- Certified PRM (Professional Risk Manager), Completed , January 2017

What's your job?

Risk Management Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Risk Management Resume Guide for India

A well-crafted risk management resume is essential for success in India’s growing risk and compliance sector. Whether you’re a fresher starting your career after completing an MBA or a professional certification, or an experienced professional seeking growth at leading banks like HDFC, ICICI, SBI, or corporate risk departments, this guide provides everything you need to create a standout resume.

This comprehensive guide includes:

- Resume format recommendations for India

- Key skills Indian risk employers look for

- Complete resume example with Indian context

- Top risk management employers in India

- Salary insights in INR by experience level

- Certification guidance

- ATS optimization tips for Indian job portals

Why Your Risk Management Resume Matters in India

India’s risk management sector is expanding rapidly, with banks, NBFCs, insurance companies, Big 4 firms, and large corporates actively hiring skilled risk professionals. A strong resume helps you:

- Stand out from thousands of applicants on Naukri and LinkedIn

- Pass ATS screening used by large financial institutions

- Showcase skills that Indian employers value, including regulatory compliance and risk modeling

- Demonstrate your expertise in Indian regulatory frameworks (RBI, SEBI, IRDAI)

Indian risk management recruiters value technical skills, regulatory knowledge, and analytical abilities. Your resume must immediately communicate your risk expertise, certifications, and understanding of the Indian regulatory environment. With India’s focus on risk governance, a well-optimized resume is your ticket to landing interviews at top institutions.

Risk Management Resume Format for India

Indian employers prefer clean, professional resume formats. Here’s what works best:

Recommended Format

- Length: 1-2 pages (freshers: 1 page, experienced: 2 pages max)

- Layout: Reverse chronological (most recent first)

- Font: Clean fonts like Calibri or Arial (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Professional Presentation

Your resume should reflect the precision expected in risk management. Keep it data-driven and results-focused.

Personal Details for Indian Risk Management Resumes

Include:

- Full name

- Phone number with country code (+91)

- Professional email address

- LinkedIn profile URL

- City, State (full address not required)

What to Avoid

- Complex formatting or graphics

- Personal information like religion or caste

- Salary expectations

- References (provide when requested)

Key Skills for Risk Managers in India

Indian financial employers look for specific risk management capabilities.

Core Risk Skills

- Credit Risk: Loan assessment, portfolio risk, NPAs

- Market Risk: VaR, stress testing, scenario analysis

- Operational Risk: Process risk, control assessment

- Regulatory Compliance: RBI, SEBI, IRDAI guidelines

- Enterprise Risk: ERM frameworks, risk appetite

- Liquidity Risk: ALM, funding risk

- Fraud Risk: Detection, prevention, investigation

Technical Skills

- Risk modeling and analytics

- Statistical software (R, Python, SAS)

- Excel (advanced modeling)

- SQL and database management

- Risk management systems (SAS Risk, Moody’s)

- Business intelligence tools

- Basel III/IV frameworks

Regulatory Knowledge for India

- RBI guidelines and circulars

- Basel norms implementation

- SEBI regulations

- IRDAI guidelines

- ICAAP and SREP requirements

- Ind-AS and accounting standards

- PMLA and KYC requirements

Soft Skills Valued

- Analytical Thinking: Data analysis and interpretation

- Communication: Reporting to board and regulators

- Attention to Detail: Precision in risk calculations

- Problem-Solving: Risk mitigation strategies

- Stakeholder Management: Cross-functional coordination

How to Present Skills

List technical and regulatory skills prominently. Mention specific risk tools and frameworks. Include certifications with issuing bodies.

Risk Management Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Priya Mehta

Mumbai, Maharashtra | +91-98XXX-XXXXX | priya.mehta@email.com | linkedin.com/in/priyamehta

Professional Summary

Senior Risk Manager with 10+ years of experience in credit risk, market risk, and regulatory compliance at leading Indian banks. FRM certified with expertise in Basel III implementation, stress testing, and ICAAP documentation. Successfully led RBI inspection preparations with zero major observations. Proven track record of building risk frameworks reducing credit losses by 25% and ensuring regulatory compliance across all risk dimensions.

