- Certificate course in Foundations of Casualty Actuarial Science, Completed , January 2014

What's your job?

Insurance Actuary Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Insurance Actuary Resume Examples and Templates: A Complete Guide

A professional insurance actuary resume is essential for standing out in India’s growing actuarial profession. Whether you’re applying for positions at insurance companies like LIC, ICICI Prudential, or HDFC Life, consulting firms like Milliman or Willis Towers Watson, or reinsurance companies like Munich Re and Swiss Re, your resume should highlight your actuarial qualifications, technical expertise, and ability to assess and manage financial risks.

This guide walks you through insurance actuary resume examples and templates, formatting tips, and keywords to help you write a resume that stands out to recruiters at leading insurance and financial organisations in India.

Understanding the Insurance Actuary Role in India

Insurance actuaries are highly specialised professionals who use mathematics, statistics, and financial theory to assess risk and uncertainty in the insurance industry. From pricing life insurance products at LIC to reserving for general insurance at ICICI Lombard, actuaries play a critical role in India’s rapidly expanding insurance sector.

Key responsibilities include:

- Designing and pricing insurance products

- Calculating policy reserves and liabilities

- Conducting experience studies and mortality analysis

- Assessing risk and developing risk management strategies

- Preparing actuarial valuations and regulatory filings

- Developing financial models and projections

- Advising on reinsurance programmes

- Ensuring compliance with IRDAI regulations

India’s growing insurance penetration and regulatory requirements for qualified actuaries create strong demand for actuarial professionals across life, health, and general insurance sectors.

Preparing to Write Your Actuary Resume

Before drafting your resume, gather all relevant information:

Professional details to compile:

- Complete employment history in actuarial roles

- Actuarial exams passed (IAI, IFoA, SOA, CAS)

- Products designed and priced

- Valuation experience and reserve amounts handled

- Software and tools proficiency (Prophet, AXIS, Moses)

- Team sizes managed if applicable

- Business impact and savings generated

- Notable achievements and recognition

Research target employers:

- Review requirements from insurance companies like LIC, SBI Life, HDFC Life

- Understand expectations at consulting firms like Milliman, WTW, Deloitte

- Note specific exam requirements and software skills mentioned in job descriptions

Choosing the Best Resume Format

Select a format that best presents your actuarial experience:

Chronological Format

Best for actuaries with steady career progression through traditional actuarial roles. Highlights your work at organisations in reverse chronological order.

Functional Format

Suitable for career changers entering actuarial field or those with extensive exam progress but limited work experience.

Combination Format

Ideal for mid-career professionals balancing diverse experience across life, general, and health insurance or consulting and corporate roles.

Format recommendations by experience: | Experience Level | Recommended Format | Resume Length | |-----------------|-------------------|---------------| | Entry-level (0-3 years) | Chronological | 1 page | | Mid-level (4-8 years) | Combination | 1-2 pages | | Senior (8+ years) | Chronological | 2 pages |

Professional Summary Examples

Your professional summary should immediately communicate your actuarial expertise:

Entry-Level Actuary

Mathematics graduate from IIT Bombay seeking actuarial position in life insurance. Completed 5 IAI exams including CT1-CT5 with top 10 national rankings in CT1 and CT3. Completed internship at ICICI Prudential working on product pricing and experience analysis. Proficient in R, Python, and Excel VBA. Strong analytical and problem-solving skills. Eager to contribute to product development while pursuing Fellowship qualification.

Experienced Actuary

Results-driven actuary with 6+ years of experience in life insurance product development and pricing. Currently Deputy Manager at HDFC Life Mumbai leading pricing team for protection and savings products. Expertise in term insurance, ULIP, and traditional product design. Achieved 15% improvement in profitability through pricing optimisation. Associate of IAI (AIAI) with 3 Fellowship papers remaining. Proficient in Prophet and Excel VBA.

