- Certified Professional Adjuster (CPA), Completed , January 2015

- Certified Insurance Appraiser (CIA), Completed , January 2016

What's your job?

Insurance Adjuster Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Insurance Claims Adjuster Resume Examples and Templates: A Complete Guide

A professional insurance claims adjuster resume is essential for standing out in India’s growing insurance sector. Whether you’re applying for positions at general insurance companies like ICICI Lombard, HDFC ERGO, or Bajaj Allianz, life insurance firms like LIC or SBI Life, or third-party administrators, your resume should highlight your claims expertise, investigative skills, and ability to process claims efficiently while maintaining customer satisfaction.

This guide walks you through insurance claims adjuster resume examples and templates, formatting tips, and keywords to help you write a resume that stands out to recruiters at leading insurance organisations in India.

Understanding the Claims Adjuster Role in India

Insurance claims adjusters are critical professionals responsible for investigating, evaluating, and settling insurance claims. From motor insurance claims at New India Assurance to health claims at Star Health, claims adjusters ensure fair and timely resolution while protecting the company from fraudulent claims.

Key responsibilities include:

- Investigating insurance claims and verifying coverage

- Assessing damage through site inspections and documentation

- Reviewing policy terms and determining claim validity

- Negotiating settlements with policyholders

- Detecting and preventing fraudulent claims

- Coordinating with surveyors, assessors, and repair services

- Processing claim payments and documentation

- Maintaining claims records and regulatory compliance

India’s expanding insurance penetration and increasing claim volumes create strong demand for skilled claims professionals across motor, health, property, and life insurance segments.

Preparing to Write Your Claims Adjuster Resume

Before drafting your resume, gather all relevant information:

Professional details to compile:

- Complete employment history in claims roles

- Types of claims handled (motor, health, property, life)

- Claims volume processed monthly/annually

- Settlement ratios and turnaround times

- Software and systems used (claims management systems)

- Investigation and fraud detection experience

- Team sizes managed if applicable

- Notable achievements and recognition

Research target employers:

- Review requirements from general insurers like ICICI Lombard, HDFC ERGO

- Understand expectations at life insurers like LIC, HDFC Life

- Note specific certifications and skills mentioned in job descriptions

Choosing the Best Resume Format

Select a format that best presents your claims experience:

Chronological Format

Best for claims adjusters with steady career progression through claims processing roles. Highlights your work at organisations in reverse chronological order.

Functional Format

Suitable for career changers entering claims field or customer service professionals transitioning to insurance claims.

Combination Format

Ideal for mid-career professionals balancing diverse experience across multiple insurance lines or combining field and office-based claims roles.

Format recommendations by experience: | Experience Level | Recommended Format | Resume Length | |-----------------|-------------------|---------------| | Entry-level (0-2 years) | Chronological | 1 page | | Mid-level (3-7 years) | Combination | 1-2 pages | | Senior (7+ years) | Chronological | 2 pages |

Professional Summary Examples

Your professional summary should immediately communicate your claims expertise:

Entry-Level Claims Adjuster

Commerce graduate from Mumbai University seeking claims adjuster position in general insurance. Completed training programme at ICICI Lombard handling motor insurance claims. Proficient in claims documentation, policy verification, and customer communication. Strong attention to detail and analytical skills. Eager to contribute to efficient claims processing while developing expertise in claims investigation.

Experienced Claims Adjuster

Results-driven claims adjuster with 6+ years of experience processing motor and health insurance claims. Currently Senior Claims Officer at HDFC ERGO Mumbai handling 150+ claims monthly with 95% settlement ratio. Expertise in claims investigation, fraud detection, and customer dispute resolution. Reduced average claim turnaround from 15 to 8 days through process improvements. Licentiate of Insurance Institute of India (LIII).

Claims Manager

Strategic claims leader with 12+ years of experience managing claims operations for general insurance. Currently Claims Manager at Bajaj Allianz Pune leading team of 30 claims professionals. Oversee claims portfolio worth ₹200 crore annually with 92% settlement ratio. Expertise in motor, property, and liability claims. Reduced fraudulent claims by 35% through enhanced detection protocols. MBA from Symbiosis with Associateship of Insurance Institute of India (AIII).

Motor Claims Specialist

Specialised motor claims adjuster with 8 years of experience in auto insurance claims assessment. Currently Lead Motor Claims Adjuster at Tata AIG handling high-value and complex motor claims. Expertise in accident investigation, vehicle damage assessment, and third-party negotiations. Processed 5,000+ motor claims with ₹150 crore cumulative settlement. Certified Motor Vehicle Assessor with IRDA registration.

