- Advanced Appraiser for Property Tax Purposes , Completed , January 2016

- International Accredited Business Accountant (IABA, Completed , January 2018

What's your job?

Assessors Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Tax Assessor Resume Guide for India

A well-crafted tax assessor resume is essential for success in India’s property tax and assessment sector. Whether you’re pursuing a career with municipal corporations, development authorities, state revenue departments, or property tax consultancies, this guide provides everything you need to create a standout resume.

This comprehensive guide includes:

- Resume format recommendations for assessor roles in India

- Key skills employers look for in tax assessors

- Complete resume example with Indian context

- Top assessor employers in India

- Salary insights in INR by experience level

- Required qualifications and certifications

- ATS optimization tips for government job portals

Why Your Tax Assessor Resume Matters in India

India’s urban local bodies and revenue departments manage property tax collection worth thousands of crores annually. Tax assessors play crucial roles in property valuation, assessment accuracy, revenue optimisation, and compliance enforcement. With digitisation of property records and GIS-based assessment systems, skilled assessors are in high demand.

A strong tax assessor resume helps you:

- Stand out from competition for municipal and government positions

- Showcase your expertise in property valuation and tax assessment

- Demonstrate your knowledge of property tax laws and regulations

- Highlight your experience with assessment software and GIS tools

Municipal corporations and revenue departments receive many applications. Your resume must immediately communicate your assessment expertise, regulatory knowledge, and track record of accurate valuations.

Tax Assessor Resume Format for India

Indian government employers prefer professional resume formats that highlight technical skills and regulatory knowledge.

Recommended Format

- Length: 1-2 pages

- Layout: Reverse chronological

- Font: Arial, Calibri, or Times New Roman (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Personal Details for Indian Tax Assessor Resumes

Include:

- Full name

- Phone number with +91 country code

- Professional email address

- City, State

- Employee ID (for internal transfers)

What to Avoid

- Personal details like religion or caste

- Confidential taxpayer information

- Political affiliations

- Salary expectations in resume

Key Skills for Tax Assessors in India

Indian employers look for a combination of technical expertise and regulatory knowledge.

Assessment Skills

- Property Valuation: Market value determination, land valuation

- Tax Calculation: Rate application, exemption processing

- Survey and Inspection: Property measurement, physical verification

- Documentation: Assessment records, mutation entries

- Dispute Resolution: Objection handling, appeal support

Technical Skills

- GIS/GPS: Property mapping, location verification

- Assessment Software: Municipal tax software, SPARROW, etc.

- MS Office: Excel for calculations, Word for reports

- Online Portals: State land records, RERA databases

- Data Management: Record maintenance, database updates

Regulatory Knowledge

- Property Tax Laws: State municipal acts, property tax rules

- Land Revenue Code: State-specific land laws

- RERA: Real Estate Regulation and Development Act

- Stamp Duty: Registration and stamp duty provisions

- GST: Property-related GST provisions

Property Types

- Residential: Houses, flats, plots

- Commercial: Shops, offices, complexes

- Industrial: Factories, warehouses

- Agricultural: Farm land (where applicable)

- Vacant Land: Non-agricultural vacant plots

Soft Skills

- Attention to Detail: Accurate calculations and records

- Integrity: Ethical assessment practices

- Communication: Taxpayer interaction, team coordination

- Problem-Solving: Dispute resolution, complex cases

- Time Management: Meeting assessment deadlines

Tax Assessor Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Ramesh Yadav

Jaipur, Rajasthan | +91-98XXX-XXXXX | ramesh.yadav.assessor@email.com

Professional Summary

Tax Assessor with 8+ years of experience in property tax assessment and revenue administration. Currently Senior Property Tax Inspector at Jaipur Municipal Corporation handling assessments for 50,000+ properties generating ₹200+ Cr annual tax revenue. Expertise in GIS-based property mapping, assessment software operation, and taxpayer grievance redressal. Successfully led property resurvey project increasing tax base by 25%. Strong knowledge of Rajasthan Municipalities Act and property tax rules. Committed to fair assessment practices and revenue optimisation.