Senior Actuary

Strategic actuarial leader with 12+ years of experience in life insurance valuation and product development. Currently Vice President and Appointed Actuary at Max Life Insurance managing statutory reporting and regulatory compliance. Led IFRS 17 implementation programme worth ₹50 crore. Expertise in embedded value, ALM, and risk management. Fellow of IAI (FIAI) and Fellow of IFoA (FIA). B.Tech from IIT Delhi with MBA from ISB Hyderabad.

Consulting Actuary

Experienced consulting actuary with 10 years of expertise across life, health, and pension practices. Currently Principal Consultant at Milliman India leading actuarial consulting for 15+ insurance clients. Expertise in M&A valuations, product development, and regulatory advisory. Delivered ₹25 crore in consulting revenue over past 3 years. Fellow of IAI with qualified actuary status. Regular speaker at IAI and CII conferences.

Showcasing Your Work Experience

Present your actuarial experience with specific achievements and metrics:

Vice President - Appointed Actuary

Max Life Insurance | Delhi NCR April 2019 – Present

- Serve as Appointed Actuary responsible for statutory valuation and IRDAI filings

- Manage actuarial team of 25 professionals across valuation, pricing, and reinsurance

- Oversee reserves exceeding ₹50,000 crore across all lines of business

- Led IFRS 17 implementation ensuring compliance with new accounting standards

- Designed protection product achieving ₹500 crore first-year premium

- Implemented Embedded Value model improving investor communication

- Chair Product Approval Committee reviewing all new product launches

- Achieved 98% IRDAI compliance across all regulatory submissions

Manager - Product Pricing

ICICI Prudential Life Insurance | Mumbai June 2015 – March 2019

- Led pricing team for individual life products including term and savings

- Designed ULIP products generating ₹2,000 crore annual premium

- Developed experience studies for mortality, morbidity, and persistency

- Optimised term insurance pricing improving profitability by 20%

- Implemented dynamic pricing models using policyholder data

- Prepared product filings and IRDAI submissions for 15+ products

- Mentored team of 5 actuarial analysts on pricing methodology

- Received “Excellence in Product Innovation” award for ULIP design

Deputy Manager - Valuation

SBI Life Insurance | Mumbai July 2012 – May 2015

- Conducted quarterly and annual statutory valuations for IRDAI

- Managed reserves for ₹30,000 crore policy portfolio

- Prepared Appointed Actuary reports and board presentations

- Implemented automation reducing valuation cycle by 30%

- Supported annual embedded value calculation and reporting

- Contributed to ALM analysis and investment strategy reviews

- Completed 6 IAI exams during tenure achieving Associate status

Essential Skills for Insurance Actuaries

Technical Skills

- Actuarial modelling and valuation

- Product pricing and design

- Reserve calculation and testing

- Embedded Value and IFRS 17

- Experience studies and analysis

- ALM and risk management

- Stochastic modelling

- Reinsurance structuring

- Capital modelling (ICS, Solvency II)

- Financial projections and budgeting

Software Proficiency

- Prophet (valuation and pricing)

- AXIS (life insurance modelling)

- Moses (general insurance)

- Excel VBA and macros

- R and Python for data analysis

- SQL for database queries

- SAS for statistical analysis

- Tableau and Power BI

- GGY AXIS

- ResQ and other valuation tools

Soft Skills

- Analytical thinking and problem-solving

- Communication and presentation

- Stakeholder management

- Team leadership and mentoring

- Attention to detail and accuracy

- Project management

- Business acumen

- Regulatory awareness

- Decision-making under uncertainty

- Continuous learning orientation

Certifications for Insurance Actuaries

Professional Qualifications

| Qualification | Issuing Body | Relevance |

|---|---|---|

| Fellow of IAI (FIAI) | Institute of Actuaries of India | Indian actuarial practice |

| Associate of IAI (AIAI) | Institute of Actuaries of India | Intermediate qualification |

| Fellow of IFoA (FIA) | Institute and Faculty of Actuaries | International recognition |

| Associate of IFoA (AIA) | Institute and Faculty of Actuaries | UK qualification |

| Fellow of SOA (FSA) | Society of Actuaries | US life insurance |

| Fellow of CAS (FCAS) | Casualty Actuarial Society | US general insurance |

Academic Qualifications

- B.Sc/M.Sc in Mathematics or Statistics (IITs, IISc, ISI)

