- Participated in finance competitions and stock market simulations

- Assisted in organizing financial literacy workshops for the local community

- Collaborated with other members on group projects and investment case studies

What's your job?

Investment Banking Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Investment Banking Resume Examples and Templates: A Complete Guide

A professional investment banking resume is essential for standing out in India’s highly competitive finance sector. Whether you’re applying for positions at bulge bracket banks like Goldman Sachs, JP Morgan, or Morgan Stanley, Indian investment banks like Kotak Investment Banking, Avendus, or JM Financial, or boutique advisory firms, your resume should highlight your deal experience, financial modelling expertise, and ability to deliver exceptional results under pressure.

This guide walks you through investment banking resume examples and templates, formatting tips, and keywords to help you write a resume that stands out to recruiters at leading investment banks in India.

Understanding the Investment Banking Role in India

Investment bankers are financial advisors who help companies raise capital, execute mergers and acquisitions, and provide strategic advisory services. From advising on billion-dollar M&A deals to managing IPO processes, investment bankers play a crucial role in India’s growing capital markets and corporate finance landscape.

Key responsibilities include:

- Executing mergers, acquisitions, and divestitures

- Managing initial public offerings (IPOs) and follow-on offerings

- Building financial models (DCF, LBO, merger models)

- Conducting valuation and due diligence

- Preparing pitch books and client presentations

- Negotiating transaction terms and documentation

- Liaising with regulators (SEBI, RBI, stock exchanges)

- Managing client relationships and deal origination

India’s active M&A market, growing startup ecosystem seeking exits, and increasing capital market activity create strong demand for skilled investment banking professionals.

Preparing to Write Your Investment Banking Resume

Before drafting your resume, gather all relevant information:

Professional details to compile:

- Complete employment history in finance roles

- Deals executed with transaction values

- Financial modelling and valuation experience

- Sector and industry expertise

- Education and certifications (CFA, CA)

- Technical skills and software proficiency

- Team sizes and responsibilities

- Notable achievements and recognition

Research target employers:

- Review requirements from bulge brackets (Goldman Sachs, Morgan Stanley)

- Understand expectations at Indian banks (Kotak, Avendus, Axis Capital)

- Note specific deal types and sectors mentioned in job descriptions

Choosing the Best Resume Format

Select a format that best presents your investment banking experience:

Chronological Format

Best for investment banking professionals with progressive career growth through analyst to associate to VP roles. Highlights your work at firms in reverse chronological order.

Functional Format

Suitable for career changers from corporate finance, audit, or consulting backgrounds transitioning into investment banking.

Combination Format

Ideal for professionals with diverse experience across equity capital markets, M&A, and private equity or combining banking with other finance roles.

Format recommendations by experience: | Experience Level | Recommended Format | Resume Length | |-----------------|-------------------|---------------| | Analyst (0-3 years) | Chronological | 1 page | | Associate (3-6 years) | Chronological | 1 page | | VP+ (6+ years) | Chronological | 1-2 pages |

Professional Summary Examples

Your professional summary should immediately communicate your investment banking expertise:

Investment Banking Analyst

CA from ICAI and MBA from IIM Ahmedabad seeking analyst position at leading investment bank. Completed summer internship at Goldman Sachs Mumbai working on M&A transactions in technology sector. Built DCF and LBO models for 3 live deals. Proficient in financial modelling, valuation, and pitch book preparation. Strong analytical and communication skills. Eager to contribute to deal execution while developing expertise in investment banking.

Associate Investment Banker

Results-driven investment banking associate with 4+ years of experience in M&A and ECM. Currently Associate at Kotak Investment Banking Mumbai having executed 15+ transactions worth ₹25,000 crore. Expertise in technology and consumer sector M&A, IPOs, and QIPs. Led financial modelling and due diligence for marquee deals. CA and CFA charterholder with strong client relationship skills. Consistently ranked top performer in annual reviews.

Vice President - Investment Banking

Strategic investment banking leader with 10+ years of experience executing M&A and capital markets transactions. Currently Vice President at Avendus Capital leading technology and digital economy practice. Executed 40+ transactions worth ₹50,000 crore including landmark deals. Expertise in cross-border M&A, private equity exits, and growth capital. MBA from IIM Bangalore with CFA charter. Strong origination track record and client relationships with top PE funds and corporates.