Key Skills

Property Tax Assessment | Property Valuation | GIS Mapping | Survey & Inspection | Tax Calculation | Revenue Collection | Objection Handling | Assessment Software | MS Excel | Data Management | Rajasthan Municipalities Act | RERA | Stamp Duty Rules | Taxpayer Communication

Professional Experience

Senior Property Tax Inspector | Jaipur Municipal Corporation | Jaipur | April 2019 – Present

- Supervise property tax assessment for 3 zones covering 50,000+ properties

- Lead team of 8 junior assessors and surveyors

- Ensure accurate property valuation using market value approach

- Handle property tax objections and appeals

- Coordinate with legal department on disputed assessments

- Implement GIS-based property identification system

- Train staff on assessment software and procedures

- Prepare monthly revenue reports for senior management

- Conduct special drives for non-compliant properties

Key Achievements:

- Led property resurvey increasing tax base by 25% (₹50 Cr additional revenue)

- Reduced objections by 40% through accurate initial assessments

- Awarded “Best Assessor Zone” recognition 2022

Property Tax Inspector | Jodhpur Municipal Corporation | Jodhpur | June 2015 – March 2019

- Conducted property surveys and physical verifications

- Calculated property tax as per municipal act provisions

- Processed new property registrations and mutations

- Prepared assessment notices and tax demand statements

- Maintained assessment registers and records

- Handled taxpayer queries and objections at first level

- Participated in special assessment drives

Key Achievements:

- Assessed 10,000+ properties during tenure

- Achieved 95% accuracy rate in assessments

- Promoted from Junior to Inspector level

Junior Assessor | Bikaner Municipal Council | Bikaner | January 2013 – May 2015

- Assisted senior assessors in property surveys

- Collected property data and measurements

- Entered assessment data in municipal software

- Issued property tax receipts and notices

- Maintained zone-wise assessment records

- Learned assessment procedures and regulations

Education

B.Com | University of Rajasthan | 2012

- First Class

Certificate in Urban Local Governance | YASHADA, Pune | 2018

- Property Tax Administration module

- GIS Applications in ULBs

Certifications & Training

- Property Tax Assessment Training | State Institute of Urban Development | 2019

- GIS for Municipal Administration | NIRD | 2020

- Revenue Administration | ATI Rajasthan | 2017

- MS Excel Advanced | RKCL | 2016

Languages

Hindi (Native) | English (Working) | Rajasthani (Native)

Top Tax Assessor Employers in India

India’s property tax sector offers diverse opportunities.

Municipal Corporations

- Metro Corporations: Delhi MCD, Mumbai BMC, Bangalore BBMP, Chennai GCC

- State Capitals: Jaipur JMC, Lucknow LMC, Bhopal BMC

- Large Cities: Surat SMC, Pune PMC, Ahmedabad AMC

- Municipal Councils: Mid-sized city municipalities

- Nagar Panchayats: Smaller urban bodies

Development Authorities

- Delhi Development Authority (DDA): Property management

- State Development Authorities: HUDA, BDA, AUDA

- Smart City SPVs: Urban development projects

- Industrial Development Corporations: Industrial area assessments

- Housing Boards: State housing bodies

State Revenue Departments

- Sub-Registrar Offices: Stamp duty and registration

- Land Revenue Offices: Agricultural land records

- District Collectorate: Revenue administration

- Tehsil Offices: Land record maintenance

- Survey and Settlement: Land survey departments

Consultancy and Private Sector

- Property Tax Consultants: Advisory services

- Real Estate Consultancies: Valuation services

- Software Companies: Municipal IT providers

- Surveying Firms: GIS and survey services

- Law Firms: Property tax litigation support

How to Apply

- State PSC for gazetted positions

- Municipal corporation recruitment notifications

- Direct recruitment through employment exchanges

- Outsourced/contractual positions through agencies

- Naukri.com with “assessor,” “property tax” keywords

Tax Assessor Salary in India

Salaries vary based on experience, employer type, and grade.

Salary by Experience Level

| Experience | Annual Salary (INR) |

|---|---|

| Junior Assessor (0-3 years) | ₹2.5 - ₹4.5 LPA |

| Property Tax Inspector (3-7 years) | ₹4 - ₹7 LPA |

| Senior Inspector (7-12 years) | ₹6 - ₹10 LPA |

| Assessment Officer (12+ years) | ₹8 - ₹15 LPA |

Note: Government positions follow state pay commission scales with allowances.

