- Financial Conduct Authority (FCA), Completed , January 2000

What's your job?

Stocks and Securities Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Stock Broker and Securities Resume Guide for India

A well-crafted stock broker and securities resume is essential for success in India’s dynamic financial markets sector. Whether you’re pursuing a career with ICICI Securities, HDFC Securities, Kotak Securities, Zerodha, Angel One, or investment banks like Goldman Sachs, Morgan Stanley, JP Morgan, this guide provides everything you need to create a standout resume.

This comprehensive guide includes:

- Resume format recommendations for securities roles in India

- Key skills employers look for in stock brokers and traders

- Complete resume example with Indian context

- Top securities employers in India

- Salary insights in INR by experience level

- Required qualifications and SEBI certifications

- ATS optimization tips for financial job portals

Why Your Securities Resume Matters in India

India’s stock market has seen tremendous growth with increasing retail participation and institutional investment. With SEBI regulations requiring certified professionals and growing demand for equity research, portfolio management, and trading, skilled securities professionals are in high demand.

A strong securities resume helps you:

- Stand out from competition for broker and analyst positions

- Showcase SEBI certifications and regulatory compliance knowledge

- Demonstrate trading performance and client acquisition skills

- Highlight market analysis and investment expertise

Financial services firms receive numerous applications. Your resume must immediately communicate your certifications, performance metrics, and market expertise.

Securities Resume Format for India

Indian financial employers prefer professional resume formats that highlight certifications, performance, and analytical skills.

Recommended Format

- Length: 1-2 pages

- Layout: Reverse chronological

- Font: Arial, Calibri, or Times New Roman (11-12pt)

- Sections: Contact, Summary, Certifications, Skills, Experience, Education

Personal Details for Indian Securities Resumes

Include:

- Full name

- Phone number with +91 country code

- Professional email address

- City, State

- LinkedIn profile

What to Avoid

- Personal details like religion or marital status

- Unverifiable performance claims

- Confidential client information

- Salary expectations in resume

Key Skills for Securities Professionals in India

Indian employers look for a combination of regulatory knowledge, analytical skills, and sales capabilities.

Technical Skills

- Equity Research: Fundamental and technical analysis

- Trading: Order execution, market making

- Portfolio Management: Asset allocation, rebalancing

- Risk Management: VaR, hedging strategies

- Financial Modeling: DCF, comparable analysis

- Derivatives: Options, futures trading

Regulatory Knowledge

- SEBI Regulations: Securities laws and compliance

- NSE/BSE Rules: Exchange regulations

- AMFI Guidelines: Mutual fund regulations

- Depository Rules: NSDL/CDSL procedures

- KYC/AML: Client onboarding compliance

- Margin Requirements: Trading margin rules

Software & Tools

- Trading Platforms: NSE NOW, BSE BOLTplus, broker terminals

- Bloomberg/Reuters: Market data terminals

- Excel: Financial modeling and analysis

- Technical Analysis: TradingView, MetaStock

- CRM Systems: Client management

- Back Office: Order management systems

Sales & Client Management

- Client Acquisition: Building client base

- Relationship Management: HNI and retail clients

- Investment Advisory: Personalized recommendations

- Portfolio Reporting: Performance communication

- Cross-selling: Multiple product distribution

Securities Resume Example for India

Here’s a complete resume example tailored for Indian financial employers:

Rahul Kapoor

Mumbai, Maharashtra | +91-98XXX-XXXXX | rahul.kapoor.equity@email.com | linkedin.com/in/rahulkapoor-securities

Professional Summary

SEBI Registered Investment Adviser with 7+ years of experience in equity broking, research, and portfolio advisory. Currently working as Vice President at ICICI Securities, managing ₹500+ Cr AUM with 200+ HNI clients. NISM certified with expertise in equity research, derivatives trading, and wealth management. Consistently achieved 120%+ of revenue targets with 85% client retention rate. CFA Level 3 candidate with strong fundamental and technical analysis skills.