Director - Investment Banking

Senior investment banking executive with 15+ years of experience building and leading advisory practices. Currently Managing Director at JM Financial overseeing consumer and retail investment banking. Led India’s largest consumer sector IPO and 5 marquee M&A transactions. Expertise in deal origination, client coverage, and transaction execution. CA and MBA from ISB with deep sector expertise and board-level relationships across leading consumer companies.

Showcasing Your Work Experience

Present your investment banking experience with specific achievements and deal metrics:

Vice President - Investment Banking

Avendus Capital | Mumbai April 2019 – Present

- Lead technology sector coverage originating and executing M&A transactions

- Executed 20+ transactions worth ₹30,000 crore across M&A and PE exits

- Led sell-side advisory for ₹2,500 crore tech company acquisition

- Managed IPO process for ₹1,500 crore technology company

- Originate mandates through relationships with PE funds and founders

- Supervise team of 4 associates and analysts on transaction execution

- Build complex financial models including DCF, LBO, and merger models

- Prepare board presentations and negotiate transaction documentation

- Achieved “Top Performer” recognition for 3 consecutive years

Associate - Investment Banking

Kotak Investment Banking | Mumbai June 2015 – March 2019

- Executed 15+ M&A and ECM transactions worth ₹25,000 crore

- Led due diligence and financial modelling for consumer sector M&A

- Managed IPO and QIP processes for 5 listed companies

- Built valuation models (DCF, trading comps, precedent transactions)

- Prepared pitch books and information memoranda for mandates

- Coordinated with legal, tax, and accounting advisors

- Worked 80+ hours per week during live transactions

- Promoted from Analyst to Associate within 3 years

- Received “Rising Star” recognition for deal execution

Analyst - Investment Banking

Goldman Sachs | Bangalore July 2012 – May 2015

- Supported execution of M&A and ECM transactions

- Built financial models for technology and consumer deals

- Prepared pitch books and client presentations

- Conducted industry research and competitive analysis

- Participated in due diligence and data room management

- Worked on 10+ transactions during tenure

- Completed Goldman Sachs analyst training programme

- Received “Analyst of the Year” nomination (2014)

Essential Skills for Investment Bankers

Technical Skills

- Financial modelling (3-statement, DCF, LBO)

- Valuation methodologies

- Merger models and accretion/dilution

- Due diligence and analysis

- Pitch book and presentation creation

- Industry research and analysis

- Transaction structuring

- Regulatory and compliance knowledge

- Data room management

- Deal documentation review

Software Proficiency

- Microsoft Excel (advanced modelling)

- Microsoft PowerPoint (pitch books)

- Bloomberg Terminal

- Capital IQ / FactSet

- PitchBook / Mergermarket

- Virtual data rooms (Intralinks, Merrill)

- Microsoft Word

- Financial databases

- Presentation design tools

- Deal tracking systems

Soft Skills

- Analytical and critical thinking

- Communication and presentation

- Attention to detail and accuracy

- Time management under pressure

- Client relationship management

- Team leadership and collaboration

- Negotiation skills

- Work ethic and stamina

- Commercial awareness

- Problem-solving

Certifications for Investment Bankers

Professional Certifications

| Certification | Issuing Body | Relevance |

|---|---|---|

| CFA Charter | CFA Institute | Investment analysis |

| CA (Chartered Accountant) | ICAI | Accounting and audit |

| CPA | AICPA | US accounting |

| FRM | GARP | Risk management |

| NISM Series | NISM | Indian securities |

| Investment Banking Certificate | CFI/WSO | Technical skills |

Academic Qualifications

- MBA from premier institutes (IIMs, ISB, XLRI)

- CA with articleship from Big Four

- B.Tech/B.E. from IITs/NITs with MBA

- B.Com from top colleges

- MS Finance from global universities

- CFA with relevant experience

Additional Certifications

- Financial Modelling certification

- Valuation certification

- M&A certification

- SEBI registered categories

- LBO modelling course

- Excel advanced certification

Tips by Experience Level

Investment Banking Analysts (0-3 years)

- Highlight IIM/ISB MBA or CA qualification

- Include internship and deal exposure

- Emphasise financial modelling skills

- Showcase attention to detail and work ethic

- Include technical certifications (CFA progress)

Target employers: Bulge brackets, top Indian banks, Big Four corporate finance

Associates (3-6 years)

