- Microsoft Certified: Azure Fundamentals, Completed , January 2011

- Data engineer certification, Completed , January 2011

What's your job?

Auditor Resume Samples and Templates for 2026

- Table of Contents

- Downloadable Sample

- Resume Tips from Experts

- Resume Text Version

- Share

Auditor Resume Guide for India

A well-crafted auditor resume is essential for success in India’s growing audit and assurance sector. Whether you’re a fresher starting your career in internal audit or an experienced professional seeking positions at top companies like Deloitte India, PwC, EY, KPMG, or corporate internal audit departments, this guide provides everything you need to create a standout resume that impresses Indian employers and passes ATS screening on portals like Naukri and LinkedIn.

This comprehensive guide includes:

- Resume format recommendations for Indian audit sector

- Key skills Indian employers look for

- Complete resume example with Indian context

- Top auditor employers in India

- Salary insights in INR by experience level

- CA, CIA, and CISA certification guidance

- ATS optimization tips for Indian job portals

Why Your Auditor Resume Matters in India

India’s audit and assurance sector is thriving, with companies like Deloitte, PwC, EY, KPMG, Grant Thornton, and corporate internal audit teams actively hiring qualified auditors. A strong resume helps you:

- Stand out from thousands of CA and audit applicants on Naukri and LinkedIn

- Pass ATS screening used by Big Four firms and major corporations

- Showcase skills that Indian audit partners value, including statutory audit, internal controls, and compliance expertise

- Demonstrate your professional certifications and audit experience

Indian audit partners and hiring managers typically spend 6-10 seconds reviewing each resume initially. Your auditor resume must immediately communicate your certifications (CA, CIA, CISA), audit experience, and value. With India being a global hub for audit and finance operations, opportunities for auditors are abundant—a well-optimized resume is essential for landing positions at top firms.

Auditor Resume Format for India

Indian employers prefer clean, professional resume formats. Here’s what works best for audit positions:

Recommended Format

- Length: 1-2 pages (freshers: 1 page, experienced: 2 pages max)

- Layout: Reverse chronological (most recent first)

- Font: Arial, Calibri, or Times New Roman (11-12pt)

- Sections: Contact, Summary, Skills, Experience, Education, Certifications

Resume vs Biodata

In India, “biodata” is occasionally used for government audit positions like CAG (Comptroller and Auditor General). For corporate audit roles at Big Four firms, MNCs, and private companies, use a professional resume format.

Personal Details for Indian Auditor Resumes

Indian resumes typically include:

- Full name (professional photo optional)

- Phone number with country code (+91)

- Professional email address

- LinkedIn profile URL

- City, State (full address not required)

What to Avoid

- Decorative fonts or graphics (causes ATS issues)

- Personal information like religion, caste, or father’s name

- Salary expectations (discuss during interview)

- References (provide when requested)

Key Skills for Auditors in India

Indian employers look for a combination of technical audit expertise and software proficiency.

Technical Skills

- Statutory Audit: Companies Act 2013, Indian Accounting Standards (Ind AS)

- Internal Audit: Risk-based audit, SOX compliance, internal controls

- Tax Audit: Income Tax Act, GST audit, transfer pricing

- Financial Reporting: IFRS, GAAP, financial statement analysis

- Risk Assessment: Enterprise risk management, fraud detection

- Compliance: RBI regulations, SEBI guidelines, FEMA

- IT Audit: General IT controls, application controls, cybersecurity

- Forensic Audit: Fraud investigation, anti-money laundering (AML)

Software & Tools

- Audit Software: ACL, IDEA, TeamMate, CaseWare

- ERP Systems: SAP, Oracle, Tally Prime

- Data Analytics: Excel (Advanced), SQL, Power BI, Tableau

- Documentation: MS Office, Google Workspace

- Accounting Software: Tally ERP 9, QuickBooks

Soft Skills Valued in Indian Audit Firms

- Analytical Thinking: Evaluating complex transactions and controls

- Attention to Detail: Identifying discrepancies and material misstatements

- Communication: Presenting audit findings to management and audit committees

- Professional Skepticism: Maintaining objectivity and independence

- Time Management: Meeting audit deadlines during busy season

- Teamwork: Working with cross-functional audit teams

How to Present Skills

List skills in order of relevance to the job description. Use exact keywords from job postings on Naukri or LinkedIn. For auditor roles, prioritize statutory audit, internal controls, Ind AS, and CA/CIA certifications.

