- Certified Bank Teller (CBT), Completed , January 2005

What's your job?

Bank Teller and Customer Service Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Bank Teller & Customer Service Resume Guide for India

A well-crafted Bank Teller and Customer Service resume is essential for success in India’s competitive banking sector. Whether you’re a fresher from IBPS Clerk or an experienced professional seeking positions at SBI, HDFC Bank, ICICI Bank, or other leading institutions, this guide provides everything you need to create a standout resume that impresses Indian banking recruiters and passes ATS screening on portals like Naukri and LinkedIn.

This comprehensive guide includes:

- Resume format recommendations for Indian banking sector

- Key skills Indian banking employers look for

- Complete resume example with Indian context

- Top bank teller employers in India

- Salary insights in INR by experience level

- Certification guidance for the Indian market

- ATS optimization tips for Indian job portals

Why Your Bank Teller Resume Matters in India

India’s banking sector employs millions of frontline banking staff across Public Sector Banks (PSBs) like SBI, PNB, Bank of Baroda, and Private Banks like HDFC Bank, ICICI Bank, Axis Bank. A strong resume helps you:

- Stand out from thousands of IBPS clerk applicants on Naukri and LinkedIn

- Pass ATS screening used by private banks and recruitment agencies

- Showcase skills that Indian banking employers value, including cash handling, customer service, and banking operations

- Demonstrate your accuracy and customer service excellence

Indian banking recruiters typically spend 6-10 seconds reviewing each resume initially. Your Bank Teller resume must immediately communicate your banking experience, cash handling accuracy, and customer service skills. With India’s banking sector employing lakhs of frontline staff, a well-optimized resume is essential.

Bank Teller Resume Format for India

Indian employers prefer clean, professional resume formats. Here’s what works best:

Recommended Format

- Length: 1-2 pages (freshers: 1 page, experienced: 2 pages max)

- Layout: Reverse chronological (most recent first)

- Font: Arial, Calibri, or Times New Roman (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Resume vs Biodata

In India, use a professional resume format for private bank positions. “Biodata” format may be used for PSU bank applications through IBPS recruitment.

Personal Details for Indian Banking Resumes

Indian resumes typically include:

- Full name

- Phone number with country code (+91)

- Professional email address

- LinkedIn profile URL

- City, State (full address not required)

What to Avoid

- Decorative fonts or graphics (causes ATS issues)

- Personal information like religion, caste, or father’s name

- Salary expectations (discuss during interview)

- References (provide when requested)

Key Skills for Bank Tellers in India

Indian banking employers look for comprehensive frontline banking skills covering transactions, customer service, and compliance.

Cash Handling & Transactions

- Cash Management: Cash receipt, payment, vault operations

- Transaction Processing: Deposits, withdrawals, fund transfers

- Cheque Processing: Cheque deposit, clearing, collection

- Foreign Exchange: Currency exchange (where applicable)

- Remittances: RTGS, NEFT, IMPS processing

Customer Service

- Customer Interaction: Account queries, service requests

- Account Opening: Savings, current, FD account opening

- Product Information: Explaining bank products and services

- Complaint Resolution: Handling customer grievances

- Cross-Selling: Suggesting relevant banking products

Banking Operations

- KYC Compliance: Know Your Customer documentation

- Core Banking System (CBS): Finacle, BaNCS, Flexcube operations

- Documentation: Form filling, document verification

- Passbook/Statement: Passbook printing, statement generation

- Digital Banking: Assisting with mobile banking, UPI, net banking

Administrative Skills

- Record Keeping: Transaction registers, voucher filing

- Reconciliation: Daily cash reconciliation, balancing

- Reporting: Daily transaction reports, exception reports

- Queue Management: Customer flow management

Soft Skills for Indian Banking

- Accuracy: Zero-error cash handling

- Communication: Multilingual customer service

- Patience: Handling diverse customer needs

- Speed: Quick transaction processing

How to Present Skills

Create a dedicated skills section. Group by category (Transactions, Customer Service, Operations). Highlight banking software proficiency.