Salary by Employer Type

| Employer Type | Salary Range (Mid-Level) |

|---|---|

| Metro Municipal Corporations | ₹5 - ₹9 LPA + benefits |

| State Capital Municipalities | ₹4 - ₹7 LPA + benefits |

| Smaller ULBs | ₹3 - ₹6 LPA + benefits |

| Development Authorities | ₹5 - ₹9 LPA |

| Revenue Departments | ₹4 - ₹8 LPA |

| Private Consultancy | ₹4 - ₹10 LPA |

Salary by City

| City | Salary Range (Mid-Level) |

|---|---|

| Delhi | ₹5 - ₹9 LPA |

| Mumbai | ₹5 - ₹9 LPA |

| Bangalore | ₹5 - ₹8 LPA |

| Chennai | ₹4 - ₹7 LPA |

| Jaipur | ₹4 - ₹7 LPA |

| Lucknow | ₹4 - ₹6 LPA |

Government Grade Pay (Typical)

| Position | Pay Level |

|---|---|

| Junior Assessor | Level 2-4 |

| Tax Inspector | Level 5-6 |

| Senior Inspector | Level 6-7 |

| Assessment Officer | Level 8-10 |

Qualifications for Tax Assessors in India

Educational Background

Minimum:

- Graduate in any discipline

- 10+2 for junior positions in some ULBs

Preferred:

- B.Com, BBA, or economics background

- Diploma in Urban Planning/Administration

- Legal background for dispute handling

Desirable Skills

- Computer Proficiency: MS Office, assessment software

- GIS Knowledge: Property mapping, GPS

- Revenue Laws: State-specific municipal acts

- Communication: Hindi/English and regional language

Career Path

- Junior Assessor/Data Entry

- Property Tax Inspector

- Senior Inspector

- Assessment Officer

- Revenue Officer

- Tax Superintendent

- Assessment Incharge/Manager

ATS Tips for Your Tax Assessor Resume

Government and municipal recruitment uses screening methods:

Keyword Optimization

Include relevant terms like:

- Tax assessor, property tax

- Assessment, valuation, survey

- Municipal corporation, revenue

- GIS, property mapping

- Property tax act, municipal act

- Tax collection, revenue generation

Formatting Tips

- Use standard section headings

- Include quantified achievements (properties assessed, revenue generated)

- List software skills and certifications

- Mention specific acts and regulations known

- Save as PDF for format preservation

Final Tips for Your Tax Assessor Resume

✅ Lead with experience - Properties assessed, revenue generated

✅ Show regulatory knowledge - Municipal acts, tax rules

✅ Highlight technical skills - GIS, assessment software

✅ Quantify achievements - Tax base increase, accuracy rate

✅ Include certifications - Government training programmes

✅ Mention integrity - Important for government positions

✅ Update regularly - Add new training and achievements

Quick Checklist

- Contact information complete

- Summary highlights assessment experience

- Skills include technical and regulatory

- Experience shows quantified results

- Education and certifications listed

- Languages mentioned

- Clean, professional format

Ready to create your professional tax assessor resume? Use our resume builder to get started with expert-designed templates.

Looking for more guidance? Check out our resume format guide for additional tips.

Frequently Asked Questions

What is the best resume format for Tax Assessors in India?

Use a 1-2 page reverse chronological format highlighting assessment experience. Include summary, skills, experience, education, and certifications. Emphasise properties assessed, revenue generated, and regulatory knowledge.

What qualifications are needed for tax assessor jobs?

Minimum graduate degree, often in commerce or economics. Computer proficiency essential. Knowledge of state municipal acts and property tax rules required. Training certifications from state institutes add value.

What skills should I highlight on a tax assessor resume?

Highlight property valuation, tax calculation, GIS mapping, assessment software operation, survey techniques, and objection handling. Include knowledge of municipal acts, RERA, and stamp duty provisions.

How much do Tax Assessors earn in India?

Junior assessors: ₹2.5-4.5 LPA. Inspectors: ₹4-7 LPA. Senior positions: ₹6-10 LPA. Assessment officers: ₹8-15 LPA. Metro municipal corporations pay higher. Government positions include allowances and benefits.

How do I get a job in municipal property tax department?

Apply through municipal corporation recruitment notifications in newspapers and websites. Some positions through state PSC. Contractual positions through employment exchanges. Prepare for written tests on revenue laws and general knowledge.

Is GIS knowledge important for tax assessors?

