- Certified Branch Manager, Completed , January 2012

What's your job?

Bank Manager Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Bank Manager Resume Guide for India

A well-crafted Bank Manager resume is essential for success in India’s competitive banking sector. Whether you’re a fresher from IBPS PO or an experienced professional seeking positions at SBI, HDFC Bank, ICICI Bank, or other leading institutions, this guide provides everything you need to create a standout resume that impresses Indian banking recruiters and passes ATS screening on portals like Naukri and LinkedIn.

This comprehensive guide includes:

- Resume format recommendations for Indian banking sector

- Key skills Indian banking employers look for

- Complete resume example with Indian context

- Top bank manager employers in India

- Salary insights in INR by experience level

- CAIIB, banking certification guidance

- ATS optimization tips for Indian job portals

Why Your Bank Manager Resume Matters in India

India’s banking sector is one of the largest employers, with Public Sector Banks (PSBs) like SBI, PNB, Bank of Baroda, and Private Banks like HDFC Bank, ICICI Bank, Axis Bank actively hiring bank managers. A strong resume helps you:

- Stand out from thousands of banking professionals on Naukri and LinkedIn

- Pass ATS screening used by private banks and recruitment agencies

- Showcase skills that Indian banking employers value, including branch operations, NPA management, and regulatory compliance

- Demonstrate your leadership capabilities and banking certifications (CAIIB, DBF)

Indian banking recruiters typically spend 6-10 seconds reviewing each resume initially. Your Bank Manager resume must immediately communicate your banking experience, branch management expertise, and business development achievements. With India’s banking sector growing rapidly, a well-optimized resume is essential.

Bank Manager Resume Format for India

Indian employers prefer clean, professional resume formats. Here’s what works best:

Recommended Format

- Length: 1-2 pages (freshers: 1 page, experienced: 2 pages max)

- Layout: Reverse chronological (most recent first)

- Font: Arial, Calibri, or Times New Roman (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Resume vs Biodata

In India, use a professional resume format for private bank positions. “Biodata” format may be used for PSU bank internal promotions and government documentation.

Personal Details for Indian Banking Resumes

Indian resumes typically include:

- Full name with banking credentials (CAIIB, DBF)

- Phone number with country code (+91)

- Professional email address

- LinkedIn profile URL

- City, State (full address not required)

What to Avoid

- Decorative fonts or graphics (causes ATS issues)

- Personal information like religion, caste, or father’s name

- Salary expectations (discuss during interview)

- References (provide when requested)

Key Skills for Bank Managers in India

Indian banking employers look for comprehensive branch management expertise covering operations, business development, and compliance.

Branch Operations

- Branch Management: Daily operations, staffing, customer service

- Cash Management: Vault operations, cash handling, remittances

- Customer Service: Service delivery, complaint resolution, TAT management

- Operations Control: KYC compliance, audit closure, process adherence

- Technology: CBS (Core Banking Solution), Internet Banking, Mobile Banking

Business Development

- Deposit Mobilization: CASA, term deposits, recurring deposits

- Advances Portfolio: Retail lending, MSME loans, agricultural credit

- Cross-Selling: Insurance (bancassurance), mutual funds, third-party products

- Customer Acquisition: New accounts, relationship management

- Target Achievement: Business targets, fee income, CASA ratio

Credit & Risk Management

- Credit Appraisal: Loan processing, credit assessment, documentation

- NPA Management: Recovery, restructuring, SARFAESI, write-offs

- Risk Assessment: Credit risk, operational risk, compliance risk

- Portfolio Management: Monitoring, review, early warning signals

Regulatory Compliance

- RBI Guidelines: Regulatory compliance, reporting requirements

- KYC/AML: Know Your Customer, Anti-Money Laundering compliance

- Audit Management: Internal audit, RBI inspection, concurrent audit

- Documentation: Legal documentation, security perfection

Soft Skills for Indian Banking

- Leadership: Team management, motivation, performance management

- Communication: Customer interaction, stakeholder management

- Problem-Solving: Issue resolution, decision making

- Business Acumen: Market awareness, competition analysis

How to Present Skills

Create a dedicated skills section. Group by category (Operations, Business Development, Credit). Highlight banking certifications prominently.