Showcasing Your Work Experience

Present your claims experience with specific achievements and metrics:

Claims Manager

Bajaj Allianz General Insurance | Pune April 2019 – Present

- Lead claims department managing 30 claims officers and assessors

- Oversee claims portfolio worth ₹200 crore annually across all lines

- Achieved 92% claims settlement ratio with 99% compliance

- Reduced average claim turnaround time from 12 to 7 days

- Implemented fraud detection system reducing fraudulent claims by 35%

- Established network of 500+ garages and service providers

- Introduced digital claims assessment reducing processing costs by 25%

- Chair weekly claims review committee ensuring quality standards

- Received “Excellence in Claims Management” award (2022)

Senior Claims Officer

ICICI Lombard General Insurance | Mumbai June 2015 – March 2019

- Processed 150+ motor and health claims monthly

- Achieved 95% settlement ratio with average TAT of 8 days

- Conducted field investigations for suspicious claims

- Negotiated third-party settlements up to ₹50 lakh

- Trained 15 new claims officers on processing procedures

- Implemented digital documentation reducing paperwork by 40%

- Identified fraudulent claims saving ₹2 crore annually

- Received “Claims Star” award for exceptional performance (2018)

Claims Officer

New India Assurance | Delhi July 2012 – May 2015

- Processed motor and property insurance claims

- Achieved 90% first-contact resolution for customer queries

- Coordinated with surveyors and assessors for damage evaluation

- Maintained claims records with 98% documentation accuracy

- Assisted in policy verification and coverage confirmation

- Participated in claims audit and compliance reviews

- Completed Insurance Institute examinations during tenure

Essential Skills for Claims Adjusters

Technical Skills

- Claims investigation and assessment

- Policy interpretation and coverage analysis

- Damage evaluation and estimation

- Fraud detection and prevention

- Claims management systems

- Documentation and record keeping

- Regulatory compliance (IRDAI)

- Survey and loss assessment

- Subrogation and recovery

- Reinsurance claims handling

Software Proficiency

- Claims management software

- Policy administration systems

- Microsoft Office Suite

- Digital documentation tools

- Video calling for remote assessment

- Mobile claims apps

- CRM systems

- Analytics and reporting tools

- Fraud detection software

- Document management systems

Soft Skills

- Attention to detail and accuracy

- Customer service and empathy

- Negotiation and conflict resolution

- Communication (verbal and written)

- Analytical and investigative thinking

- Decision-making under pressure

- Time management and organisation

- Team collaboration

- Problem-solving

- Ethical judgement

Certifications for Claims Adjusters

Professional Certifications

| Certification | Issuing Body | Relevance |

|---|---|---|

| Licentiate (LIII) | Insurance Institute of India | Foundation certification |

| Associateship (AIII) | Insurance Institute of India | Intermediate level |

| Fellowship (FIII) | Insurance Institute of India | Senior certification |

| Motor Vehicle Assessor | IRDAI | Motor claims authority |

| Certified Fraud Examiner (CFE) | ACFE | Fraud investigation |

| Loss Adjuster Licence | IRDAI | Independent adjustment |

Academic Qualifications

- B.Com/M.Com from recognised universities

- BBA/MBA in Insurance Management

- LLB for legal claims expertise

- B.Sc/M.Sc for technical claims

- Diploma in Insurance (III, ICSI)

Additional Certifications

- IRDAI Insurance Agents Licence

- General Insurance Surveyors Licence

- Fire and Allied Perils Surveyor

- Marine Surveyor certification

- Health Insurance certification

- Motor Insurance training programme

Tips by Experience Level

Entry-Level Claims Adjusters (0-2 years)

- Highlight commerce or related degree

- Include internship and training programme experience

- Emphasise customer service and communication skills

- Showcase attention to detail and documentation abilities

- Include Insurance Institute examinations completed

Target employers: General insurers, TPAs, BPOs handling claims

Mid-Level Claims Adjusters (3-7 years)

- Quantify claims volume and settlement ratios

- Highlight specialisation (motor, health, property)

- Showcase fraud detection and investigation skills

- Demonstrate process improvement contributions

- Include certifications like AIII or specialised licences

Target positions: Senior Claims Officer, Lead Adjuster, Team Lead

Senior Claims Adjusters (7+ years)

- Emphasise team management and budget responsibility

- Highlight strategic contributions and cost savings

- Showcase vendor and network management

- Demonstrate regulatory compliance expertise

- Include industry recognition and thought leadership

Target positions: Claims Manager, Head of Claims, Regional Claims Head

ATS Optimisation for Claims Adjuster Resumes

Ensure your resume passes Applicant Tracking Systems:

Essential keywords to include:

- Claims adjuster, claims officer, claims processing

- Motor claims, health claims, property claims

- Settlement, investigation, assessment

- IRDAI, Insurance Institute of India

- Fraud detection, claims verification

- TAT, turnaround time, settlement ratio

- Survey, damage assessment

- Policy interpretation, coverage

- Customer service, dispute resolution

- General insurance, life insurance

ATS-friendly formatting:

- Use standard section headings (Summary, Experience, Skills, Education)

- List certifications with issuing body names

- Avoid tables, graphics, and complex formatting

- Use standard fonts (Arial, Calibri, Times New Roman)

- Include claims volumes and settlement ratios as numbers

Conclusion

A professional insurance claims adjuster resume is essential for success in India’s expanding insurance sector. Whether you’re targeting positions at general insurers like ICICI Lombard, HDFC ERGO, and Bajaj Allianz, or exploring opportunities at life insurers and third-party administrators, your resume must demonstrate your claims expertise, investigative skills, and customer focus.

Focus on quantifying your achievements—claims volumes processed, settlement ratios achieved, and turnaround times maintained. Highlight your certifications from the Insurance Institute of India and any specialised licences that validate your expertise. With India’s growing insurance market and increasing claim volumes, skilled claims professionals have excellent career opportunities across all segments.

Use our resume builder to create an ATS-optimised claims adjuster resume, or explore our professional templates designed specifically for insurance professionals in India.

Frequently Asked Questions

What sections should a strong insurance adjuster resume include?

At minimum, include contact information, a professional summary, work experience, key skills, and education. Depending on your experience level, you may also add certifications, achievements, projects, or industry-specific sections that highlight your expertise.

How do I write a professional summary for an insurance adjuster role?

Keep it concise — two to three sentences highlighting your experience level, core competencies, and a key achievement or strength that shows why you're right for the job. Tailor it to match the specific role you're applying for.

What skills are most important to list on an insurance adjuster resume?

Include a mix of technical skills specific to insurance adjuster roles and soft skills like communication, problem-solving, and teamwork. Research job postings in your target companies to identify the most commonly requested skills.

How detailed should my work experience be?

Use bullet points to describe your roles, focusing on specific results, tools used, and the impact you made. Quantify achievements where possible — numbers and percentages help recruiters quickly understand your contributions.

Do I need certifications on my insurance adjuster resume?

Certifications aren't always required, but they can strengthen your application — especially if they demonstrate advanced training or specialised expertise. List the certification name, issuing organisation, and year obtained.

What's the best resume format for an insurance adjuster?

Most insurance adjuster professionals benefit from a reverse-chronological format that lists your most recent experience first. If you're changing careers or have gaps, a functional or combination format might work better.

How long should my insurance adjuster resume be?

Aim for one page if you're early in your career. Experienced professionals with extensive achievements can use two pages — just ensure every section adds value and remains relevant to the role.

Should I tailor my resume for each job application?

Yes. Customising your resume with keywords and responsibilities from the job posting improves your chances of passing Applicant Tracking Systems (ATS) and resonating with recruiters. Focus on relevant experience and skills for each role.

