- Chartered Tax Adviser, Chartered Institute of Taxation- 2016, Completed , January 2016

What's your job?

Tax Preparation and Planning Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Tax Preparation and Planning Resume Guide for India

A well-crafted tax preparation and planning resume is essential for success in India’s growing tax compliance industry. Whether you’re a fresher starting your career in tax filing or an experienced professional seeking positions at CA firms, tax consultancies, or corporate tax departments, this guide provides everything you need to create a standout resume that impresses Indian employers and passes ATS screening on portals like Naukri and LinkedIn.

This comprehensive guide includes:

- Resume format recommendations for Indian tax preparation sector

- Key skills Indian employers look for

- Complete resume example with Indian context

- Top tax preparation employers in India

- Salary insights in INR by experience level

- Certification guidance for tax preparers

- ATS optimization tips for Indian job portals

Why Your Tax Preparation Resume Matters in India

India’s tax compliance sector is expanding rapidly with increased digitalization and mandatory filing requirements. CA firms, tax consultancies, financial services companies, and corporate tax teams actively hire qualified tax preparers. A strong resume helps you:

- Stand out from thousands of commerce graduates and tax professionals on Naukri and LinkedIn

- Pass ATS screening used by CA firms and corporate HR

- Showcase skills that Indian employers value, including ITR filing, GST compliance, and Tally proficiency

- Demonstrate your accuracy and compliance track record

Indian employers typically spend 6-10 seconds reviewing each resume initially. Your tax preparation resume must immediately communicate your filing expertise, software proficiency, and attention to detail. With India’s tax base expanding and compliance requirements increasing, tax preparers are in high demand—a well-optimized resume is essential.

Tax Preparation Resume Format for India

Indian employers prefer clean, professional resume formats. Here’s what works best:

Recommended Format

- Length: 1-2 pages (freshers: 1 page, experienced: 2 pages max)

- Layout: Reverse chronological (most recent first)

- Font: Arial, Calibri, or Times New Roman (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Resume vs Biodata

In India, “biodata” is occasionally used for government positions. For CA firm jobs, consultancy roles, and corporate positions, use a professional resume format.

Personal Details for Indian Tax Preparation Resumes

Indian resumes typically include:

- Full name (professional photo optional)

- Phone number with country code (+91)

- Professional email address

- LinkedIn profile URL

- City, State (full address not required)

What to Avoid

- Decorative fonts or graphics (causes ATS issues)

- Personal information like religion, caste, or father’s name

- Salary expectations (discuss during interview)

- References (provide when requested)

Key Skills for Tax Preparers in India

Indian employers look for a combination of technical tax knowledge and software proficiency.

Income Tax Skills

- ITR Preparation: ITR-1 to ITR-7 for individuals, HUFs, firms, companies

- TDS Compliance: TDS deduction, TDS returns (24Q, 26Q, 27Q), TDS certificates

- TCS Compliance: TCS collection, TCS returns, TCS certificates

- Advance Tax: Quarterly advance tax calculation and payment

- Tax Planning: Legitimate tax savings, deductions (80C, 80D, etc.)

- Tax Computation: Income computation, tax liability calculation

- Form 26AS Reconciliation: TDS credit verification, discrepancy resolution

GST Skills

- GST Return Filing: GSTR-1, GSTR-3B filing for regular taxpayers

- GST Reconciliation: ITC reconciliation, GSTR-2A/2B matching

- E-invoicing: E-invoice generation and compliance

- E-way Bills: E-way bill generation and management

- GST Registration: New registrations, amendments, cancellations

- Quarterly Returns (QRMP): Quarterly filing for small taxpayers

Software & Tools

- Tax Software: ClearTax, Taxmann, Saral TDS, Winman, Genius

- Accounting Software: Tally Prime, Tally ERP 9, Busy Accounting

- Government Portals: Income Tax portal, GST portal, TIN NSDL

- Microsoft Excel: Advanced functions, tax calculations, data management

- ERP Systems: SAP (basic), Oracle Financials (basic)

Soft Skills for Tax Preparers

- Attention to Detail: Accuracy in data entry and calculations

- Time Management: Meeting filing deadlines (quarterly, annual)

- Client Communication: Explaining tax matters to clients

- Organization: Managing multiple client files and deadlines

- Problem-Solving: Resolving filing issues and discrepancies

How to Present Skills

List skills in order of relevance to the job description. Use exact keywords from job postings on Naukri or LinkedIn. For tax preparer roles, prioritize ITR filing, TDS, GST, and tax software skills.

