- Participated in business workshops and networking events

- Collaborated with other members on business case studies and group projects

What's your job?

Compliance Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Compliance Officer Resume Guide for India

A well-crafted compliance officer resume is essential for success in India’s expanding regulatory and compliance sector. Whether you’re a fresher starting your career after completing CA, CS, or LLB, or an experienced professional seeking growth at leading banks like HDFC, ICICI, SBI, or corporate compliance departments, this guide provides everything you need to create a standout resume.

This comprehensive guide includes:

- Resume format recommendations for India

- Key skills Indian compliance employers look for

- Complete resume example with Indian context

- Top compliance employers in India

- Salary insights in INR by experience level

- Certification guidance

- ATS optimization tips for Indian job portals

Why Your Compliance Resume Matters in India

India’s compliance sector is growing rapidly due to increasing regulatory requirements. Organizations like RBI-regulated banks, SEBI-registered entities, insurance companies, NBFCs, and large corporates actively hire compliance professionals. A strong resume helps you:

- Stand out from thousands of applicants on Naukri and LinkedIn

- Pass ATS screening used by large financial institutions

- Showcase skills that Indian employers value, including regulatory knowledge

- Demonstrate your expertise in Indian regulatory frameworks

Indian compliance recruiters value regulatory expertise, attention to detail, and strong ethics. Your compliance resume must immediately communicate your regulatory knowledge, certifications, and ability to navigate the Indian compliance landscape. With increasing regulatory scrutiny, a well-optimized resume is essential.

Compliance Resume Format for India

Indian employers prefer clean, professional resume formats. Here’s what works best:

Recommended Format

- Length: 1-2 pages (freshers: 1 page, experienced: 2 pages max)

- Layout: Reverse chronological (most recent first)

- Font: Clean fonts like Calibri or Arial (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Professional Presentation

Your resume should reflect the precision expected in compliance. Keep it organized and error-free.

Personal Details for Indian Compliance Resumes

Include:

- Full name

- Phone number with country code (+91)

- Professional email address

- LinkedIn profile URL

- City, State (full address not required)

What to Avoid

- Complex formatting

- Personal information like religion or caste

- Salary expectations

- References (provide when requested)

Key Skills for Compliance Officers in India

Indian financial employers look for specific compliance capabilities.

Core Compliance Skills

- Regulatory Compliance: RBI, SEBI, IRDAI guidelines

- KYC/AML: Customer due diligence, transaction monitoring

- Policy Development: Compliance policies and procedures

- Risk Assessment: Compliance risk identification

- Audit Support: Regulatory inspections and audits

- Reporting: STR, CTR, regulatory returns

- Training: Compliance awareness programs

Regulatory Knowledge for India

- RBI Master Directions and Circulars

- SEBI regulations and guidelines

- PMLA (Prevention of Money Laundering Act)

- FEMA (Foreign Exchange Management Act)

- Companies Act, 2013

- Income Tax Act compliance

- GST compliance

- Labour laws and POSH Act

Technical Skills

- Compliance management systems

- AML/KYC software

- Regulatory reporting tools

- Microsoft Office Suite

- Data analytics for compliance

- Document management systems

- E-filing portals

Soft Skills Valued

- Integrity: Ethical conduct

- Attention to Detail: Accuracy in compliance

- Communication: Regulatory liaison

- Analytical Skills: Issue identification

- Stakeholder Management: Cross-functional coordination

How to Present Skills

List regulatory expertise prominently. Mention specific regulations and frameworks. Include professional certifications.