Auditor Resume Example for India

Here’s a complete resume example tailored for Indian employers:

Priya Sharma, CA

Mumbai, Maharashtra | +91-98XXX-XXXXX | priya.sharma@email.com | linkedin.com/in/priyasharma-auditor

Professional Summary

Results-driven Chartered Accountant with 6+ years of experience in statutory audit, internal audit, and financial reporting. Expertise in Companies Act 2013, Ind AS, and SOX compliance with proven track record of leading audits for clients with revenues of ₹500+ Cr. Experienced in risk-based audit planning, internal controls assessment, and regulatory compliance. Proficient in ACL, SAP, and advanced data analytics. Seeking to contribute audit expertise to a dynamic assurance practice.

Key Skills

Statutory Audit | Internal Audit | Risk-Based Audit Planning | Ind AS & IFRS | Companies Act 2013 | SOX Compliance | Tax Audit | GST Audit | Internal Controls | Financial Reporting | SAP FICO | ACL Analytics | Data Analytics | MS Excel (Advanced) | Fraud Detection | CARO Reporting

Professional Experience

Audit Manager | Deloitte Haskins & Sells LLP | Mumbai | April 2021 – Present

- Lead statutory audits for 8 listed and unlisted clients with combined revenues exceeding ₹2,000 Cr

- Manage audit teams of 5-8 members, ensuring quality delivery within tight deadlines

- Conduct risk assessment and develop risk-based audit strategies aligned with SA standards

- Review financial statements for compliance with Ind AS and Companies Act 2013

- Prepare CARO reports and auditor’s reports for statutory filings

- Identify material misstatements and internal control deficiencies, recommending remediation measures

- Implement data analytics using ACL and Excel to enhance audit coverage and efficiency

- Received “Star Performer” recognition for exceptional client service and audit quality

Senior Audit Associate | KPMG India | Bangalore | June 2019 – March 2021

- Executed statutory audits for manufacturing and BFSI clients with revenues up to ₹800 Cr

- Performed substantive testing, control testing, and analytical review procedures

- Led GST audit and tax audit procedures for multiple clients

- Documented audit findings and communicated with client management

- Supervised and mentored team of 3 audit associates

- Assisted in SOX compliance testing for US-listed parent companies

Audit Associate | Grant Thornton Bharat LLP | Mumbai | August 2017 – May 2019

- Participated in statutory audits for mid-size companies across manufacturing and services sectors

- Performed vouching, verification, and reconciliation of financial records

- Prepared audit work papers and maintained documentation per SA standards

- Assisted in bank audit and concurrent audit engagements

- Gained exposure to internal audit and management audit assignments

Education

Chartered Accountant (CA) | Institute of Chartered Accountants of India (ICAI) | 2017

- All India Rank: Top 100

- Cleared both groups in first attempt

Bachelor of Commerce (B.Com) | Mumbai University | 2014

- First Class with Distinction

- Specialization: Accounting and Finance

Higher Secondary Certificate | Maharashtra Board | 2011

- 92% in Commerce stream

Certifications

- Chartered Accountant (CA) | ICAI | 2017

- Certified Information Systems Auditor (CISA) | ISACA | 2022

- Diploma in Information Systems Audit (DISA) | ICAI | 2020

- Certificate Course on GST | ICAI | 2019

Professional Memberships

- Associate Member, ICAI (Membership No: XXXXX)

- Member, ISACA India Chapter

Languages

English (Fluent) | Hindi (Fluent) | Marathi (Native)

Declaration

I hereby declare that the information provided above is true to the best of my knowledge.