Bank Manager Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Rajesh Kumar Sharma, CAIIB

Lucknow, Uttar Pradesh | +91-98XXX-XXXXX | rajesh.sharma.banker@email.com | linkedin.com/in/rajeshsharma-bankmanager

Bank Manager | 15 Years Banking Experience | CAIIB Certified

Professional Summary

Results-driven Bank Manager with 15+ years of experience in branch management, business development, and credit operations in India’s banking sector. Expertise in deposit mobilization, advances portfolio management, and NPA recovery with proven track record of achieving 125% of business targets and managing branch with ₹500 Cr+ business portfolio. Strong background in both retail and MSME banking with extensive experience in PSU and private banking. CAIIB certified banker with demonstrated leadership in team management and customer service excellence. Seeking to contribute banking expertise to a progressive financial institution.

Skills

Branch Operations: Branch Management, Cash Management, Customer Service, Operations Control, CBS Operations Business Development: Deposit Mobilization, CASA Growth, Advances Portfolio, Cross-Selling, Target Achievement Credit Management: Credit Appraisal, NPA Management, Recovery, SARFAESI, Loan Documentation Compliance: RBI Guidelines, KYC/AML, Audit Management, Regulatory Reporting Technology: Core Banking (Finacle, BaNCS), Internet Banking, Mobile Banking, CRM Systems

Professional Experience

Chief Manager - Branch Head | State Bank of India | Lucknow | April 2019 – Present

- Head branch with ₹500 Cr+ business portfolio (₹300 Cr deposits, ₹200 Cr advances)

- Lead team of 25 staff members ensuring smooth branch operations

- Achieved 125% of business targets consistently for 4 consecutive years

- Mobilized ₹50 Cr+ in CASA deposits through aggressive customer acquisition

- Reduced branch NPA from 8% to 3.5% through focused recovery efforts

- Implemented digital banking initiatives increasing customer adoption by 40%

- Received “Best Branch” award for region in FY 2022-23

- Maintain 100% KYC compliance and zero critical audit observations

Manager - Advances | State Bank of India | Kanpur | June 2015 – March 2019

- Managed credit portfolio of ₹150 Cr covering retail, MSME, and agriculture

- Processed and sanctioned loans with 98% quality disbursement

- Conducted credit appraisal and due diligence for loan proposals

- Achieved 115% of advances target through proactive business development

- Mentored team of 5 officers in credit appraisal and documentation

- Reduced loan turnaround time from 15 days to 7 days

Assistant Manager - Branch Operations | State Bank of India | Varanasi | July 2011 – May 2015

- Managed branch operations including customer service and cash management

- Handled customer complaints and ensured service delivery standards

- Processed account opening, KYC updates, and service requests

- Supported branch manager in business development activities

- Maintained compliance with operational guidelines

Probationary Officer | State Bank of India | Various Branches | August 2009 – June 2011

- Completed rotational training across banking departments

- Gained exposure to deposits, advances, forex, and treasury operations

- Passed JAIIB and CAIIB examinations during probation period

Key Achievements

Business Excellence | SBI Lucknow | 2022

- Achieved highest CASA mobilization in region

- Acquired 5000+ new savings accounts through campaigns

- Result: “Star Performer” recognition, branch ranked #1 in circle

NPA Recovery Campaign | SBI Lucknow | 2021

- Led focused NPA recovery drive using SARFAESI and OTS

- Recovered ₹15 Cr from NPAs through systematic follow-up

- Result: Reduced branch NPA ratio by 4.5 percentage points

Digital Banking Initiative | SBI Kanpur | 2018

- Promoted YONO app adoption among branch customers

- Conducted customer education programs on digital banking

- Result: 40% increase in digital transactions, reduced counter footfall

Education

Master of Business Administration (MBA) | IGNOU | 2014

- Specialization: Banking and Finance

- First Class

Bachelor of Commerce (B.Com) | Lucknow University | 2008

- First Class with Distinction (72%)