- B.Tech in quantitative disciplines

- MBA with actuarial focus (ISB, IIMs)

- M.Phil/PhD in Actuarial Science

- B.Com/M.Com with actuarial specialisation

Additional Certifications

- Certified Enterprise Risk Analyst (CERA)

- Chartered Enterprise Risk Actuary

- IRDAI Appointed Actuary registration

- Financial Risk Manager (FRM)

- Project Management Professional (PMP)

- CFA Charter

Tips by Experience Level

Entry-Level Actuaries (0-3 years)

- Highlight exam progress with specific papers passed

- Include internship and academic project details

- Emphasise mathematical and analytical skills

- Showcase software proficiency (Excel, R, Python)

- Include national rankings in IAI exams if achieved

Target employers: Insurance companies, actuarial consulting firms, Big Four

Mid-Level Actuaries (4-8 years)

- Quantify products priced and business written

- Highlight progression towards Fellowship

- Showcase specialisation (pricing, valuation, risk)

- Demonstrate leadership and mentoring experience

- Include cross-functional project involvement

Target positions: Manager, Deputy Manager, Senior Consultant

Senior Actuaries (8+ years)

- Emphasise strategic contributions and P&L impact

- Highlight Appointed Actuary or peer review experience

- Showcase team management and budget responsibility

- Demonstrate thought leadership and industry recognition

- Include regulatory and board-level engagement

Target positions: Appointed Actuary, Vice President, Director, Partner

ATS Optimisation for Actuary Resumes

Ensure your resume passes Applicant Tracking Systems:

Essential keywords to include:

- Actuary, actuarial, FIAI, AIAI

- Life insurance, general insurance, health

- Product pricing, valuation, reserving

- Prophet, AXIS, actuarial modelling

- Embedded Value, IFRS 17, Solvency

- Experience studies, mortality, morbidity

- Risk management, ALM

- IRDAI, regulatory compliance

- Reinsurance, capital modelling

- IAI, IFoA, SOA exams

ATS-friendly formatting:

- Use standard section headings (Summary, Experience, Skills, Education)

- List exam passes clearly with dates

- Avoid tables, graphics, and complex formatting

- Use standard fonts (Arial, Calibri, Times New Roman)

- Include reserve amounts and business metrics as numbers

Conclusion

A professional insurance actuary resume is essential for success in India’s growing actuarial profession. Whether you’re targeting positions at insurance companies like LIC, HDFC Life, and ICICI Prudential, or exploring opportunities at consulting firms and reinsurance companies, your resume must demonstrate your actuarial qualifications, technical expertise, and business impact.

Focus on highlighting your exam progress and Fellowship status—these are the primary qualifications employers seek. Quantify your achievements through reserves managed, products priced, and business results delivered. With India’s expanding insurance sector and regulatory requirements for qualified actuaries, the demand for actuarial professionals continues to grow across all experience levels.

Use our resume builder to create an ATS-optimised actuary resume, or explore our professional templates designed specifically for actuarial professionals in India.

Frequently Asked Questions

What sections should a strong insurance actuary resume include?

At minimum, include contact information, a professional summary, work experience, key skills, and education. Depending on your experience level, you may also add certifications, achievements, projects, or industry-specific sections that highlight your expertise.

How do I write a professional summary for an insurance actuary role?

Keep it concise — two to three sentences highlighting your experience level, core competencies, and a key achievement or strength that shows why you're right for the job. Tailor it to match the specific role you're applying for.

What skills are most important to list on an insurance actuary resume?

Include a mix of technical skills specific to insurance actuary roles and soft skills like communication, problem-solving, and teamwork. Research job postings in your target companies to identify the most commonly requested skills.

How detailed should my work experience be?

