CFA: Financial expertise

Skill Development

- Python/R programming

- SQL and data analytics

- Machine learning for risk

- Regulatory reporting tools

How to List Certifications

Include certification name, issuing body, and year. FRM and CFA should be prominently displayed. Mention CAIIB for banking roles.

ATS Tips for Your Risk Management Resume

Financial institutions use Applicant Tracking Systems (ATS) to screen resumes:

For Naukri.com

- Use keywords from job description (risk, Basel, compliance)

- Keep formatting simple—ATS can’t read complex layouts

- Use standard section headings

- Upload in .docx or .pdf format

For LinkedIn Applications

- Match your resume to your LinkedIn profile

- Use industry-standard job titles

- Include certifications prominently

- Get endorsements from colleagues

General ATS Tips

- DO: Use clean fonts, clear headings, bullet points

- DO: Include exact keywords (Basel III, credit risk, VaR)

- DO: List specific tools and frameworks

- DON’T: Use headers/footers, text boxes, or graphics

- DON’T: Use creative section titles

Keyword Strategy for Indian Risk Roles

Common keywords include:

- Credit risk, market risk, operational risk

- Basel III, RBI, SEBI, regulatory compliance

- VaR, stress testing, ICAAP

- Risk modeling, analytics, portfolio

- FRM, CFA, CA

Final Tips for Your Risk Management Resume

✅ Show certifications: FRM and other credentials prominently

✅ Include regulatory knowledge: RBI, Basel III expertise

✅ Quantify achievements: Reduced losses, improved ratios

✅ List technical skills: Programming and tools

✅ Show progression: Career growth in risk function

✅ Mention key projects: Basel implementation, RBI audits

Quick Checklist

- Contact information with +91 phone number and LinkedIn

- Professional summary highlights risk expertise

- Skills section includes risk types and tools

- Experience shows quantified achievements

- Education includes MBA/relevant degree

- FRM and other certifications listed

- Technical skills mentioned

- Formatting is clean and ATS-friendly

- Length is appropriate (1-2 pages)

Ready to create your professional risk management resume? Use our resume builder to get started with templates optimized for financial services.

Looking for more guidance? Check out our resume format guide for additional tips on structuring your risk management resume for the Indian job market.

Frequently Asked Questions

What should a risk management resume include?

A strong risk management resume includes your contact details, a clear professional summary, detailed work experience, a skills section (like risk assessment, mitigation planning), education, and relevant certifications such as FRM or CRM. Emphasize measurable results where possible.

How do I write an effective professional summary for a risk manager role?

Write 2–3 sentences that highlight your experience in identifying and mitigating risks, key technical strengths, and one quantifiable impact you've delivered — for example, reduced operational losses by 20% through improved risk controls.

What skills are most important on a risk management resume?

Include both technical skills (risk assessment, quantitative analysis, compliance, reporting tools) and soft skills (decision-making, problem-solving, communication, strategic thinking). Listing tools like Excel, SAS, R, Python, GRC platforms can also help.

Should I list certifications on my risk management resume?

Yes — certifications like FRM (Financial Risk Manager), CRM (Certified Risk Manager), CFA, or ISO 31000 training strengthen credibility and show specialized knowledge in risk practices.

How do I highlight achievements in risk management roles?

Use bullet points that focus on specific outcomes — such as reduced compliance issues by 30%, implemented new risk controls that cut losses by $1M, or enhanced risk reporting accuracy across departments.

How long should a risk management resume be?

One page is ideal if you're early in your career. Two pages are acceptable if you have extensive experience or major accomplishments — just make sure every item adds value and relevance.

Should I tailor my resume for different risk management jobs?

Yes — customize your resume using relevant keywords from the job description (like enterprise risk management, credit risk analysis, operational risk, regulatory compliance). This helps both recruiters and applicant tracking systems (ATS) recognize your fit.

How do I show risk management experience if I'm switching careers?

Emphasize transferable skills like analytical thinking, process improvement, compliance work, and any relevant project or coursework. Demonstrating your understanding of risk frameworks and tools also helps.

What are common mistakes to avoid on a risk management resume?

Avoid vague language like "handled risk tasks," long paragraphs without specifics, and missing measurable outcomes. Keep bullet points concise, results-oriented, and aligned with the job you're applying for.

How can I make my resume stand out if I work in a technical risk role?

Highlight your familiarity with risk modeling, data analytics tools, scenario analysis, and automated risk platforms. Show how you used these technologies to improve decision-making or reduce risk exposure.

Risk Management Text-Only Resume Templates and Samples

Abhi sandilya

Phone: 9871275111

Email: writer@shriresume.com

Address: Chandigarh

About Me

Risk Management

Detail-oriented and analytical recent graduate seeking an entry-level position in Risk Management. Aim to leverage strong analytical skills, attention to detail, and passion for problem-solving to identify and mitigate risks, ensuring the success and stability of the organization.Results-driven risk management professional with a deep understanding of financial, operational, and regulatory risks in the business sector.

Extra Curricular Activities

Education

Business, Bachelor of Business Administration, Graduated, April 2024

Bharat College Delhi

Delhi

Bhiwani, HR

Certifications

- Certificate in Risk Management , Completed , April 2024

- Certificate in Financial Risk Management , Completed , May 2024

Internships

Period: April 2024 - May 2024

Intern

Risk Management Department

- Assisted in identifying and assessing potential risks to the organization

- Supported senior risk managers in developing risk mitigation strategies

- Analyzed data and prepared reports to communicate risk exposure to stakeholders

Skills

- Strong analytical and critical thinking skills

- Proficiency in Microsoft Office Suite (Excel, Word, PowerPoint)

- Excellent communication and presentation skills

- Ability to work collaboratively with cross-functional teams

- Attention to detail and accuracy in data analysis

- Understanding of risk management principles and techniques

Languages

Softwares

Operating System

Personal Interests

- Reading books on risk management and business strategy

- Playing strategic board games like chess and Risk

- Volunteering for community risk awareness programs

- Hiking and outdoor activities

India's

premier resume service

India's

premier resume service