- Specialization: Accounting

Higher Secondary Certificate | UP Board | 2005

- 78% in Commerce stream

Certifications

- Certified Associate of Indian Institute of Bankers (CAIIB) | IIBF | 2012

- Junior Associate of Indian Institute of Bankers (JAIIB) | IIBF | 2010

- Diploma in Banking & Finance (DBF) | IIBF | 2013

- Certificate in Risk Management | IIBF | 2018

- AMFI Certification (Mutual Funds) | AMFI | 2016

- IRDA Certification (Insurance) | IRDA | 2015

Professional Memberships

- Member, Indian Institute of Banking and Finance (IIBF)

- Member, All India Bank Officers’ Confederation (AIBOC)

Awards & Recognition

- Star Performer Award | SBI Circle Office | 2022

- Best Branch Award | SBI Regional Office | 2021

- Excellence in Recovery | SBI Zonal Office | 2020

Languages

English (Fluent) | Hindi (Native) | Basic Urdu

Declaration

I hereby declare that the information provided above is true to the best of my knowledge.

Rajesh Kumar Sharma Lucknow, December 2024

Top Bank Manager Employers in India

India’s banking sector offers diverse opportunities. Here are the top employers:

Public Sector Banks (PSBs)

- State Bank of India (SBI): India’s largest bank

- Punjab National Bank (PNB): Major PSU bank

- Bank of Baroda: International presence

- Canara Bank: Strong South India presence

- Union Bank of India: Pan-India network

- Bank of India: Established PSU bank

Private Sector Banks

- HDFC Bank: India’s largest private bank

- ICICI Bank: Leading private bank

- Axis Bank: Growing private bank

- Kotak Mahindra Bank: Premium banking

- IndusInd Bank: Corporate and retail banking

- Yes Bank: Revitalized private bank

Small Finance Banks

- AU Small Finance Bank: Strong retail presence

- Equitas Small Finance Bank: Growing network

- Ujjivan Small Finance Bank: Microfinance focus

- Jana Small Finance Bank: Financial inclusion

Regional Rural Banks (RRBs)

- Various State RRBs: Rural banking focus

- Gramin Banks: Agricultural lending

Foreign Banks

- Citibank: Corporate banking

- Standard Chartered: Retail and corporate

- HSBC: Premium banking

- Deutsche Bank: Corporate focus

How to Apply

- IBPS PO/SO recruitment for PSU banks

- Direct recruitment through bank career portals

- Apply through Naukri.com and LinkedIn

- Internal promotions through departmental exams

- Campus placements from business schools

Bank Manager Salary in India

Banking offers competitive salaries with good benefits. Salaries vary based on bank type, experience, and location.

Salary by Experience Level

| Experience | PSU Banks (INR) | Private Banks (INR) |

|---|---|---|

| PO/Officer (0-3 years) | ₹6 - ₹9 LPA | ₹5 - ₹10 LPA |

| Manager (4-8 years) | ₹9 - ₹14 LPA | ₹10 - ₹18 LPA |

| Senior Manager (8-15 years) | ₹14 - ₹22 LPA | ₹18 - ₹30 LPA |

| Chief Manager (15-20 years) | ₹22 - ₹32 LPA | ₹30 - ₹45 LPA |

| AGM/DGM (20+ years) | ₹32 - ₹50 LPA | ₹45 - ₹80 LPA |

Note: PSU banks offer additional benefits like pension, housing, medical, and LFC. Private banks offer higher variable pay and bonuses.