Priya Sharma Mumbai, December 2024

Top Auditor Employers in India

India’s audit sector offers excellent opportunities for qualified professionals. Here are the top employers:

Big Four Accounting Firms

- Deloitte Haskins & Sells LLP: Largest professional services network in India

- PwC India: Strong audit and assurance practice

- EY India (Ernst & Young): Growing audit practice with GDS operations

- KPMG India: Comprehensive assurance services

Mid-Size Audit Firms

- Grant Thornton Bharat LLP: Strong mid-market focus

- BDO India: Growing audit practice

- RSM India: International network firm

- Walker Chandiok & Co LLP: Part of Grant Thornton network

- S.R. Batliboi & Associates LLP: EY member firm

Corporate Internal Audit

- Reliance Industries: Large internal audit team

- Tata Group Companies: Multiple audit opportunities across group

- HDFC Bank / ICICI Bank: Banking internal audit

- Infosys / TCS / Wipro: IT company internal audit

- Mahindra Group: Diversified conglomerate

Public Sector and Government

- CAG (Comptroller and Auditor General): Government audit

- RBI (Reserve Bank of India): Banking regulation and audit

- SEBI: Securities market regulation

- Public Sector Banks: Internal audit departments

BPO/Shared Services (Internal Audit)

- Genpact: F&A audit and compliance

- WNS: Internal audit services

- Accenture: Risk and compliance

How to Apply

- Apply through Naukri.com and LinkedIn

- Visit firm career pages directly (Big Four have dedicated portals)

- Apply through ICAI campus placements for freshers

- Network through CA study groups and professional associations

- Register with finance and audit staffing agencies

Auditor Salary in India

Salaries vary based on experience, firm type, certifications, and location. Big Four firms typically offer structured salary bands.

Salary by Experience Level

| Experience | Big Four (INR) | Mid-Size Firms (INR) | Corporate (INR) |

|---|---|---|---|

| Fresher CA (0-1 years) | ₹7 - ₹10 LPA | ₹5 - ₹8 LPA | ₹6 - ₹9 LPA |

| Associate (2-4 years) | ₹10 - ₹16 LPA | ₹8 - ₹12 LPA | ₹9 - ₹14 LPA |

| Senior/Manager (5-8 years) | ₹16 - ₹28 LPA | ₹12 - ₹20 LPA | ₹14 - ₹24 LPA |

| Senior Manager (8-12 years) | ₹28 - ₹45 LPA | ₹20 - ₹35 LPA | ₹24 - ₹40 LPA |

| Partner/Director (12+ years) | ₹50 LPA - ₹2 Cr+ | ₹35 - ₹80 LPA | ₹40 - ₹1 Cr+ |

Note: Partners at Big Four can earn significantly higher through profit-sharing.

Salary by City

| City | Salary Range (Mid-Level) |

|---|---|

| Mumbai | ₹14 - ₹25 LPA |

| Delhi NCR | ₹13 - ₹24 LPA |

| Bangalore | ₹13 - ₹23 LPA |

| Pune | ₹12 - ₹20 LPA |

| Hyderabad | ₹11 - ₹20 LPA |

| Chennai | ₹11 - ₹19 LPA |

Factors Affecting Salary

- Certifications: CA is essential; CIA, CISA add significant premium

- Firm Type: Big Four pays 30-50% higher than mid-size firms

- Specialization: IT audit, forensic audit command premium

- All India Rank: Top rankers receive higher starting packages

- Industry Focus: BFSI audit specialists earn more

- Location: Mumbai and Delhi NCR offer highest packages

Salary data based on Glassdoor India, AmbitionBox, and industry surveys.

Certifications for Auditors in India

Professional certifications are crucial in India’s audit profession. CA is typically mandatory for statutory audit roles.

Essential Certifications

Chartered Accountant (CA) - ICAI The gold standard for auditors in India. Required for signing statutory audit reports. Three levels: Foundation, Intermediate, and Final with articleship.

Certified Internal Auditor (CIA) - IIA Global certification for internal auditors. Highly valued for internal audit and risk management roles. Three-part exam covering internal audit essentials.

Certified Information Systems Auditor (CISA) - ISACA Essential for IT audit roles. Covers information systems audit, control, and security. Growing demand with digital transformation.