Key Skills

Credit Risk | Market Risk | Basel III | RBI Compliance | Risk Modeling | Stress Testing | ICAAP | Portfolio Analytics | VaR | Python/R | SAS | ERM Framework

Professional Experience

Senior Manager – Credit Risk | HDFC Bank | Mumbai | April 2019 – Present

- Lead credit risk management for retail portfolio worth ₹50,000 crore

- Develop and validate credit scoring models improving approval accuracy by 20%

- Manage ICAAP documentation and capital adequacy reporting

- Prepare board-level risk reports and MIS dashboards

- Coordinate RBI inspections with zero major observations in 3 years

- Implement Basel III advanced approaches for credit risk

- Lead team of 8 risk analysts

- Reduced NPA ratio from 3.2% to 2.4% through enhanced early warning systems

Manager – Risk Analytics | ICICI Bank | Mumbai | June 2015 – March 2019

- Developed market risk VaR models for trading book

- Implemented stress testing framework for liquidity risk

- Prepared regulatory submissions to RBI

- Built credit risk scorecards using logistic regression

- Automated risk reporting reducing TAT by 50%

- Received “Excellence Award” for Basel III project

Risk Analyst | Axis Bank | Mumbai | July 2012 – May 2015

- Analyzed credit portfolio for early warning signals

- Prepared risk reports for management and board

- Supported regulatory compliance activities

- Developed Excel-based risk tools

- Assisted in internal audit responses

Education

MBA (Finance) | IIM Calcutta | 2012

- 2-year full-time program

- Specialization: Risk Management and Finance

- Dean’s Merit List

B.Com (Honours) | Shri Ram College of Commerce, Delhi | 2010

- First Class with Distinction

- Specialization: Accountancy

Certifications

- Financial Risk Manager (FRM) | GARP | 2015

- Certified Enterprise Risk Professional (CERP) | IRM | 2018

- Certificate in Quantitative Finance (CQF) | Fitch Learning | 2020

- Advanced Excel and VBA | 2014

- Python for Finance | Coursera | 2019

Risk Frameworks & Tools

- Regulatory: Basel III, RBI guidelines, ICAAP, SREP

- Credit Risk: PD/LGD/EAD models, scorecards, rating systems

- Market Risk: VaR (Historical, Parametric, Monte Carlo), Greeks

- Operational Risk: RCSA, KRI, loss database

- Tools: SAS Enterprise Risk, Moody’s RiskCalc, Python, R, SQL

Key Achievements

- Led Basel III advanced approach implementation for credit risk

- Zero major RBI observations across 3 inspection cycles

- Reduced credit losses by ₹200 crore through enhanced EWS

- Built risk analytics team from scratch (hired and trained 8 analysts)

- Presented at Indian Banks’ Association risk conference 2023

Publications & Speaking

- “Credit Risk Modeling in Indian Context” – NIBM Journal, 2022

- Speaker at ASSOCHAM Risk Management Summit 2023

- Internal training on Basel III for 200+ employees

Languages

Hindi (Native) | English (Fluent) | Gujarati (Native) | Marathi (Conversational)

Declaration

I hereby declare that the information provided above is true to the best of my knowledge.

Priya Mehta Mumbai, December 2024

Top Risk Management Employers in India

India’s risk management sector offers excellent opportunities:

Banks

- SBI: India’s largest bank

- HDFC Bank: Private sector leader

- ICICI Bank: Major private bank

- Axis Bank: Large private bank

- Kotak Mahindra Bank: Growing private bank

- Bank of Baroda, PNB: Large PSU banks

NBFCs

- Bajaj Finance: Leading NBFC

- HDFC Ltd: Housing finance

- L&T Finance: Diversified NBFC

- Mahindra Finance: Vehicle finance

- Muthoot Finance: Gold loans

Insurance Companies

- LIC: Public sector insurance

- ICICI Prudential: Private life insurance

- HDFC Life: Leading insurer

- SBI Life: Bank-backed insurer

- General Insurance: New India, ICICI Lombard

Big 4 and Consulting

- Deloitte Risk Advisory: Risk consulting

- PwC Risk Assurance: Financial services risk

- KPMG Risk Consulting: Enterprise risk

- EY Financial Services Risk: Banking risk

- McKinsey, BCG: Strategy and risk

Corporates

- Reliance Industries: Corporate risk

- Tata Group companies: Multiple entities

- Infosys/TCS: IT sector risk

- Large manufacturing: Operational risk

How to Apply

- Apply through company career pages

- Use Naukri and LinkedIn

- Network at risk conferences (PRMIA, GARP events)

- Campus placements for freshers

- Recruitment consultants (Hays, Michael Page)

Risk Management Salary in India

Salaries vary based on experience, employer type, and certifications.