Salary by City

| City | Salary Range (Manager Level) |

|---|---|

| Mumbai | ₹12 - ₹20 LPA |

| Delhi NCR | ₹11 - ₹18 LPA |

| Bangalore | ₹11 - ₹18 LPA |

| Chennai | ₹10 - ₹16 LPA |

| Hyderabad | ₹10 - ₹16 LPA |

| Kolkata | ₹9 - ₹15 LPA |

Factors Affecting Salary

- Bank Type: Private banks pay higher cash, PSU banks offer benefits

- Certification: CAIIB holders get additional increments

- Performance: Incentives based on target achievement

- Location: Metro branches pay more

- Specialization: Credit, forex, treasury roles command premium

Salary data based on Glassdoor India, AmbitionBox, and industry surveys.

Certifications for Bank Managers in India

Professional certifications are highly valued in Indian banking.

IIBF Certifications (Essential)

- JAIIB (Junior Associate): Foundation banking certification

- CAIIB (Certified Associate): Advanced banking certification, promotion linked

- DBF (Diploma in Banking & Finance): Comprehensive diploma

Regulatory Certifications

- AMFI Certification: Required for mutual fund selling

- IRDA Certification: Required for insurance selling

- NISM Certifications: Securities market certifications

Specialized Certifications

- Credit Management: IIBF certification

- Risk Management: CRM certification

- Treasury Management: IIBF certification

- IT in Banking: Technology certifications

- AML/KYC Certification: Compliance certification

Professional Development

- MBA in Banking/Finance: Career advancement

- Certified Financial Planner (CFP): Wealth management

- PG Diploma in Banking: Academic qualification

How to List Certifications

Include CAIIB/JAIIB after your name. List all IIBF certifications prominently as they affect promotions and career progression.

ATS Tips for Your Bank Manager Resume

Most private banks and recruitment agencies use Applicant Tracking Systems (ATS) to screen resumes. Optimize yours:

For Naukri.com

- Use keywords from job descriptions (branch manager, CASA, advances, NPA)

- Keep formatting simple (no tables, columns, or graphics)

- Use standard section headings (Experience, Education, Skills)

- Upload in .docx or .pdf format

- Update profile every 15 days

For LinkedIn Applications

- Match resume to LinkedIn profile

- Use standard job titles (Branch Manager, Chief Manager, Bank Manager)

- Include banking certifications (CAIIB, JAIIB)

- Get endorsements from banking professionals

General ATS Tips

- DO: Standard fonts, clear headings, bullet points

- DO: Include metrics (₹500 Cr portfolio, 125% target, 40% growth)

- DO: Mention certifications and banking credentials

- DON’T: Use headers/footers, text boxes, images

- DON’T: Use creative section titles

Keyword Strategy for Banking Roles

Common keywords from job postings:

- Bank Manager, Branch Manager, Chief Manager

- CASA, Deposits, Advances, NPA Management

- Business Development, Target Achievement

- KYC, Compliance, RBI Guidelines

- CAIIB, JAIIB, Core Banking, Finacle

Final Tips for Your Bank Manager Resume

✅ Include CAIIB/JAIIB prominently—essential for banking careers

✅ Quantify achievements (₹500 Cr portfolio, 125% target, ₹15 Cr recovery)

✅ Show business development skills—CASA, advances, cross-selling

✅ Highlight compliance—audit observations, KYC compliance

✅ Demonstrate leadership—team size, branch management

✅ Include all banking certifications—AMFI, IRDA, NISM

✅ Proofread carefully—accuracy critical in banking

Quick Checklist

- Contact with +91 phone and LinkedIn

- CAIIB/JAIIB credentials displayed after name

- Professional summary highlighting banking experience

- Skills organized by category (Operations, Business, Credit)

- Experience showing portfolio size and target achievements

- Education with percentage/grade

- Certifications (CAIIB, JAIIB, AMFI, IRDA)

- Awards and recognition

- ATS-friendly formatting

- Declaration statement

Ready to create your professional Bank Manager resume? Use our resume builder to get started with expert-designed templates optimized for Indian job portals.

For more guidance on resume structure, check out our resume format guide with tips specifically for the Indian banking job market.

Frequently Asked Questions

What should I include in a bank manager resume?