- Quantify deals executed with transaction values

- Highlight sector expertise and deal types

- Showcase leadership and client interaction

- Demonstrate progression from analyst role

- Include CFA charter or CA qualification

Target positions: Associate, Senior Associate, VP candidate

Vice Presidents and Above (6+ years)

- Emphasise origination and client relationships

- Highlight marquee transactions and sector expertise

- Showcase team management and P&L contribution

- Demonstrate strategic thinking and market knowledge

- Include board relationships and industry recognition

Target positions: Vice President, Director, Managing Director

ATS Optimisation for Investment Banking Resumes

Ensure your resume passes Applicant Tracking Systems:

Essential keywords to include:

- Investment banking, M&A, ECM, DCM

- Financial modelling, valuation, DCF

- LBO, merger model, due diligence

- IPO, QIP, private placement

- Pitch book, information memorandum

- Transaction, deal execution

- CFA, CA, MBA

- Goldman Sachs, Morgan Stanley, Kotak

- Excel, PowerPoint, Bloomberg

- Analyst, associate, vice president

ATS-friendly formatting:

- Use standard section headings (Summary, Experience, Skills, Education)

- List deal values in ₹ crore format

- Avoid tables, graphics, and complex formatting

- Use standard fonts (Arial, Calibri, Times New Roman)

- Keep to one page unless VP+ level

Conclusion

A professional investment banking resume is essential for success in India’s competitive finance sector. Whether you’re targeting positions at bulge bracket banks like Goldman Sachs and Morgan Stanley, or Indian investment banks like Kotak, Avendus, and JM Financial, your resume must demonstrate your deal experience, technical skills, and ability to deliver under pressure.

Focus on quantifying your achievements—transaction values, deals executed, and client relationships built. Highlight your qualifications like CA, CFA, and MBA from premier institutes that validate your expertise. With India’s active capital markets and growing M&A activity, skilled investment banking professionals have excellent career opportunities across all levels.

Use our resume builder to create an ATS-optimised investment banking resume, or explore our professional templates designed specifically for finance professionals in India.

Frequently Asked Questions

What sections should a strong investment banking resume include?

At minimum, include contact information, a professional summary, work experience, key skills, and education. Depending on your experience level, you may also add certifications, achievements, projects, or industry-specific sections that highlight your expertise.

How do I write a professional summary for an investment banking role?

Keep it concise — two to three sentences highlighting your experience level, core competencies, and a key achievement or strength that shows why you're right for the job. Tailor it to match the specific role you're applying for.

What skills are most important to list on an investment banking resume?

Include a mix of technical skills specific to investment banking roles and soft skills like communication, problem-solving, and teamwork. Research job postings in your target companies to identify the most commonly requested skills.

How detailed should my work experience be?

Use bullet points to describe your roles, focusing on specific results, tools used, and the impact you made. Quantify achievements where possible — numbers and percentages help recruiters quickly understand your contributions.

Do I need certifications on my investment banking resume?

Certifications aren't always required, but they can strengthen your application — especially if they demonstrate advanced training or specialised expertise. List the certification name, issuing organisation, and year obtained.

What's the best resume format for an investment banking?

Most investment banking professionals benefit from a reverse-chronological format that lists your most recent experience first. If you're changing careers or have gaps, a functional or combination format might work better.

How long should my investment banking resume be?

Aim for one page if you're early in your career. Experienced professionals with extensive achievements can use two pages — just ensure every section adds value and remains relevant to the role.

Should I tailor my resume for each job application?

Yes. Customising your resume with keywords and responsibilities from the job posting improves your chances of passing Applicant Tracking Systems (ATS) and resonating with recruiters. Focus on relevant experience and skills for each role.