Salary by Experience Level

| Experience | Annual Salary (INR) |

|---|---|

| Fresher/Analyst (0-3 years) | ₹6 - ₹15 LPA |

| Manager (4-7 years) | ₹15 - ₹35 LPA |

| Senior Manager (8-12 years) | ₹35 - ₹60 LPA |

| VP/Director (12+ years) | ₹60 - ₹1.5 Cr |

| CRO/Head of Risk | ₹1 Cr - ₹5 Cr+ |

Note: Big 4 and private banks pay higher; FRM certification adds 20-30% premium.

Salary by City

| City | Salary Range (Manager Level) |

|---|---|

| Mumbai | ₹25 - ₹45 LPA |

| Delhi NCR | ₹22 - ₹40 LPA |

| Bangalore | ₹20 - ₹38 LPA |

| Chennai | ₹18 - ₹32 LPA |

| Hyderabad | ₹18 - ₹32 LPA |

| Kolkata | ₹15 - ₹28 LPA |

Certification Premium

- FRM: 20-30% salary increase

- CFA: Additional premium in market risk

- MBA from IIM: Significant premium

- CA/CPA: Valued in credit risk

Factors Affecting Salary

- Employer Type: Banks pay more than NBFCs

- Certifications: FRM is highly valued

- Technical Skills: Python/R adds premium

- Experience: Regulatory experience valued

Salary data based on Glassdoor India, AmbitionBox, and industry surveys.

Certifications for Risk Professionals in India

Professional certifications significantly boost career prospects.

Essential Certifications

- FRM (Financial Risk Manager): GARP certification, globally recognized

- PRM (Professional Risk Manager): PRMIA certification

- CFA (Chartered Financial Analyst): CFA Institute

- CERP (Certified Enterprise Risk Professional): IRM certification

Recommended Certifications

- CA (Chartered Accountant): ICAI certification

- CAIIB: Banking certification from IIBF

- CQF: Certificate in Quantitative Finance

- Basel III Certification: Various providers

Educational Background

- MBA Finance: IIMs, ISB, top B-schools

- M.Com/Economics: Quantitative background

- Engineering + MBA: Valued for analytics

- CA/CFA: Financial expertise

Skill Development

- Python/R programming

- SQL and data analytics

- Machine learning for risk

- Regulatory reporting tools

How to List Certifications

Include certification name, issuing body, and year. FRM and CFA should be prominently displayed. Mention CAIIB for banking roles.

ATS Tips for Your Risk Management Resume

Financial institutions use Applicant Tracking Systems (ATS) to screen resumes:

For Naukri.com

- Use keywords from job description (risk, Basel, compliance)

- Keep formatting simple—ATS can’t read complex layouts

- Use standard section headings

- Upload in .docx or .pdf format

For LinkedIn Applications

- Match your resume to your LinkedIn profile

- Use industry-standard job titles

- Include certifications prominently

- Get endorsements from colleagues

General ATS Tips

- DO: Use clean fonts, clear headings, bullet points

- DO: Include exact keywords (Basel III, credit risk, VaR)

- DO: List specific tools and frameworks

- DON’T: Use headers/footers, text boxes, or graphics

- DON’T: Use creative section titles

Keyword Strategy for Indian Risk Roles

Common keywords include:

- Credit risk, market risk, operational risk

- Basel III, RBI, SEBI, regulatory compliance

- VaR, stress testing, ICAAP

- Risk modeling, analytics, portfolio

- FRM, CFA, CA

Final Tips for Your Risk Management Resume

✅ Show certifications: FRM and other credentials prominently

✅ Include regulatory knowledge: RBI, Basel III expertise

✅ Quantify achievements: Reduced losses, improved ratios

✅ List technical skills: Programming and tools

✅ Show progression: Career growth in risk function

✅ Mention key projects: Basel implementation, RBI audits

Quick Checklist

- Contact information with +91 phone number and LinkedIn

- Professional summary highlights risk expertise

- Skills section includes risk types and tools

- Experience shows quantified achievements

- Education includes MBA/relevant degree

- FRM and other certifications listed

- Technical skills mentioned

- Formatting is clean and ATS-friendly

- Length is appropriate (1-2 pages)

Ready to create your professional risk management resume? Use our resume builder to get started with templates optimized for financial services.

Looking for more guidance? Check out our resume format guide for additional tips on structuring your risk management resume for the Indian job market.

Frequently Asked Questions

What should a risk management resume include?

A strong risk management resume includes your contact details, a clear professional summary, detailed work experience, a skills section (like risk assessment, mitigation planning), education, and relevant certifications such as FRM or CRM. Emphasize measurable results where possible.

How do I write an effective professional summary for a risk manager role?