A strong bank manager resume should have your contact information, a concise professional summary, detailed work experience, relevant skills, education, and any certifications you hold. Focus on outcomes like team performance, sales growth, compliance improvements, and customer satisfaction that show real impact.

How do I write a professional summary for a bank manager resume?

Your summary should quickly explain your experience (years in banking and leadership), key strengths (like team management or risk oversight), and one or two measurable accomplishments — for example, revenue growth or improved operational performance.

Which skills are important for a bank manager resume?

Include both technical skills (financial management, risk assessment, regulatory compliance, credit and loan management) and soft skills (leadership, communication, customer relationship management, strategic planning). These help your resume appeal to both recruiters and automated systems.

How should I list my work experience?

List your most recent positions first, and under each one use bullet points to describe your responsibilities and achievements — especially where you led teams, improved branch performance, or met financial targets. Quantifying results (like percentage increases in sales) makes your experience more compelling.

Should I tailor my resume for each job application?

Yes — customizing your resume to match the specific job description using relevant keywords (like risk management, customer service, team leadership, budgeting) improves your chances of getting past applicant tracking systems and grabbing the recruiter's attention.

How long should a bank manager resume be?

For most professionals, one to two pages is ideal. Early in your career, one page is usually enough; if you have many years of experience or leadership roles, two pages are okay as long as every section adds value.

Do certifications matter on a bank manager resume?

Yes — certifications in finance, banking operations, credit analysis, or management (like CAIIB or relevant professional development courses) can give you an edge by showing commitment and specialized knowledge.

What's the best format for this resume?

A reverse-chronological format — listing your most recent experience first — usually works best. It's clean, easy to read, and highlights your progression into leadership roles in banking.

How do I make my resume stand out from other candidates?

Focus on results and achievements rather than just duties. For example, "Led a branch team to exceed sales targets by 20%" or "Implemented new compliance procedures that reduced audit findings" shows concrete value.

Can I include achievements outside traditional banking roles?

Yes — but make sure they relate to valuable skills like leadership, customer service, performance improvement, or financial oversight. Relevant achievements from related fields can still strengthen your application.

How do I highlight leadership experience on a bank manager resume?

Show leadership through team size managed, targets achieved, training initiatives led, or performance improvements. Concrete outcomes matter more than titles.

Should I include branch performance metrics on my resume?

Yes. Metrics like revenue growth, loan portfolio expansion, reduction in NPAs, or customer satisfaction scores make your resume stronger and more credible.

How do I mention compliance and regulatory experience?

Clearly state your role in audits, regulatory reporting, KYC/AML compliance, risk controls, and policy implementation. This reassures employers about operational reliability.

What keywords help a bank manager resume pass ATS systems?

Use keywords such as branch operations, risk management, credit appraisal, customer relationship management, regulatory compliance, sales targets, and financial analysis.

Can assistant bank managers apply for bank manager roles with the same resume?

Yes, but the resume should emphasize leadership responsibilities, decision-making authority, and results — not just support tasks.

How do I show customer relationship management experience?

Mention high-value accounts handled, complaint resolution, cross-selling success, or improvements in customer retention and satisfaction.

Should I include training and mentoring experience?

Absolutely. Training staff, onboarding new employees, or mentoring junior bankers shows leadership readiness and management capability.

How do I write resume points for loan and credit management?

Specify loan types handled, approval limits, risk assessment involvement, and portfolio performance. This demonstrates technical and decision-making skills.

Is it important to mention digital banking experience?

Yes. Experience with core banking systems, digital platforms, online banking initiatives, or process automation is increasingly valuable and should be highlighted.

What if I've worked in multiple banking departments?

That's a strength. Organize experience clearly and show how cross-department exposure helped you make better managerial decisions.

How do I handle gaps or role changes in a banking career?

Briefly explain them through skills gained, certifications completed, or responsibilities handled during the gap. Keep it factual and forward-focused.

What makes a bank manager resume stand out to recruiters?