Use bullet points to describe your roles, focusing on specific results, tools used, and the impact you made. Quantify achievements where possible — numbers and percentages help recruiters quickly understand your contributions.

Do I need certifications on my insurance actuary resume?

Certifications aren't always required, but they can strengthen your application — especially if they demonstrate advanced training or specialised expertise. List the certification name, issuing organisation, and year obtained.

What's the best resume format for an insurance actuary?

Most insurance actuary professionals benefit from a reverse-chronological format that lists your most recent experience first. If you're changing careers or have gaps, a functional or combination format might work better.

How long should my insurance actuary resume be?

Aim for one page if you're early in your career. Experienced professionals with extensive achievements can use two pages — just ensure every section adds value and remains relevant to the role.

Should I tailor my resume for each job application?

Yes. Customising your resume with keywords and responsibilities from the job posting improves your chances of passing Applicant Tracking Systems (ATS) and resonating with recruiters. Focus on relevant experience and skills for each role.

Insurance Actuary Text-Only Resume Templates and Samples

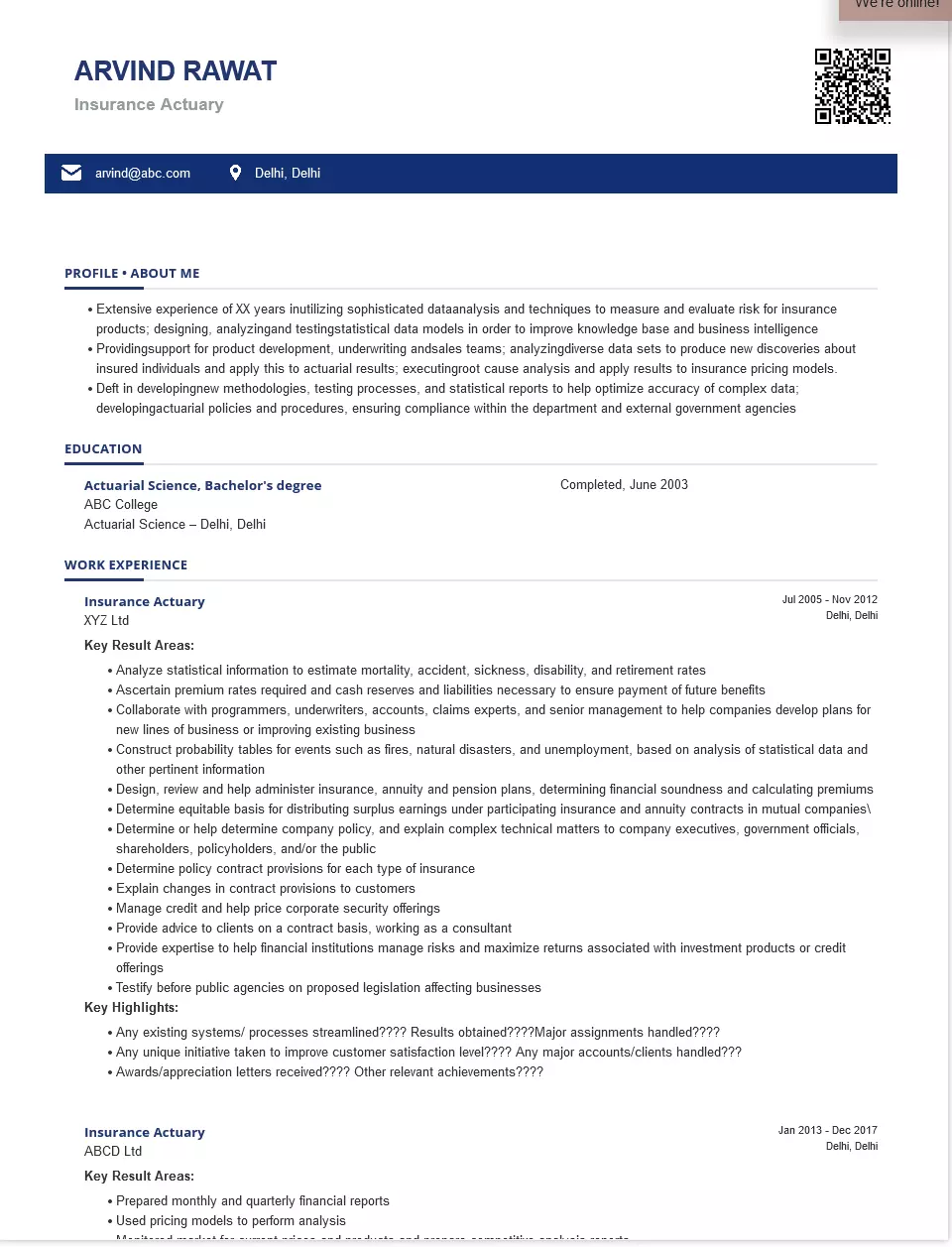

ARVIND RAWAT

Phone: 0000000

Email: arvind@abc.com

Address: C-21, Sector-21, Delhi

About Me

Insurance Actuary

- An Experienced Insurance Actuary Skilled in analyzing the financial costs of risk and uncertainty; using mathematics, statistics, and financial theory to assess the risk that an event will occur and help businesses and clients develop policies that minimize the cost of that risk

- Extensive experience of XX years in utilizing sophisticated data analysis and techniques to measure and evaluate the risk for insurance products; designing, analyzing, and testing statistical data models to improve the knowledge base and business intelligence

- Providing support for product development, underwriting, and sales teams; analyzing diverse data sets to produce discoveries about insured individuals and applying this to actuarial results; executing root cause analysis and applying results to insurance pricing models.

- Deft in developing new methodologies, testing processes, and statistical reports to help optimize the accuracy of complex data; developing actuarial policies and procedures, ensuring compliance within the department and external government agencies

Education

