- Certified Private Insurance Investigator (CPII), Completed , January 2017

What's your job?

Insurance Investigator Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Insurance Investigator Resume Examples and Templates: A Complete Guide

A professional insurance investigator resume is essential for standing out in India’s growing insurance fraud investigation sector. Whether you’re applying for positions at general insurance companies like ICICI Lombard, New India Assurance, or United India Insurance, life insurers, or specialised investigation agencies, your resume should highlight your investigative expertise, fraud detection skills, and ability to protect organisations from fraudulent claims.

This guide walks you through insurance investigator resume examples and templates, formatting tips, and keywords to help you write a resume that stands out to recruiters at leading insurance organisations in India.

Understanding the Insurance Investigator Role in India

Insurance investigators are specialised professionals who detect, investigate, and prevent fraudulent insurance claims. From uncovering staged motor accidents at general insurers to investigating suspicious life insurance claims, investigators protect companies from significant financial losses while ensuring genuine claimants receive fair treatment.

Key responsibilities include:

- Investigating suspicious claims for potential fraud

- Conducting field surveillance and site inspections

- Interviewing claimants, witnesses, and medical professionals

- Gathering evidence and documentation

- Analysing medical treatment records and policy documents

- Collaborating with law enforcement agencies

- Preparing investigation reports for legal proceedings

- Testifying in court as expert witnesses

India’s expanding insurance sector and increasing fraud attempts create strong demand for skilled investigators across motor, health, life, and property insurance segments.

Preparing to Write Your Insurance Investigator Resume

Before drafting your resume, gather all relevant information:

Professional details to compile:

- Complete employment history in investigation roles

- Types of fraud cases investigated (motor, health, property, life)

- Number of cases handled and fraud amounts uncovered

- Investigation techniques and surveillance experience

- Software and database tools used

- Law enforcement collaboration experience

- Legal proceedings and court testimony experience

- Notable achievements and recognition

Research target employers:

- Review requirements from insurers like ICICI Lombard, HDFC ERGO, United India

- Understand expectations at investigation agencies

- Note specific certifications and skills mentioned in job descriptions

Choosing the Best Resume Format

Select a format that best presents your investigation experience:

Chronological Format

Best for investigators with steady career progression through claims and investigation roles. Highlights your work at organisations in reverse chronological order.

Functional Format

Suitable for career changers from law enforcement, military, or legal backgrounds transitioning to insurance investigation.

Combination Format

Ideal for mid-career professionals balancing diverse experience across multiple insurance types or combining corporate and agency investigation roles.

Format recommendations by experience: | Experience Level | Recommended Format | Resume Length | |-----------------|-------------------|---------------| | Entry-level (0-3 years) | Chronological | 1 page | | Mid-level (3-8 years) | Combination | 1-2 pages | | Senior (8+ years) | Chronological | 2 pages |

Professional Summary Examples

Your professional summary should immediately communicate your investigation expertise:

Entry-Level Insurance Investigator

Criminology graduate from Delhi University seeking insurance investigation position. Completed training programme in fraud detection and claims investigation at ICICI Lombard. Strong analytical and observational skills with attention to detail. Proficient in interview techniques, evidence gathering, and documentation. Eager to protect insurance organisations from fraudulent claims while developing expertise in complex investigations.

Experienced Insurance Investigator

Results-driven insurance investigator with 7+ years of experience investigating motor and health insurance fraud. Currently Senior Investigator at New India Assurance Mumbai handling 200+ cases annually. Expertise in surveillance, witness interviewing, and evidence collection. Uncovered fraudulent claims worth ₹15 crore over career. Certified Fraud Examiner (CFE) with strong law enforcement collaboration skills. Known for thorough investigations and court-admissible evidence collection.

Senior Investigation Manager

Strategic investigation leader with 12+ years of experience managing fraud investigation teams for general insurance. Currently Head of Special Investigation Unit at Bajaj Allianz Pune leading team of 25 investigators. Developed fraud detection protocols reducing claim fraud by 40%. Expertise in motor, health, and property fraud investigation. Ex-CBI officer with CFE and LIII certifications. Strong track record of successful prosecutions and fraud ring busts.

Forensic Investigation Specialist

Specialised forensic investigator with 10 years of expertise in medical and document fraud investigation. Currently Lead Forensic Investigator at United India Insurance handling complex multi-crore fraud cases. Expertise in medical record analysis, forensic accounting, and digital evidence collection. Collaborated with 50+ prosecutions with 90% conviction rate. CFE and ACFE certification with published research on insurance fraud patterns.