Bank Teller Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Priya Kumari

Patna, Bihar | +91-98XXX-XXXXX | priya.kumari.banker@email.com | linkedin.com/in/priyakumari-bankteller

Professional Summary

Dedicated and customer-focused Bank Teller with 5+ years of experience in cash handling, customer service, and banking operations in India’s banking sector. Expertise in transaction processing, KYC compliance, and customer query resolution with proven track record of maintaining 100% cash accuracy and serving 150+ customers daily. Strong background in both PSU and private banking with hands-on experience in Finacle CBS and digital banking platforms. JAIIB certified banker seeking to contribute frontline banking expertise to a progressive financial institution.

Skills

Cash Handling: Cash Receipt, Payment Processing, Vault Operations, Cash Reconciliation, Currency Verification Transactions: Deposits, Withdrawals, Fund Transfers, Cheque Processing, RTGS/NEFT/IMPS Customer Service: Account Queries, Service Requests, Complaint Resolution, Cross-Selling, Product Information Banking Operations: KYC Compliance, Account Opening, CBS Operations (Finacle), Documentation, Digital Banking Soft Skills: Accuracy, Speed, Communication, Multilingual Service (Hindi, English)

Professional Experience

Senior Teller / Single Window Operator | State Bank of India | Patna | April 2021 – Present

- Handle 150+ customer transactions daily with 100% cash accuracy

- Process deposits, withdrawals, and fund transfers worth ₹50 Lakh+ daily

- Maintain cash drawer balance with zero discrepancies for 36 consecutive months

- Assist customers with account opening, KYC updates, and service requests

- Cross-sell bank products achieving 120% of target for insurance and mutual funds

- Train 5 new tellers on CBS operations and cash handling procedures

- Received “Best Teller” recognition for Q3 2023 for exceptional accuracy and customer service

- Support branch in digital banking adoption campaigns

Teller / Clerk | Punjab National Bank | Patna | June 2019 – March 2021

- Processed 120+ customer transactions daily across cash and non-cash services

- Handled cheque deposits, clearing, and collection activities

- Maintained KYC documentation and updated customer records

- Assisted customers with passbook printing and statement requests

- Participated in financial literacy camps and customer outreach programs

- Achieved consistent positive customer feedback scores

Banking Associate (Trainee) | HDFC Bank | Muzaffarpur | July 2018 – May 2019

- Completed training in frontline banking operations

- Assisted senior tellers with cash handling and customer service

- Learned CBS operations and banking procedures

- Gained exposure to private sector banking practices

Key Achievements

Cash Accuracy Excellence | SBI Patna | 2022

- Maintained zero cash shortage/excess for entire year

- Developed personal verification checklist for large transactions

- Result: “Zero Error Champion” recognition, selected for training new staff

Customer Service Award | SBI Patna | 2023

- Received highest customer satisfaction scores in branch

- Resolved complex customer issues with patience and professionalism

- Result: Branch-level appreciation, recommended for promotion

Digital Banking Promotion | PNB Patna | 2020

- Helped 500+ customers register for mobile banking

- Conducted YONO SBI/PNB ONE demonstrations

- Result: Exceeded digital adoption target by 150%

Education

Bachelor of Commerce (B.Com) | Patna University | 2018

- First Class (68%)

- Specialization: Accounting

Higher Secondary Certificate | Bihar Board | 2015

- 72% in Commerce stream

Certifications

- Junior Associate of Indian Institute of Bankers (JAIIB) | IIBF | 2020

- Certificate in KYC/AML | IIBF | 2021

- Customer Service Excellence | Bank Internal Training | 2022

- Digital Banking Certification | IIBF | 2021

- Computer Proficiency Certificate | NIELIT | 2017

Professional Memberships

- Member, All India Bank Employees Association (AIBEA)

Computer Skills

- Core Banking System: Finacle, BaNCS

- MS Office: Word, Excel, Basic

- Digital Banking: Mobile Banking, UPI, Net Banking

Languages

English (Fluent) | Hindi (Native) | Bhojpuri (Native)

Declaration

I hereby declare that the information provided above is true to the best of my knowledge.