Tax Preparation Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Meena Kumari

Jaipur, Rajasthan | +91-98XXX-XXXXX | meena.kumari@email.com | linkedin.com/in/meenakumari-tax

Professional Summary

Detail-oriented Tax Preparation Specialist with 5+ years of experience in income tax return filing, TDS compliance, and GST filing for individuals and businesses. Expertise in ITR preparation (ITR-1 to ITR-6), TDS return filing, and GST compliance with proven track record of filing 1,000+ returns annually with 99.8% accuracy. Proficient in ClearTax, Tally Prime, and government portals. Experienced in serving 300+ clients including salaried individuals, professionals, and SMEs. Seeking senior tax preparation role at a growing firm.

Key Skills

ITR Preparation (ITR-1 to ITR-7) | TDS Return Filing (24Q, 26Q, 27Q) | TCS Compliance | GST Returns (GSTR-1, GSTR-3B) | Tax Planning (Section 80C, 80D) | Form 26AS Reconciliation | E-invoicing | E-way Bills | ClearTax | Taxmann | Tally Prime | Saral TDS | Income Tax Portal | GST Portal | MS Excel (Advanced)

Professional Experience

Senior Tax Executive | M/s Agarwal & Associates (CA Firm) | Jaipur | April 2021 – Present

- Lead tax preparation team handling 500+ clients including individuals, HUFs, partnerships, and companies

- File 800+ income tax returns annually across ITR-1 to ITR-6 categories with 99.8% accuracy

- Manage TDS compliance for 100+ clients, filing quarterly returns (24Q, 26Q, 27Q) on time

- Handle GST return filing (GSTR-1, GSTR-3B) for 150+ registered businesses

- Perform Form 26AS reconciliation and resolve TDS credit mismatches

- Provide tax planning advice to clients, helping achieve average tax savings of 15%

- Train and supervise team of 4 junior tax assistants on filing procedures and software

- Reduced late filing instances by 95% through improved deadline tracking system

- Received “Excellence in Tax Services” recognition from senior partner

Tax Associate | TaxKraft Consultants Pvt Ltd | Jaipur | June 2019 – March 2021

- Prepared and filed 400+ income tax returns annually for salaried individuals and professionals

- Managed TDS return preparation and filing for 50+ clients

- Handled GST registration, return filing, and ITC reconciliation for SME clients

- Conducted Form 26AS verification and resolved discrepancies with deductors

- Assisted clients with tax refund tracking and follow-up

- Maintained client records and documentation using Tally ERP 9

Junior Tax Assistant | Sharma Tax Services | Jaipur | July 2018 – May 2019

- Assisted in income tax return preparation and data entry

- Compiled tax documents and organized client files

- Generated TDS certificates (Form 16, Form 16A) for clients

- Responded to basic client queries regarding tax filing status

- Learned ClearTax, Tally, and government portal operations

Education

Bachelor of Commerce (B.Com) | University of Rajasthan | 2018

- First Class (72%)

- Specialization: Accounting and Taxation

Higher Secondary Certificate | Rajasthan Board | 2015

- 78% in Commerce stream

Certifications

- GST Practitioner Course | ICAI | 2020

- Income Tax Return Practitioner Certificate | NSDL | 2019

- Tally Prime with GST Certification | Tally Solutions | 2021

- Advanced Excel for Tax Professionals | NIIT | 2020

- Certificate Course on TDS | ICAI | 2022

Technical Proficiencies

- Tax Software: ClearTax, Taxmann, Saral TDS, Genius ITR

- Accounting Software: Tally Prime, Tally ERP 9, Busy Accounting

- Government Portals: Income Tax e-Filing Portal, GST Portal, TRACES, TIN NSDL

- Office Tools: MS Excel (Advanced), MS Word, Google Sheets

Languages

English (Professional) | Hindi (Native) | Rajasthani (Native)

Declaration

I hereby declare that the information provided above is true to the best of my knowledge.