Showcasing Your Work Experience

Present your investigation experience with specific achievements and metrics:

Head of Special Investigation Unit

Bajaj Allianz General Insurance | Pune April 2019 – Present

- Lead SIU team of 25 investigators across motor, health, and property segments

- Manage annual investigation caseload of 2,000+ cases worth ₹200 crore

- Reduced claim fraud rate from 8% to 5% through enhanced detection protocols

- Developed fraud analytics system identifying suspicious claims at FNOL stage

- Established network of 100+ field investigators and surveillance agencies

- Collaborated with police and CBI on 30+ criminal prosecutions

- Implemented training programme for claims team on fraud red flags

- Achieved 85% success rate in fraud detection and recovery

- Received “Excellence in Investigation” award (2022)

Senior Fraud Investigator

ICICI Lombard General Insurance | Mumbai June 2015 – March 2019

- Investigated 150+ motor and health fraud cases annually

- Uncovered fraudulent claims worth ₹5 crore per year

- Conducted surveillance operations and field investigations

- Prepared investigation reports and evidence packages for legal proceedings

- Testified as expert witness in 20+ court cases

- Trained 15 junior investigators on investigation techniques

- Developed informant network for fraud tip-offs

- Received “Investigator of the Year” award (2018)

Claims Investigator

New India Assurance | Delhi July 2012 – May 2015

- Investigated motor and property insurance claims for fraud indicators

- Conducted site inspections and accident scene reconstructions

- Interviewed claimants, witnesses, and repair service providers

- Analysed medical treatment records for inconsistencies

- Collaborated with surveyors and loss assessors on complex cases

- Maintained investigation files with 98% documentation accuracy

- Completed CFE certification during tenure

Essential Skills for Insurance Investigators

Investigation Skills

- Fraud detection and analysis

- Surveillance and observation

- Interview and interrogation techniques

- Evidence collection and preservation

- Crime scene investigation

- Statement taking and verification

- Document analysis and verification

- Medical record review

- Digital forensics basics

- Report writing for legal proceedings

Technical Skills

- Investigation management software

- Database search and analysis

- Video and photo evidence processing

- GPS tracking and surveillance equipment

- Social media investigation

- Background verification tools

- Microsoft Office Suite

- Case management systems

- Fraud analytics platforms

- Court presentation technology

Soft Skills

- Attention to detail and accuracy

- Analytical and critical thinking

- Communication (verbal and written)

- Persistence and determination

- Ethical judgement and integrity

- Time management under pressure

- Interviewing and rapport building

- Team collaboration

- Confidentiality and discretion

- Stress management

Certifications for Insurance Investigators

Professional Certifications

| Certification | Issuing Body | Relevance |

|---|---|---|

| Certified Fraud Examiner (CFE) | Association of Certified Fraud Examiners | Global fraud investigation |

| Licentiate (LIII) | Insurance Institute of India | Insurance fundamentals |

| Associateship (AIII) | Insurance Institute of India | Advanced insurance |

| Certified Forensic Interviewer | International Association of Interviewers | Interview techniques |

| Private Detective Licence | State Police | Investigation authority |

| IRDA Surveyor Licence | IRDAI | Survey and assessment |

Academic Qualifications

- BA/MA in Criminology or Criminal Justice

- LLB for legal expertise

- B.Com/M.Com with investigation specialisation

- Police or military background

- Diploma in Private Investigation

- Forensic Science degree

Additional Certifications

- Anti-Money Laundering certification

- Digital Forensics certification

- Advanced Surveillance Training

- Statement Analysis certification

- First Responder Training

- Court Testimony Training

Tips by Experience Level

Entry-Level Investigators (0-3 years)

- Highlight criminology or law enforcement education

- Include internship and training programme experience

- Emphasise analytical and observational skills

- Showcase interview and documentation abilities

- Include relevant certifications completed

Target employers: Insurance company SIUs, investigation agencies

Mid-Level Investigators (3-8 years)

- Quantify cases investigated and fraud amounts uncovered

- Highlight specialisation (motor, health, property fraud)

- Showcase surveillance and evidence collection expertise

- Demonstrate law enforcement collaboration

- Include CFE or equivalent certification

Target positions: Senior Investigator, Lead Investigator, SIU Manager

Senior Investigators (8+ years)

- Emphasise team management and strategic contributions

- Highlight fraud prevention programme development

- Showcase prosecution success and conviction rates

- Demonstrate industry recognition and thought leadership

- Include policy development and training contributions

Target positions: Head of SIU, Director of Investigation, Chief Fraud Officer

ATS Optimisation for Insurance Investigator Resumes

Ensure your resume passes Applicant Tracking Systems:

Essential keywords to include:

- Insurance investigator, fraud investigator, SIU

- Fraud detection, claims investigation

- Surveillance, evidence collection

- Interview, witness statement

- CFE, Certified Fraud Examiner

- Motor fraud, health fraud, property fraud

- Law enforcement, prosecution

- Investigation report, legal proceedings

- Medical records, document verification

- Fraudulent claims, fraud prevention

ATS-friendly formatting:

- Use standard section headings (Summary, Experience, Skills, Education)

- List certifications with issuing body names

- Avoid tables, graphics, and complex formatting

- Use standard fonts (Arial, Calibri, Times New Roman)

- Include case counts and fraud amounts as numbers

Conclusion

A professional insurance investigator resume is essential for success in India’s expanding insurance fraud investigation sector. Whether you’re targeting positions at general insurers like ICICI Lombard, United India, and New India Assurance, or exploring opportunities at specialised investigation agencies, your resume must demonstrate your investigative expertise, fraud detection skills, and track record of protecting organisations.

Focus on quantifying your achievements—cases investigated, fraud amounts uncovered, and prosecution success rates. Highlight your CFE certification and law enforcement collaboration experience that validate your expertise. With India’s growing insurance sector and increasing fraud sophistication, skilled investigators have excellent career opportunities across all segments.

Use our resume builder to create an ATS-optimised insurance investigator resume, or explore our professional templates designed specifically for investigation professionals in India.

Frequently Asked Questions

What sections should a strong insurance investigator resume include?

At minimum, include contact information, a professional summary, work experience, key skills, and education. Depending on your experience level, you may also add certifications, achievements, projects, or industry-specific sections that highlight your expertise.

How do I write a professional summary for an insurance investigator role?

Keep it concise — two to three sentences highlighting your experience level, core competencies, and a key achievement or strength that shows why you're right for the job. Tailor it to match the specific role you're applying for.

What skills are most important to list on an insurance investigator resume?

Include a mix of technical skills specific to insurance investigator roles and soft skills like communication, problem-solving, and teamwork. Research job postings in your target companies to identify the most commonly requested skills.

How detailed should my work experience be?

Use bullet points to describe your roles, focusing on specific results, tools used, and the impact you made. Quantify achievements where possible — numbers and percentages help recruiters quickly understand your contributions.

Do I need certifications on my insurance investigator resume?

Certifications aren't always required, but they can strengthen your application — especially if they demonstrate advanced training or specialised expertise. List the certification name, issuing organisation, and year obtained.

What's the best resume format for an insurance investigator?

Most insurance investigator professionals benefit from a reverse-chronological format that lists your most recent experience first. If you're changing careers or have gaps, a functional or combination format might work better.

How long should my insurance investigator resume be?

Aim for one page if you're early in your career. Experienced professionals with extensive achievements can use two pages — just ensure every section adds value and remains relevant to the role.

Should I tailor my resume for each job application?

Yes. Customising your resume with keywords and responsibilities from the job posting improves your chances of passing Applicant Tracking Systems (ATS) and resonating with recruiters. Focus on relevant experience and skills for each role.