Priya Kumari Patna, December 2024

Top Bank Teller Employers in India

India’s banking sector offers extensive opportunities for tellers and customer service staff. Here are the top employers:

Public Sector Banks (Through IBPS)

- State Bank of India (SBI): India’s largest bank, separate recruitment

- Punjab National Bank (PNB): IBPS Clerk recruitment

- Bank of Baroda: IBPS recruitment

- Canara Bank: Large branch network

- Union Bank of India: Pan-India presence

- Bank of India: Established PSU bank

Private Sector Banks

- HDFC Bank: India’s largest private bank

- ICICI Bank: Leading private bank

- Axis Bank: Growing private bank

- Kotak Mahindra Bank: Premium banking

- IndusInd Bank: Corporate and retail

- Yes Bank: Revitalized bank

Small Finance Banks

- AU Small Finance Bank: Strong presence

- Equitas SFB: Growing network

- Ujjivan SFB: Financial inclusion focus

- Jana SFB: Expanding operations

Cooperative Banks

- Urban Cooperative Banks: City-based operations

- District Cooperative Banks: Regional presence

- State Cooperative Banks: State-level operations

Payment Banks

- Paytm Payments Bank: Digital-first banking

- Airtel Payments Bank: Mobile banking

- India Post Payments Bank: Extensive network

How to Apply

- IBPS Clerk recruitment for PSU banks

- SBI Clerk separate recruitment

- Direct recruitment through bank career portals

- Walk-in interviews at private banks

- Campus placements

Bank Teller Salary in India

Bank teller roles offer stable employment with benefits. Salaries vary based on bank type, experience, and location.

Salary by Experience Level

| Experience | PSU Banks (INR) | Private Banks (INR) |

|---|---|---|

| Fresher (0-2 years) | ₹3 - ₹4.5 LPA | ₹2.5 - ₹4 LPA |

| Junior (2-5 years) | ₹4.5 - ₹6.5 LPA | ₹4 - ₹6 LPA |

| Experienced (5-10 years) | ₹6.5 - ₹9 LPA | ₹6 - ₹8.5 LPA |

| Senior (10+ years) | ₹9 - ₹12 LPA | ₹8.5 - ₹11 LPA |

Note: PSU banks offer additional benefits like pension (for older batches), medical, housing allowance, and LFC. Private banks may offer higher incentives for cross-selling.

Salary by City

| City | Salary Range (Experienced) |

|---|---|

| Mumbai | ₹5.5 - ₹8 LPA |

| Delhi NCR | ₹5 - ₹7.5 LPA |

| Bangalore | ₹5 - ₹7.5 LPA |

| Chennai | ₹4.5 - ₹7 LPA |

| Kolkata | ₹4.5 - ₹7 LPA |

| Tier-2 Cities | ₹4 - ₹6 LPA |

Factors Affecting Salary

- Bank Type: PSU banks offer better job security and benefits

- Location: Metro cities pay higher

- Performance: Incentives for cross-selling targets

- Certification: JAIIB holders may get increments

- Promotion: Officers (through exam) earn significantly more

Salary data based on Glassdoor India, AmbitionBox, and industry surveys.

Certifications for Bank Tellers in India

Professional certifications enhance career growth in banking.

IIBF Certifications (Recommended)

- JAIIB (Junior Associate): Foundation banking knowledge

- Certificate in KYC/AML: Compliance knowledge

- Digital Banking Certificate: Technology skills

Entry Requirements

- IBPS Clerk Exam: For PSU bank recruitment

- SBI Clerk Exam: For SBI recruitment

- Private Bank Tests: Bank-specific assessments

Skill Certifications

- Computer Proficiency: NIELIT, MS Office

- Typing Certificate: For data entry speed

- English Proficiency: Communication skills

Career Advancement

- IBPS PO/SBI PO: Promotion to officer cadre

- CAIIB: After becoming officer

- Internal Departmental Exams: Career progression

How to List Certifications

Include JAIIB after completing, along with other banking certifications. IBPS/SBI selection should be mentioned in experience.