Write 2–3 sentences that highlight your experience in identifying and mitigating risks, key technical strengths, and one quantifiable impact you've delivered — for example, reduced operational losses by 20% through improved risk controls.

What skills are most important on a risk management resume?

Include both technical skills (risk assessment, quantitative analysis, compliance, reporting tools) and soft skills (decision-making, problem-solving, communication, strategic thinking). Listing tools like Excel, SAS, R, Python, GRC platforms can also help.

Should I list certifications on my risk management resume?

Yes — certifications like FRM (Financial Risk Manager), CRM (Certified Risk Manager), CFA, or ISO 31000 training strengthen credibility and show specialized knowledge in risk practices.

How do I highlight achievements in risk management roles?

Use bullet points that focus on specific outcomes — such as reduced compliance issues by 30%, implemented new risk controls that cut losses by $1M, or enhanced risk reporting accuracy across departments.

How long should a risk management resume be?

One page is ideal if you're early in your career. Two pages are acceptable if you have extensive experience or major accomplishments — just make sure every item adds value and relevance.

Should I tailor my resume for different risk management jobs?

Yes — customize your resume using relevant keywords from the job description (like enterprise risk management, credit risk analysis, operational risk, regulatory compliance). This helps both recruiters and applicant tracking systems (ATS) recognize your fit.

How do I show risk management experience if I'm switching careers?

Emphasize transferable skills like analytical thinking, process improvement, compliance work, and any relevant project or coursework. Demonstrating your understanding of risk frameworks and tools also helps.

What are common mistakes to avoid on a risk management resume?

Avoid vague language like "handled risk tasks," long paragraphs without specifics, and missing measurable outcomes. Keep bullet points concise, results-oriented, and aligned with the job you're applying for.

How can I make my resume stand out if I work in a technical risk role?

Highlight your familiarity with risk modeling, data analytics tools, scenario analysis, and automated risk platforms. Show how you used these technologies to improve decision-making or reduce risk exposure.