Meena Kumari Jaipur, December 2024

Top Tax Preparation Employers in India

India’s tax preparation sector offers diverse opportunities. Here are the top employers:

CA Firms (High Volume Hiring)

- Large CA Firms: Multi-partner firms with 500+ clients need tax preparers

- Mid-Size CA Practices: Firms with 100-500 clients

- Small CA Offices: Sole practitioners with diverse clientele

- Specialized Tax Firms: Focused on tax compliance and advisory

Tax Consultancies & Fintech

- ClearTax: Leading tax e-filing platform

- H&R Block India: International tax preparation firm

- Tax2Win: Online tax filing services

- Quicko: Tax filing and ITR services

- myITreturn: Online tax preparation

Financial Services Companies

- HDFC Securities: Investment and tax services

- ICICI Securities: Financial planning including tax

- Kotak Securities: Wealth and tax services

- Axis Direct: Investment with tax planning

Corporate Tax Departments

- Large Corporates: In-house tax compliance teams

- MNC Subsidiaries: Shared services tax operations

- BPO/F&A Outsourcing: Tax processing services

- Banks & NBFCs: Employee tax management

Government & Public Sector

- Income Tax Department: Tax processing centers

- State Tax Departments: GST seva kendras

- Public Sector Companies: In-house tax teams

How to Apply

- Apply through Naukri.com and Indeed India

- Register with local CA firms directly

- Apply to fintech tax platforms online

- Network through commerce college alumni

- Check local newspaper classifieds

Tax Preparation Salary in India

Salaries vary based on experience, location, firm size, and expertise level.

Salary by Experience Level

| Experience | CA Firms (INR) | Corporate/Fintech (INR) |

|---|---|---|

| Fresher (0-1 years) | ₹1.8 - ₹3 LPA | ₹2.5 - ₹4 LPA |

| Early Career (2-4 years) | ₹3 - ₹5 LPA | ₹4 - ₹7 LPA |

| Mid-Career (5-8 years) | ₹5 - ₹8 LPA | ₹7 - ₹12 LPA |

| Senior (8+ years) | ₹8 - ₹14 LPA | ₹12 - ₹18 LPA |

Note: Bonuses during filing season (January-July) can add 10-20% to annual income.

Salary by City

| City | Salary Range (Mid-Level) |

|---|---|

| Mumbai | ₹5 - ₹10 LPA |

| Delhi NCR | ₹4.5 - ₹9 LPA |

| Bangalore | ₹4.5 - ₹9 LPA |

| Pune | ₹4 - ₹8 LPA |

| Hyderabad | ₹4 - ₹8 LPA |

| Jaipur/Ahmedabad | ₹3 - ₹6 LPA |

| Tier-2 Cities | ₹2.5 - ₹5 LPA |

Factors Affecting Salary

- Volume Expertise: High-volume filing experience valued

- Software Proficiency: ClearTax, Tally certified professionals earn more

- Client Base: Experience with diverse client types adds value

- Accuracy Record: Zero-error track record commands premium

- GST Expertise: Combined ITR and GST skills pay higher

- CA Background: CA Inter/Foundation adds 20-30% premium

Salary data based on Glassdoor India, AmbitionBox, and local market surveys.

Certifications for Tax Preparers in India

Professional certifications enhance your profile and demonstrate expertise.

ICAI Certifications (Highly Valued)

- GST Practitioner Course: Comprehensive GST compliance training

- Certificate Course on TDS: TDS provisions and compliance

- Certificate Course on Income Tax: Direct tax fundamentals

NSDL/CDSL Certifications

- Income Tax Return Practitioner: ITR filing certification

- TDS Return Preparer: TDS compliance certification

- e-TDS/TCS Return Preparer: Electronic filing certification

Software Certifications

- Tally Prime with GST: Official Tally certification

- ClearTax Certified: Platform-specific certification

- Saral TDS Certification: TDS software proficiency

- Advanced Excel: Data analysis and tax calculations

Professional Qualifications

- CA Intermediate / CA Foundation: ICAI pathway

- CMA Foundation: Cost accounting fundamentals

- B.Com with Taxation: Academic foundation

- Diploma in Taxation: Various universities

How to List Certifications

Include certification name, issuing organization, and year obtained. GST and ITR-related certifications should be prominently displayed.