Actuarial Science, Bachelor's degree, Completed, June 2003

Universal Business School

– Marks null

Karjat, MH

Certifications

Work Experience

Period: July 2012 - Current

Assistant Vice President - Risk Management Actuary

Shree Balaji Employment Services

- Analyze statistical information to estimate mortality, accident, sickness, disability, and retirement rates

- Ascertain premium rates required and cash reserves and liabilities necessary to ensure payment of future benefits

- Collaborate with programmers, underwriters, accounts, claims experts, and senior management to help companies develop plans for new lines of business or improve existing business

- Construct probability tables for events such as fires, natural disasters, and unemployment, based on analysis of statistical data and other pertinent information

- Design, review, and help administer insurance, annuity, and pension plans, determining financial soundness and calculating premiums

- Determine the equitable basis for distributing surplus earnings under participating insurance and annuity contracts in mutual companies\

- Determine or help determine company policy, and explain complex technical matters to company executives, government officials, shareholders, policyholders, and/or the public

- Determine policy contract provisions for each type of insurance

- Explain changes in contract provisions to customers

- Manage credit and help price corporate security offerings

- Provide advice to clients on a contract basis, working as a consultant

- Provide expertise to help financial institutions manage risks and maximize returns associated with investment products or credit offerings

- Testify before public agencies on proposed legislation affecting businesses

Period: January 2006 - December 2011

Insurance Actuary / Actuarial Analyst

Swiss Re

- Prepared monthly and quarterly financial reports

- Used pricing models to perform analysis

- Monitored market for current prices and products and prepare competitive analysis reports

- Handled preparation and submission for filings of long-term care rates

- Designed and pricedinsurance policies and pensions and ensure plans are financially sound

Skills

- Analytical

- Problem-Solving

- Computer

- Knowledge of Business and Finance

- Communication

- Interpersonal

- Research

- Economics

- Legislation

- Financial Risk

- Risk Management

- Actuarial Science

- Reinsurance

Languages

Softwares

Operating System

Personal Interests

- Yoga

- Cycling

- Reading Newspaper

- Singing

India's

premier resume service

India's

premier resume service