Certifications

- SEBI Registered Investment Adviser (RIA) | SEBI | 2020

- NISM Series V-A (Mutual Fund Distributors) | NISM | 2017

- NISM Series VIII (Equity Derivatives) | NISM | 2018

- NISM Series XV (Research Analyst) | NISM | 2019

- CFA Level 3 Candidate | CFA Institute | Expected 2025

- AMFI Registered Mutual Fund Distributor | AMFI | 2017

Key Skills

Equity Research | Portfolio Advisory | Derivatives Trading | Client Relationship Management | Wealth Management | Technical Analysis | Fundamental Analysis | Financial Modeling | Risk Management | SEBI Compliance | Bloomberg Terminal | Trading Platforms | HNI Management | Revenue Generation

Professional Experience

Vice President - Equity Advisory | ICICI Securities | Mumbai | April 2021 – Present

- Manage portfolio advisory for 200+ HNI clients with AUM of ₹500+ Cr

- Achieve 125% of annual revenue target (₹8 Cr) consistently

- Provide equity research and investment recommendations

- Maintain 85% client retention rate with high satisfaction scores

- Lead team of 5 relationship managers

- Generate ₹50 Lakhs+ monthly brokerage revenue

- Conduct client seminars and investment workshops

- Ensure 100% compliance with SEBI and exchange regulations

Senior Relationship Manager | HDFC Securities | Mumbai | June 2018 – March 2021

- Managed 150+ HNI clients with combined AUM of ₹200 Cr

- Achieved 115% of revenue targets for 3 consecutive years

- Provided personalized equity and derivatives advisory

- Cross-sold mutual funds, PMS, and insurance products

- Built client base from 50 to 150 clients

- Received “Top Performer” award for FY 2019-20

Equity Dealer | Kotak Securities | Mumbai | January 2016 – May 2018

- Executed buy/sell orders for retail and HNI clients

- Processed 500+ trades daily with zero errors

- Provided market updates and trading ideas to clients

- Achieved monthly brokerage targets consistently

- Learned technical analysis and trading strategies

Trainee Analyst | Sharekhan | Mumbai | July 2015 – December 2015

- Completed equity research training program

- Assisted senior analysts in company research

- Prepared equity research reports

- Learned fundamental and technical analysis

Education

MBA (Finance) | Narsee Monjee Institute of Management Studies (NMIMS) | Mumbai | 2015

B.Com (Honours) | Shri Ram College of Commerce (SRCC) | Delhi | 2013

- First Class with Distinction

Key Achievements

- ₹500+ Cr AUM under management

- 125% revenue target achievement (FY 2023-24)

- 85% client retention rate

- “Top Performer” award - HDFC Securities (FY 2019-20)

- Built client base from 50 to 200+ HNIs

Languages

Hindi (Native) | English (Fluent) | Marathi (Conversational)

Top Securities Employers in India

India’s securities industry offers diverse opportunities across broking, research, and investment banking.

Full-Service Brokers

- ICICI Securities: Largest retail broker

- HDFC Securities: Full-service broking

- Kotak Securities: Integrated securities

- Axis Securities: Bank-backed broker

- SBI Securities: Public sector broker

- Motilal Oswal: Research-driven broker

Discount Brokers

- Zerodha: Largest discount broker

- Angel One (Angel Broking): Tech-enabled broker

- Upstox: Digital trading platform

- 5Paisa: Discount broking

- Groww: Investment platform

Investment Banks (India Operations)

- Goldman Sachs: Equity research and trading

- Morgan Stanley: Investment banking

- JP Morgan: Securities services

- Credit Suisse: Wealth management

- BofA Securities: Research and trading

- Citi: Institutional securities

Asset Management Companies

- HDFC AMC: Largest mutual fund

- ICICI Prudential AMC: Equity and debt funds

- SBI Mutual Fund: Public sector AMC

- Nippon India: Foreign AMC

- Kotak AMC: Diversified funds

Wealth Management

- IIFL Wealth: HNI wealth management

- Edelweiss Wealth: Private wealth

- JM Financial: Wealth services

- Avendus Wealth: Ultra HNI focus

- Sanctum Wealth: Family office services

How to Apply

- Company career portals

- Naukri.com with “equity research,” “stock broker,” “investment adviser” keywords

- LinkedIn job postings

- Campus placements (MBA/B-schools)

- Referrals and networking

Securities Salary in India

Salaries vary based on role, employer type, and performance.