Insurance Adjuster Text-Only Resume Templates and Samples

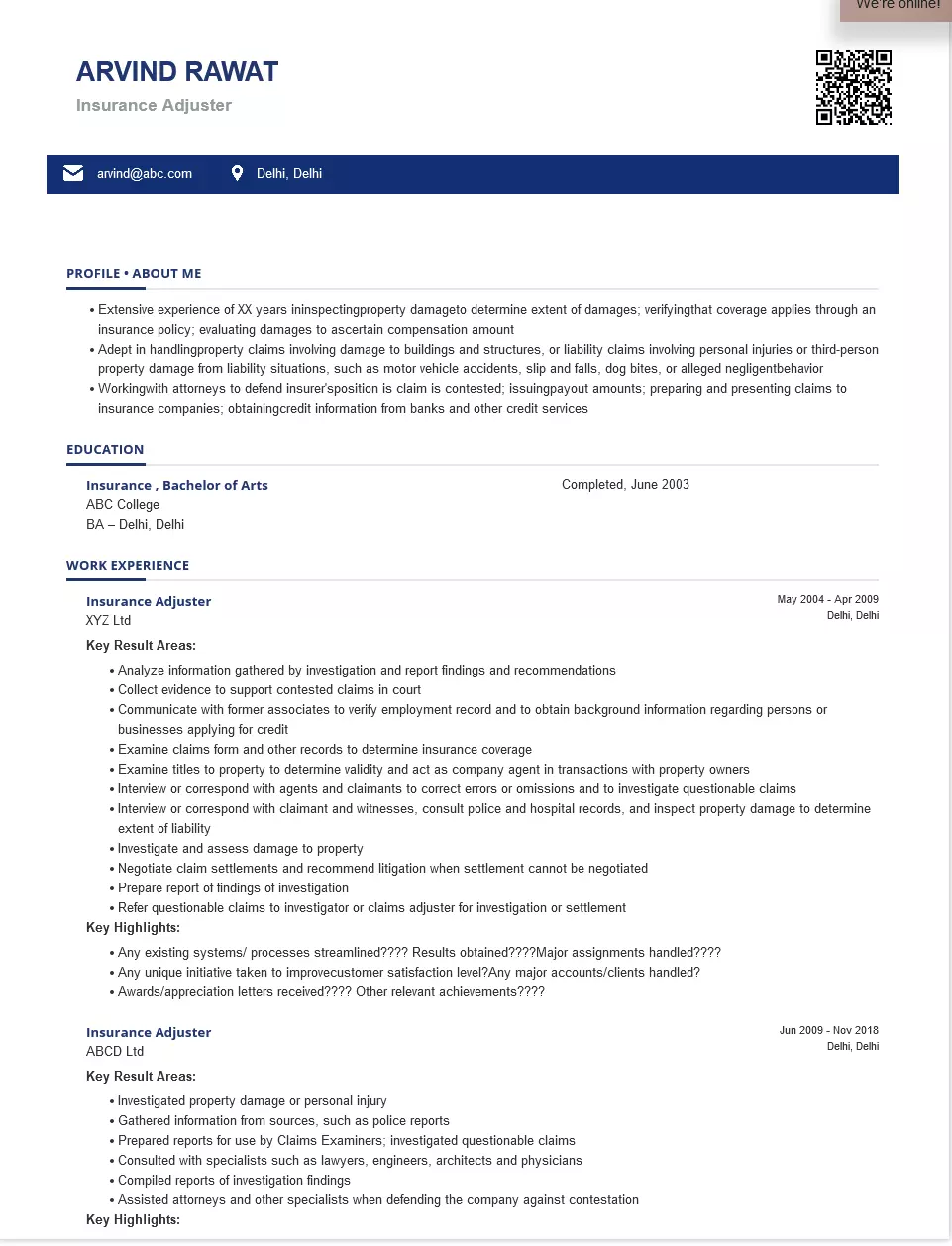

ARVIND RAWAT

Phone: 0000000

Email: arvind@abc.com

Address: C-21, Sector-21, Delhi

About Me

Insurance Adjuster

- An Accomplished Insurance Adjuster Possess expertise in handling insurance claims filed by policyholders; planning and scheduling work needed to process claim, interviewing claimant and witnesses, and investigating claims

- Extensive experience of XX years in inspecting property damage to determine the extent of damages; verifying that coverage applies through an insurance policy; evaluating damages to ascertain the compensation amount

- Adept in handling property claims involving damage to buildings and structures, or liability claims involving personal injuries or third-person property damage from liability situations, such as motor vehicle accidents, slips, and falls, dog bites, or alleged negligent behavior

- Working with attorneys to defend an insurer's position if a claim is contested; issuing payout amounts; preparing and presenting claims to insurance companies; obtaining credit information from banks and other credit services

Education

Insurance , Bachelor of Arts, Completed, June 2003

Ebenezer Group Of Institutions

– Marks null

Bangalore, KA

Certifications

Work Experience

Period: May 2016 - Current

Insurance Adjuster / Insurance Claims Manager

Three Pentacles

- Analyze information gathered by investigation and report findings and recommendations

- Collect evidence to support contested claims in court

- Communicate with former associates to verify employment records and obtain background information regarding persons or businesses applying for credit

- Examine claims forms and other records to determine insurance coverage

- Examine titles to property to determine validity and act as company agent in transactions with property owners

- Interview or correspond with agents and claimants to correct errors or omissions and to investigate questionable claims

- Interview or correspond with claimants and witnesses, consult police and hospital records, and inspect property damage to determine the extent of liability

- Investigate and assess damage to property

- Negotiate claim settlements and recommend litigation when settlement cannot be negotiated

- Prepare a report on the findings of the investigation

- Refer questionable claims to an investigator or claims adjuster for investigation or settlement

Period: June 2009 - November 2015

Insurance Adjuster / Insurance Executive

Monish Shah Financial Planning Services

- Investigated property damage or personal injury

- Gathered information from sources, such as police reports

- Prepared reports for use by Claims Examiners; investigated questionable claims

- Consulted with specialists such as lawyers, engineers, architects, and physicians

- Compiled reports of investigation findings

- Assisted attorneys and other specialists when defending the company against contestation

Skills

- Claims Adjuster experience

- Liability

- Investigating

- Communication

- Customer Service

- Written Communication

- Claim Handling

- Property Claims

Languages

Softwares

Operating System

Personal Interests

- Gymming

- Yoga

- Reading

- Blogging

India's

premier resume service

India's

premier resume service