Insurance Investigator Text-Only Resume Templates and Samples

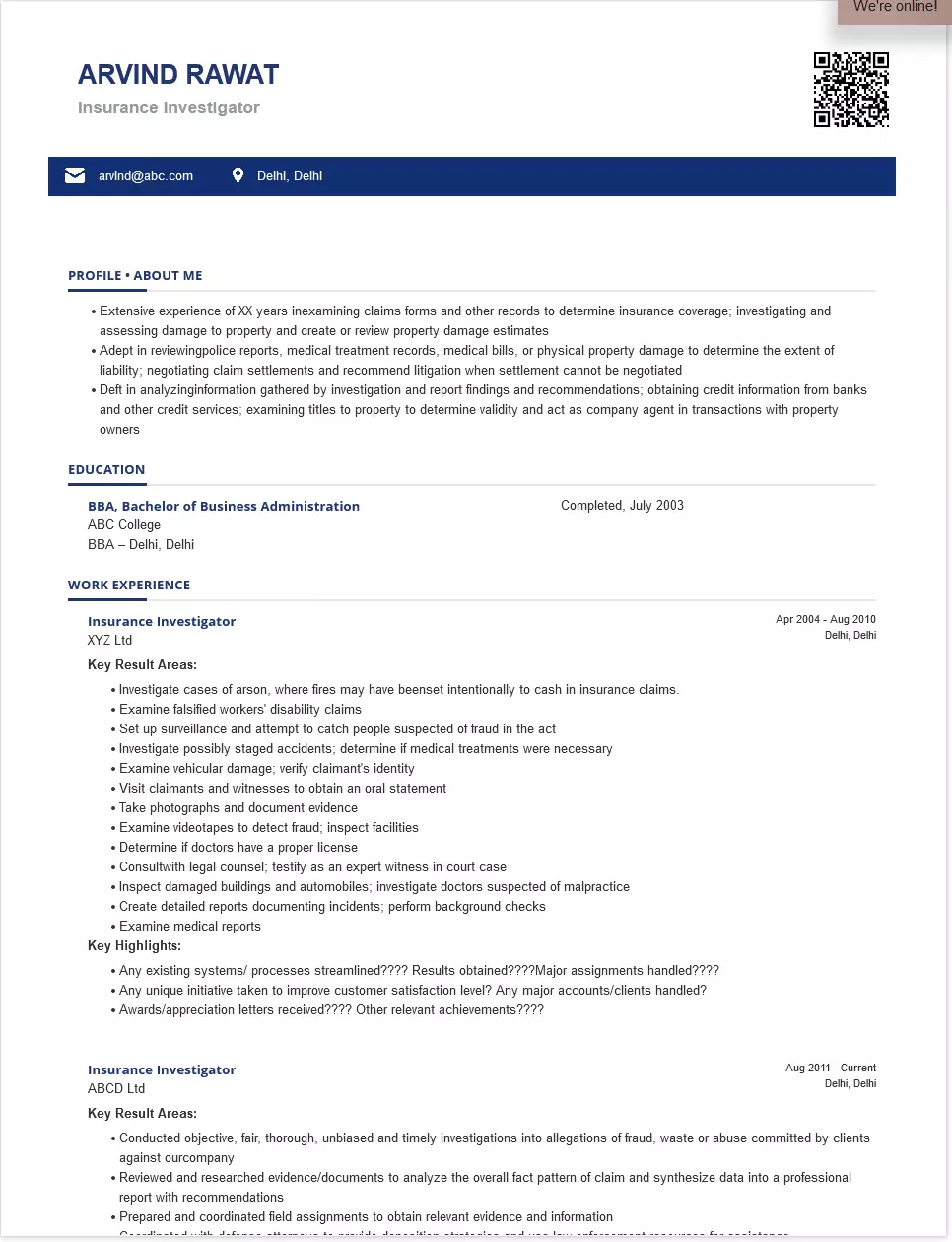

ARVIND RAWAT

Phone: 0000000

Email: arvind@abc.com

Address: C-21, Sector-21, Delhi

About Me

Insurance Investigator

- Extensive experience of XX years in examining claims forms and other records to determine insurance coverage; investigating and assessing damage to property and creating or reviewing property damage estimates

- Adept in reviewing police reports, medical treatment records, medical bills, or physical property damage to determine the extent of liability; negotiating claim settlements and recommending litigation when settlement cannot be negotiated

- Deft in analyzing the information gathered by investigation and report findings and recommendations; obtaining credit information from banks and other credit services; examining titles to property to determine validity and act as company agent in transactions with property owners

Education

Management, Bachelor of Business Administration, Completed, July 2003

College Of Engineering Guindy

– Marks null

Chennai, TN

Certifications

Work Experience

Period: April 2010 - Current

Insurance Investigator / Insurance Claims Investigator

Code F Solutions Pvt Ltd

- Investigate cases of arson, where fires may have been set intentionally to cash in insurance claims.

- Examine falsified workers' disability claims

- Set up surveillance and attempt to catch people suspected of fraud in the act

- Investigate possibly staged accidents; determine if medical treatments were necessary

- Examine vehicular damage; verify claimant's identity

- Visit claimants and witnesses to obtain an oral statement

- Take photographs and document evidence

- Examine videotapes to detect fraud; inspect facilities

- Determine if doctors have a proper license

- Consult with legal counsel; testify as an expert witness in the court case

- Inspect damaged buildings and automobiles; investigate doctors suspected of malpractice

- Create detailed reports documenting incidents; perform background checks

- Examine medical reports

Period: August 2003 - April 2009

Insurance Investigator

Russell Tobin Associates Staffing Solutions India Pvt Ltd

- Conducted objective, fair, thorough, unbiased, and timely investigations into allegations of fraud, waste, or abuse committed by clients against our company

- Reviewed and researched evidence/documents to analyze the overall fact pattern of the claim and synthesize data into a professional report with recommendations

- Prepared and coordinated field assignments to obtain relevant evidence and information

- Coordinated with defense attorneys to provide deposition strategies and use law enforcement resources for assistance

- Managed and prioritized a large and varied caseload effectively and efficiently to achieve positive results; prepared prosecution packages and restitution proposals

Skills

- Organization

- Written communication

- Investigation

- Critical thinking

- Decision-making

- Negotiation

- Persuasion

- Good numeracy and literally

Languages

Softwares

Operating System

Personal Interests

- Reading Books / Newspaper

- Yoga

- Blogging

India's

premier resume service

India's

premier resume service