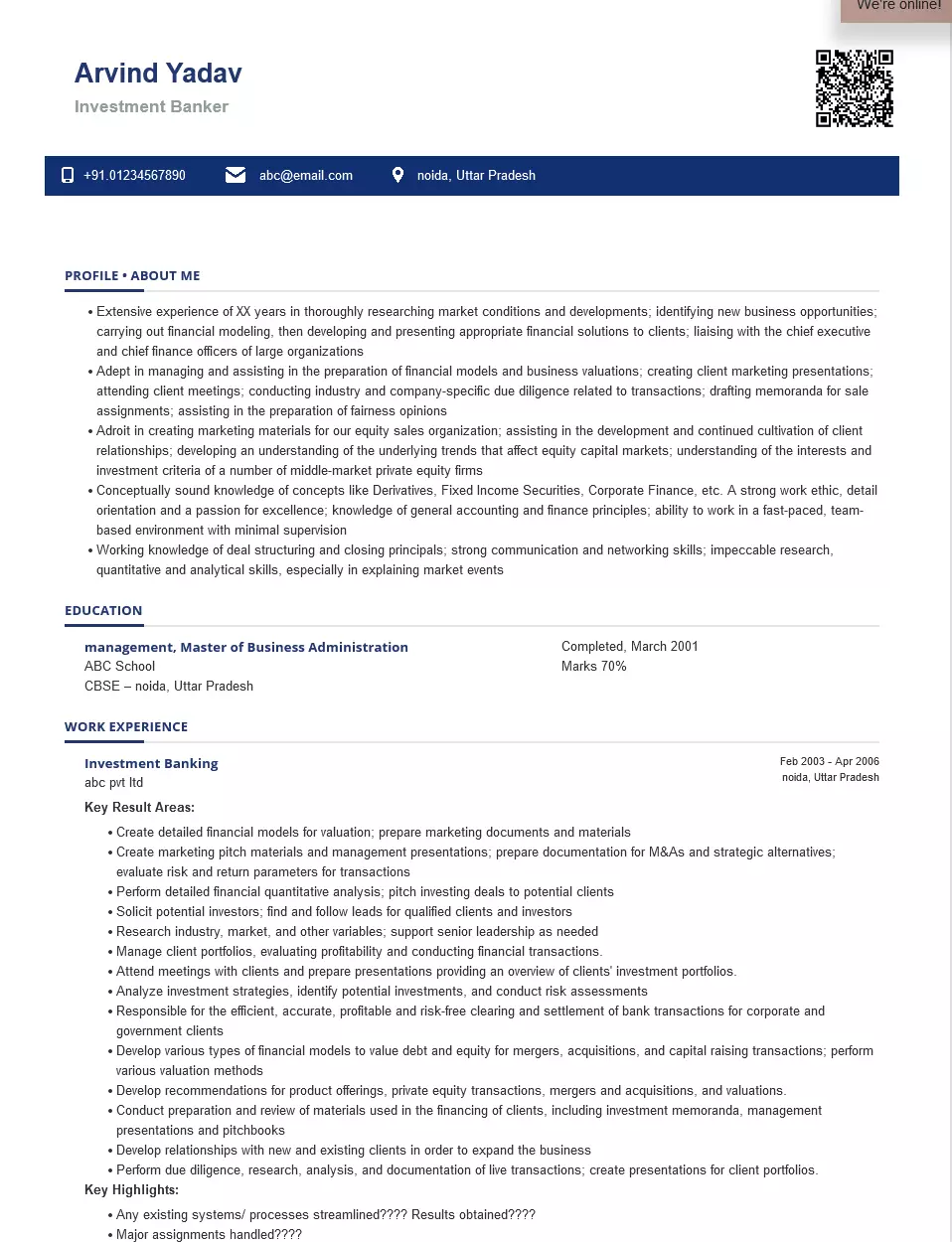

Investment Banking Text-Only Resume Templates and Samples

Abhi Saha

Phone: 9871445009

Email: writer@shriresume.com

Address: Chandigarh

About Me

Investment Banker

Ambitious and detail-oriented recent graduate seeking an entry-level position in Investment Banking. Aim to leverage skills in financial analysis, modeling, and market research to contribute to successful investment projects and transactions.

Extra Curricular Activities

Education

Finance, Bachelor of Arts, Completed, March 2024

IMT

UPTU

Ghaziabad, UP

Certifications

- Financial Modeling and Valuation Analyst (FMVA), Completed , March 2024

- Certificate in Investment Banking Basics, Completed , January 2024

Internships

Period: December 2023 - March 2024

Intern

Investment Banking Division

- Assisted in financial modeling and analysis for various investment projects

- Conducted research on industry trends, company valuations, and market conditions

- Supported senior bankers in preparing pitchbooks and client presentations

Skills

- Proficient in financial analysis and modeling (Excel, Bloomberg Terminal)

- Strong knowledge of investment banking processes and financial markets

- Excellent communication and presentation skills

- Ability to work in a fast-paced, high-pressure environment

- Problem-solving and critical thinking abilities

- Strong teamwork and collaboration skills

Languages

Softwares

Operating System

Personal Interests

Travelling

Drawing

India's

premier resume service

India's

premier resume service