Increasingly important as municipalities adopt GIS-based property mapping. Knowledge of GPS survey, GIS software, and digital property records adds significant value. Many ULBs now require GIS skills for assessment positions.

What is the career growth for tax assessors?

Path: Junior Assessor → Inspector → Senior Inspector → Assessment Officer → Revenue Officer → Tax Superintendent. Government positions offer promotion through departmental exams and seniority. Can also move to revenue or registration departments.

Should I mention knowledge of municipal acts?

Yes, essential. Mention specific knowledge of state municipal act (Maharashtra Municipal Corporation Act, Rajasthan Municipalities Act, etc.), property tax rules, and related revenue laws. Shows you understand legal framework.

What software skills are needed for assessors?

MS Excel for calculations, assessment software used by your ULB (SPARROW, NIC software, etc.), GIS tools for property mapping, and general computer proficiency. Mention specific software names if experienced.

How important is integrity for assessor positions?

Critical. Assessors handle public revenue and property records. Government positions require character verification. Highlight ethical conduct, accuracy, and fair assessment practices. Avoid anything suggesting bias or impropriety.

Assessors Text-Only Resume Templates and Samples

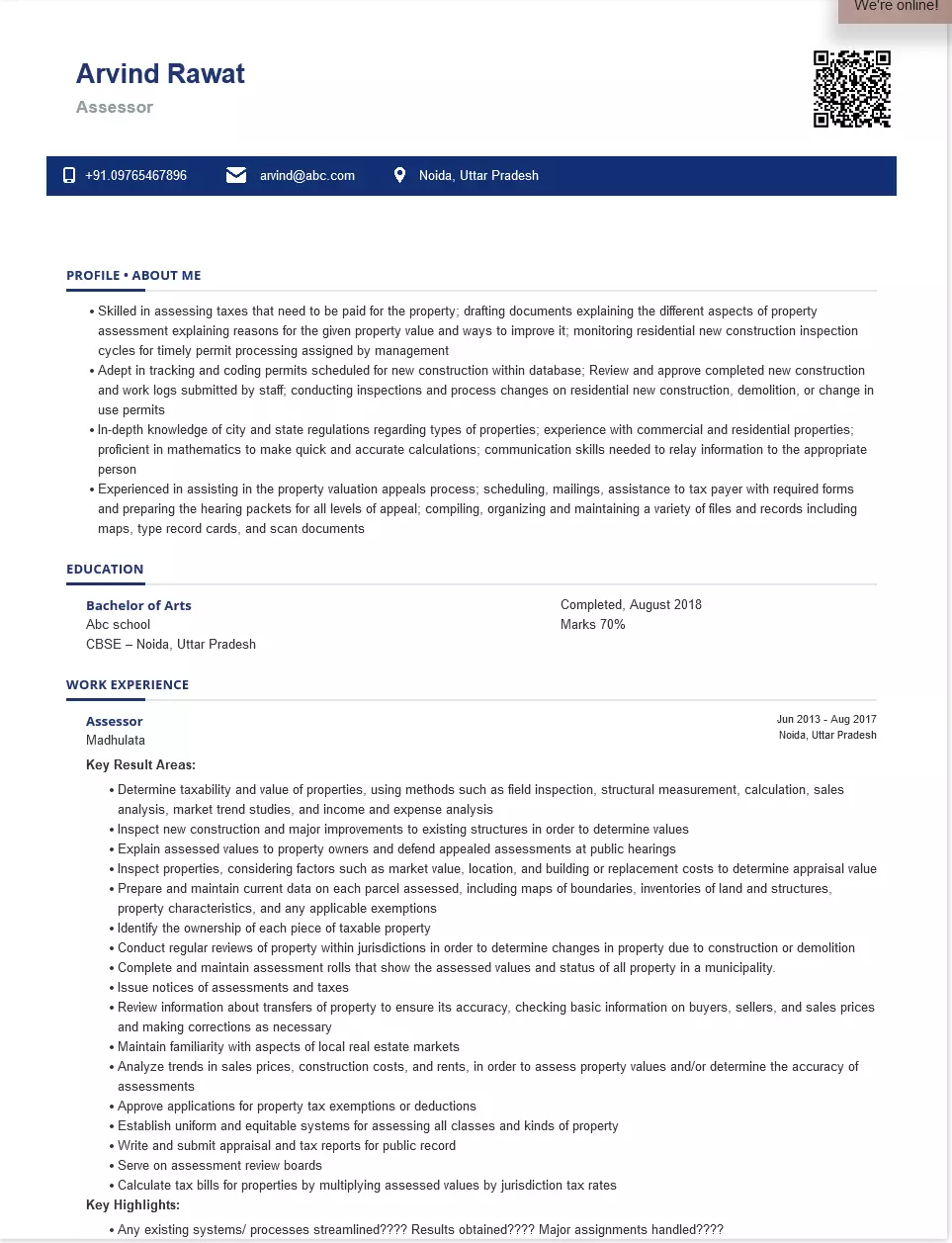

Arvind Rawat

Phone: 09765467896

Email: arvind@abc.com

Address: Alpha1 greater noida, Beta 2 greater noida, Noida

About Me

Assessor

- Extensive experience of XX years in determining the value of a property by inspecting the building as well as its foundation location and condition; studying current market values of surrounding properties; inspecting new construction or large additions to homes or buildings to determine worth

- Skilled in assessing taxes that need to be paid for the property; drafting documents explaining the different aspects of property assessment explaining reasons for the given property value and ways to improve it; monitoring residential new construction inspection cycles for timely permit processing assigned by management

- Adept in tracking and coding permits scheduled for new construction within the database; Review and approve completed new construction and work logs submitted by staff; conducting inspections and process changes on residential new construction, demolition, or change in use permits

- In-depth knowledge of city and state regulations regarding types of properties; experience with commercial and residential properties; proficient in mathematics to make quick and accurate calculations; communication skills needed to relay information to the appropriate person

- Experienced in assisting in the property valuation appeals process; scheduling, mailings, assistance to taxpayers with required forms and preparing the hearing packets for all levels of appeal; compiling, organizing, and maintaining a variety of files and records including maps, type record cards, and scan documents

Education

Arts, Bachelor of Arts, Completed, August 2018