ATS Tips for Your Bank Teller Resume

Most private banks use Applicant Tracking Systems (ATS) to screen resumes. Optimize yours:

For Naukri.com

- Use keywords from job descriptions (bank teller, cash handling, customer service)

- Keep formatting simple (no tables, columns, or graphics)

- Use standard section headings (Experience, Education, Skills)

- Upload in .docx or .pdf format

- Update profile every 15 days

For LinkedIn Applications

- Match resume to LinkedIn profile

- Use standard job titles (Bank Teller, Clerk, Single Window Operator)

- Include banking certifications (JAIIB)

- Get endorsements from banking professionals

General ATS Tips

- DO: Standard fonts, clear headings, bullet points

- DO: Include metrics (150 customers daily, 100% accuracy, ₹50 Lakh transactions)

- DO: Mention CBS software and banking skills

- DON’T: Use headers/footers, text boxes, images

- DON’T: Use creative section titles

Keyword Strategy for Teller Roles

Common keywords from job postings:

- Bank Teller, Clerk, Single Window Operator

- Cash Handling, Transactions, Customer Service

- Deposits, Withdrawals, Fund Transfer

- KYC, Account Opening, CBS, Finacle

- IBPS, SBI Clerk, Banking Operations

Final Tips for Your Bank Teller Resume

✅ Highlight cash accuracy—zero-error record is crucial

✅ Quantify achievements (150 customers daily, 100% accuracy, ₹50 Lakh daily)

✅ Show customer service skills—satisfaction scores, feedback

✅ Include CBS proficiency—Finacle, BaNCS experience

✅ Mention cross-selling success—insurance, FD targets

✅ List language skills—multilingual service valued

✅ Proofread carefully—accuracy reflects your work quality

Quick Checklist

- Contact with +91 phone and LinkedIn

- Professional summary highlighting teller experience

- Skills organized by category (Cash, Service, Operations)

- Experience showing transaction volumes and accuracy

- Key achievements with measurable results

- Education with percentage

- Certifications (JAIIB, computer skills)

- Languages spoken

- ATS-friendly formatting

- Declaration statement

Ready to create your professional Bank Teller resume? Use our resume builder to get started with expert-designed templates optimized for Indian job portals.

For more guidance on resume structure, check out our resume format guide with tips specifically for the Indian banking job market.

Frequently Asked Questions

What's the difference between a bank teller and a banking customer service role on a resume?

A bank teller focuses on daily transactions such as deposits, withdrawals, and cash handling, while customer service roles include assisting customers with questions, resolving issues, and explaining bank products. Many resumes for these roles combine both skills because frontline banking jobs often require both transactional and service abilities.

What are the most important skills to list on a bank teller and customer service resume?

Highlight cash handling accuracy, transaction processing, customer service, and communication skills, along with software tools used in banking (like CBS/Finacle or Microsoft Office). Including both technical and soft skills shows that you're ready for both everyday tasks and customer interactions.

How do I write a strong professional summary for this resume?

Your summary should quickly communicate your experience in handling cash, serving customers, and working with banking systems — and include a key accomplishment if possible (for example, consistently balanced cash drawers with zero errors).

Should I list specific banking software on my resume?

Yes — mentioning systems you're familiar with (like Finacle, BaNCS, or other core banking platforms) helps your resume stand out, especially because banks use these tools day-to-day for transactions and record-keeping.

How do I show customer service experience if I've never worked in a bank before?

You can highlight any roles where you interacted with customers, solved problems, or managed inquiries (like retail, hospitality, or support roles). Emphasize things like resolving complaints, assisting clients with product questions, and helping with everyday needs — all are valuable in banking.

What achievements should I include on my bank teller resume?

Where possible, use numbers and results — for example, average daily transactions handled, accuracy rates, customer satisfaction scores, or targets met in product referrals. These help recruiters see your impact more clearly.

How long should a bank teller and customer service resume be?

For most candidates, one page is ideal — especially if you're earlier in your career. If you have extensive banking experience or significant achievements, you can extend to two pages, but keep the information relevant and concise.

Do I need a separate skills section, or can I list skills within my work experience?

Both are useful. A dedicated Skills section helps with applicant tracking systems (ATS), while highlighting specific abilities in your work experience (like "processed 150+ transactions daily" or "resolved client issues with a 95% satisfaction rate") gives context to your skills.