Clear structure, quantified achievements, leadership impact, strong compliance knowledge, and alignment with the job description make a resume stand out quickly.

Bank Manager Text-Only Resume Templates and Samples

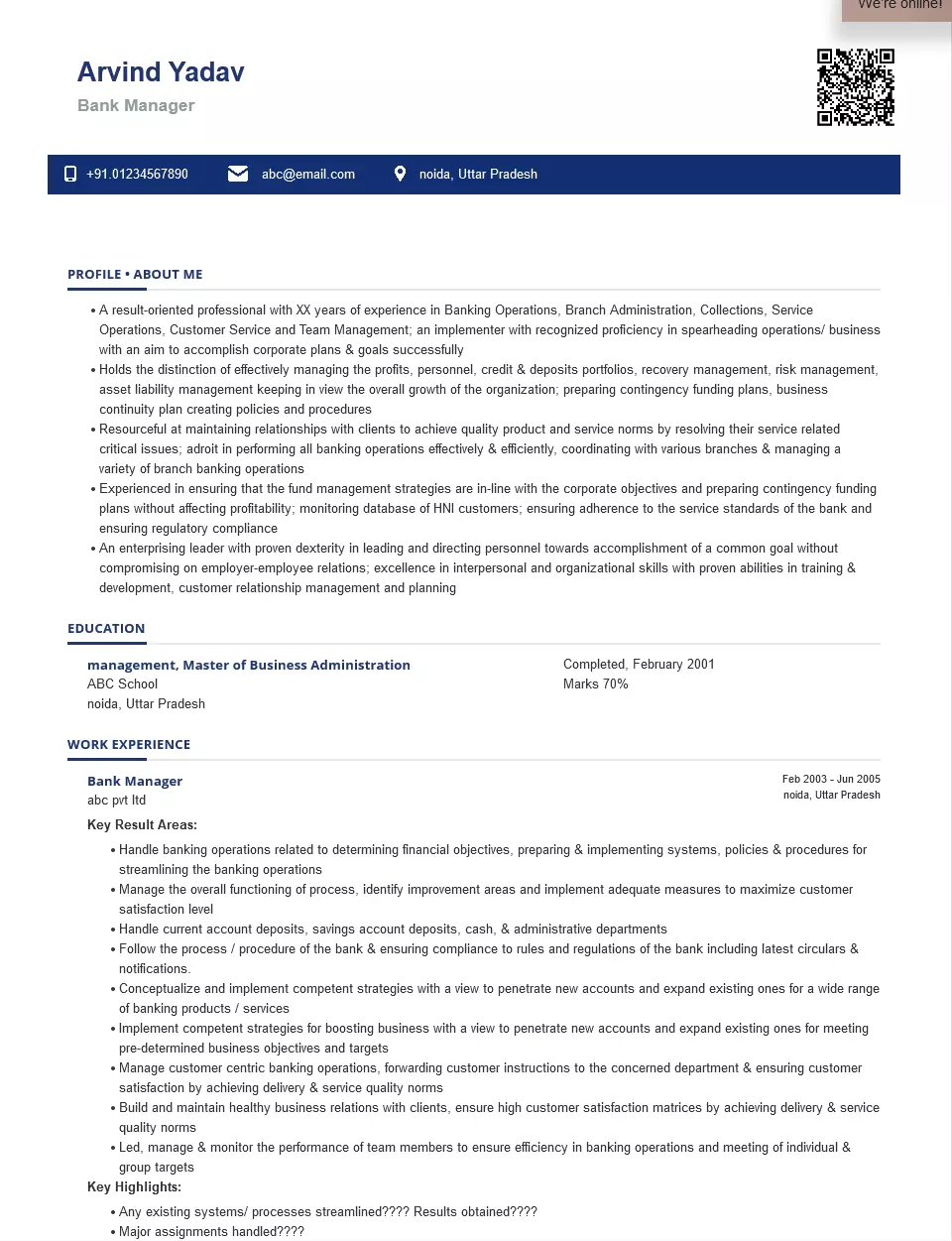

Arvind Yadav

Phone: 01234567890

Email: abc@email.com

Address: Sec-44, Noida, Noida

About Me

Bank Manager / Branch Manager / Investment Banker

- A result-oriented professional with XX years of experience in Banking Operations, Branch Administration, Collections, Service Operations, Customer Service, and Team Management; an implementer with recognized proficiency in spearheading operations/ business with an aim to accomplish corporate plans & goals successfully