Salary by Experience Level

| Experience | Annual Salary (INR) |

|---|---|

| Trainee/Associate (0-2 years) | ₹4 - ₹8 LPA |

| Analyst/RM (2-5 years) | ₹8 - ₹18 LPA |

| Senior RM/AVP (5-8 years) | ₹18 - ₹35 LPA |

| VP/Director (8-12 years) | ₹35 - ₹60 LPA |

| Senior VP/MD (12+ years) | ₹60 - ₹1.5 Cr+ |

Note: Investment banks and top-tier firms pay at higher end.

Salary by Employer Type

| Employer Type | Salary Range (Experienced) |

|---|---|

| Investment Banks (GS, MS) | ₹25 - ₹80+ LPA |

| Full-Service Brokers | ₹12 - ₹35 LPA |

| Discount Brokers | ₹10 - ₹25 LPA |

| AMCs | ₹15 - ₹40 LPA |

| Wealth Management | ₹15 - ₹50 LPA |

Additional Benefits

- Incentives: Performance-based (30-100% of fixed)

- Brokerage Sharing: For sales roles

- Stock Options: At larger firms

- Annual Bonus: Based on P&L contribution

- Medical Insurance: Family coverage

Qualifications for Securities Jobs in India

Educational Requirements

Entry Level:

- Graduate in any discipline

- NISM certifications mandatory

- CFA/CA preferred for research roles

Experienced Roles:

- MBA (Finance) preferred

- CFA Charter highly valued

- 3-5 years relevant experience

Mandatory NISM Certifications

- NISM Series V-A: Mutual Fund Distributors

- NISM Series VIII: Equity Derivatives

- NISM Series XV: Research Analyst

- NISM Series XXI-A: Portfolio Managers

SEBI Registrations

- Investment Adviser (RIA): For advisory services

- Research Analyst (RA): For publishing research

- Stock Broker: Through broker membership

- Portfolio Manager: For PMS services

Valuable Additional Certifications

- CFA (Chartered Financial Analyst): Global standard

- CA (Chartered Accountant): Financial expertise

- FRM (Financial Risk Manager): Risk focus

- CMT (Chartered Market Technician): Technical analysis

ATS Tips for Your Securities Resume

Financial services firms use ATS for screening:

Keyword Optimization

Include relevant terms like:

- Stock broker, equity research, investment adviser

- NISM certified, SEBI registered

- Portfolio management, wealth management

- Technical analysis, fundamental analysis

- HNI, client acquisition, AUM

- Derivatives, options, futures

- Bloomberg, trading terminal

Formatting Tips

- Use clear section headings

- List certifications with registration numbers

- Include AUM and revenue figures

- Quantify client base and performance

- Save as PDF for format preservation

Final Tips for Your Securities Resume

✅ Lead with certifications - NISM, SEBI registrations prominently displayed

✅ Quantify performance - Revenue, AUM, client numbers

✅ Show client management - HNI experience, retention rates

✅ Include regulatory compliance - SEBI, exchange compliance record

✅ Mention software - Bloomberg, trading platforms

✅ Highlight market knowledge - Sectors, companies analyzed

✅ Add education - MBA, CFA, CA credentials

Quick Checklist

- NISM/SEBI certifications prominently listed

- Contact information with LinkedIn

- Summary highlights AUM and performance

- Skills include both technical and sales

- Experience shows quantified achievements

- Education and certifications listed

- Clean, ATS-friendly format

Ready to create your professional securities resume? Use our resume builder to get started with expert-designed templates.

Looking for more guidance? Check out our resume format guide for additional tips.

Frequently Asked Questions

What is the best resume format for Securities professionals in India?

Use a reverse chronological format with certifications prominently displayed. Include sections for summary, certifications, skills, experience, and education. Keep it to 1-2 pages with specific performance metrics like AUM, revenue, and client numbers.

What NISM certifications are mandatory for securities jobs?

NISM Series V-A (Mutual Fund) for distribution, Series VIII for derivatives trading, and Series XV for research analysts. Specific certifications depend on the role. SEBI RIA registration is required for investment advisory services.

What skills should I highlight on a securities resume?

Highlight equity research, technical/fundamental analysis, client relationship management, trading execution, regulatory compliance (SEBI/exchange), and software proficiency (Bloomberg, trading terminals). Include both analytical and sales skills.

How much do securities professionals earn in India?

Entry-level analysts earn ₹4-8 LPA. Experienced RMs earn ₹12-25 LPA. AVP/VP level earns ₹25-50 LPA. Investment bank roles pay significantly higher (₹30-80+ LPA). Performance incentives can double total compensation.