Should I include achievements like sales or cross-selling in a teller resume?

Yes — if you've referred customers to bank products or helped achieve sales goals, that's valuable because many banks expect frontline staff to support product adoption in addition to basic transactions.

Is formal education important on a bank teller resume?

While some bank teller jobs accept high school diplomas, including any relevant higher education (like business or finance courses) can strengthen your resume. Mention degrees or diplomas clearly, along with any related coursework.

What certifications can help my bank teller resume?

Certifications like Bank Teller Certificates, AML/KYC compliance courses, or digital banking training can bolster your profile, especially if you're competing with others who have similar experience.

How do I make my bank teller resume ATS-friendly?

Use standard headings (Skills, Experience, Education), include relevant keywords from job postings (like cash handling, customer service, KYC compliance), and avoid special characters or complex formatting that might confuse ATS software.

Should I highlight language skills on my resume?

Yes — speaking multiple languages is a plus in customer service roles, especially in busy branches where you may serve diverse clients.

Bank Teller and Customer Service Text-Only Resume Templates and Samples

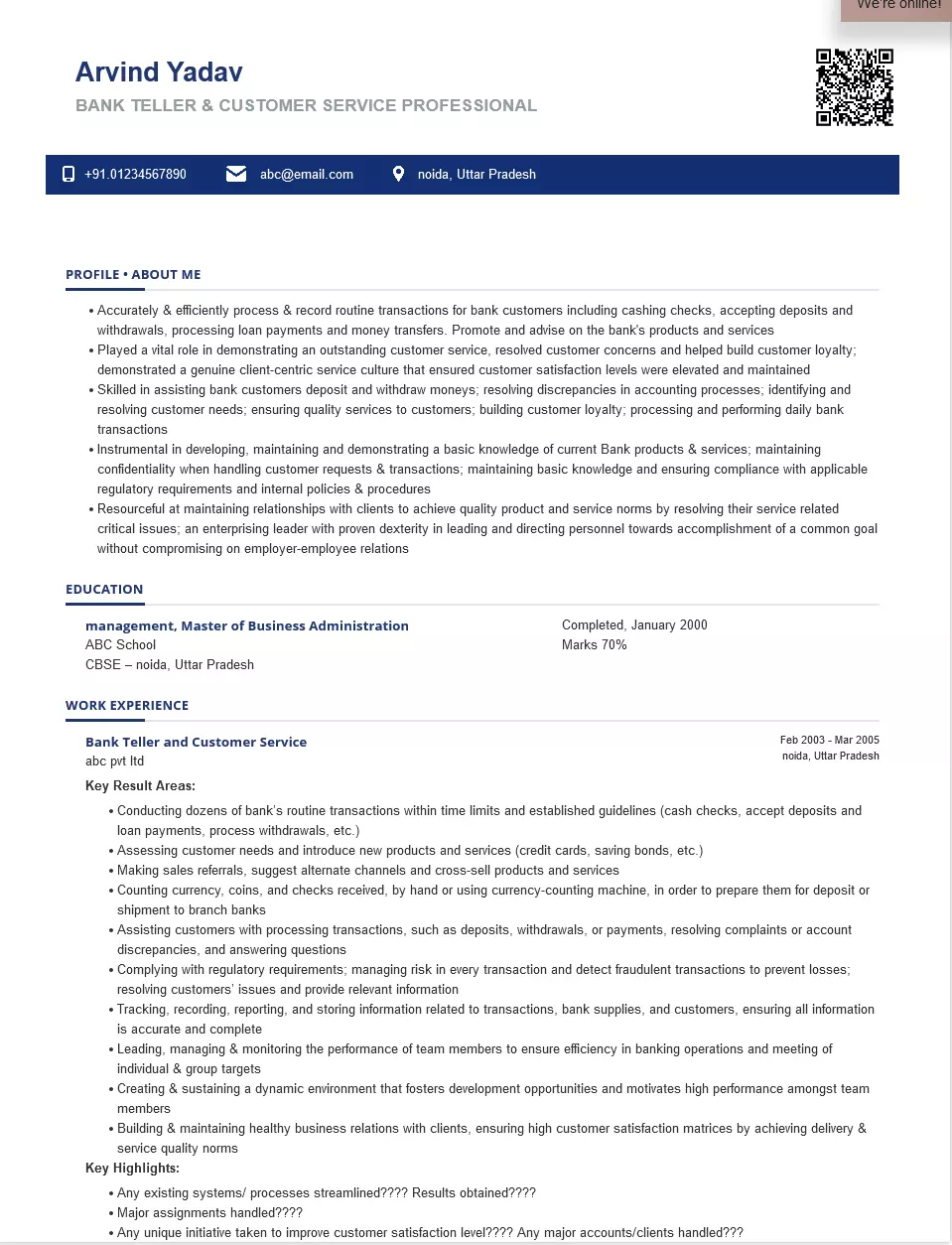

Arvind Yadav

Phone: 01234567890

Email: abc@email.com

Address: Sec-44, Noida, Noida

About Me

BANK TELLER & CUSTOMER SERVICE PROFESSIONAL

- Accurately & efficiently process & record routine transactions for bank customers including cashing checks, accepting deposits and withdrawals, and processing loan payments and money transfers. Promote and advise on the bank's products and services

- Played a vital role in demonstrating outstanding customer service, resolved customer concerns, and helped build customer loyalty; demonstrated a genuine client-centric service culture that ensured customer satisfaction levels were elevated and maintained

- Skilled in assisting bank customers deposit and withdraw money; resolving discrepancies in accounting processes; identifying and resolving customer needs; ensuring quality services to customers; building customer loyalty; processing and performing daily bank transactions

- Instrumental in developing, maintaining, and demonstrating a basic knowledge of current Bank products & services; maintaining confidentiality when handling customer requests & transactions; maintaining basic knowledge and ensuring compliance with applicable regulatory requirements and internal policies & procedures