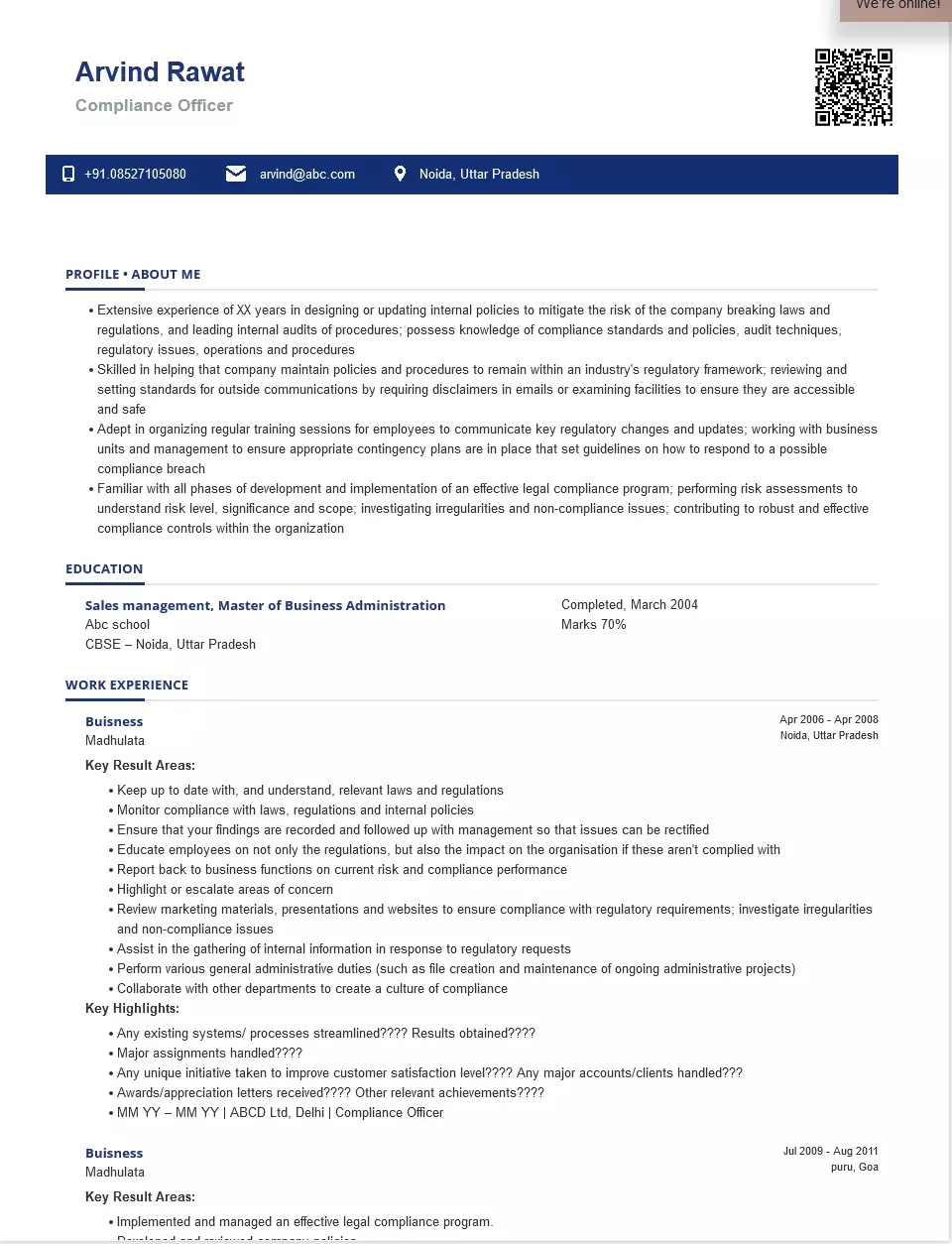

Compliance Officer Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Rahul Sharma

Mumbai, Maharashtra | +91-98XXX-XXXXX | rahul.compliance@email.com | linkedin.com/in/rahulsharma

Professional Summary

Senior Compliance Officer with 8+ years of experience in banking compliance, AML/KYC, and regulatory affairs. CA and CAIIB qualified with expertise in RBI compliance, PMLA requirements, and FEMA regulations. Successfully managed RBI inspections with zero major adverse observations. Proven track record of building compliance frameworks and reducing regulatory risks at leading private sector banks.