Manav Rachna University

– Marks 70

Noida, UP

Certifications

Work Experience

Period: June 2018 - Current

Claims Assessor

TopGear Consultants

- Determine the taxability and value of properties, using methods such as field inspection, structural measurement, calculation, sales analysis, market trend studies, and income and expense analysis

- Inspect new construction and major improvements to existing structures in order to determine values

- Explain assessed values to property owners and defend appealed assessments at public hearings

- Inspect properties, considering factors such as market value, location, and building or replacement costs to determine the appraisal value

- Prepare and maintain current data on each parcel assessed, including maps of boundaries, inventories of land and structures, property characteristics, and any applicable exemptions

- Identify the ownership of each piece of taxable property

- Conduct regular reviews of property within jurisdictions in order to determine changes in property due to construction or demolition

- Complete and maintain assessment rolls that show the assessed values and status of all property in a municipality.

- Issue notices of assessments and taxes

- Review information about transfers of property to ensure its accuracy, checking basic information on buyers, sellers, and sales prices and making corrections as necessary

- Maintain familiarity with aspects of local real estate markets

- Analyze trends in sales prices, construction costs, and rents, in order to assess property values and/or determine the accuracy of assessments

- Approve applications for property tax exemptions or deductions

- Establish uniform and equitable systems for assessing all classes and kinds of property

- Write and submit appraisal and tax reports for public record

- Serve on assessment review boards

- Calculate tax bills for properties by multiplying assessed values by jurisdiction tax rates

Period: October 2012 - April 2017

Assessor / Proof Assessor

ReWise Analytics & Technologies Pvt. Ltd.

- Verified legal descriptions of real estate properties in public records

- Investigated to figure out the value of the property and the amount of taxes the owners owe

- Identified the owners of the property and notify them of assessed property values and taxes

- Conducted inspections of properties and maintain a database of gathered information

- Inspected new and existing properties, noting unique characteristics

- Used “comparables,” or similar nearby properties, to help determine the value

- Prepared written reports on the property value

- Prepared and maintained current data on each real estate property

Skills

- Patients

- Customer Service

- Data Collection

- Risk Assessments

- Corrective Action

- Crisis Intervention

- System Security

- Data Entry

- Substance Abuse

- Rehabilitation

- Quality Standards

- Plumbing

- Roofing

- Assessment Data and Results

- Assessment Reports

Languages

Softwares

Operating System

Personal Interests

- Swimming

- Golf

- Traveling

India's

premier resume service

India's

premier resume service