- Resourceful at maintaining relationships with clients to achieve quality product and service norms by resolving their service-related critical issues; an enterprising leader with proven dexterity in leading and directing personnel toward the accomplishment of a common goal without compromising on employer-employee relations

Education

Banking and Finance, Bachelor of Science, Completed, January 2000

ABC School

GD University

Rampur, UP

Certifications

Work Experience

Period: February 2003 - Current

Customer Services

CBS Corporations Pvt ltd

- Conducted dozens of bank’s routine transactions within time limits and established guidelines (cash checks, accept deposits and loan payments, process withdrawals, etc.)

- Made sales referrals, suggested alternate channels, and cross-sell products and services

- Counted currency, coins, and checks received, by hand or using the currency-counting machine, in order to prepare them for deposit or shipment to branch banks.

- Assisted customers with processing transactions, such as deposits, withdrawals, or payments, and resolved complaints or account discrepancies.

- Tracked, recorded, reported, and stored information related to transactions, bank supplies, and customers, ensuring all information is accurate and complete.

- Led and managed & monitored the performance of team members to ensure efficiency in banking operations and meeting individual & group targets.

- Created a dynamic environment that fosters development opportunities and motivates high performance among team members.

Period: February 1964 - August 1967

Bank Teller and Customer Service

Zion XXX Ltd

- Maintained and balanced cash drawers and reconciled discrepancies

- Involved in following all bank financial and security regulations and procedures

- Managed customer-centric banking operations, forwarding customer instructions to the concerned department & ensuring customer satisfaction by achieving delivery & service quality norms

- Built & maintained healthy business relations with clients, ensuring high customer satisfaction matrices by achieving delivery & service quality norms.

- Identified & networked with prospective clients, generating business from existing accounts, and achieved profitability and increased sales growth

Skills

Hard Skills

- Cash Drawer Balancing

- Recordkeeping & Documentation

- Customer Confidentiality

- Deposits, Loans, Transfers, Money Orders, and Withdrawals.

- Accounting, Accounts Payable & Accounts Receivable

Soft Skills

- Time Management

- Ability to Multitask

- Adaptability

- Customer Service

Languages

Softwares

Operating System

Personal Interests

- Stand-up comedy

- Baking

- Journaling

- Calligraphy

- Fencing

India's

premier resume service

India's

premier resume service