- Holds the distinction of effectively managing the profits, personnel, credit & deposits portfolios, recovery management, risk management, and asset liability management keeping in view the overall growth of the organization; preparing contingency funding plans, and business continuity plans to create policies and procedures

- Resourceful at maintaining relationships with clients to achieve quality product and service norms by resolving their service-related critical issues; adroit in performing all banking operations effectively & efficiently, coordinating with various branches & managing a variety of branch banking operations

- Experienced in ensuring that the fund management strategies are in-line with the corporate objectives and preparing contingency funding plans without affecting profitability; monitoring database of HNI customers; ensuring adherence to the service standards of the bank and ensuring regulatory compliance

- An enterprising leader with proven skill in leading and directing personnel toward the accomplishment of a common goal without compromising on employer-employee relations; excellence in interpersonal and organizational skills with proven abilities in training & development, customer relationship management, and planning

Education

Economics , Master of Business Administration, Completed, February 2001

JYD Pvt ltd

BGR University

Noida, UP

Certifications

Work Experience

Period: February 2003 - Current

Investment Banker

Abc Pvt Ltd

- Handled banking operations related to determining financial objectives, preparing & implementing systems, policies & procedures for streamlining the banking operations

- Managed the overall functioning of the process, identify improvement areas and implement adequate measures to maximize the customer satisfaction level.

- Handled current account deposits, savings account deposits, cash, & administrative departments.

- Followed the process/procedure of the bank & ensuring compliance with the rules and regulations of the bank including the latest circulars & notifications.

- Conceptualized and implement competent strategies with a view to penetrating new accounts and expanding existing ones for a wide range of banking products/services.

- Implemented competent strategies for boosting business with a view to penetrating new accounts and expanding existing ones for meeting pre-determined business objectives and targets.

- Managed customer-centric banking operations, forwarding customer instructions to the concerned department & ensuring customer satisfaction by achieving delivery & service quality norms.

- Created and maintained healthy business relations with clients, ensuring high customer satisfaction matrices by achieving delivery & service quality norms.

- Led, managed & monitored the performance of team members to ensure efficiency in banking operations and meeting individual & group targets.

Period: May 1996 - September 2001

Bank Manager

JYD Pvt ltd

- Ensured the highest standards of Know-Your-Customer (KYC) requirements by administering the file flow from login to disbursements like preliminary checks for documents such as KYC, APS entry, and verification of documents like income papers, bank statements, etc.

- Directed all operational aspects including distribution operations, customer service, human resources, administration, and sales; developed forecasts, financial objectives, and business plans.

- Assessed local market conditions and identify current and prospective sales opportunities.

- Met goals and metrics; manage budget and allocate funds appropriately.

- Brought out the best of the branch’s personnel by providing training, coaching, development, and motivation.

- Located areas of improvement and propose corrective actions that meet challenges and leverage growth opportunities.

- Created and sustained a dynamic environment that fosters development opportunities and motivates high performance among team members.

Skills

Hard Skills

- Product Training

- Staff training

- Regulatory Compliance

- Accounts Receivable

- Sales Professional

- Loans

- Revenue generation

- Account analysis

- Bank Security Expert

Soft Skills

- Communication Skill

- Networking Skill

- Management Skill

- Organization Skill

- Customer Service Skill

- Interpersonal Skill

Languages

Softwares

Operating System

Personal Interests

- Traveling

- Singing

- Learning languages

- Photography

- Travel

India's

premier resume service

India's

premier resume service