ICAI Certifications (Highly Valued)

- DISA (Diploma in Information Systems Audit): IT audit specialization

- FAFD (Forensic Accounting and Fraud Detection): Fraud investigation

- Certificate Course on GST: Indirect tax expertise

- Certificate Course on Valuation: Business valuation

- Concurrent Audit of Banks: Banking audit specialization

Other Valuable Certifications

- CPA (US): Valued for MNC audit roles

- ACCA: International recognition

- CFE (Certified Fraud Examiner): Forensic audit

- CRMA (Certification in Risk Management Assurance): Risk management

- ISO Lead Auditor Certifications: Quality and compliance audits

How to List Certifications

Include certification name, issuing body, and year obtained. CA qualification should be prominently displayed after your name. List DISA and other ICAI certifications that add value for the target role.

ATS Tips for Your Auditor Resume

Most Big Four firms and corporate recruiters use Applicant Tracking Systems (ATS) to screen resumes. Optimize yours:

For Naukri.com

- Use keywords from the job description (statutory audit, internal audit, Ind AS, CA)

- Keep formatting simple (no tables, columns, or graphics)

- Use standard section headings (Experience, Education, Skills)

- Upload in .docx or .pdf format

- Update your Naukri profile regularly for better visibility

For LinkedIn Applications

- Match your resume to your LinkedIn profile

- Use industry-standard job titles (Audit Manager, Senior Auditor, Audit Associate)

- Include relevant keywords in your LinkedIn skills section

- Get endorsements from audit partners and managers

General ATS Tips

- DO: Use standard fonts, clear headings, bullet points

- DO: Include metrics (audited ₹500 Cr revenue clients, led team of 6)

- DO: Mention CA membership number format

- DON’T: Use headers/footers, text boxes, or images

- DON’T: Use creative section titles

Keyword Strategy for Indian Auditor Roles

Review 5-10 job postings on Naukri. Common keywords include:

- Chartered Accountant, CA, Statutory Audit, Internal Audit

- Ind AS, IFRS, Companies Act 2013, CARO

- Risk-Based Audit, Internal Controls, SOX Compliance

- Tax Audit, GST Audit, Transfer Pricing

- ACL, IDEA, SAP, Data Analytics

- CISA, CIA, DISA, Forensic Audit

Final Tips for Your Auditor Resume

✅ Display CA qualification prominently—it’s the most critical credential for audit roles in India

✅ Quantify achievements (audited clients with ₹500 Cr revenue, identified ₹50 lakh material misstatement)

✅ Highlight Big Four or reputed firm experience—carries significant weight

✅ Include ICAI membership number—validates your CA status

✅ Show industry expertise—BFSI, manufacturing, IT services specializations are valued

✅ Mention data analytics skills—ACL, IDEA, Power BI are increasingly important

✅ Proofread carefully—accuracy is paramount in audit resumes

Quick Checklist

- Contact information with +91 phone number and LinkedIn

- CA designation after name (if applicable)

- Professional summary highlighting certifications and audit experience

- Skills section with statutory audit, Ind AS, internal controls keywords

- Experience showing client size, audit scope, and achievements

- Education with CA details, AIR if applicable

- Certifications (CA, CISA, DISA, CIA)

- Professional memberships (ICAI, ISACA)

- ATS-friendly formatting

- Declaration statement included

Ready to create your professional auditor resume? Use our resume builder to get started with expert-designed templates optimized for Indian job portals.

For more guidance on resume structure, check out our resume format guide with tips specifically for the Indian audit and finance job market.

Frequently Asked Questions

What should I include in an Auditor resume?

An effective auditor resume should include your contact information, a strong professional summary, relevant work experience, education, key auditing skills, and certifications. Highlight specific audit tasks you performed, tools you used, and outcomes you achieved rather than just listing responsibilities.

How do I write a strong professional summary for an Auditor resume?

Your summary should clearly state your experience level, core auditing skills, and a notable achievement — for example, how you improved reporting accuracy or helped streamline audit processes. Keeping it concise but impactful helps recruiters see your value quickly.

Which skills matter most on an Auditor resume?

Both technical skills (like financial analysis, GAAP/GAAS knowledge, audit software) and soft skills (communication, analytical thinking, problem-solving) are important. Tailor these to the job description you're targeting so your resume is relevant and ATS-friendly.

Should I list certifications on my Auditor resume?