ATS Tips for Your Tax Preparation Resume

Most employers use Applicant Tracking Systems (ATS) to screen resumes. Optimize yours:

For Naukri.com

- Use keywords from job descriptions (ITR filing, TDS, GST, ClearTax)

- Keep formatting simple (no tables, columns, or graphics)

- Use standard section headings (Experience, Education, Skills)

- Upload in .docx or .pdf format

- Update your Naukri profile regularly

For Indeed India

- Match job titles to standard terms (Tax Executive, Tax Preparer)

- Include location preferences clearly

- Add skills as separate tags in your profile

General ATS Tips

- DO: Use standard fonts, clear headings, bullet points

- DO: Include metrics (filed 800+ returns, 99.8% accuracy)

- DO: Mention software names explicitly (ClearTax, Tally Prime)

- DON’T: Use headers/footers, text boxes, or images

- DON’T: Use creative section titles

Keyword Strategy for Tax Preparation Roles

Common keywords from job postings:

- Tax Preparer, Tax Executive, Tax Associate, ITR Filing

- Income Tax Return, ITR-1, ITR-2, ITR-3, ITR-4

- TDS, TCS, Form 24Q, Form 26Q, Form 16

- GST, GSTR-1, GSTR-3B, GST Registration

- ClearTax, Tally, Taxmann, Saral TDS

- Form 26AS, Tax Computation, Tax Planning

Final Tips for Your Tax Preparation Resume

✅ Highlight filing volume—quantify returns filed (800+ annually)

✅ Show accuracy record—99.8% accuracy, zero late filings impress employers

✅ List software proficiency—ClearTax, Tally, government portals

✅ Include client diversity—individuals, HUFs, firms, companies

✅ Mention deadline management—on-time filing track record

✅ Show GST expertise—combined ITR and GST skills are valuable

✅ Proofread carefully—errors suggest lack of attention to detail

Quick Checklist

- Contact information with +91 phone number

- Professional summary with filing volume and accuracy

- Skills section with ITR, TDS, GST, and software keywords

- Experience showing client count, filing volume, and achievements

- Education with B.Com or relevant degree

- Certifications (GST Practitioner, Tally, ClearTax)

- Technical proficiencies section

- Languages (English and regional)

- ATS-friendly formatting

- Declaration statement

Ready to create your professional tax preparation resume? Use our resume builder to get started with expert-designed templates optimized for Indian job portals.

For more guidance on resume structure, check out our resume format guide with tips specifically for the Indian tax and finance job market.

Frequently Asked Questions

What are the must-have sections in a tax preparation resume?

Include contact information, a clear professional summary, work experience, a skills section (technical and soft skills), education, and relevant certifications like CPA or tax credentials. Highlight measurable achievements and results.

How do I write a strong professional summary for a tax planning role?

Keep it concise: mention your years of tax experience, your expertise in tax compliance or planning, key software tools (e.g., QuickBooks, TurboTax, Excel), and a notable achievement (like improving accuracy or optimizing client tax savings).

What skills are most important to list on a tax preparer resume?

List both technical skills (tax law knowledge, IRS compliance, tax software proficiency, financial analysis) and soft skills (attention to detail, communication, client service, problem-solving). Employers look for a mix of both.

Should I include certifications on a tax planning resume?

Yes — certifications like CPA (Certified Public Accountant), EA (Enrolled Agent), or tax preparation certificates add authority to your resume and signal professional credibility to employers.

How do I show tax planning experience if I'm new to the field?

If you're early in your career, emphasize relevant coursework, internships, training programs, or volunteer tax preparation experience. Include software tools you've used and specific tax tasks you handled.

What achievements should I highlight on my resume?

Where possible, quantify results — for example, reduced client tax liability by 10% or processed 200+ individual returns during tax season with 99% accuracy. Measurable outcomes make your resume stronger.

How long should a tax preparation resume be?