Risk Management Text-Only Resume Templates and Samples

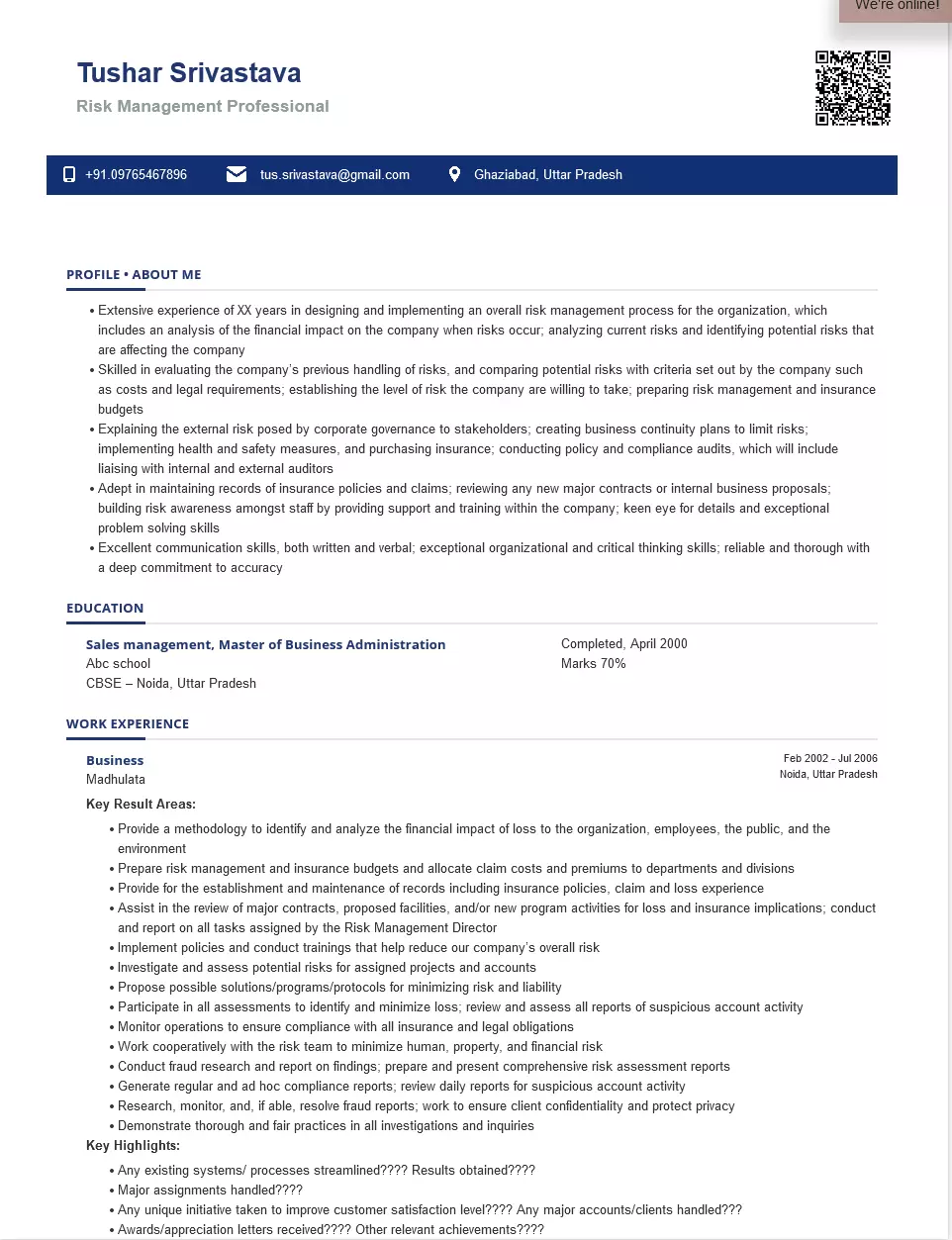

Tushar Srivastava

Phone: 09765467896

Email: tus.srivastava@gmail.com

Address: House No. 145, Block - H, Green View Apartments,, Sector 17, Vasundhara, Ghaziabad

About Me

Risk Management Professional / Operations Risk Analyst / Market Risk Analyst

- Extensive experience of XX years in designing and implementing an overall risk management process for the organization, which includes an analysis of the financial impact on the company when risks occur; analyzing current risks, and identifying potential risks that are affecting the company

- Skilled in evaluating the company’s previous handling of risks, and comparing potential risks with criteria set out by the company such as costs and legal requirements; establishing the level of risk the company is willing to take; preparing risk management and insurance budgets

- Explaining the external risk posed by corporate governance to stakeholders; creating business continuity plans to limit risks; implementing health and safety measures, and purchasing insurance; conducting policy and compliance audits, which will include liaising with internal and external auditors

- Adept in maintaining records of insurance policies and claims; reviewing any new major contracts or internal business proposals; building risk awareness amongst staff by providing support and training within the company; keen eye for details and exceptional problem-solving skills

- Excellent communication skills, both written and verbal; exceptional organizational and critical thinking skills; reliable and thorough with a deep commitment to accuracy

Education

Accounting and Finance, Master of Business Administration, Completed, April 2000

GJR Institute of Business Administration

IIT

Noida, UP

Certifications

Work Experience

Period: February 2002 - Current

Senior Risk Management Specialist

MCT Pvt Ltd

- Provided a methodology to identify and analyze the financial impact of loss to the organization, employees, the public, and the environment.

- Prepared risk management and insurance budgets and allocate claim costs and premiums to departments and divisions.

- Assisted in the review of major contracts, proposed facilities, and/or new program activities for loss and insurance implications.

- Implemented policies and conducted training that help reduce our company’s overall risk.

- Participated in all assessments to identify and minimize loss, reviewed and assessed all reports of suspicious account activity.

- Worked cooperatively with the risk team to minimize human, property, and financial risk

- Monitored operations to ensure compliance with all insurance and legal obligations.

Period: June 1995 - November 2000

Enterprise Risk Management Specialist

HU Pvt Ltd

- Conducted and reported on all tasks assigned by the Risk Management Director.

- Conducted assessments to define and analyze possible risks; audited processes and procedures

- Evaluated the gravity of each risk by considering its consequences.

- Developed risk management controls and systems; designed processes to eliminate or mitigate potential risks.

- Created contingency plans to manage crises; evaluated existing policies and procedures to find weaknesses.

- Prepared reports and presented recommendations; helped implement solutions and plans.

- Evaluated employees’ risk awareness and trained them when necessary.

Skills

Hard Skills

- Quality Assurance

- SQL querying skills,

- Databases

- Strategic thinker

- Influencing ideas to senior levels

- Priority management

Soft Skills

- Communication skills

- Organizational skills

- Critical thinking skills

- Analytical skills

- Public speaking skills

- Organizational abilities

- Statistical analysis abilities

- Interpersonal skills

Languages

Softwares

Operating System

Personal Interests

- Traveling

- Singing

- Yoga

- Dance

India's

premier resume service

India's

premier resume service