Yes — certifications like CA (Chartered Accountant), CPA, CIA, CISA, and others related to audit and compliance show credibility and expertise. How you list them (with issuing body and year) can make them stand out more.

How long should my Auditor resume be?

Generally 1–2 pages is appropriate. Freshers or those early in their careers can aim for one page, while experienced auditors with extensive accomplishments might use two pages. Keep the most relevant achievements at the top.

How can I optimize my Auditor resume for Applicant Tracking Systems (ATS)?

Use simple formatting, standard section headings, and include relevant keywords from the job description (like statutory audit, internal controls, risk assessment, compliance). Avoid graphics, unusual fonts, and tables that ATS systems might struggle to read.

Should I tailor my resume for each Auditor job application?

Absolutely. Match your skills and work-experience language to each job posting to improve relevance for both human recruiters and ATS scans. It might only take a few minutes to adjust key phrases or reorder bullet points, but it makes a big difference.

What are common resume mistakes for Auditor job seekers?

Avoid vague descriptions like "performed audits" without context or measurable impact. Skip irrelevant details, aim for clear formatting, and show results (such as reducing audit cycle times or identifying significant compliance issues).

How should I structure my work experience as an Auditor?

Use bullet points under each job title to describe what you did, how you did it, and the result. Quantify outcomes where possible — e.g., "conducted 30+ audits annually, improving compliance accuracy by 15%."

Do education and extracurricular projects matter on an Auditor resume?

Yes. List your degree(s) clearly and include relevant projects or coursework if you're early in your career. For experienced professionals, certifications often matter more but educational background still supports your qualifications.