How important is CFA for securities careers?

CFA is highly valued, especially for equity research, portfolio management, and investment banking roles. While not mandatory, it significantly improves credibility and compensation. Many employers sponsor CFA preparation for promising employees.

Should I include trading performance on my resume?

Yes, if you have verifiable metrics. Include AUM managed, revenue generated, client acquisition numbers, and retention rates. Avoid vague claims. Focus on demonstrable achievements that show your value to potential employers.

What is the difference between full-service and discount brokers?

Full-service brokers (ICICI, HDFC) offer advisory, research, and personalized service with higher commissions. Discount brokers (Zerodha, Angel) focus on low-cost execution with minimal advisory. Career paths differ - advisory roles in full-service, tech/operations in discount.

How do I transition from retail to institutional securities?

Build strong fundamental analysis skills, complete CFA, gain experience in equity research, and network with institutional professionals. Institutional roles require deeper analytical capabilities and different client management skills.

What software skills are required for securities jobs?

Bloomberg Terminal for research roles, trading platforms (NSE NOW, broker terminals) for trading, Excel for financial modeling, and CRM systems for client management. Technical analysis tools like TradingView are valuable for trading roles.

What is the career path in securities?

Typical path: Trainee → Analyst/RM → Senior RM → AVP → VP → SVP/Director → MD. Alternatively, specialize in equity research → Senior Analyst → Research Head, or trading → Prop Desk → Trading Head. Cross-functional moves to wealth management or investment banking are possible.