Key Skills

RBI Compliance | PMLA/AML | KYC Operations | FEMA | Regulatory Reporting | Policy Development | Compliance Audit | STR/CTR Filing | Training | Risk Assessment

Professional Experience

Senior Manager – Compliance | HDFC Bank | Mumbai | April 2020 – Present

- Head compliance function for retail banking division

- Manage KYC/AML operations for 10 million+ customer base

- Coordinate RBI inspections with zero major adverse findings

- Develop and update compliance policies and procedures

- File STRs and CTRs as per PMLA requirements

- Conduct compliance training for 5,000+ employees annually

- Report to Compliance Committee and Board on compliance status

- Lead team of 12 compliance officers

Key Achievements:

- Implemented new AML system reducing false positives by 40%

- Zero RBI penalties in 4 years

- Reduced KYC TAT from 7 days to 2 days

Manager – Compliance | ICICI Bank | Mumbai | June 2016 – March 2020

- Managed branch compliance for Western Region (500+ branches)

- Conducted compliance audits and gap assessments

- Ensured FEMA compliance for forex transactions

- Prepared regulatory returns and submissions

- Implemented compliance training programs

- Supported RBI audit preparations

Assistant Manager – Compliance | Axis Bank | Mumbai | July 2014 – May 2016

- Started compliance career in KYC operations

- Performed customer due diligence

- Monitored transactions for suspicious activities

- Prepared compliance reports

- Assisted in policy documentation

Education

Chartered Accountant (CA) | ICAI | 2014

- All India Rank: Top 100

- Articleship: Deloitte India

Bachelor of Commerce | Mumbai University | 2011

- First Class with Distinction

- Specialization: Accountancy

Professional Certifications

- CAIIB (Certified Associate of Indian Institute of Bankers) | IIBF | 2017

- Certified Anti-Money Laundering Specialist (CAMS) | ACAMS | 2019

- Certificate in Compliance (Banking) | IIBF | 2016

- FEMA Practitioner Course | ICSI | 2020

- Certified KYC Professional | 2018

Regulatory Expertise

- RBI: Master Directions, KYC MD, Fraud Reporting, Wilful Defaulter

- PMLA: KYC/CDD, STR/CTR, Record Keeping, PEP

- FEMA: Current Account, Capital Account, LRS, ECB

- SEBI: Insider Trading, LODR (for listed entities)

- Companies Act: Board compliance, CSR, Related Party

Key Achievements

- Led successful implementation of video KYC during COVID

- Zero major RBI adverse observations across 4 inspection cycles

- Reduced compliance breaches by 60% through enhanced monitoring

- Trained 10,000+ employees on PMLA and KYC requirements

- Developed comprehensive compliance manual adopted bank-wide

Regulatory Inspections Handled

- RBI Annual Financial Inspection

- RBI Risk-Based Supervision

- SEBI inspection (for banking securities)

- Income Tax surveys

- FIU-IND inquiries

Publications & Speaking

- “KYC Challenges in Digital Banking” – IIBF Journal, 2022

- Speaker at ASSOCHAM Banking Compliance Summit 2023

- Internal training on PMLA amendments for 500+ staff

Languages

Hindi (Native) | English (Fluent) | Marathi (Conversational)

Declaration

I hereby declare that the information provided above is true to the best of my knowledge.

Rahul Sharma Mumbai, December 2024

Top Compliance Employers in India

India’s compliance sector offers excellent opportunities:

Banks

- SBI: India’s largest bank

- HDFC Bank: Private sector leader

- ICICI Bank: Major private bank

- Axis Bank: Large private bank

- Kotak Mahindra Bank: Growing bank

- PSU Banks: PNB, Bank of Baroda, Canara

NBFCs

- Bajaj Finance: Leading NBFC

- HDFC Ltd: Housing finance (merged with HDFC Bank)

- L&T Finance: Diversified NBFC

- Mahindra Finance: Vehicle finance

- Shriram Finance: Retail NBFC

Insurance Companies

- LIC: Public sector insurer

- ICICI Prudential: Private life insurance

- HDFC Life: Leading insurer

- General Insurers: ICICI Lombard, Bajaj Allianz

Corporate Compliance

- IT Companies: Infosys, TCS, Wipro

- Manufacturing: Tata, Reliance, L&T

- FMCG: HUL, ITC, Nestle

- Pharma: Sun Pharma, Dr. Reddy’s

Big 4 and Consulting

- Deloitte: Regulatory consulting

- PwC: Compliance advisory

- KPMG: Risk and compliance

- EY: Regulatory services

How to Apply

- Apply through company career pages

- Use Naukri and LinkedIn

- Network at compliance conferences

- Campus placements for freshers

- Recruitment consultants

Compliance Salary in India

Salaries vary based on experience, employer type, and certifications.