For most professionals, one page is ideal if you're earlier in your career. If you have extensive experience or multiple certifications, two pages are acceptable, as long as every entry adds value.

Do I need to tailor my resume for every job application?

Yes — customize your resume to match the job description by including relevant keywords (like tax compliance, tax planning, audit support, corporate tax, individual returns). This helps both recruiters and applicant tracking systems.

What software tools should I list on a tax preparer resume?

Mention tax and accounting software you're proficient in, such as TurboTax, Lacerte, ProConnect, QuickBooks, Excel, and any IRS e-filing systems. Software skills are often key screening criteria.

What are common mistakes to avoid on a tax planning resume?

Avoid vague language like "handled tax tasks," cluttered formatting, and lack of specifics. Don't skip measurable achievements or relevant keywords — these make it harder for recruiters and ATS to see your value.

Tax Preparation and Planning Text-Only Resume Templates and Samples

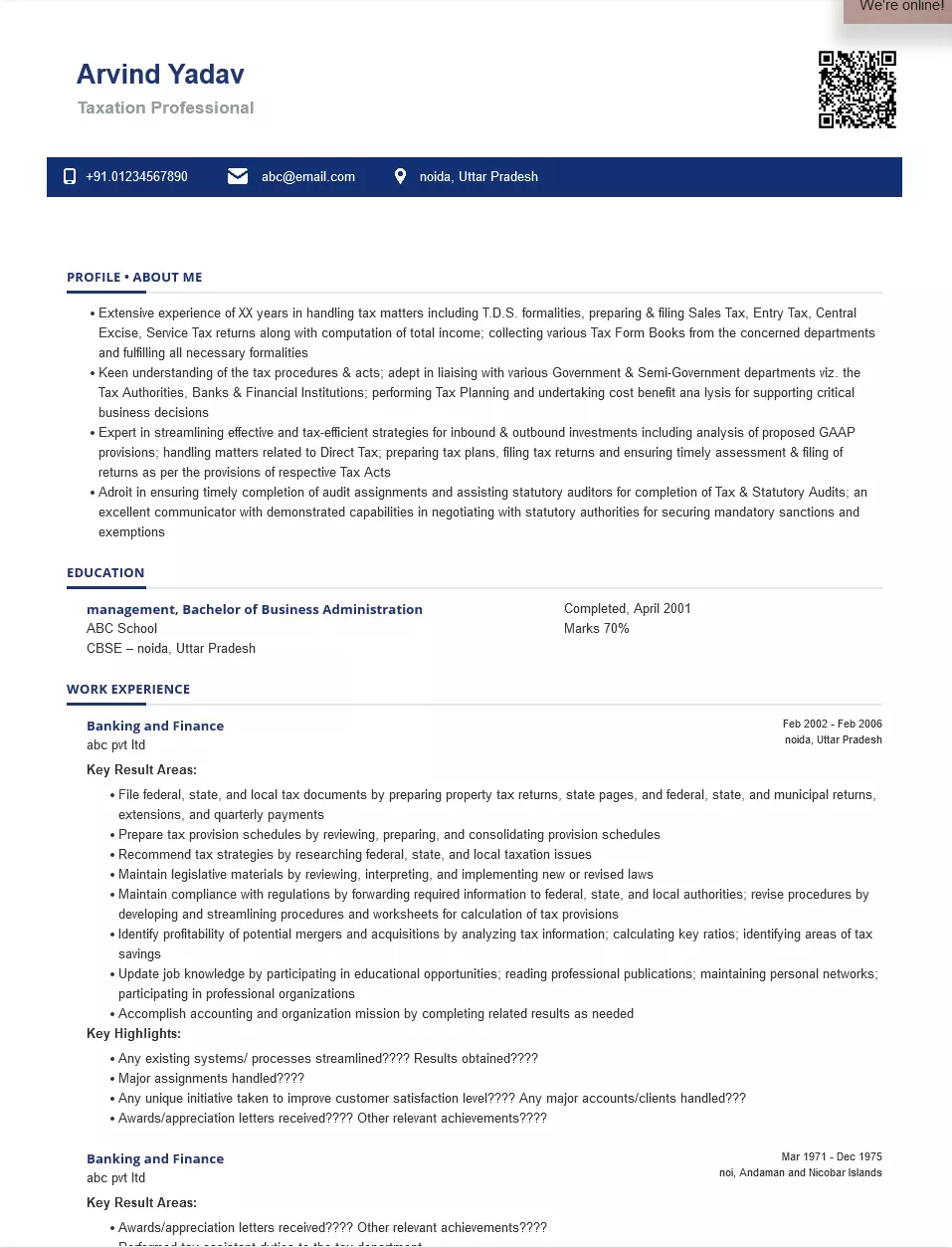

Arvind Yadav

Phone: 01234567890

Email: abc@email.com

Address: Sec-44, Noida, Noida

About Me

Taxation Professional

- Extensive experience of XX years in handling tax matters including T.D.S. formalities, preparing & filing Sales Tax, Entry Tax, Central Excise, and Service Tax returns along with computation of total income; collecting various Tax Form Books from the concerned departments and fulfilling all necessary formalities

- Keen understanding of the tax procedures & acts; adept in liaising with various Government & Semi-Government departments viz. the Tax Authorities, Banks & Financial Institutions; performing Tax Planning and undertaking cost-benefit analysis for supporting critical business decisions

- Expert in streamlining effective and tax-efficient strategies for inbound & outbound investments including analysis of proposed GAAP provisions; handling matters related to Direct Tax; preparing tax plans, filing tax returns, and ensuring timely assessment & filing of returns as per the provisions of respective Tax Acts

- Adroit in ensuring timely completion of audit assignments and assisting statutory auditors for completion of Tax & Statutory Audits; an excellent communicator with demonstrated capabilities in negotiating with statutory authorities for securing mandatory sanctions and exemptions

Education

Accounting and Science in Taxation, Bachelor of Commerce, Completed, April 2001

ABC School

University of Middle East

Noida, UP

Accountancy, Master of Commerce, Completed, January 2014