Stocks and Securities Text-Only Resume Templates and Samples

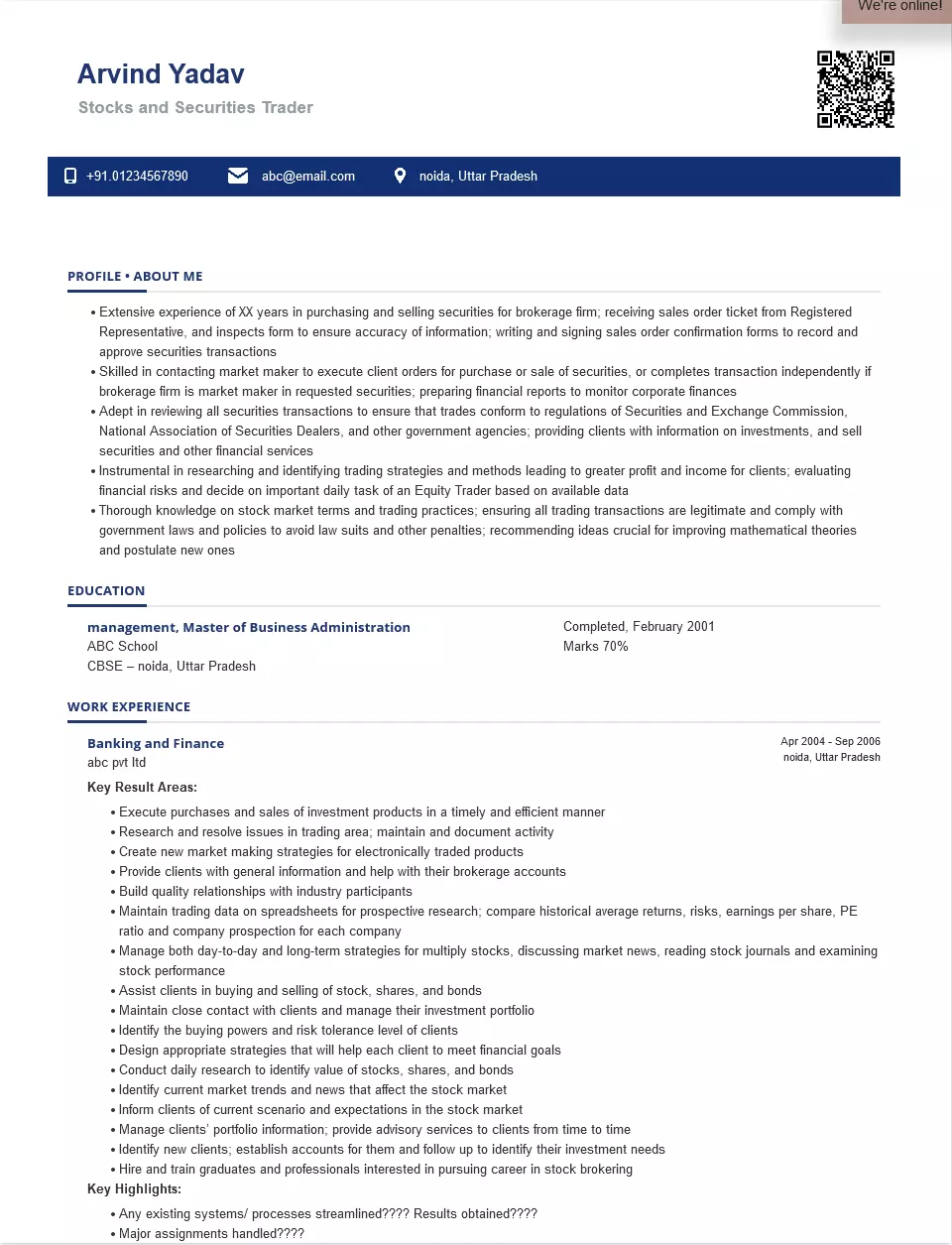

Arvind Yadav

Phone: 01234567890

Email: abc@email.com

Address: Sec-44, Noida, Noida

About Me

Stocks and Securities Trader / Stocks Trader

- Extensive experience of XX years in purchasing and selling securities for brokerage firm; receiving sales order tickets from Registered Representative, and inspecting forms to ensure accuracy of information; writing and signing sales order confirmation forms to record and approve securities transactions

- Skilled in contacting market makers to execute client orders for the purchase or sale of securities, or completing transactions independently if a brokerage firm is a market maker in requested securities; preparing financial reports to monitor corporate finances

- Adept in reviewing all securities transactions to ensure that trades conform to regulations of the Securities and Exchange Commission, National Association of Securities Dealers, and other government agencies; providing clients with information on investments, and selling securities and other financial services

- Instrumental in researching and identifying trading strategies and methods leading to greater profit and income for clients; evaluating financial risks and deciding on important daily tasks of an Equity Trader based on available data

- Thorough knowledge of stock market terms and trading practices; ensuring all trading transactions are legitimate and comply with government laws and policies to avoid lawsuits and other penalties; recommending ideas crucial for improving mathematical theories and postulating new ones

Education

SF School of Business Administration , Master of Business Administration, Completed, February 2001

ABC School

CBSE

Noida, UP

Certifications

Work Experience

Period: April 2004 - Current

Stocks Trader

FYIJ Pvt ltd

- Prepared financial reports to monitor corporate finances.

- researching and identifying trading strategies and methods leading to greater profit and income for clients

- Evaluated financial risks and decided on the important daily tasks of an Equity Trader based on available data

- Ensured all trading transactions are legitimate and complied with government laws and policies to avoid lawsuits and other penalties

- Recommended ideas crucial for improving mathematical theories and postulating new ones.

- Provided clients with information on investments, and selling securities and other financial services.

- Maintained trading data on spreadsheets for prospective research; compare historical average returns, risks, earnings per share, PE ratio, and company prospection for each company.

- Maintained close contact with clients and manage their investment portfolios.

- Created new market-making strategies for electronically traded products.

Period: January 1970 - November 1977

Banking and Finance

Abc Pvt ltd

- Contacted prospective clients to present information and explain available services.

- Offered advice on the purchase or sale of particular securities.

- Monitored financial markets and the performance of individual securities.

- Analyzed company finances to provide recommendations for public offerings, mergers, and acquisitions.

- Managed both day-to-day and long-term strategies for multiple stocks, discussing market news, reading stock journals, and examining stock performance.

- Executed purchases and sales of investment products promptly and efficiently.

- Evaluated cost and revenue of agreements; made bids or offers to buy or sell securities.

- Agreed on buying or selling prices at optimal levels for clients.

- Bought or sold stocks, bonds, commodity futures, foreign currencies, or other securities on behalf of investment dealers.

- Identified opportunities or developed channels for the purchase or sale of securities or commodities.

Skills

- Negotiation

- Organizational skills

- Analytical skills

- Communication Skill

- Problem-Solving

- Time Management

- Ability to work under Pressure

Languages

Softwares

Operating System

Personal Interests

- Creating and organizing a book club

- Networking events

- Local meetups

India's

premier resume service

India's

premier resume service