Salary by Experience Level

| Experience | Annual Salary (INR) |

|---|---|

| Fresher/Executive (0-3 years) | ₹5 - ₹12 LPA |

| Manager (4-7 years) | ₹12 - ₹25 LPA |

| Senior Manager (8-12 years) | ₹25 - ₹45 LPA |

| AVP/VP (12+ years) | ₹45 - ₹80 LPA |

| Chief Compliance Officer | ₹80 LPA - ₹2 Cr+ |

Note: Banks and Big 4 pay higher; CA/CS qualifications add premium.

Salary by City

| City | Salary Range (Manager Level) |

|---|---|

| Mumbai | ₹18 - ₹30 LPA |

| Delhi NCR | ₹16 - ₹28 LPA |

| Bangalore | ₹15 - ₹26 LPA |

| Chennai | ₹12 - ₹22 LPA |

| Hyderabad | ₹12 - ₹22 LPA |

| Kolkata | ₹10 - ₹18 LPA |

Certification Premium

- CA: Significant premium in banking

- CS: Valued in corporate compliance

- CAMS: 15-20% premium for AML roles

- CAIIB: Banking career essential

Factors Affecting Salary

- Employer Type: Banks pay more than corporates

- Certifications: CA/CS highly valued

- Specialization: AML/FEMA expertise pays more

- Experience: Regulatory handling experience valued

Salary data based on Glassdoor India, AmbitionBox, and industry surveys.

Certifications for Compliance Professionals

Professional certifications boost career prospects.

Essential Certifications

- CA (Chartered Accountant): ICAI certification

- CS (Company Secretary): ICSI certification

- CAIIB: Banking qualification from IIBF

- CAMS: Anti-Money Laundering certification

Recommended Certifications

- Certificate in Compliance: IIBF

- FEMA Course: ICSI or ICAI

- Certified Compliance Professional: Various providers

- LLB: For regulatory interpretation

Educational Background

- CA/CS: Most valued qualifications

- MBA Finance: Management perspective

- LLB: Legal expertise

- B.Com/Economics: Foundation

Skill Development

- Regulatory updates tracking

- AML software training

- Data analytics for compliance

- Communication and presentation

How to List Certifications

Include certification name, issuing body, and year. CA/CS should be prominently displayed. Mention CAMS for AML-focused roles.

ATS Tips for Your Compliance Resume

Financial institutions use Applicant Tracking Systems:

For Naukri.com

- Use keywords from job description (compliance, RBI, AML)

- Keep formatting simple

- Use standard section headings

- Upload in .docx or .pdf format

For LinkedIn Applications

- Match resume to LinkedIn profile

- Use industry-standard job titles

- Include certifications prominently

- Get endorsements from colleagues

General ATS Tips

- DO: Use clean fonts, clear headings, bullet points

- DO: Include exact keywords (RBI, PMLA, KYC, AML)

- DO: List specific regulations and frameworks

- DON’T: Use headers/footers, text boxes, or graphics

- DON’T: Use creative section titles

Keyword Strategy

Common keywords include:

- Compliance, regulatory, RBI, SEBI

- KYC, AML, PMLA, FEMA

- Audit, inspection, reporting

- Policy, procedure, training

- CA, CS, CAIIB, CAMS

Final Tips for Your Compliance Resume

✅ Show certifications: CA, CS, CAIIB prominently

✅ Include regulatory expertise: Specific regulations known

✅ Highlight inspection success: Zero adverse findings

✅ Quantify achievements: Metrics and improvements

✅ Show progression: Career growth in compliance

✅ Mention training delivered: Compliance awareness programs

Quick Checklist

- Contact information with +91 phone number and LinkedIn

- Professional summary highlights compliance expertise

- Skills section includes regulatory frameworks

- Experience shows inspection handling

- Education includes CA/CS/relevant qualifications

- Professional certifications listed

- Regulatory expertise detailed

- Formatting is clean and ATS-friendly

- Length is appropriate (1-2 pages)

Ready to create your professional compliance resume? Use our resume builder to get started with templates optimized for financial services.