Abc School

University of Middle East – Marks null

New Delhi,

Certifications

Work Experience

Period: February 2002 - Current

Tax Manager

Abc Pvt Ltd

- Handled matters related to Direct Tax, filled tax returns, and ensured timely assessment & filing of returns as per the provisions of respective Tax Acts.

- Demonstrated capabilities in negotiating with statutory authorities for securing mandatory sanctions and exemptions.

- Filed federal, state, and local tax documents by preparing property tax returns, state pages, and federal, state, and municipal returns, extensions, and quarterly payments.

- Prepared tax provision schedules by reviewing, preparing, and consolidating provision schedules.

- Recommended tax strategies by researching federal, state, and local taxation issues.

- Maintained legislative materials by reviewing, interpreting, and implementing new or revised laws.

- Identified profitability of potential mergers and acquisitions by analyzing tax information. calculated key ratios and identified areas of tax savings.

Period: March 1971 - December 2001

Tax Accountant

UUF Pvt Ltd

- Performed tax assistant duties to the tax department.

- Assisted tax professionals and tax consultants in handling taxation matters.

- Answered and responded to clients’ inquiries on their tax problems.

- Maintained compliance with regulations by forwarding required information to federal, state, and local authorities; revise procedures by developing and streamlining procedures and worksheets for the calculation of tax provisions.

- Scheduled and organized tax works and assignments for tax professionals and practitioners.

- Assisted and supported tax practitioners and professionals in filing tax returns on time.

- Organized and managed all tax reports, statements, and documents relating to clients.

- Assisted and supported an administrative staff of the tax department.

- Assisted and supported the audit team in their tasks of tax audits.

- Maintained strict client confidentiality relating to their tax matters.

- Accomplish accounting and organization mission by completing related results as needed

- Adhered to tax professional standards and ethics in tax assistant functions.

Skills

Hard Skills

- Financial statements

- Payroll taxes

- Corporate tax law

- Tax returns

- Mathematics

Soft Skills

- Attention to detail

- Analytical skills

- Problem-solving

- Time management

- Collaboration

- Teamwork

Languages

Softwares

Operating System

Personal Interests

- Volunteering at a charity center

- Design

- Blog writing

- Painting

India's

premier resume service

India's

premier resume service