Auditor Text-Only Resume Templates and Samples

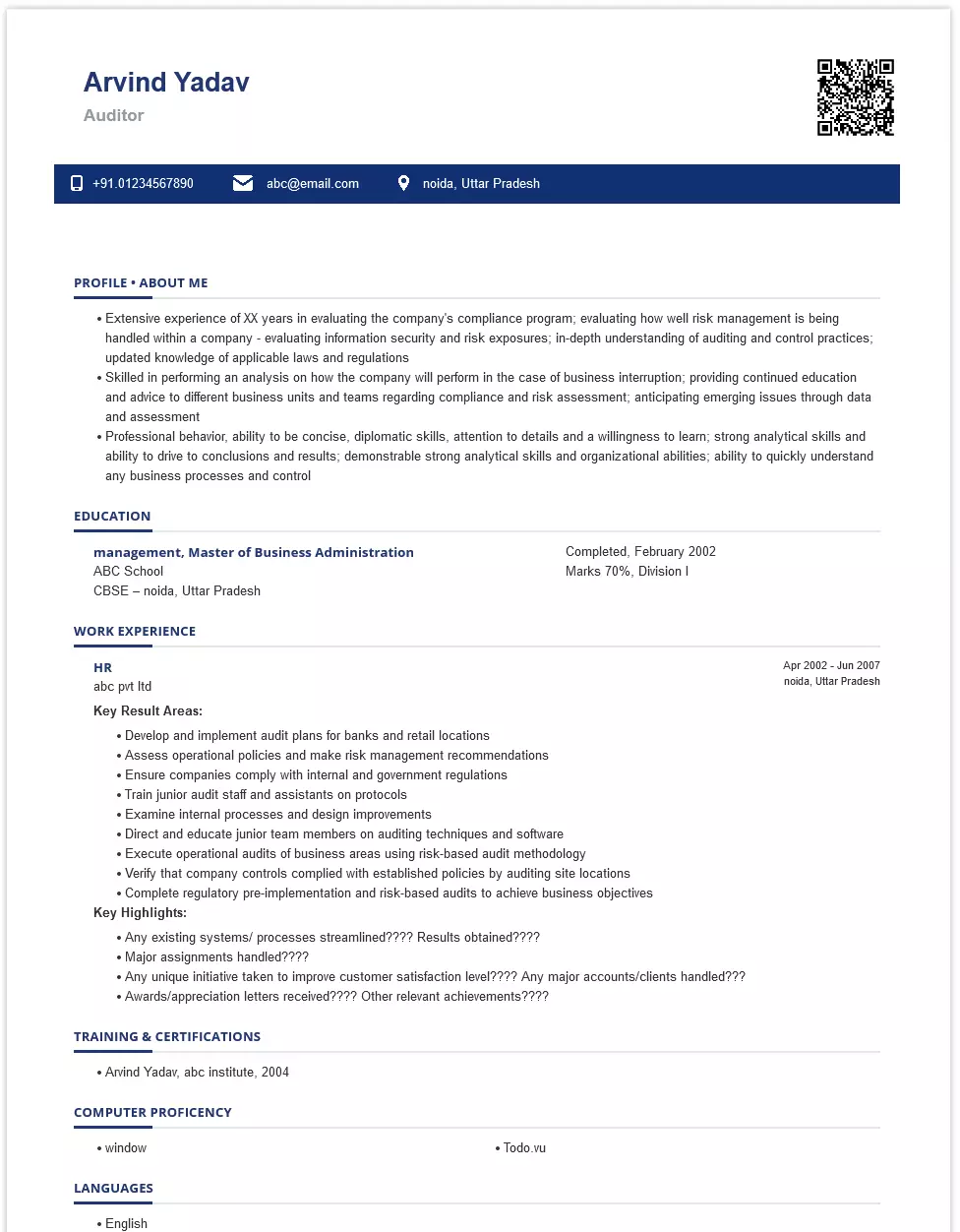

Arvind Yadav

Phone: 01234567890

Email: abc@email.com

Address: sec-44, Noida, noida

About Me

Auditor

- Professional Auditor who diligently monitors budgetary matters to achieve financial accountability and transparency.

- Skilled in risk assessment and discussing potential compliance issues with management, experience in applying innovative entrepreneurial thinking to creatively identify and resolve issues in a timely manner

- Extensive experience of XX years in evaluating the company's compliance program; evaluating how well risk management is being handled within a company - evaluating information security and risk exposures; in-depth understanding of auditing and control practices; updated knowledge of applicable laws and regulations

- Skilled in performing an analysis on how the company will perform in the case of business interruption; providing continued education and advice to different business units and teams regarding compliance and risk assessment; anticipating emerging issues through data and assessment

- Professional behavior, ability to be concise, diplomatic skills, attention to detail, and a willingness to learn; strong analytical skills and ability to drive to conclusions and results; demonstrable strong analytical skills and organizational abilities; ability to quickly understand any business processes and control

Education

Mechanical , Bachelor of Engineering / Bachelor of Technology, Completed, February 2002

ABE Engineering

– Marks 70

Ghaziabad, UP

Certifications

Work Experience

Period: April 2017 - Current

Technical Auditor

K20s - Kinetic Technologies Private Limited

- Develop and implement audit plans for banks and retail locations

- Assess operational policies and make risk management recommendations

- Ensure companies comply with internal and government regulations

- Train junior audit staff and assistants on protocols

- Examine internal processes and design improvements

- Direct and educate junior team members on auditing techniques and software

- Execute operational audits of business areas using risk-based audit methodology

- Verify that company controls complied with established policies by auditing site locations

- Complete regulatory pre-implementation and risk-based audits to achieve business objectives

Period: September 2010 - September 2016

Senior Auditor

Citi

- Planned and oversaw the auditing process; allocated responsibilities to junior and staff auditors

- Reviewed team members’ work for accuracy and compliance

- Performed effective risk and control assessments; completed audits on time and submit reports to the auditing manager

- Presented audit findings and find ways to increase compliance and efficiency; coordinated periodical audits

- Monitored new trends and technologies as they applied to audit areas

- Systematically prepared documents and assembled financial statements for independent auditors

- Tested the effectiveness of internal controls by completing walk-throughs of business processes

- Diligently monitored remediation plans to confirm proper resolution.

Skills

- Audit Reports

- Customer Service

- Financial Statements

- Audit Findings

- Audit Procedures

- Payroll

- Internal Audit

- CPA

- Corrective Action

- Management Policies

- Audit Engagements

- Journal Entries

- Detect Deficient

- Fixed Assets

Languages

Softwares

Operating System

Personal Interests

- Watching Movies

- Trekking

- Reading

India's

premier resume service

India's

premier resume service