Looking for more guidance? Check out our resume format guide for additional tips on structuring your compliance resume for the Indian job market.

Frequently Asked Questions

What should a compliance resume include?

A strong compliance resume includes your contact details, a concise professional summary, detailed work experience, a list of relevant skills (like risk assessment, regulatory reporting, internal controls), education, and any certifications such as CCEP or CRCM.

How do I write a professional summary for a compliance role?

Write 2–3 sentences that describe your compliance experience, your strongest areas (e.g., risk management, audit support, policy development), and one result you delivered — such as improved compliance scores or reduced audit findings.

What skills should be highlighted on a compliance resume?

Include both technical skills (risk assessment, regulatory knowledge, policy review, audit coordination) and soft skills (attention to detail, communication, problem-solving, ethical judgment). Specific tools and frameworks you've used are also helpful to list.

Should I list certifications on my compliance resume?

Yes — certifications like Certified Compliance & Ethics Professional (CCEP), Certified Regulatory Compliance Manager (CRCM), or anti-money laundering credentials can make your resume stand out and increase credibility.

How do I show accomplishments on a compliance resume?

Use bullet points that focus on results — for example, reduced compliance violations by 25% or led audit preparations resulting in zero findings. Numbers and measurable outcomes make your achievements stronger.

How long should a compliance resume be?

For most professionals, one page is suitable, especially if you're early in your compliance career. If you have extensive experience or significant achievements, a two-page resume is acceptable — just make sure every line adds value.

Should I tailor my compliance resume for each job application?

Yes — match your resume to the job description by including relevant keywords like risk assessment, SOX compliance, GDPR, AML/KYC, internal controls, and regulatory reporting. This helps with both applicant tracking systems (ATS) and recruiter relevance.

How do I show compliance experience if I'm switching careers?

Focus on transferable skills like risk evaluation, policy adherence, reporting, audit support, or quality assurance. Highlight projects, training, or coursework that aligns with compliance functions.

What are common mistakes to avoid on a compliance resume?

Avoid vague phrases like "handled compliance tasks," long paragraphs without specifics, and missing measurable results. Keep formatting clean, use clear bullet points, and include specific compliance standards or regulations you've worked with.

Should I include software tools on my compliance resume?

Yes — list systems and tools you've used for compliance work, such as GRC platforms, audit management tools, case management systems, or data analytics tools. This shows technical readiness and makes your resume more relevant.

Compliance Text-Only Resume Templates and Samples

Abhi sandilya

Phone: 9871275111

Email: writer@shriresume.com

Address: Bangalore Urban

About Me

Compliance

Detail-oriented and responsible recent graduate seeking an entry-level position in Compliance. Aim to leverage strong analytical skills, attention to detail, and knowledge of regulatory requirements to ensure compliance and integrity within business operations.Passionate about driving business success through proactive compliance measures that protect organizations from legal and reputational risks.

Extra Curricular Activities

Education

Computer, Bachelor of Computer Applications, Completed, February 2024

GNKITMS

KUK

Gokavaram, AP

Certifications

- Certificate in Compliance Fundamentals, Completed , March 2024

- Microsoft Office Specialist (MOS) - Excel, Completed , February 2024

Internships

Period: February 2024 - May 2024

Intern

Compliance Department Delhi

- Assisted in monitoring and ensuring compliance with company policies and regulations

- Supported senior compliance officers in conducting audits and risk assessments

- Collaborated with other departments to gather data and ensure compliance with industry standards

Skills

- Strong analytical and critical thinking skills

- Excellent attention to detail and organizational skills

- Proficiency in Microsoft Office Suite (Excel, Word, PowerPoint)

- Understanding of compliance regulations and business ethics

- Effective communication and teamwork skills

- Ability to manage multiple tasks and meet deadlines

Languages

Softwares

Operating System

Personal Interests

- Reading books on business ethics and corporate governance

- Playing strategic games like chess and Go

- Volunteering for community service projects

- Exploring new cultures and learning about different business environments

India's

premier resume service

India's

premier resume service